The Social Security COLA 2026 will provide a modest boost to monthly benefits beginning in January, but new federal projections show that higher Medicare premiums and medical expenses may limit how much income retirees will actually keep. Analysts say the increase reflects easing inflation, yet many older Americans may still face tighter household budgets as healthcare costs climb faster than their benefits

Social Security COLA Could Affect Medicare Costs

| Key Fact | Detail/Statistic |

|---|---|

| Projected Social Security COLA 2026 | 2.8% benefit increase |

| Projected Medicare Part B premium | $202.90 per month |

| Share of COLA potentially offset by Medicare increases | 25–70% depending on income and coverage |

| Official Website | Social Security Administration |

What the Social Security COLA 2026 Means for Retirees

The SSA expects a 2.8% cost-of-living adjustment for 2026 based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The index tracks inflation across essential goods and services, including food, transportation, and housing.

“COLA helps shield retirees against lost purchasing power, but it does not always keep up with the medical expenses that older adults face,” said Dr. Laura Mitchell, an economist at the Brookings Institution, in an interview about long-term benefit trends.

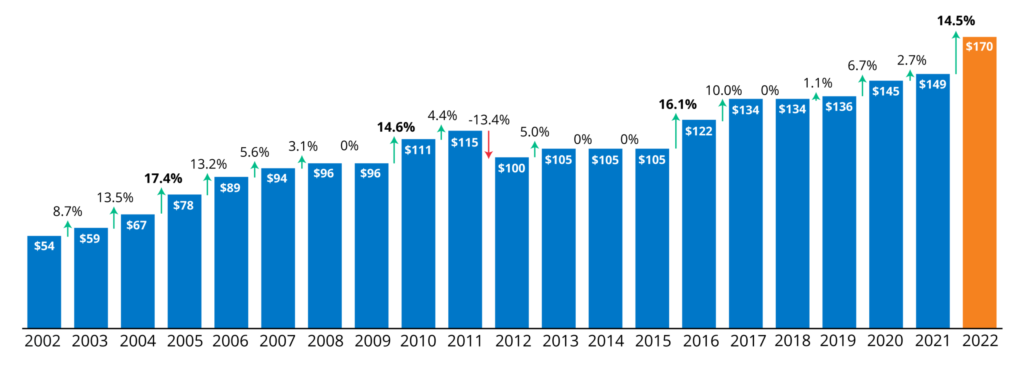

The 2026 increase is smaller than the unusually high adjustments seen during the post-pandemic inflation surge, including the 8.7% COLA in 2023—the largest in four decades. Economists attribute the moderation to a cooling economy, stabilized energy prices, and slower growth in consumer spending.

Still, rising healthcare spending continues to outpace general inflation, creating a persistent gap for millions of Medicare beneficiaries.

How Medicare Costs Could Offset the Benefits Increase

While Social Security benefits will rise modestly, Medicare Part B premiums are projected to rise to $202.90 per month in 2026, according to preliminary estimates from CMS. Deductibles and coinsurance amounts are also expected to increase.

This creates a financial squeeze because Part B premiums are automatically deducted from monthly Social Security payments. For many retirees, the result is a smaller net gain than the COLA headline suggests.

“Most beneficiaries will see a positive increase in their checks, but many will be disappointed by how little remains once Medicare costs are subtracted,” said Jason Reed, a policy specialist at the Center for Retirement Research at Boston College.

Budget analysts estimate that between one-quarter and two-thirds of the COLA increase may be absorbed by higher Medicare expenses depending on an individual’s income, coverage choices, and prescription drug needs.

Why Medicare Costs Keep Rising

Medicare spending is increasing faster than Social Security benefits for several reasons:

1. Higher utilization of outpatient services

As more Americans live longer with chronic illnesses, demand for outpatient therapies and specialist visits has risen steadily.

2. Increased spending on prescription drugs

CMS reports that new, high-cost medications—including treatments for cancer, diabetes, and autoimmune disorders—are adding pressure to Part B and Part D budgets.

3. Demographic shifts

More than 10,000 people in the United States turn 65 every day. This growing population increases the overall cost of administering Medicare.

4. Rising provider reimbursements

Annual adjustments for physicians and hospitals drive higher program spending.

