Even with annual COLA increases designed to protect purchasing power, millions of American retirees say their finances feel increasingly strained as healthcare, housing, and everyday expenses rise faster than benefits. Economists, retirement advocates, and federal data suggest the gap reflects both structural limits in how COLA increases are calculated and the unique spending patterns of older households.

Even With COLA Increases, Many Retirees Still Feel Financial Pressure

| Key Fact | Detail |

|---|---|

| Average COLA increases | Roughly 2%–3% annually in recent years |

| Largest cost pressures | Healthcare, housing, and utilities |

| Inflation index used | CPI-W (urban workers), not retirees |

| Retirees relying mainly on Social Security | About 50% |

| Official Website | Social Security Administration |

How COLA Increases Are Calculated

COLA increases, or Cost-of-Living Adjustments, are applied annually to Social Security benefits to prevent inflation from eroding retirees’ purchasing power. The adjustment is based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), as measured by the U.S. Bureau of Labor Statistics.

The CPI-W tracks spending patterns of households where at least half of income comes from wages, and at least one household member works in a clerical or wage-based job. Retirees, by definition, are not the target population.

“The CPI-W was never designed to measure the inflation older Americans experience,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College. “As retirees age, their spending shifts in ways the index does not fully capture.”

Because the index emphasizes transportation, apparel, and work-related expenses, categories that often decline in retirement, it underweights healthcare and housing, which grow as a share of retiree budgets.

Why Retirees Feel the Squeeze Despite COLA Increases

Healthcare Costs Absorb Much of the Increase

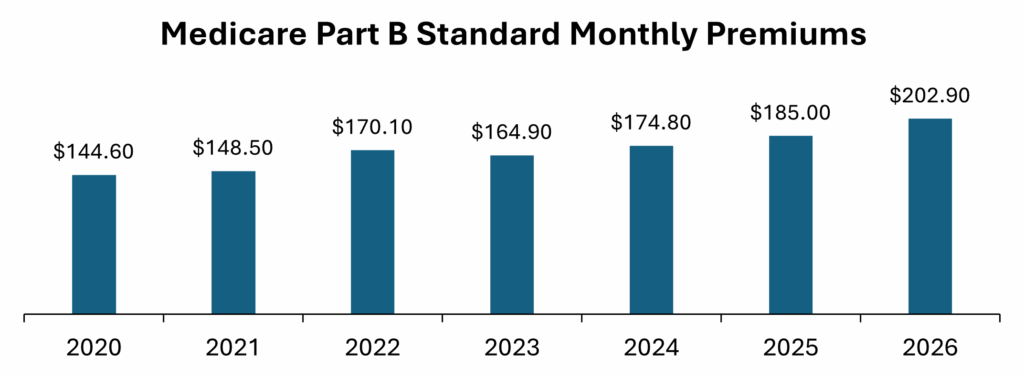

Healthcare is consistently cited as the single largest reason retirees say COLA increases feel inadequate. While Social Security benefits rise annually, Medicare Part B premiums, prescription drug costs, and out-of-pocket medical expenses often grow more quickly.

According to the Centers for Medicare & Medicaid Services (CMS), Medicare Part B premiums are automatically deducted from Social Security checks for most beneficiaries. When premiums rise, they reduce the net increase retirees actually receive.

“In many years, retirees technically get a COLA increase, but practically see little or no change in their take-home benefit,” said Mary Johnson, a Social Security policy analyst at The Senior Citizens League.

Healthcare inflation has been particularly volatile since the COVID-19 pandemic, driven by labor shortages, hospital consolidation, and rising drug prices, according to the Kaiser Family Foundation.

Housing and Utility Costs Continue to Rise

Housing remains another major pressure point. Even retirees who own homes outright face rising property taxes, homeowners insurance premiums, maintenance costs, and utility bills.

Data from the Bureau of Labor Statistics show that shelter costs have been among the fastest-rising components of inflation nationwide. In many regions, homeowners insurance premiums have surged due to climate-related risks, while electricity and natural gas prices remain elevated.

“For retirees on fixed incomes, housing costs are largely unavoidable,” said Dr. Richard Johnson, a senior fellow at the Urban Institute. “COLA increases rarely keep pace with those increases year after year.”

