The 2026 Social Security COLA will increase by 2.8%, according to the Social Security Administration (SSA). Beginning in January 2026, this adjustment will raise the average retiree benefit by about $56 per month. The agency said the change reflects inflation trends measured in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While the increase aims to preserve purchasing power for older Americans, many households may continue to face financial pressure as essential living costs remain high.

2026 Social Security

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA Increase | 2.8% benefit rise |

| Average New Benefit | $2,071 monthly for retired workers |

| Inflation Basis | CPI-W index |

How the 2026 Social Security COLA Was Calculated

The 2.8% increase is tied to year-over-year inflation changes recorded in the CPI-W during the third quarter of 2025. Although overall inflation slowed from the steep surges seen earlier in the decade, several categories—particularly shelter, utilities, prescription drugs, and healthcare services—remained elevated.

What the 2026 Increase Means for Retirees

Average Benefit Adjustments

The average monthly payment for a retired worker will rise from roughly $2,015 in 2025 to about $2,071 in 2026. Couples who both receive benefits will see average payments reach approximately $3,208 per month. Individuals receiving disability benefits and eligible survivors will experience proportional increases.

Why the Increase May Still Feel Small

Rising consumer prices continue to place financial stress on older adults. Analysts from organizations such as the Urban Institute and AARP note that seniors face higher-than-average inflation in several essential spending categories, including hospital services, long-term care, and medications.

Higher Medicare Part B premiums may also reduce the net benefit increase for many retirees. For some households, the COLA may trigger higher taxable income if combined earnings exceed IRS thresholds.

