The U.S. government confirmed this month that Social Security checks for most retired workers remain near an average of $2000 per month, reflecting long-term earnings patterns and the underlying benefit formula. Officials stressed that the figure is not a formal benefit cap, but rather the typical amount many retirees qualify for based on work history, inflation adjustments, and the Social Security Administration’s (SSA) rules.

Social Security Checks Cap at $2000

| Key Fact | Detail |

|---|---|

| Average monthly retirement benefit | About $2000 |

| Maximum possible payment at age 70 | Over $5000 |

| 2026 projected COLA | Estimated 2.5–3% |

| Trust Fund depletion estimate | 2033–2034 |

| Percentage relying on Social Security for half of income | 50% of retirees |

Why Most Social Security Checks Average About $2000

Earnings Patterns Limit Benefit Amounts

The SSA calculates benefits based on a worker’s highest 35 years of inflation-adjusted earnings. Many workers have interrupted careers or years of low wages, which lowers their final benefit.

“Most Americans do not reach the consistent wage levels needed to qualify for very high monthly benefits,” said Stephen Goss, chief actuary of the SSA, during a recent policy briefing.

High earners who pay the maximum taxable amount each year can qualify for substantially larger benefits, but that group represents a small percentage of the workforce.

Understanding the Misconceptions Around a ‘Benefit Cap’

Why $2000 Is Not a Legal Maximum

Several recent news reports and online discussions suggested that most retirees “hit a cap” around $2000. Officials clarified that this is misleading.

“It’s crucial to understand that Social Security benefits are not capped at $2000,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “The $2000 figure represents the average, not a ceiling.”

Benefits can exceed $5,000 per month for high earners who delay claiming until age 70.

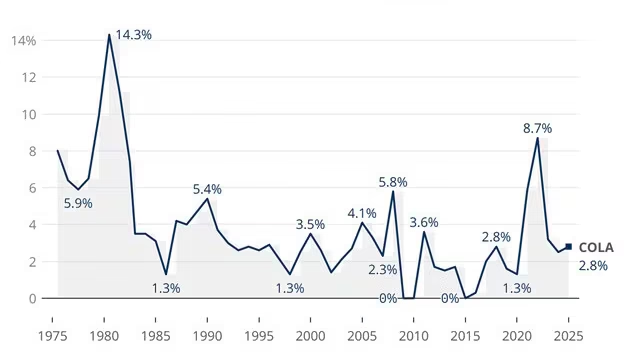

How COLA Adjustments Shape Monthly Payments

Inflation Drives Annual Increases

The program’s annual Cost-of-Living Adjustment (COLA) ensures benefits rise with inflation. The 2024 COLA was 3.2 percent, and early estimates for 2026 range from 2.5 to 3 percent, according to the Congressional Budget Office.

However, many retirees argue that real living costs — especially healthcare, housing, and transportation — rise faster than the official COLA measurement.

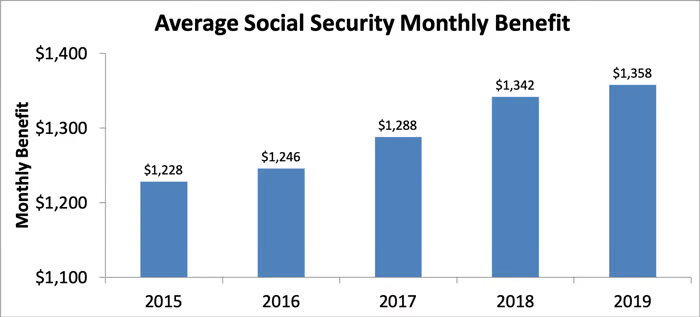

Historical Context: How Social Security Checks Have Evolved

When Social Security was established in 1935, benefits were modest and intended only as supplemental income. Over time, Congress expanded the program through wage indexing, survivor benefits, disability benefits, and Medicare.

In the 1970s, benefits increased rapidly due to inflation, prompting a shift to an automatic COLA formula. By comparison, average monthly retirement benefits were under $500 in 1980 (in nominal dollars). Adjusted for inflation, today’s $2000 average reflects decades of wage growth and program adjustments.