Structural Limits of the COLA Formula

Economists across the ideological spectrum agree that the CPI-W does not reflect retiree spending patterns. A long-discussed alternative, the Consumer Price Index for the Elderly (CPI-E), weights healthcare and housing more heavily.

Studies by the Bureau of Labor Statistics indicate that CPI-E has historically risen slightly faster than CPI-W, meaning COLA increases based on CPI-W may understate inflation for older Americans over time.

“The difference may seem small in a single year,” said Monique Morrissey, an economist at the Economic Policy Institute. “But compounded over 20 or 30 years, it can significantly erode purchasing power.”

Despite broad acknowledgment of the issue, adopting CPI-E would increase Social Security costs, raising concerns about long-term program financing.

Heavy Reliance on Social Security Income

The impact of insufficient COLA increases is magnified by how heavily retirees depend on Social Security. According to the Social Security Administration, about half of all retirees rely on Social Security for at least 50% of their income, while roughly one in four depend on it for nearly all income.

This reliance leaves little room to absorb rising expenses. Unlike workers, retirees cannot easily increase earnings to offset higher costs.

Secondary factors such as regional cost differences (KW2), limited retirement savings (KW3), and longer life expectancy (KW4) further compound financial vulnerability.

“Even modest inflation can be destabilizing when your income is fixed,” said Dr. Teresa Ghilarducci, a retirement expert at The New School. “COLA increases slow the erosion, but they do not eliminate it.”

The Human Impact Behind the Numbers

Beyond economic data, retirees describe making difficult tradeoffs. Surveys by The Senior Citizens League show growing numbers of older Americans delaying medical care, cutting back on food quality, or reducing home heating and cooling to manage expenses.

For many, these decisions carry health and safety risks.

“We hear from retirees every year who say their COLA increase went entirely to Medicare premiums or rent,” Johnson said. “That leaves nothing for emergencies.”

Advocacy groups argue these pressures disproportionately affect women and minorities, who tend to have lower lifetime earnings and savings.

Policy Debate and Reform Proposals

The persistent gap between COLA increases and retiree expenses has fueled renewed policy debate in Washington. Proposed reforms include:

- Switching to CPI-E for COLA calculations

- Providing minimum benefit increases for long-term, low-income retirees

- Reducing Medicare premium growth for older beneficiaries

However, these proposals face fiscal and political obstacles. According to the Social Security Trustees, the program’s trust fund is projected to face depletion in the mid-2030s without legislative changes.

“Any increase in benefits must be balanced against the program’s long-term solvency,” said Andrew Biggs, a former deputy commissioner of the Social Security Administration.

Financial Planning Strategies Retirees Are Using

In response to ongoing pressure, financial planners say retirees are increasingly adopting defensive strategies. These include delaying Social Security claims to boost monthly benefits, downsizing housing, and prioritizing guaranteed income products.

“COLA increases are helpful, but they should not be the sole inflation hedge,” said Christine Benz, director of personal finance at Morningstar.

Still, planners acknowledge such strategies are not available to everyone, particularly those already retired or living on limited incomes.

Why SSI Recipients Will See Two Payments in December — And Why It’s Not a Bonus

What Comes Next for COLA Increases

Looking ahead, COLA increases will continue to fluctuate with inflation. While higher inflation can produce larger adjustments, it also raises living costs simultaneously, often leaving retirees no better off in real terms.

“The irony is that large COLAs usually follow periods of high inflation,” Johnson said. “That means retirees are often just trying to catch up.”

Absent structural changes, experts expect the gap between COLA increases and retiree expenses to remain a defining challenge of retirement security in the United States.

FAQs About Even With COLA Increases, Many Retirees Still Feel Financial Pressure

What are COLA increases?

COLA increases are annual adjustments to Social Security benefits intended to offset inflation and preserve purchasing power.

Why don’t COLA increases fully cover retiree expenses?

They are based on CPI-W, which does not reflect retiree-specific spending patterns, especially healthcare and housing.

Would switching to CPI-E increase benefits?

Most analyses suggest CPI-E would result in slightly higher COLA increases over time.

Are changes to COLA increases likely?

Proposals exist, but concerns about Social Security’s long-term financing make reforms uncertain.