As online claims circulate about Holiday Refund Deposits Arriving Before Christmas, the Internal Revenue Service (IRS) says no special stimulus or seasonal payments have been authorized. While some taxpayers may still receive routine refunds or account adjustments in December, officials stress that no new federal holiday refund program exists, despite persistent and widely shared claims on social media platforms.

Holiday Refund Deposits Arriving Before Christmas

| Key Fact | Detail |

|---|---|

| New holiday refunds | No new IRS holiday payment program approved |

| December deposits | May include regular refunds or corrections only |

| Viral claims | $1,000–$2,000 holiday or tariff payments not authorized |

| Legislative status | Any new stimulus requires congressional action |

| Official Website | IRS.gov |

What Are Holiday Refund Deposits Arriving Before Christmas?

The phrase Holiday Refund Deposits Arriving Before Christmas has gained traction across social media, video platforms, and search engines, often framed as breaking financial news. Posts frequently claim that the IRS is preparing to send surprise deposits—sometimes labeled “holiday refunds,” “economic relief payments,” or “tariff dividends”—to millions of Americans before the end of December.

In practice, the phrase has no official meaning within federal tax policy. The IRS has not issued guidance, press releases, or internal notices referencing a holiday-based refund initiative for the current tax year.

According to a review by The Associated Press, many viral claims reuse outdated language from earlier stimulus programs, particularly those authorized during the COVID-19 pandemic. Others misinterpret routine IRS payment activity, such as delayed refunds or corrected credits, as evidence of a new program.

“The IRS does not issue surprise payments,” said Nina Olson, former National Taxpayer Advocate, in prior public commentary. “Every payment program has a clear legal basis and a formal announcement.”

What the IRS Is Actually Sending Out in December

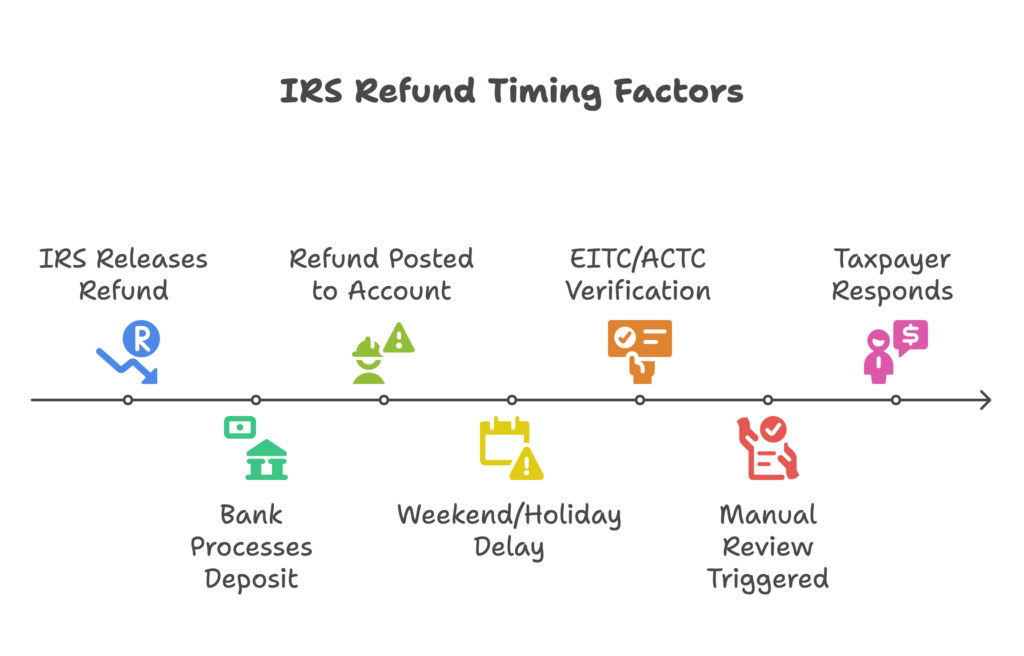

Although no holiday-specific payments exist, December is still an active month for IRS disbursements. These payments, however, fall into well-defined and limited categories.

Regular Tax Refunds and Processing Delays

Taxpayers who filed returns later in the year—particularly those who requested extensions until October—may still be receiving refunds in December. Others may see deposits due to delays caused by manual reviews, identity verification, or backlogs.

According to IRS operational data, paper-filed returns and amended returns (Form 1040-X) often take significantly longer to process, sometimes extending into the final weeks of the year.

