The Social Security Administration (SSA) is launching a broad 2025 overhaul designed to deliver faster service, higher payments, and streamlined digital access for more than 71 million Americans. The Social Security’s 2025 Overhaul initiative introduces new online tools, expanded cost-of-living adjustments, and system-wide operational improvements aimed at modernizing a decades-old infrastructure while addressing rising demand and demographic pressures.

Social Security’s 2025

| Key Fact | Detail |

|---|---|

| 2026 Cost-of-Living Adjustment (COLA) | Benefits rising 2.8% for 71 million recipients |

| Disability backlog improvements | Appeals backlog reduced by 25% in FY 2025 |

| New digital access tools | Users can securely view their Social Security Number online |

| Paper checks phased out | Expanded push for electronic payment and account digitization |

What’s Driving the 2025 Social Security Overhaul

The 2025 overhaul reflects the largest operational shift at the agency in more than a decade. According to the SSA, the reforms aim to improve service quality, modernize technology, and address longstanding bottlenecks aggravated by an aging population and rising disability claims.

Federal officials say the changes are meant to ensure that Social Security remains reliable and accessible amid challenges ranging from staffing shortages to outdated technology infrastructure.

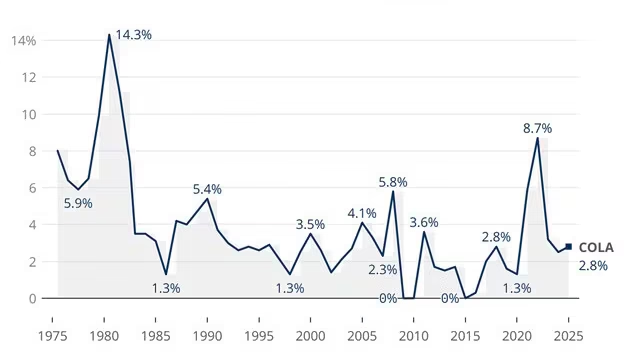

Higher Payments Through the 2026 Cost-of-Living Adjustment

The SSA announced a 2.8% COLA increase for 2026, affecting approximately 71 million beneficiaries. The agency said the adjustment reflects moderate but persistent inflation trends tracked by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the statutory basis for COLA calculations.

Experts note that while the 2.8% increase offers relief for retirees and disabled Americans, it may still fall short for households facing increased housing, medical, and long-term care costs—categories that often rise faster than general inflation.

Impact on Workers and Taxes

The taxable maximum income—the amount of earnings subject to Social Security tax—will rise to $184,500 in 2026. Economists say the increased limit represents a modest attempt to bolster trust-fund revenues without altering the system’s broader structure.

Expanding Digital Tools and 24/7 Online Services

In 2025, SSA introduced new digital services that allow users to:

- View their Social Security Number securely online

- Access statements and benefits information

- Update direct-deposit information

- Upload required documents electronically

- Schedule or manage appointments

- Track claim status in real time

Federal officials argue these services make routine interactions faster and more accessible.

But digital-access advocates warn that older Americans, low-income beneficiaries, and rural residents could face challenges without expanded broadband access or digital-literacy support.

Why Digital Access Matters

According to the Government Accountability Office (GAO), the SSA handles over 160 million transactions annually, many of which historically required in-person visits or phone-based assistance. Digital access reduces strain on field offices—many of which saw severe staffing shortages after decades of budget constraints.

“Digitization is essential for modern service delivery, but it must be inclusive,” said Dr. Helen Martins, a senior policy analyst at the nonpartisan Center on Budget and Policy Priorities.

