The Internal Revenue Service (IRS) has announced a wide range of updates to federal income tax brackets, standard deductions, and credits for the 2026 tax year, marking one of the most substantial adjustments since the pandemic. These 2026 Tax Changes aim to prevent inflation from pushing taxpayers into higher income brackets and to maintain purchasing power for millions of households. The revisions will apply when Americans file their 2026 returns in early 2027.

IRS Announces 2026 Tax Changes

| Key Fact | Detail (2026) |

|---|---|

| Standard Deduction (Single/MFS) | $16,100 |

| Standard Deduction (Married Filing Jointly) | $32,200 |

| Top Marginal Rate Threshold (Single) | $640,600 |

| AMT Exemption (Single) | $90,100 |

| Estate Tax Exemption | $15 million |

Why 2026 Tax Changes Matter Now

The IRS adjusts income tax brackets and related provisions every year to counter “bracket creep,” a condition in which inflation pushes taxpayers into higher tax brackets even when their real incomes have not increased. Because inflation remained elevated through 2024 and 2025, the adjustments for the 2026 tax year are larger than usual.

Annual inflation indexing has been a part of U.S. tax policy for decades, but economic conditions over the past several years have amplified its importance. According to economists at the Urban-Brookings Tax Policy Center, the 2026 adjustments help ensure that taxpayers’ nominal wage increases do not lead to higher effective tax rates. “Indexation is designed to protect households from invisible tax increases during inflationary periods,” said Dr. Lena Ortiz, a senior fellow at the institute.

The IRS confirmed that the 2026 adjustments follow statutory rules and reflect rising consumer prices as measured by the Chained Consumer Price Index. The agency emphasized that the goal is to preserve fairness and stability across the tax system.

2026 Federal Income Tax Brackets: What’s New

Rates Stay the Same, Thresholds Rise Sharply

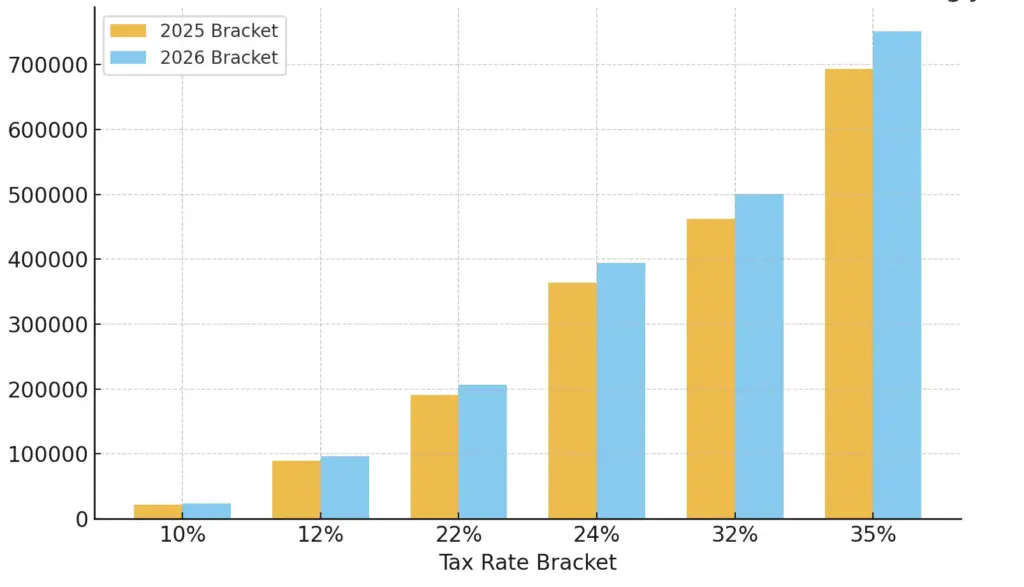

The IRS retained the seven existing federal income tax rates—10%, 12%, 22%, 24%, 32%, 35%, and 37%. However, income thresholds for each bracket increased to match inflation.

New 2026 Bracket Threshold Examples

Single filers:

- 12% bracket starts at $12,401

- 22% bracket begins at $50,401

- 37% bracket applies above $640,600

Married filing jointly:

- 12% bracket begins at $24,801

- 22% bracket starts at $100,801

- 37% bracket applies above $768,700

These higher thresholds mean that more income will be taxed at lower rates, reducing the effective tax burden for many workers.

Financial analysts say the updated brackets are especially meaningful for middle-income households. “Bracket shifts help maintain after-tax income and can cushion families against rising living expenses,” said Anna Clarke, a policy researcher at the Tax Foundation.

Higher Standard Deductions Offer Broad Relief

The standard deduction increase is one of the most influential components of the 2026 Tax Changes. Because most U.S. taxpayers do not itemize deductions, the standard deduction directly affects taxable income.

