Social Security recipients, including retirees, will see changes in their benefit schedules as the year shifts from December 2025 to January 2026. This article provides a detailed overview of important dates for payments, highlighting the impact of the 2.8% Cost-of-Living Adjustment (COLA) on Social Security benefits. The changes affect millions of Americans, particularly retirees, ensuring they are informed on when to expect their monthly payments.

Here’s the Full December 2025 and January 2026 Social Security Timeline

| Key Fact | Detail/Statistic |

|---|---|

| COLA Increase | 2.8% rise in Social Security benefits for 2026. |

| SSI Payments for January | Paid early on December 31, 2025. |

| Retirement Benefit Payment Dates | Scheduled by birthdate from Dec 10 to Dec 24, 2025. |

| January 2026 Social Security Payments | Issued in mid to late January, 2026. |

| Official Website | SSA.gov |

As 2025 draws to a close, retirees and other Social Security beneficiaries can expect a series of important payment dates in December 2025 and January 2026. With the 2.8% COLA increase coming into effect for 2026, understanding when payments will be made is essential for planning. This article outlines the key dates and explains the COLA adjustment, ensuring that all recipients are informed about their expected payment schedules.

Social Security Timeline for December 2025

Social Security payments are typically made according to a regular monthly schedule, but with some variations for the final month of the year. December 2025 brings a mix of regular payments and early deposits due to the New Year’s holiday.

Supplemental Security Income (SSI) Payments

For recipients of Supplemental Security Income (SSI), payments for January 2026 will be issued early, on December 31, 2025, since January 1 falls on a federal holiday. This ensures that recipients receive their benefits in time for the new year, with the 2.8% COLA increase included in this early payment.

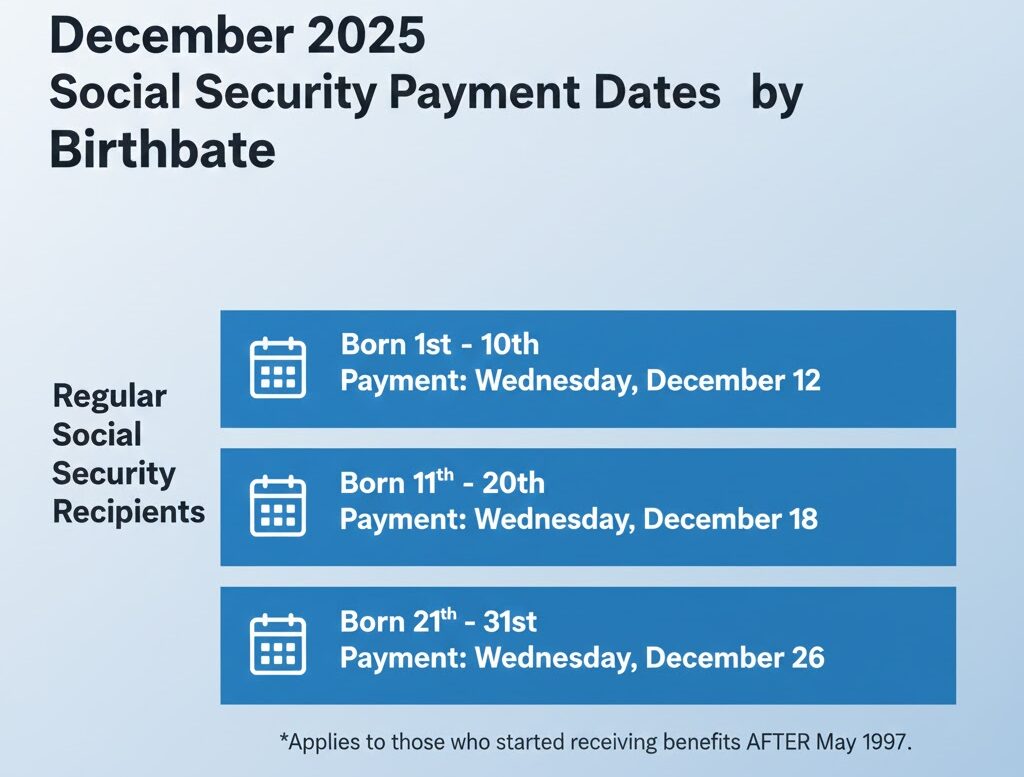

Social Security Retirement Payments

For Social Security retirement beneficiaries, the payment schedule is based on birthdates. For those born between the 1st and 10th of the month, payments will be made on December 10, 2025. For those born between the 11th and 20th, payments will be issued on December 17, and for those born between the 21st and 31st, payments will be scheduled for December 24, 2025. This means that December 2025 will see three waves of payments, depending on the recipient’s birthdate.

