Americans preparing to retire in 2026 are increasingly relying on a simple but widely accepted formula to estimate their Social Security benefit, as federal analysts update wage indexing assumptions and cost-of-living indicators for the coming year. The method offers future retirees a clearer and more reliable foundation for planning during a period of continued economic uncertainty.

Easy Formula to Estimate Your Real Social Security Benefit

| Key Fact | Detail / Statistic |

|---|---|

| Retirement benefits are based on a 35-year earnings average | Uses the Average Indexed Monthly Earnings (AIME) method |

| Early filing permanently reduces benefits by up to 30% | Applies to claims before full retirement age |

| 2026 COLA may be moderate due to easing inflation | Analysts project smaller increases |

Understanding the Formula Behind the 2026 Social Security Benefit

How AIME Determines Your Baseline Payment

The Social Security Administration calculates retirement benefits using the Average Indexed Monthly Earnings (AIME) formula, which adjusts past wages to reflect national wage growth. This ensures a fair comparison between earnings from decades ago and wages earned today.

Once the AIME is calculated, the agency applies a bend-point formula that divides earnings into three tiers, each with a different percentage applied. The result is the worker’s Primary Insurance Amount (PIA), the foundation for their Social Security benefit.

Why Accurate Indexing Matters

Dr. Laura Benton, a public policy scholar at the University of Wisconsin, said wage indexing “prevents benefits from lagging behind the broader economy.” She noted that upcoming wage data for 2024 and 2025 will directly influence the 2026 benefit formula.

How Filing Age Affects Total Lifetime Benefits

Choosing the Right Time to Claim

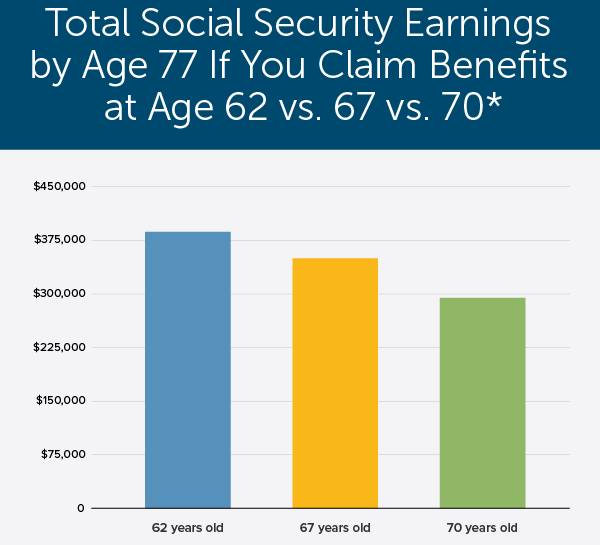

The age at which someone begins receiving benefits remains the most important factor influencing payouts. Claiming at 62 results in permanently reduced benefits, while waiting beyond full retirement age increases monthly income.

Earlier Claims Reduce Lifetime Payouts

The Congressional Research Service estimates that early filers may see reductions of 25% to 30% depending on their birth year.

Delaying Can Boost Monthly Benefits Significantly

For workers who postpone filing beyond full retirement age, delayed retirement credits can raise benefits by up to 8% per year until age 70.