2026 Standard Deduction Amounts

- Single / Married filing separately: $16,100

- Married filing jointly: $32,200

- Head of household: $24,150

These adjustments preserve the expanded deduction levels introduced under the Tax Cuts and Jobs Act (TCJA) in 2018. While some TCJA provisions are set to expire after 2025, Congress voted to maintain the deduction structure through 2026.

More than 85% of taxpayers take the standard deduction, according to IRS data, making these increases broadly impactful.

Updates to Credits, Exemptions, and Income Exclusions

The IRS adjusted more than 60 tax items as part of the 2026 updates.

Alternative Minimum Tax (AMT)

The AMT aims to ensure high-income taxpayers pay a baseline level of tax. For 2026, the exemption rises to:

- $90,100 for single filers

- $140,200 for married filing jointly

The phase-out thresholds also increase, reducing the number of filers subject to AMT.

Earned Income Tax Credit (EITC)

The maximum EITC for families with three or more qualifying children increases to $8,231.

This credit is central to supporting low-income working households.

Adoption Credit

The adoption credit rises to $17,670, with a refundable portion of $5,120.

This increase reflects the rising costs of adoption services.

Estate and Gift Taxes

The estate-tax exclusion increases to $15 million, one of the highest thresholds ever.

A modest increase also applies to the annual gift-tax exclusion.

Retirement Contribution Limits

The IRS expects increases to:

- 401(k) contribution limits

- IRA contribution thresholds

- Catch-up contributions for taxpayers age 50 and older

Official numbers will be released in a separate IRS statement.

Health-Related Accounts

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) also receive inflation-based increases, offering families more flexibility to cover medical costs.

Economic Context Behind the 2026 Tax Changes

The Bureau of Labor Statistics reports that inflation remained above historic norms throughout 2023, 2024, and 2025. Rising costs for housing, healthcare, and transportation placed pressure on household budgets.

Economists say adjustments like the 2026 bracket revisions are essential to maintaining real earnings. “Without indexation, the average taxpayer’s effective rate would rise every year simply because inflation pushes them into higher brackets,” said David Merrill, policy analyst at the Congressional Budget Office.

Federal budget analysts emphasize that inflation indexing does not reduce tax revenue in real terms. Instead, it preserves the system’s neutrality, preventing unintended tax increases.

How We Got Here: History of Inflation Indexing

Before Congress mandated inflation indexing in the early 1980s, taxpayers often faced rising tax bills even when their real incomes did not increase. That era—marked by double-digit inflation—highlighted the importance of protecting taxpayers from bracket creep.

Indexing began in 1985 and has remained part of federal tax law. Significant adjustments occurred in high-inflation years such as:

- 1990

- 2008

- 2022–2023

The 2026 Tax Changes fall among the larger adjustments seen in recent decades.

Still Waiting on Your November Social Security Check? Here Are the Most Common Reasons

How the 2026 Tax Changes Affect Different Families

Scenario 1: Single Worker Earning $55,000

- Standard deduction reduces taxable income to $38,900

- More income remains in lower brackets compared with 2025

- Estimated tax savings: $150–$250

Scenario 2: Married Couple with Two Children, Earning $120,000

- Standard deduction: $32,200

- More income taxed in lower rates

- Estimated savings: $220–$350

Scenario 3: High-Income Earner Subject to AMT

- Higher AMT exemption reduces risk of entering AMT

- Potential savings: up to $800, depending on deductions

These simplified examples illustrate broad trends but do not account for state taxes or individual circumstances.

What Taxpayers Should Expect Next

The IRS will publish updated withholding tables later in 2025, which employers use to calculate paycheck withholding in 2026. Workers may see changes in their take-home pay starting in January 2026.

Tax professionals recommend reviewing withholding early in the year, especially for those who:

- Changed jobs

- Married or divorced

- Had children

- Have multiple income sources

These life changes can significantly affect tax liability.

FAQs About IRS Announces 2026 Tax Changes

Do the 2026 Tax Changes affect 2025 returns?

No. They apply only to 2026 income, filed in 2027.

Will my paycheck change in January 2026?

Most likely. Employers adjust withholding annually based on IRS tables.

Do these changes cut taxes?

Not directly. They prevent inflation-driven tax increases.

Are tax rates changing?

No. Tax rates remain the same; only income thresholds shift.

Could Congress change tax law before 2027?

Possibly. Many provisions from the Tax Cuts and Jobs Act are set to expire, and lawmakers continue to debate potential reforms.

Final Paragraph

As the IRS prepares for the upcoming filing cycle, the 2026 Tax Changes aim to maintain fairness and protect taxpayers from inflation-related shifts in their tax burden. While Congress may consider broader reforms in the coming years, the current adjustments provide a stable foundation for Americans planning their 2026 finances.