January 2026 Payment Dates

The first payments of 2026 will reflect the COLA increase, which is an automatic adjustment based on inflation. These payments will continue to follow the monthly schedule, but with the first checks of the new year incorporating the 2.8% COLA increase.

Retirement and Disability Payments

For Social Security retirement and disability beneficiaries, payments will be made as follows:

- Born 1st–10th: January 14, 2026

- Born 11th–20th: January 21, 2026

- Born 21st–31st: January 28, 2026

In contrast to SSI recipients, who already receive their January payment at the end of December, other beneficiaries will need to wait for their respective dates in January 2026.

Impact of the 2.8% COLA Increase

The 2.8% COLA adjustment for 2026 is a critical component of Social Security for millions of Americans. This increase reflects rising inflation and ensures that benefits keep pace with the cost of living. For most retirees, the COLA increase means an additional boost to their monthly Social Security checks, with the average monthly increase estimated at $56. This adjustment is particularly important for retirees, who rely on their Social Security benefits to cover day-to-day living expenses.

How the COLA is Applied

The COLA increase applies automatically to most Social Security benefits, including those for retirees, survivors, and people with disabilities. The Social Security Administration (SSA) adjusts the monthly payment based on the new COLA rate, and beneficiaries do not need to take any action to receive the increase. The new amounts will be reflected in the January 2026 payments for most recipients, and in the December 31, 2025 payment for SSI recipients.

A Brief History of Social Security and COLA Adjustments

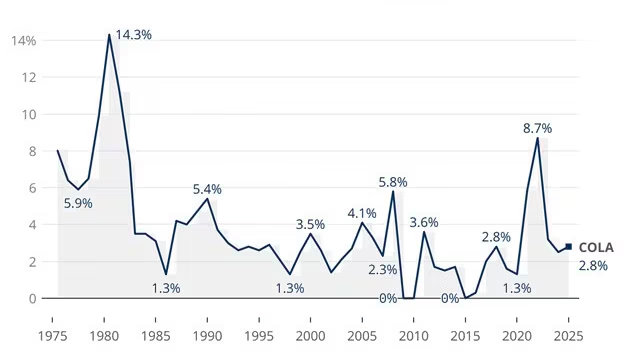

The Social Security program, first established in 1935, provides financial support to millions of retirees, disabled individuals, and survivors of deceased workers. The Cost-of-Living Adjustment (COLA) was introduced in 1975 as a way to ensure that Social Security benefits keep pace with inflation, maintaining their purchasing power.

The COLA is determined based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks inflation. Over the years, COLA increases have ranged from minimal adjustments to more substantial increases, depending on inflation levels. In 2026, the 2.8% COLA increase marks one of the higher adjustments seen in recent years.

Impact of Inflation on Social Security Payments

Inflation erodes purchasing power, meaning that retirees and other fixed-income individuals may struggle to maintain their standard of living as prices for goods and services rise. This is particularly true for Social Security beneficiaries, whose payments are tied to the cost of living. The COLA adjustment helps protect beneficiaries from the effects of inflation by ensuring their benefits rise with the prices they must pay for goods and services.

Inflation rates have fluctuated in recent years, and the 2.8% COLA increase for 2026 reflects an effort to keep Social Security benefits aligned with economic conditions. However, some critics argue that the CPI-W may not fully capture the rising costs that many retirees face, particularly for healthcare expenses.

How Social Security Benefits are Calculated

The amount of Social Security benefits a person is eligible for is based on their earnings history. Social Security uses a formula that takes the average of a person’s highest-earning years (usually the top 35) and adjusts that amount for inflation to determine their monthly benefit.

