As living costs continue to rise, more Americans are searching for ways to strengthen their retirement income without jeopardizing Social Security eligibility. Financial analysts, federal advisers, and retirement researchers say that seniors can safely expand their income through diversified investments, measured withdrawals, and part-time work, provided they understand the rules governing benefit reductions and long-term planning. New data highlights both the opportunities and the risks for older adults seeking financial stability.

Easy Ways to Boost Retirement Income

| Key Fact | Detail/Statistic |

|---|---|

| Social Security earnings limit (2024) | $22,320 annually before partial reductions for those under Full Retirement Age |

| Passive income categories unaffected by benefit limits | Dividends, interest, pensions, retirement withdrawals |

| Benefit growth when delaying claims | Up to 8% annual increase when delaying beyond Full Retirement Age |

| Social Security Administration |

As economic and demographic pressures evolve, retirees will continue to explore new ways to strengthen financial stability. Analysts say the most effective strategies will be those grounded in accurate information, balanced risk, and prudent long-term planning. With Social Security remaining a cornerstone of retirement, informed choices will help millions of Americans maintain stability in the years ahead.

Why Strengthening Retirement Income Has Become More Urgent

The cost of living for older Americans has grown sharply in the past three years, driven by inflation in healthcare, housing, and essential goods. The U.S. Bureau of Labor Statistics reported above-average inflation for categories that disproportionately affect seniors, placing pressure on fixed incomes.

Retirement specialists say this trend is reshaping how Americans prepare for later life.

“Retirement today demands flexibility,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College. “Social Security remains the backbone of retirement security, but supplemental income sources are now critical.”

A 2023 survey from the Employee Benefit Research Institute (EBRI) found that nearly 70% of older workers expect to continue some form of employment after retiring, reflecting shifting expectations about financial security.

How Income Interacts With Social Security Eligibility

The Social Security Administration (SSA) uses a system called the Earnings Test to determine whether beneficiaries under Full Retirement Age (FRA) may experience temporary benefit reductions. Wages above the annual earnings limit can result in partial withholding, though the SSA recalculates benefits later to compensate for withheld funds.

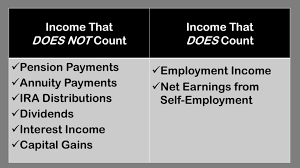

Distinguishing Countable Earnings From Non-Countable Income

The SSA counts only earned income—such as wages or self-employment profits—toward the earnings limit. Other income sources do not trigger reductions, including:

- Investment dividends and interest

- Traditional and Roth IRA withdrawals

- 401(k) distributions

- Rental income (when not tied to active business participation)

- Pension payments and annuities

These distinctions form the foundation for strategies retirees use to expand retirement income safely.

Strategies to Increase Retirement Income Without Affecting Benefits

Financial experts emphasize that retirees can pursue additional income through several distinct pathways, each carrying benefits and potential risks.

1. Working Part-Time Within Earnings Limits

Part-time employment continues to rise among older Americans. The SSA’s earnings limit—$22,320 in 2024—allows many retirees to work without penalty.

“Work can offer both financial stability and emotional fulfillment,” said Andrew Biggs, senior fellow at the American Enterprise Institute. “What matters is understanding the annual threshold and keeping earnings structured.”

Many employers now offer flexible roles that appeal to older workers, including consulting, mentoring, and seasonal positions. These jobs often provide supplemental income without exceeding SSA limits.

2. Building Passive Income Through Investments

Financial planners often encourage retirees to shift a portion of their portfolio into income-generating assets. Because investment earnings do not count as wages, they do not affect Social Security eligibility.

Common options include:

- Dividend-paying stocks

- Bond ladders, which stagger maturities for stable cash flow

- Real estate investment trusts (REITs)

- Low-risk mutual funds and ETFs designed for retirees

Professor Olivia Mitchell of the Wharton School says retirees must strike a balance. “Passive income is valuable,” she said. “But seniors need to be aware of volatility and consider their risk tolerance when structuring portfolios.”

3. Smart Withdrawals From Retirement Accounts

Withdrawals from 401(k)s and IRAs remain one of the safest ways to increase retirement income without triggering SSA penalties. The IRS mandates Required Minimum Distributions (RMDs) for those aged 73 and older, which affect tax liabilities but not Social Security eligibility.

Financial planners recommend:

- Coordinating withdrawals with tax brackets

- Avoiding excessive early withdrawals

- Using systematic withdrawal strategies such as the 4% rule or guardrail methods

These help ensure long-term portfolio durability.