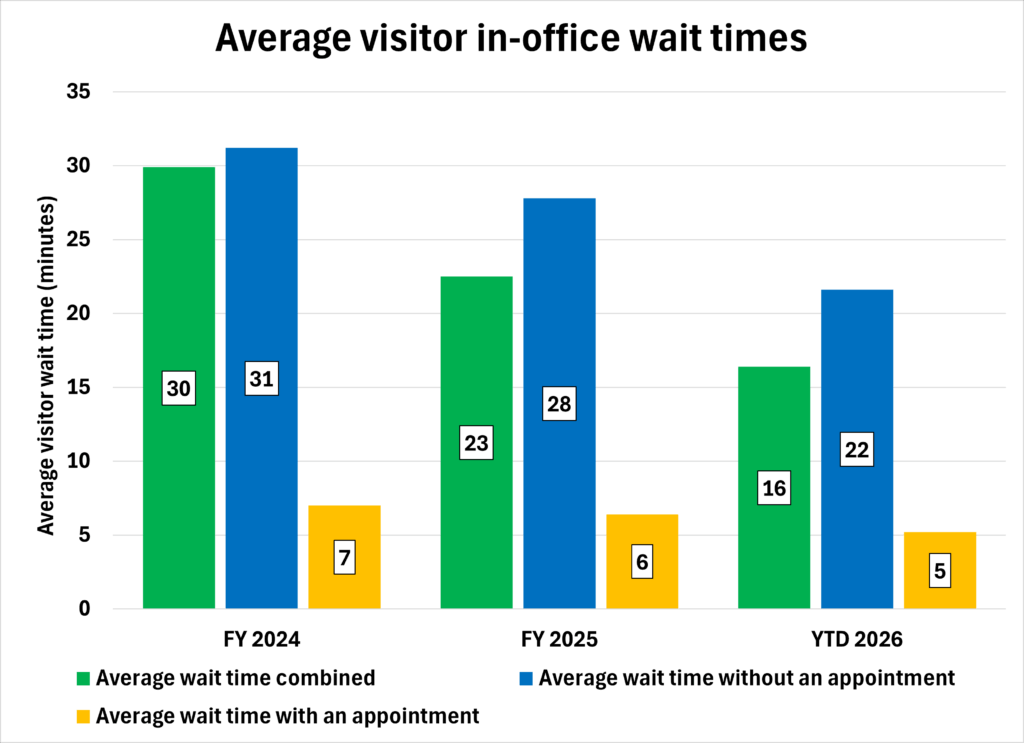

Faster Service Delivery and Reduced Backlogs

The SSA reported major improvements in service efficiency:

- 25% reduction in the disability appeals backlog

- Shorter wait times at the 800 number and local offices

- Processing updates (such as direct-deposit changes) reduced from weeks to about 1 business day

- Increased staffing levels after several years of resource constraints

In a letter to Congress, SSA Commissioner Frank Bisignano said the improvements were “a direct result of targeted hiring, improved automation, and streamlined procedures.”

Still, internal documents and watchdog reports suggest uneven improvements across states, with backlogs remaining severe in some regions.

Historical Context: How SSA’s Role Has Changed

Created in 1935, Social Security has grown from a modest retirement program to one of the world’s largest public insurance systems. Today it administers:

- Old-Age and Survivors Insurance (OASI)

- Disability Insurance (DI)

- Supplemental Security Income (SSI)

Combined, these programs support 1 in 5 Americans and distribute more than $1.4 trillion annually.

The 2025 reforms represent the most significant operational update since major disability-processing changes in the early 2000s and the online expansion of the 2010s.

International Comparison: How Other Countries Modernize Social Security

Countries such as Canada, the United Kingdom, and Australia have migrated heavily toward digital service models, offering online benefit management and automated payments.

The United Nations’ International Social Security Association (ISSA) notes that digital systems can expand access—especially in remote regions—while reducing administrative costs.

However, digital transformations can create gaps if not paired with public education and broad internet access. U.S. advocates warn similar risks apply domestically.

Funding Pressures and Long-Term Challenges

According to the 2024 Trustees Report, the combined Social Security trust funds face a projected depletion date in the mid-2030s without congressional action.

Key pressures include:

- Aging population

- Declining birth rates

- Increased longevity

- Stagnant workforce growth

Economists warn that operational improvements—while helpful—do not replace long-term financing reforms. Congress has yet to advance major bipartisan proposals.

What Advocacy Groups Say

Advocacy organizations offer a mixed assessment of the 2025 changes.

Praised Elements

Groups representing older adults applaud the push for faster processing and clearer online access.

“People should not wait months for disability rulings or lose checks because of clerical delays,” said Martha Glenn, director of the National Committee to Preserve Social Security and Medicare.

Concerns

But disability-rights groups warn that technological changes could unintentionally increase barriers.

“There must be strong safeguards to ensure people without digital access—often the poorest—are not left behind,” said Robert Greene, policy director at Disability Rights USA.

Legislative and Political Implications

Social Security has become a central topic in the 2024–2025 political cycle. Lawmakers from both parties acknowledge the system’s importance, but they remain divided on how to ensure long-term solvency.

Policy proposals include:

- Raising the payroll tax cap

- Adjusting benefit formulas

- Modifying retirement ages

- Expanding benefits for low-income households

- Introducing new revenue streams

The 2025 administrative overhaul does not change statutory benefit formulas, but it reflects a renewed federal focus on service quality amid rising public expectations.

What Beneficiaries Should Do Now

Experts recommend several steps for those receiving or applying for benefits:

- Create or review your my Social Security account

- Update direct-deposit information promptly

- Gather digital copies of identity documents

- Monitor SSA announcements for changes to verification rules

- Seek in-person help if unable to navigate online tools

The agency states it will continue to support paper-based processes for those who need them, though electronic systems will be strongly encouraged.

What Experts Expect Next

Analysts predict that digital expansion will continue through 2026, including:

- More automated verification tools

- Expanded AI-assisted document processing

- Real-time status tracking on all claims

- Better integration with state disability agencies

- Broader fraud-prevention systems

“Modernization is essential for the program’s long-term survival,” said Dr. Alan Hoyt, a public-policy professor at Georgetown University. “What matters now is ensuring these changes are both effective and equitable.”

Claiming Social Security at 62 Could Cut Your Pay — FRA Hike Shifts the Rules in 2025

Looking Ahead

The Social Security Administration’s 2025 overhaul marks a critical step in updating one of the federal government’s most relied-upon systems. With millions of Americans depending on timely benefits, the success of the reforms will hinge on implementation, digital equity, and continued funding support from Congress.

Commissioner Bisignano told lawmakers the agency is “building a foundation to serve the public well for decades to come.” Whether the overhaul can meet those expectations remains a central question as reforms roll out in the year ahead.