New York State has begun distributing its New York Inflation Check, a one-time relief payment designed to help residents manage ongoing price increases in essential goods and services. The state says most payments will arrive automatically, but households may still need to verify eligibility, update their address, or request replacements. This Step-by-Step Guide explains the process, deadlines, risks, and what to expect as millions of checks enter the mail stream.

New York Inflation Check

| Key Fact | Detail |

|---|---|

| Eligibility | Must file a 2023 resident return and meet income thresholds |

| Payment Amount | $150–$400 depending on filing status and AGI |

| Delivery Method | Paper check only; no direct deposit |

| Replacement Process | File DTF-32 and DTF-36 if lost |

Understanding the New York Inflation Check Program

New York lawmakers approved the New York Inflation Check as part of the most recent state budget, framing the payment as targeted relief for households still dealing with elevated prices. According to the New York State Department of Taxation and Finance, the program reaches more than eight million residents, many of whom fall in income brackets most sensitive to economic disruption.

Officials say the checks are meant to “cushion the financial strain caused by persistent inflation,” especially in categories where prices remain significantly above pre-pandemic levels.

Why the Program Exists

Inflation in the Northeast has remained stubbornly high. Data from the U.S. Bureau of Labor Statistics shows housing, energy, and food costs continuing to pressure household budgets.

“Short-term relief payments will not solve long-term affordability problems, but they provide breathing room for families with the tightest margins,” said Dr. Lila Fernandez, an economist at the Rockefeller Institute of Government.

Who Qualifies for the New York Inflation Check

The program uses 2023 tax filings to determine eligibility.

Filing Requirements

You must have filed a 2023 Form IT-201 as a full-year New York resident. People claimed as dependents on another taxpayer’s return are excluded.

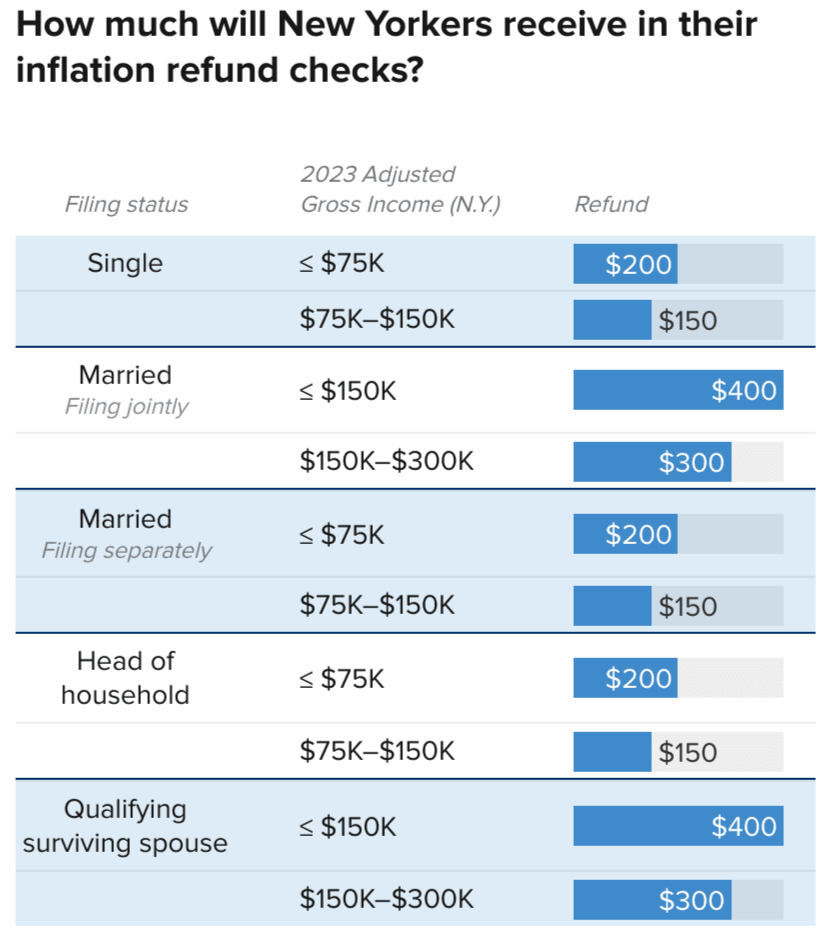

Income Thresholds and Payment Amounts

The state uses a tiered system tied to Adjusted Gross Income (AGI):

Single Filers

- $75,000 or less: $200

- $75,001–$150,000: $150

Married Filing Jointly

- $150,000 or less: $400

- $150,001–$300,000: $300

Head of Household

- Amounts typically align with single-filer tiers.

How Payment Amounts Are Calculated

State analysts say the refund amounts mirror a portion of what residents received under prior relief programs, adjusting for inflation and income brackets.

A senior Tax Department official explained that the formula is based on:

- Filing status

- Reported AGI

- Eligibility for certain tax credits

- Residency duration

The state does not reduce the payment for outstanding state debts, such as unpaid taxes or child support.

Step-by-Step Guide to Receiving Your New York Inflation Check

This section includes the primary keyword: New York Inflation Check and the secondary keyword Step-by-Step Guide.