“Healthcare inflation behaves differently from consumer inflation,” said Dr. Evan Cortez, a senior analyst at the Kaiser Family Foundation (KFF). “It is driven by scientific innovation, population aging, and the expanding scope of available treatments. That means it rarely slows down, even when the broader economy does.”

Historical Context: How Often COLA Fails to Keep Up

Economists note that COLA rarely matches the true cost increases faced by older Americans. According to an annual report by the nonpartisan Senior Citizens League, Social Security benefits have lost roughly 36% of their purchasing power since 2000 due to rising medical prices, housing costs, and insurance premiums.

Past years show a similar pattern:

- 2023: 8.7% COLA, but rapid medical inflation erased much of the gain.

- 2020–2021: Historically low COLAs during a period of rising healthcare premiums.

- 2010, 2011: No COLA at all despite cost increases for older adults.

Advocacy organizations argue that the CPI-W underestimates seniors’ expenses because it places more weight on categories relevant to working households rather than retirees.

Debate Over Reforming the COLA Formula

Several lawmakers and advocacy groups support using the Consumer Price Index for the Elderly (CPI-E)—a measure that tracks spending patterns among people ages 62 and older.

Supporters say CPI-E would more accurately reflect rising medical costs, especially prescription drugs and Medicare premiums. Critics argue that CPI-E is not fully developed and may overstate inflation.

“Switching to CPI-E could provide meaningful relief for retirees, but Congress must weigh the long-term fiscal implications,” said Dr. Hannah Giles, a senior fellow at the Urban Institute, in a recent policy briefing.

Federal agencies have not indicated any near-term plans to change the formula.

Who Faces the Greatest Financial Risk

The impact of the Social Security COLA 2026 will vary significantly across demographic groups:

Low-Income Beneficiaries

Adults who rely almost entirely on Social Security may see little improvement in disposable income after Part B deductions. Many already spend a large portion of their income on housing and food.

Older Adults with Chronic Health Conditions

Individuals who need frequent outpatient care or specialty medications may face additional financial pressure due to rising Part B and Part D expenses.

Middle-Income Retirees

These individuals often earn too much to qualify for assistance programs but not enough to absorb sharp medical cost increases.

High-Income Beneficiaries

Those subject to the Income-Related Monthly Adjustment Amount (IRMAA) will see the steepest premium increases.

A 2024 Government Accountability Office (GAO) analysis found that many eligible seniors are not enrolled in Medicare Savings Programs due to administrative barriers and limited outreach.

How Beneficiaries Can Prepare for 2026

Financial planners recommend several steps for retirees who want to protect their budgets:

Review Medicare Advantage and Medigap Options

Open enrollment in the fall allows beneficiaries to compare costs, provider networks, drug formularies, and out-of-pocket limits.

Reassess Prescription Drug Coverage

Part D plan costs can vary significantly year to year. Reviewing formularies may prevent unexpected expenses.

Consider Preventive Health Measures

Routine checkups, screenings, and wellness programs can reduce long-term medical costs.

Explore Assistance Programs

Programs such as Medicaid, Extra Help, and Medicare Savings Programs may ease the financial burden for qualified individuals.

“Too many retirees assume they do not qualify for savings programs,” said Angela Morris, a senior outreach coordinator at the National Council on Aging. “It is worth checking every year, especially when premiums rise faster than benefits.”

Florida SNAP Payments Continue This Week — Check If Your Benefits Are Due

International Context: How U.S. Adjustments Compare Globally

Several countries adjust pension benefits based on inflation, but most do not link them to healthcare costs as closely as the United States. In Canada, public pension adjustments are tied to a broader index but supported by universal healthcare coverage that reduces out-of-pocket expenses. European nations, including Germany and Sweden, use mixed formulas that incorporate wages, prices, and economic growth.

These comparisons highlight a structural challenge in the United States: retirees depend heavily on federal benefits while also shouldering significant healthcare expenses.

What Comes Next

Final Medicare premium announcements will be released later this year. Analysts say the public should expect continued debate in Congress over the adequacy of COLA calculations and the sustainability of Medicare funding.

“Planning ahead remains essential,” said Dr. Mitchell. “Retirees must take an active role in reviewing coverage options, especially during years when medical costs are expected to grow faster than income.”