Amended Returns and Adjustments

Some December deposits stem from amended returns filed earlier in the year. When taxpayers correct income reporting, dependents, or filing status, the IRS may issue an additional refund or, in some cases, adjust an existing balance.

These payments are often smaller than original refunds and can appear unexpected if taxpayers have not recently reviewed their filings.

Credit Corrections from Prior Tax Years

In recent years, the IRS has issued automatic corrections related to credits such as the Recovery Rebate Credit and the Child Tax Credit. While most of these corrections have already been completed, a small number of cases may still result in late-year payments.

Historical Context: Why Holiday Payment Rumors Persist

The persistence of holiday refund rumors is rooted in recent history. Between 2020 and 2021, the federal government authorized three rounds of economic impact payments, many of which arrived during winter months.

Those programs conditioned the public to associate December with federal relief, even though they were tied to extraordinary pandemic-era legislation rather than seasonal policy.

According to the Congressional Research Service, no broad-based stimulus program has been authorized since the conclusion of those measures. Nonetheless, their memory continues to shape public expectations, particularly during periods of inflation and economic uncertainty.

“People remember when money arrived, not always why,” said Kathryn Anne Edwards, a labor economist formerly with the RAND Corporation. “That makes misinformation easier to spread.”

Origins of the Confusion: Proposals vs. Policy

Some online claims reference political proposals involving the redistribution of tariff revenue or federal budget surpluses. While these ideas have been mentioned in speeches and interviews, they remain proposals, not enacted law.

Under U.S. law, the IRS cannot issue payments without explicit congressional authorization. Even if legislation were introduced today, experts say implementation would take months, not weeks.

“Designing eligibility rules, updating IRS systems, and notifying the public all take time,” said Joseph Rosenberg, a senior fellow at the Urban-Brookings Tax Policy Center. “There is no mechanism for an immediate, unannounced December rollout.”

The Congressional Budget Office has also noted that any new rebate program would likely require new funding allocations and administrative guidance.

How the IRS Communicates Real Payments

The IRS follows a consistent communication protocol for all payment programs. Legitimate initiatives are announced through:

- Official press releases

- IRS.gov updates

- Congressional legislation and public hearings

- Coordinated outreach with tax professionals

The agency does not rely on social media influencers, private websites, or viral posts to announce payments.

Taxpayers expecting money can verify their status through official tools, including “Where’s My Refund?” and their IRS online account.

Misinformation, Algorithms, and Financial Anxiety

Experts say the spread of claims about Holiday Refund Deposits Arriving Before Christmas reflects broader challenges in the online information ecosystem.

Search algorithms and social media platforms often amplify emotionally charged financial content, especially during the holidays, when household budgets are strained.

According to the Federal Trade Commission (FTC), reports of government-impersonation scams increase sharply between November and January. Scammers frequently promise expedited refunds or “missed payments” in exchange for personal data.

The FTC advises consumers to:

- Ignore unsolicited refund messages

- Avoid clicking links claiming “urgent IRS payments”

- Report scams to ReportFraud.ftc.gov

Who Is Most Affected by Holiday Refund Deposits Confusion

Tax professionals say confusion disproportionately affects:

- Lower-income households

- Seniors

- First-time filers

- Taxpayers without professional tax assistance

“People living paycheck to paycheck are more vulnerable to misinformation because the stakes are higher,” said April Walker, lead manager of tax practice ethics at the American Institute of Certified Public Accountants (AICPA).

Community organizations and Volunteer Income Tax Assistance (VITA) programs report increased inquiries each December related to rumored payments.

SSDI Policy Changes Ahead in 2026 — How Future Payments May Be Affected

What Comes Next After Holiday Refund Deposits

Absent new legislation, the IRS says its payment schedule will remain unchanged through year’s end. Officials continue to urge taxpayers to verify information directly through government sources and to consult qualified tax professionals when in doubt.

Any future stimulus, rebate, or refund expansion would require congressional approval, public debate, and formal IRS implementation. None of those steps are currently underway.

As the year closes, the IRS’s focus remains on preparing for the upcoming tax filing season, which typically begins in late January.

FAQs About Holiday Refund Deposits

Q: Is the IRS sending out a special holiday refund this year?

A: No. The IRS has confirmed that no holiday-specific refund or stimulus payment has been authorized.

Q: Why did I receive money from the IRS in December?

A: It may be a regular refund, an amended return adjustment, or a correction related to prior credits.

Q: Could Congress approve a holiday payment later?

A: Any new payment would require legislation and advance public notice.

Q: How can I avoid refund scams?

A: Use only IRS.gov tools, ignore unsolicited messages, and never share personal data with unknown sources.