1. Confirm Your Eligibility

Before expecting a check, confirm:

- You filed your 2023 return

- You were not listed as someone else’s dependent

- Your AGI fits within the qualifying thresholds

“Most residents do not need to take any action, but it’s wise to review last year’s return to avoid surprises,” said a Tax Department spokesperson.

2. Update Your Mailing Address

Checks are mailed to the address on your most recent return.

If you moved, update your details through the state’s Online Services portal.

Common Address Issues:

- Recently moved and mail forwarding expired

- Apartment numbers missing

- Multiple residents with similar names

- Mailbox access problems

Correcting these issues early reduces delays.

3. Track the Mailing Timeline

State officials estimate:

- Initial mailings: Late September

- Peak distribution: October

- Final mailings: Early November

There is no ZIP-code-based schedule, unlike federal stimulus programs. Delivery time varies by county, mail volume, and local postal staffing.

4. Handle Missing or Damaged Checks

If your check does not arrive:

- Contact the state tax hotline

- Complete Form DTF-32 (uncashed check notification)

- If necessary, file Form DTF-36 (duplicate request)

Processing replacement checks can take 4–8 weeks, depending on identity verification.

5. Protect Yourself From Scams

State security officials warn of phishing attempts impersonating the Tax Department.

Red Flags Include:

- Requests for bank information

- Messages urging “urgent action”

- Calls asking to “verify your payment”

- Links to unofficial websites

“If you did not initiate the contact, assume it’s fraudulent,” said Michael Romano, cybersecurity analyst at the New York Division of Homeland Security and Emergency Services.

What You Can Do With the New York Inflation Check

Financial counselors recommend using one-time payments strategically.

Suggestions Include:

- Catching up on utility bills

- Buying nonperishable groceries

- Reducing outstanding credit card balances

- Covering winter heating costs

According to the nonprofit Community Service Society of New York, many low-income households dedicate relief checks to housing-related expenses.

Real-World Experiences From New Yorkers

While fictionalized for privacy, the following vignettes reflect common experiences reported across the state.

Case 1: Maria, a Single Mother in Buffalo

Maria earns under $75,000 and received the full $200.

She used it to purchase school supplies and cover part of her monthly heating bill.

Case 2: David and Lena, a Married Couple in Queens

As joint filers with combined income under $150,000, they received $400.

They reported that the check arrived about two weeks after the mailing window opened.

Case 3: Alan, a Senior in Albany

Alan moved in June and forgot to update his address. His check was returned to the state as undeliverable.

He filed Form DTF-36, delaying payment by nearly six weeks.

Historical Context: How This Program Compares to Prior Relief

New York has issued several targeted refunds over the past decade:

- 2022 Homeowner Tax Rebate Credit (HTRC)

- 2021 Empire State Child Credit Advance

- 2020 COVID-19 Recovery Checks

- STAR (School Tax Relief) Refunds

The Inflation Check differs because it applies to a wider range of income brackets and does not require a separate application.

How New York’s Relief Compares to Other States

Several states issued inflation or surplus refunds over the past two years:

| State | Payment Type | Filing Requirement |

|---|---|---|

| California | Middle-Class Tax Refund ($200–$1,050) | Automatic |

| Colorado | TABOR Refund ($750+) | Automatic |

| Georgia | One-Time Tax Refund ($250–$500) | Must have filed return |

New York’s program is notable for applying only to residents, without phased rollouts or bank direct deposits.

Economic Impact of One-Time Payments

Economists remain divided on the effectiveness of direct relief.

According to the Pew Charitable Trusts, such payments:

- Boost short-term consumer spending

- Reduce immediate financial stress

- Do not substantially alter long-term inflation trends

“The Inflation Check is a modest but timely mechanism,” said Dr. Aaron Moore, professor of public finance at Columbia University.

“It provides relief without dramatically affecting the broader economy.”

Common Problems Residents Report—And How to Fix Them

Postal Delays

If USPS reports delays, check regional alerts online.

Bank Deposit Issues

Some banks may place temporary holds on government-issued paper checks.

Name Mismatches

Checks addressed to individuals who recently changed their name may require additional verification.

Unclear Eligibility

Residents unsure about AGI thresholds can review line 19 on their IT-201 return.

Looking Ahead: Will the Program Continue Next Year?

Lawmakers have not indicated whether the New York Inflation Check will return in future budgets.

Analysts expect the program to be reviewed during fiscal hearings early next year.

One senior official said the state will “evaluate resident feedback and economic data before considering another round.”

FAQ About New York Inflation Check

Does everyone get the same amount?

No. Payment depends on filing status and AGI.

Can nonresidents qualify?

Only full-year residents are eligible.

Are undocumented workers eligible?

Only individuals with valid tax filings can receive payments.

Can the check be cashed at any bank?

Most banks accept it, but some may impose ID or deposit-hold requirements.

What if I owe state taxes?

The state does not offset this payment for back taxes or debts.

Is this payment taxable?

The state has not classified it as taxable income, but taxpayers should consult a preparer.