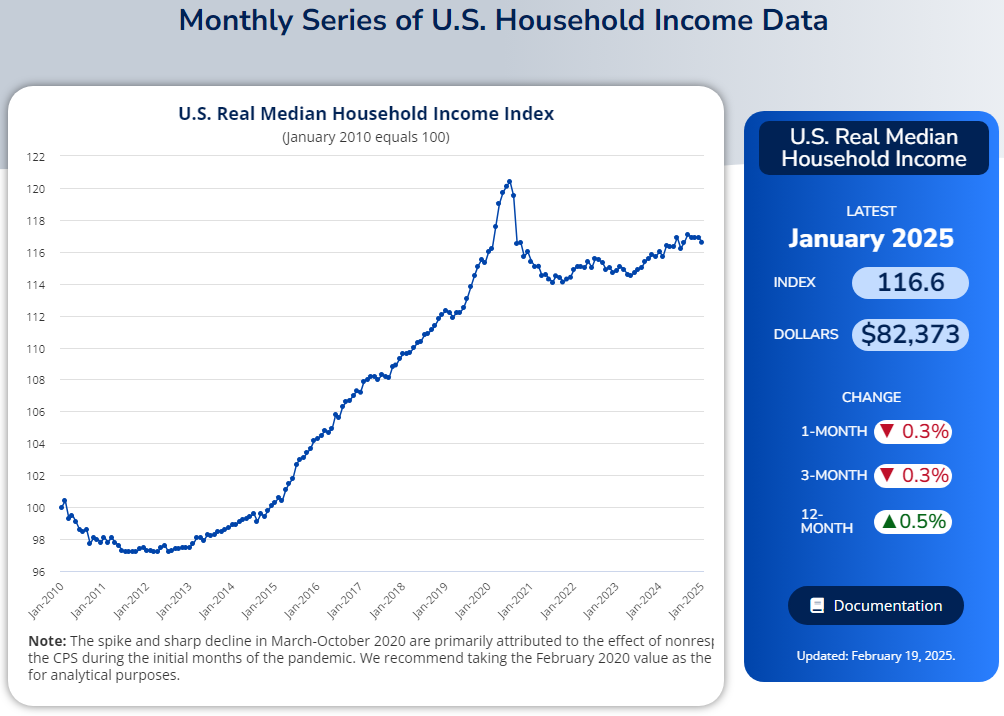

What the 2026 COLA Could Mean for Retirees

The annual cost-of-living adjustment (COLA) affects benefits after calculation. Inflation has moderated, and analysts from Reuters reported that economists expect “moderate but positive adjustments” for 2026.

Experts Expect Stability

Michael Herrera, a senior economist at the Urban Institute, stated that COLA “closely follows broader inflation pressures,” adding that 2026 projections point toward stability rather than major increases.

Historical Context: How Social Security Benefits Have Evolved

Introduced in 1935, Social Security has undergone numerous adjustments to maintain financial stability and reflect economic changes. The biggest reforms in 1983 gradually increased the full retirement age and broadened taxation of benefits.

Federal data shows that benefits have increased significantly over the past four decades due to wage indexing and cost-of-living adjustments. However, the relative purchasing power of benefits has fluctuated, especially during periods of high inflation.

Long-Term Solvency Concerns

Trustees of the Social Security trust funds have warned that without legislative reform, full benefit payments could be at risk beginning in the mid-2030s. Lawmakers continue debating solutions, including raising payroll taxes or adjusting benefits for future generations.

Impact on Different Income Groups

Lower-Income Workers Benefit More from the Bend-Point Formula

The Social Security formula intentionally replaces a larger share of earnings for lower-wage workers. The first tier of the bend-point formula allocates 90% of the worker’s AIME, offering meaningful support to households with limited savings.

Higher-Income Workers Receive Larger Dollar Amounts but Lower Replacement Rates

While high earners receive larger monthly payments in absolute terms, Social Security replaces a smaller portion of their income. This often results in higher-income households relying more heavily on private savings.

Middle-Income Workers Face the Most Uncertainty

Policy analysts note that middle-income workers could experience more lifestyle adjustments in retirement, as they rely on a combination of wages, Social Security, and personal savings.

Demographic Trends Shaping the 2026 Outlook

U.S. Census Bureau projections show that more than 11,000 Americans reach age 65 every day. This demographic shift is increasing demands on the Social Security system and is influencing ongoing policy discussions in Washington.

Economist Rachel Kim of the Center for Retirement Research said the aging population “creates financial pressure on the trust funds but also reinforces the need for accurate benefit forecasting.” She emphasized that workers near retirement must understand how benefits are calculated.

A Step-by-Step Example of the Easy Formula to Estimate Your Real Social Security Benefit

- Identify 35 years of highest earnings.

- Index each year’s earnings based on national wage growth.

- Calculate the AIME by dividing total indexed earnings by 420 months.

- Apply the bend-point formula to find the PIA.

- Adjust for filing age.

- Apply the 2026 COLA after calculating the base benefit.

Sample Calculation

A worker with an AIME of $5,000 would see the following calculation under approximate bend points:

- 90% of the first portion

- 32% of the middle portion

- 15% of the remaining portion

This results in a sample PIA of roughly $2,200 to $2,400 before applying filing adjustments and COLA. Actual results vary based on exact bend points and individual circumstances.

Policy Debates That Could Affect Future Social Security Benefits

Lawmakers continue to debate reforms aimed at extending the solvency of the Social Security trust funds. Proposals include:

- Raising or eliminating the payroll tax cap

- Gradually increasing the full retirement age

- Adjusting COLA formulas

- Creating new revenue streams

While none of these proposals would change benefits for 2026 retirees, analysts warn that long-term reforms are necessary to maintain stable benefits for future generations.

Alaska PFD Update: Final $1,000 December Payment — Who Gets It and When

How Workers Can Strengthen Their Retirement Planning

Financial planners recommend several strategies to complement Social Security benefits:

Reviewing Annual Earnings Statements

Workers should check their SSA earnings record annually to ensure accuracy. Missing wages can lower AIME and reduce benefits.

Delaying Retirement When Possible

For those in good health, delaying benefits can substantially increase lifetime income.

Diversifying Income Sources

Experts advise building savings through employer-sponsored retirement plans, IRAs, or other investments.

Considering Future Health Costs

Medical expenses often rise in retirement. Medicare premiums, supplemental insurance, and long-term care may significantly affect retirement budgets.

Seeking Professional Guidance

Certified financial planners can help estimate benefits and design a sustainable withdrawal strategy.

Looking Ahead

The Social Security Administration will release final 2026 wage indexing factors and bend points later this year. Analysts expect modest adjustments unless inflation or wage trends shift sharply. As millions of Americans prepare for retirement, understanding the benefit formula remains essential for accurate planning and long-term financial security.