The more a person has earned during their working years, the higher their Social Security benefit will be, up to a certain maximum. However, it’s important to note that COLA adjustments are applied to the benefit amount after it is calculated, which helps prevent inflation from reducing its purchasing power over time.

Impact of the COLA Increase on Other Public Assistance Programs

The COLA increase doesn’t just affect Social Security; it also impacts other public assistance programs, like SSI and Veterans’ benefits. Many federal programs are tied to COLA, meaning that when Social Security benefits increase, other programs follow suit. This ensures that individuals who rely on multiple forms of public assistance are not left behind as inflation drives up living costs.

For example, SSI recipients, who rely on this assistance to meet basic living needs, will receive their first COLA-adjusted payment on December 31, 2025. This early payment is crucial for helping recipients navigate the cost-of-living increases that will hit in early 2026.

Retirement Planning Tips for Social Security Beneficiaries

For retirees and future Social Security recipients, planning ahead is key to ensuring financial security. Here are some tips to help manage Social Security benefits effectively:

- Maximize Benefits by Working Longer: The longer you work, the higher your Social Security benefits will be. Delaying retirement past your full retirement age can also increase your monthly payments.

- Consider Taxes on Benefits: Depending on your income, a portion of your Social Security benefits may be subject to federal taxes. It’s important to understand how taxes will impact your overall retirement income.

- Factor Healthcare Costs into Retirement Plans: Medicare premiums, prescription drug costs, and other healthcare expenses can add up quickly for retirees. The COLA increase helps with inflation but may not cover the full rise in medical expenses.

Global Context and Comparison

The U.S. Social Security system is one of the largest public pension programs in the world. While many other countries have similar systems, each has its own method of adjusting benefits to account for inflation. For instance, Canada’s Canada Pension Plan (CPP) also uses a COLA adjustment, while countries like Germany use a more complex formula based on both inflation and wage growth.

In comparison, the U.S. COLA adjustment system is relatively straightforward but has faced criticism for not fully reflecting the real costs of retirement, particularly healthcare. While some countries, such as Australia and the Netherlands, have more robust social safety nets for retirees, the U.S. system remains one of the most important sources of income for older Americans.

Expert Opinions and Analysis

Dr. Sarah Jacobs, an economist at the Brookings Institution, explains that the COLA increase is a response to rising inflation but that it doesn’t always fully account for the realities of older Americans’ expenses. “While the COLA adjustment is vital, there are ongoing concerns that it doesn’t sufficiently address the rising cost of healthcare, which disproportionately affects retirees,” she notes.

Other financial experts argue that while the 2.8% COLA increase is helpful, many retirees may still face challenges due to rising medical expenses, housing costs, and other inflationary pressures. Planning for these increases, they advise, is crucial for long-term retirement security.

Conclusion

Social Security recipients, especially retirees, can expect a busy and financially important end to 2025. Early SSI payments on December 31, 2025, followed by the regular retirement and disability payments in January 2026, will provide the necessary financial support for millions of Americans. The 2.8% COLA increase will help ensure that benefits keep pace with inflation, providing relief in an uncertain economic landscape.

As the year transitions, retirees and others receiving Social Security benefits should stay informed about these important payment dates and the upcoming COLA increase, as it impacts their financial well-being in 2026.

SSDI, SSI, and Retirement Checks: Here’s the Full December 2025 Payout Timeline

FAQs About Here’s the Full December 2025 and January 2026 Social Security Timeline

Q: When will the January 2026 Social Security payment be made?

A: Social Security payments for January 2026 will be made according to the regular schedule, starting on January 14, 2026, for those born between the 1st and 10th.

Q: What is the COLA increase for Social Security in 2026?

A: The Cost-of-Living Adjustment (COLA) for 2026 is 2.8%, meaning most recipients will see an increase in their monthly benefits.

Q: Why is the SSI payment for January 2026 made early?

A: SSI payments are issued early on December 31, 2025, because January 1 is a federal holiday, ensuring beneficiaries receive their funds on time.