Several U.S. states are continuing to distribute end-of-year tax refunds as December advances, aiming to complete payments before the close of 2025. State officials say the remaining refunds are tied to processing backlogs, increased fraud screening, and extended tax relief programs. Payments are still moving through revenue departments in states including Alaska, New Jersey, New York, and Pennsylvania, according to recent government updates.

End-of-Year Tax Refunds

| Key Fact | Detail / Statistic |

|---|---|

| States still issuing tax refunds | Alaska, New York, New Jersey, Pennsylvania continue December payouts |

| Primary causes of delays | Security checks, verification of high-value claims, staffing shortages |

| December completion goal | Most states aim to finish payments before year-end |

Why States Are Still Sending Out End-of-Year Tax Refunds

Several state revenue departments say internal processing times stretched into December due to elevated refund volumes and enhanced fraud-prevention protocols. Officials in New Jersey and New York reported that their agencies implemented additional verification steps this year, a change they describe as essential for protecting taxpayers.

A spokesperson for the New York State Department of Taxation and Finance said in a recent briefing that “higher-than-usual review requirements for certain deductions slowed some refunds, but all validated payments remain on schedule for release.”

States Extending Payments Into December

Many of the remaining payments involve state tax rebates, which legislators authorized earlier in the year to offset rising living costs. According to official updates:

- Alaska continues issuing payments linked to its annual Permanent Fund dividend.

- New Jersey reports ongoing distribution of ANCHOR property tax relief rebates.

- Pennsylvania is completing payments under its Property Tax/Rent Rebate Program.

- New York is finalizing supplemental rebates for eligible homeowners.

In each instance, state officials emphasize that payments are automatic for eligible residents and do not require new applications.

Why Some End-of-Year Tax Refunds Are Delayed

Processing delays vary by state but reflect several common trends:

Increased Fraud Screening

The Internal Revenue Service (IRS) and several state tax agencies expanded fraud-detection systems after identifying a rise in suspicious refund claims. According to the IRS Fraud Enforcement Office, new filters require manual review for high-value or unusual filings.

Staffing Gaps and Technology Backlogs

Multiple states, including Pennsylvania and New Jersey, acknowledged staffing shortfalls and delays in updating older payment systems. A senior policy analyst at the Urban-Brookings Tax Policy Center said that “legacy processing systems remain one of the most persistent challenges for states managing tight year-end refund deadlines.”

Verification of High-Value Claims

State agencies confirm that larger refund claims undergo additional fact-checking, including income verification and documentation requests. These checks contribute to longer processing times but reduce the risk of improper payments.

Additional Factors Extending Refund Timelines

While the core causes for delay are well-documented, several broader economic and administrative issues contributed to the slower year-end refund cycle:

Growing Complexity in State Tax Codes

Tax experts note that state-level tax codes have become more complex over the past five years, with expanded credits, deductions, and relief programs. These changes require revenue agencies to update software, retrain staff, and implement new compliance checks—processes that can slow payment distribution.

Increased Demand for Tax Relief

Inflationary pressures and rising housing costs have led to expanded eligibility for relief programs. States like New Jersey and Pennsylvania reported record numbers of applicants for rebates, increasing workload for verification teams.

Shift Toward Digital Filing and AI-Based Review

While digital systems generally speed up processing, the adoption of artificial intelligence tools for anomaly detection resulted in more returns being flagged for manual review. According to IRS briefings, AI-expanded scrutiny was intended to reduce fraud but also extended processing times.

How States Prioritize Payments During December

State officials typically prioritize refunds and rebates using several criteria:

1. Filing Date

Earlier filings are processed first, though exceptions occur when returns require special verification.

2. Claim Complexity

Straightforward wage-only filings move through the system quickly. Returns involving multiple income streams, business deductions, or amended filings take longer.

3. Fraud Risk Scoring

Modern state systems use risk-scoring models to identify anomalies. Returns triggering a high score undergo manual review, which can add one to three weeks to processing time.

4. Payment Method

Direct deposits move faster than paper checks, which are handled through third-party print-and-mail vendors.

The Economic Impact of Year-End Refunds

Economists note that end-of-year tax refunds can influence local economies, especially when distributed in large batches.

Short-Term Boost to Consumer Spending

Refund payments typically increase household liquidity near the holidays. According to a report from the Federal Reserve Bank of Philadelphia, tax refunds correlate with short-term increases in retail spending, utility payments, and debt reduction.

Stabilizing Effect on Lower-Income Households

Rebate programs in Pennsylvania and New Jersey disproportionately benefit retirees, renters, and low-income homeowners. These groups often rely on refunds to manage year-end expenses, property taxes, or winter heating costs.

Budgetary Implications for States

Delivering refunds later in the year allows states to hold cash longer, improving short-term liquidity. However, delays can also generate criticism from lawmakers and taxpayers who expect timely disbursements.