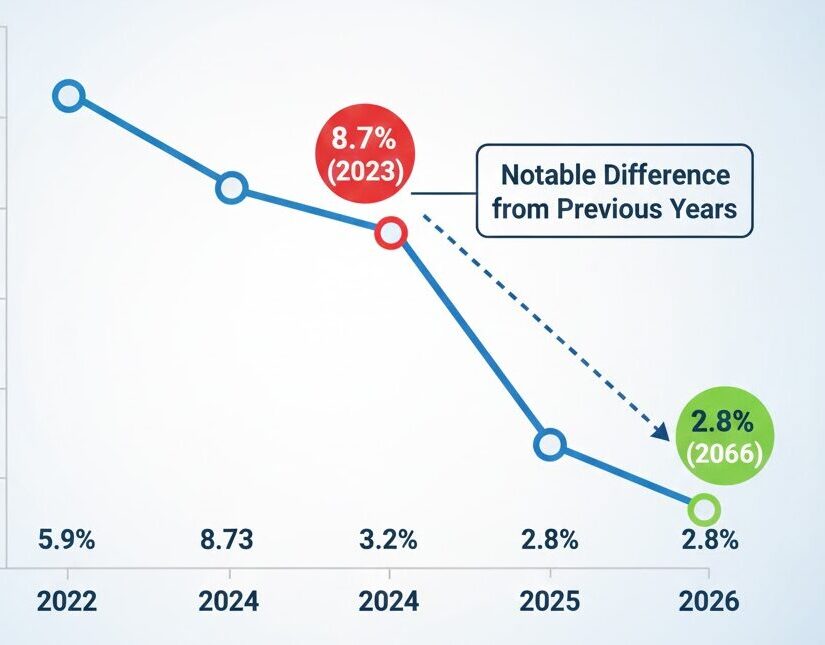

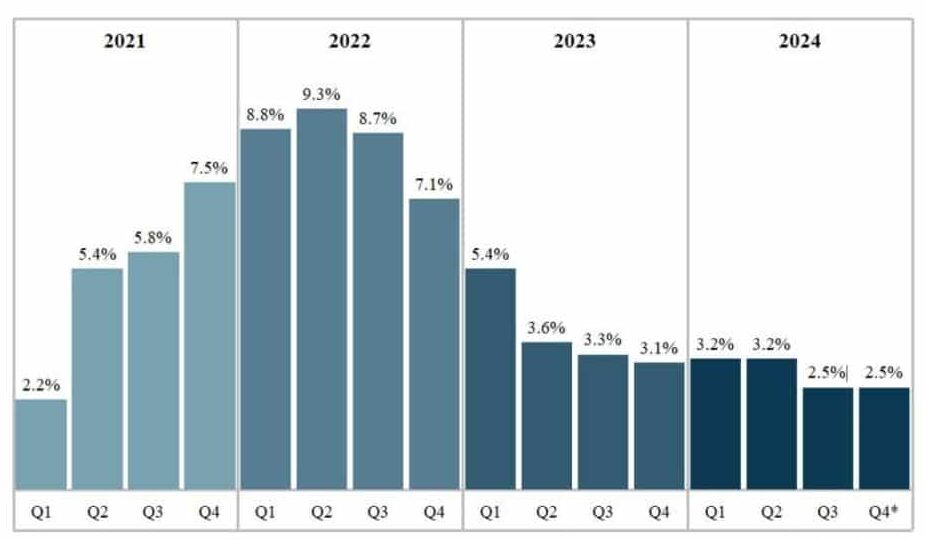

How the 2026 COLA Compares to Previous Years

The 2.8% increase represents a moderate adjustment compared with recent years. The COLA reached a four-decade high in 2023 amid rapid inflation, rising 8.7%. It then declined to 3.2% in 2024 and 2.6% in 2025 as inflation cooled.

Looking further back:

- The average COLA between 2010 and 2020 was around 1.4%.

- Some years, such as 2016, saw no COLA at all due to low inflation.

- The 2022 and 2023 adjustments were among the highest since the early 1980s.

These fluctuations underline how closely Social Security benefits depend on broader economic trends.

Medicare Costs and Their Impact on Net Benefits

Many retirees will evaluate the COLA alongside expected changes to Medicare premiums for 2026. While Part B premium amounts are set separately from Social Security, increases often offset part of the COLA.

Because Medicare spending continues to grow—driven by advances in medical technology, rising drug prices, and increased demand for services—older Americans typically lose a portion of COLA benefits to premium adjustments. For some, especially those with fixed incomes, even small increases in premiums can have noticeable effects on monthly budgets.

Demographic Differences in How the COLA Is Felt

Urban vs. Rural Seniors

Rural retirees often face lower housing costs but higher transportation and energy costs. Urban seniors may experience faster increases in rent and medical costs.

Renters vs. Homeowners

Rising rents over the last several years have placed additional strain on older renters. Homeowners with fixed-rate mortgages may be better insulated but still face rising insurance and maintenance costs.

Older Retirees vs. New Beneficiaries

Long-term retirees often experience greater erosion in purchasing power. Their past COLA increases may not fully reflect inflation over 10–20 years, leaving them more vulnerable to rising costs today.

Policy Debate: Should the COLA Formula Be Updated?

The current COLA calculation is based on the CPI-W, a measure that reflects the spending habits of workers rather than retirees. Advocacy groups argue that this index does not adequately capture senior-specific expenses, particularly healthcare.

Some lawmakers have proposed shifting to the CPI-E (Consumer Price Index for the Elderly), which more accurately tracks the spending patterns of older adults.

Policy analysts say the debate illustrates the tension between keeping the program solvent and ensuring benefits keep up with real-world costs.

Impact on the Social Security Trust Fund

Although COLA increases help beneficiaries keep pace with inflation, they also contribute to higher overall program costs. According to the Congressional Budget Office (CBO), Social Security’s Old-Age and Survivors Insurance (OASI) Trust Fund faces projected depletion within the next decade unless Congress enacts reforms.

A higher COLA increases long-term financial obligations, raising questions about sustaining the program as more Americans retire and life expectancy increases. Analysts say policymakers may need to consider revenue adjustments, benefit modifications, or formula updates to maintain solvency.

International Context: How the U.S. System Compares

Many countries adjust pension benefits for inflation, but methods vary:

- Nations such as Canada use a CPI-based formula similar to the United States.

- Some European countries tie benefits to a combination of inflation and wage growth.

- Others rely on discretionary legislative adjustments rather than automatic calculations.

The U.S. system’s automatic annual COLA is seen as a relative strength, ensuring that retirees receive predictable adjustments without political intervention.

Florida SNAP Update: These Seven Groups Will Receive Their Payments This Week

Looking Ahead: What Retirees Can Expect in Coming Years

Economists expect future COLA increases to remain modest if inflation continues to stabilize. However, global economic uncertainty, fluctuating energy prices, and demographic shifts could create volatility in future adjustments.

Retired households may also need to monitor Medicare policy, federal tax brackets, and changes in state benefit programs to understand the full impact on their financial well-being.

FAQs About 2026 Social Security

How is the COLA calculated?

The COLA is determined by annual changes in the CPI-W index measured during the third quarter.

When will the 2026 COLA take effect?

Payments reflecting the increase begin in January 2026.

Does the COLA affect Medicare premiums?

It does not directly change premiums, but rising Medicare costs may reduce the net benefit.

Could the COLA increase my taxes?

Yes. If your combined income rises above IRS thresholds, a larger share of your benefits may become taxable.