Comparing Retirement Benefits Across Demographics

Women Receive Lower Benefits

Because women often have caregiving responsibilities or face wage gaps, they typically qualify for lower monthly payments. SSA data shows the average benefit for women is roughly 15 percent lower than for men.

Racial and Geographic Disparities

Labor economists note that lifetime earnings gaps across racial groups lead to parallel gaps in Social Security benefits. Residents in rural states with lower average wages also tend to receive smaller monthly checks.

Longevity and Its Impact

Retirees who live longer rely more heavily on Social Security, especially as personal savings decline. The average 65-year-old American today can expect to live 19–21 more years, according to the Centers for Disease Control and Prevention (CDC).

Profiles: How Social Security Checks Shape Everyday Lives

Example 1: A Middle-Income Worker

Maria Lopez, 67, worked more than 40 years in retail and service jobs. She receives about $1,850 per month.

“It covers my essentials, but not much else,” she said in an interview with the AARP. “Rents going up have made budgeting much harder.”

Example 2: A High-Earning Delay Strategy

By contrast, Mark Reynolds, a former engineer, delayed claiming until 70 and averaged near the maximum taxable wage for more than three decades. He receives a monthly check of nearly $4,800.

“These payments help me maintain stability in retirement,” he said.

Understanding Other Benefit Types Beyond Retirement

Survivor Benefits

Surviving spouses can receive up to 100 percent of the deceased worker’s benefit, depending on age and eligibility.

Disability Benefits

The Social Security Disability Insurance (SSDI) program pays an average of roughly $1,500 per month. Benefits adjust annually with COLA.

Spousal Benefits

Spouses with little or no work history can receive up to 50 percent of the primary worker’s benefit.

Economic Pressures: Are Social Security Checks Keeping Up?

A Pew Research Center survey found that 60 percent of Americans worry they will not have enough income in retirement. For the 50 percent of retirees who rely on Social Security for at least half their income, rising costs pose a serious challenge.

Healthcare expenses — which grow faster than general inflation — consume a growing share of retiree budgets. According to Fidelity Investments, the average retired couple may need more than $300,000 for lifetime medical costs.

How the U.S. Compares Internationally

The Organisation for Economic Co-operation and Development (OECD) reports that the U.S. public pension replacement rate — the share of pre-retirement income replaced by public benefits — is about 40 percent, well below the OECD average of 58 percent.

Many advanced economies provide more robust public pensions, complementing them with mandatory private savings systems.

Long-Term Outlook: Trust Fund Solvency and Reform Proposals

The latest SSA Trustees Report projects that the Old-Age and Survivors Insurance (OASI) Trust Fund may be depleted by 2033–2034. After depletion, incoming payroll taxes would cover only about 77 percent of scheduled benefits unless Congress acts.

Key proposals include:

- Raising the payroll tax rate

- Increasing the taxable wage ceiling

- Modifying benefit formulas for high earners

- Gradually increasing the full retirement age

- Enhancing benefits for low-income workers

Lawmakers from both parties have introduced plans, but none have advanced due to political gridlock.

Financial Planning Considerations for Retirees

Financial planners emphasize that Social Security should be viewed as one part of a broader retirement strategy.

“Claiming age remains one of the most important decisions retirees make,” said David Certner, legislative counsel for AARP. “Delaying benefits can increase lifetime income, but not everyone can afford to wait.”

Retirees are urged to diversify income sources, maintain emergency savings, and consider working longer if possible.

Retirees Celebrate $56 COLA — But One Costly Mistake Could Wipe It Out

Public Sentiment and Political Pressures

Growing concerns about retirement security have influenced recent campaign platforms. Pew Research Center polling shows that 80 percent of Americans oppose cutting Social Security benefits, and a majority support increasing taxes on higher earners to strengthen the system.

Looking Ahead

Social Security remains the foundation of retirement income for millions of Americans. While the average Social Security checks hover around $2,000, policymakers, economists, and retirees continue to debate how to balance future financial stability with the needs of an aging population.

For now, benefit levels will continue to reflect wage growth, inflation, and legislative decisions — with the future of the program resting squarely in the hands of Congress.