What Taxpayers Should Expect Next

Officials in multiple states say end-of-year tax refunds will continue through late December. Payments are being issued by direct deposit, debit card, or mailed checks, depending on the state.

Residents awaiting funds are encouraged to:

- Check their state’s “Where’s My Refund?” portal.

- Ensure their banking information is current.

- Monitor notifications for verification requests.

A spokesperson for the New Jersey Department of the Treasury noted, “We expect the majority of outstanding refunds to be completed by year-end, barring any unresolved documentation issues.”

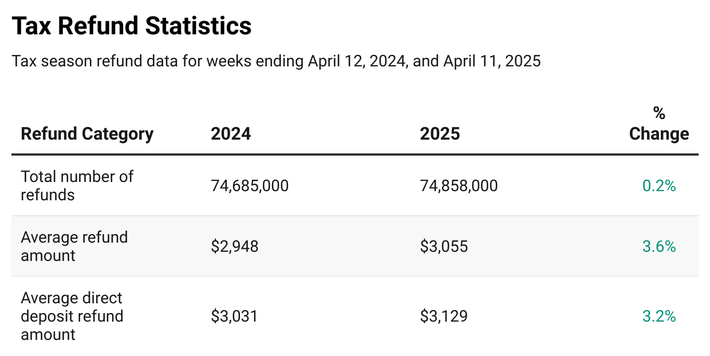

Historical Context: How Current Delays Compare to Previous Years

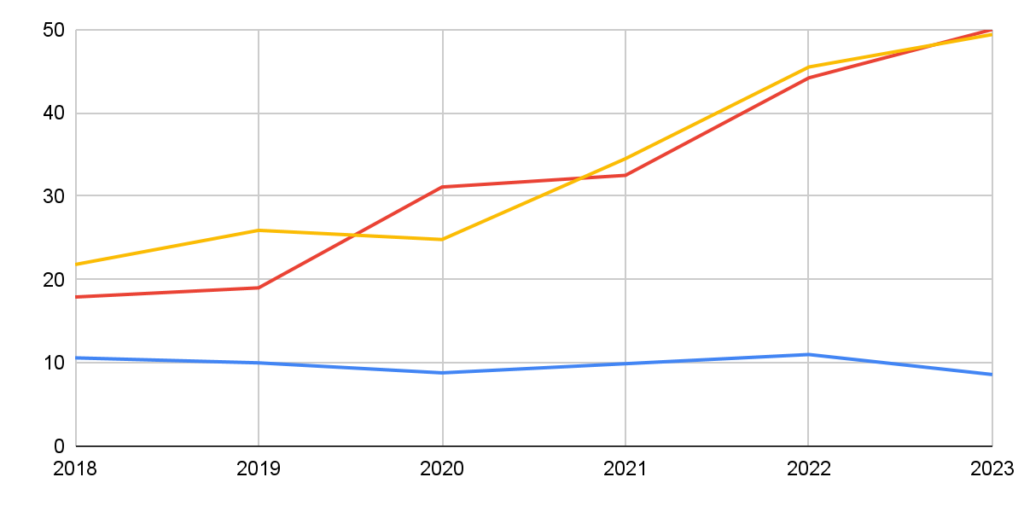

Refund delays are not unprecedented. During the pandemic years, several states experienced backlogs lasting into January or February.

However, analysts observe that:

- 2023 was one of the fastest refund years on record because states received federal grants enabling system upgrades.

- 2024 and 2025 saw longer delays as demand for relief programs grew and federal fraud alerts increased.

Tax historians suggest that the 2025 refund cycle aligns more closely with pre-pandemic norms than with the accelerated timelines seen during recovery years.

Planning to Retire in 2026? Three Smart Financial Steps to Take Before Year-End

Least Critical Information / Final Paragraph

Some states have indicated they will publish updated processing statistics in early January, offering a clearer picture of the refund cycle’s performance. Analysts say the timing could influence next year’s budget debates as lawmakers assess administrative capacity and taxpayer demand for ongoing tax relief programs.

FAQs About End-of-Year Tax Refunds

Why are some refunds processed faster than others?

Timing depends on filing complexity, verification requirements, and each state’s internal processing systems.

Do all states offer end-of-year refund status tools?

Most do, though functionality varies. Some states provide daily updates, while others refresh only weekly.

Can taxpayers speed up their refund?

Responding promptly to verification requests is the most effective way. Changing bank details or mailing preferences mid-process can cause delays.

Will next year’s refunds face the same delays?

Experts say states are investing in automation and staffing, but increased fraud activity may continue to prompt longer review cycles.

What happens if a refund is still pending in January?

States typically issue updated timelines after the new year. Refunds remain valid and will not be forfeited.