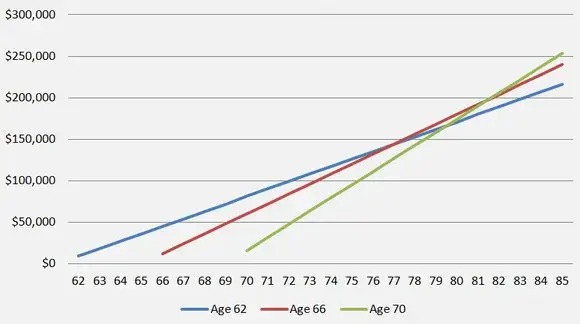

4. Delaying Social Security for Higher Future Income

Delaying Social Security benefits until age 70 remains one of the most powerful tools for long-term financial stability. SSA data shows an 8% annual benefit increase for each year claimed after FRA.

“This is often the single most predictable way to increase lifetime benefits,” said Dr. Jeffrey Brown, dean at the University of Illinois. “It’s especially valuable for individuals with longer life expectancies.”

New and Emerging Approaches for Increasing Retirement Income

With seniors facing economic uncertainty, researchers and policymakers have highlighted several innovative or underused strategies.

1. The Growth of Hybrid Annuities

Hybrid annuity products combine long-term care benefits with guaranteed income components. These financial tools have grown in popularity as seniors aim to protect against unexpected medical expenses.

Analysts at Morningstar note that annuities can play a stabilizing role for retirees seeking predictable payouts.

2. Using Home Equity Without Affecting Social Security

Home equity remains one of the largest financial assets for Americans over age 65. Several safe, regulated tools allow retirees to convert equity into income without impacting Social Security, including:

- Downsizing

- Home equity loans

- Home equity lines of credit (HELOCs)

- Reverse mortgages (when used cautiously and with counseling)

The Consumer Financial Protection Bureau (CFPB) emphasizes careful review, noting that reverse mortgages work best for long-term homeowners with clear financial plans.

3. Continuing Education and Upskilling for Older Workers

Many universities and workforce programs now offer reduced-cost training for older adults. These programs help retirees pursue flexible careers such as:

- Freelance writing

- Virtual assistance

- Accounting or bookkeeping

- Remote administrative work

- Online teaching and tutoring

Economists say skill enhancement supports both financial and emotional well-being.

A Look at International Comparisons

Several developed nations face similar demographic and financial pressures. Comparing policy structures offers context for U.S. retirees.

- Canada allows seniors to work without reducing Old Age Security payments, though high-income earners may face benefit “clawbacks.”

- United Kingdom pensioners can work without affecting the State Pension.

- Germany relaxed earnings limits for pensioners in recent years due to workforce shortages.

These parallels demonstrate increasing global emphasis on flexible, multichannel retirement income strategies.

Potential Risks and Considerations for Retirees

While retirees can safely increase income, analysts caution that certain risks must be evaluated.

Tax Planning Challenges

Additional income from investments, withdrawals, or home equity may shift retirees into higher tax brackets.

Health Coverage Implications

Certain income types can affect Medicare premiums through the Income-Related Monthly Adjustment Amount (IRMAA).

Long-Term Portfolio Stability

Aggressive investment decisions may threaten long-term financial security, especially for retirees with limited savings.

Experts recommend annual reviews with certified financial planners to avoid these pitfalls.

What Policymakers Are Debating Now

Congress continues to discuss structural reforms to ensure long-term Social Security solvency. The Congressional Budget Office warns that the trust funds may face shortfalls by the mid-2030s without legislative intervention.

Advocacy groups stress the importance of clear rules. “Retirees need confidence in the system,” said Nancy Altman, president of Social Security Works. “Income flexibility should support—not threaten—retirement security.”

December Is the Final Month Before the 2.8% Social Security COLA — How Your Check Will Change

Looking Ahead: What Retirees Should Monitor

Experts advise retirees to watch for:

- Annual SSA adjustments to earnings limits

- Changes to Medicare income thresholds

- Federal updates on long-term Social Security reform

- Market volatility affecting retirement portfolios

These indicators will shape retirement planning over the next decade.

FAQs About Easy Ways to Boost Retirement Income

1. Does investment income reduce Social Security payments?

No. Investment income is not counted as wages and does not reduce benefits, according to the Social Security Administration.

2. Will part-time work affect my benefits?

Only if annual earnings exceed SSA limits for people under Full Retirement Age.

3. Are withdrawals from retirement accounts considered earnings?

No. Withdrawals from IRAs and 401(k)s do not count against Social Security earnings limits.

4. Can delaying my benefits increase overall retirement income?

Yes. Delaying up to age 70 increases monthly benefits significantly.