The first 2026 COLA payments have begun arriving this month, giving millions of Americans an early increase in their monthly benefits. The Social Security Administration (SSA) issued January SSI benefits on December 31, 2025, because of the New Year’s Day holiday. The payments include the 2.8 percent cost-of-living adjustment, while most Social Security payments reflecting the increase will follow the regular January 2026 schedule.

2026 COLA Payments

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA increase | 2.8% |

| First recipients | SSI beneficiaries paid Dec. 31, 2025 |

| Total affected | ~71 million beneficiaries |

| Main driver of increase | Inflation measured by CPI-W |

| Avg. retired worker increase | +$50/month |

Why Early 2026 COLA Payments Are Already Arriving

The SSA advanced January SSI benefits to December 31, 2025, following federal rules that require payments to be made on the preceding business day when the scheduled date falls on a weekend or national holiday. Because January 1 is a federal holiday, the agency issued the January payment early.

An SSA spokesperson explained in a written notice that “this adjustment prevents any interruption in basic support for households that rely on monthly benefits to meet essential expenses.”

Advocacy groups note that early issuance is especially significant for low-income individuals who depend on SSI for daily living costs, including rent, food, and transportation.

The 2026 Cost-of-Living Adjustment: What the 2.8% Increase Means

The cost-of-living adjustment (COLA) for 2026 is 2.8 percent, based on inflation trends tracked through the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). According to the U.S. Bureau of Labor Statistics, moderate inflation throughout mid-2025—largely driven by rising housing and healthcare prices—played a central role in the calculation.

Economists from the Center on Budget and Policy Priorities note that while the increase provides meaningful support, it does not eliminate broader affordability pressures facing seniors and households with disabilities.

“The COLA helps prevent the benefits from eroding, but it rarely outpaces real-world cost increases faced by older adults,”

— Dr. Elaine Porter, Senior Research Fellow, CBPP

Who Receives the 2026 COLA First?

SSI Beneficiaries

SSI recipients are the first group to receive the higher 2026 benefit levels. Although the January payment arrives in December, it still represents only one monthly benefit, not an additional payment.

The SSA emphasized that the next SSI payment will arrive on February 1, 2026, consistent with the standard schedule.

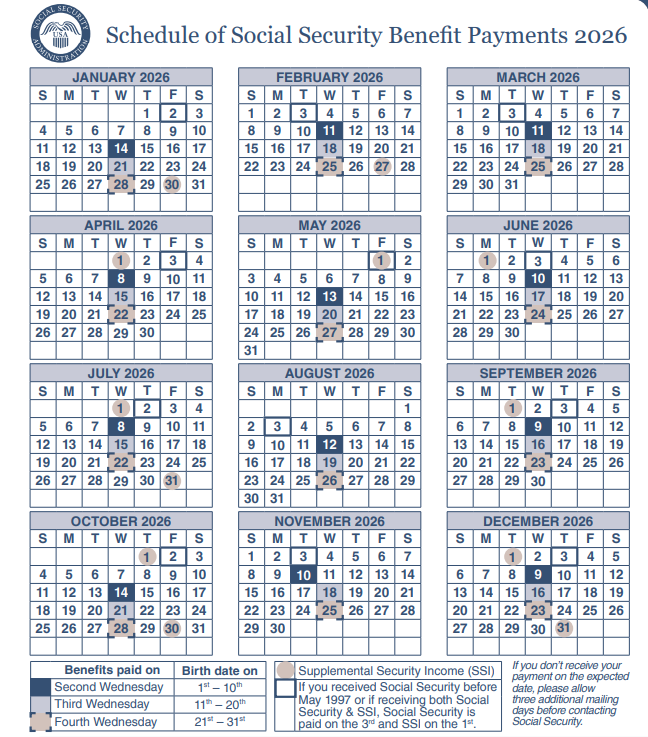

Social Security Beneficiaries

Social Security retirement, survivor, and disability beneficiaries will receive their first 2026 COLA-adjusted payments in January, based on birth date:

- January 14 — Birthdates 1st–10th

- January 21 — Birthdates 11th–20th

- January 28 — Birthdates 21st–31st

How the COLA Increase Affects Household Budgets

The SSA estimates that:

- The average retired worker will see an increase of roughly $50 per month.

- The maximum federal SSI benefit increases to $1,015 for individuals and $1,522 for couples.

- Social Security Disability Insurance (SSDI) recipients will also see modest increases, depending on past earnings.

AARP analysts report that COLA increases significantly impact beneficiaries with no employment income.

“For many retirees, even a small annual increase provides the buffer needed to keep up with prescription drug prices, energy bills, and food costs,”

— Marissa Clark, Senior Policy Analyst, AARP Public Policy Institute

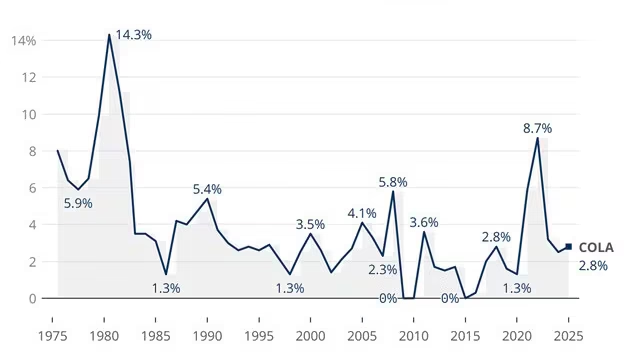

Historical Comparison: How 2026 COLA Stacks Up

The 2.8 percent COLA for 2026 is considered moderate when compared with recent years:

- 2023: 8.7% (highest since 1981)

- 2024: 3.2%

- 2025: 2.6%

- 2026: 2.8%

Economists say the 2026 figure reflects stabilizing—but still elevated—living costs. The Federal Reserve noted in late 2025 that inflation had slowed but remained above the 2 percent target, especially in housing and healthcare sectors that disproportionately affect older Americans.

How COLA Is Calculated: A Closer Look

The COLA formula, established by law, compares third-quarter CPI-W data from the current year to the previous year. If the index rises, benefits increase by the same percentage.

Some economists and lawmakers have proposed replacing CPI-W with an “elderly consumer index,” arguing that seniors spend more on healthcare and less on transportation, which could yield more accurate adjustments.

The Bureau of Labor Statistics has studied alternate indexes, but no change has been implemented.

What Early 2026 COLA Payments Mean for the Broader Economy

More than 71 million Americans receive Social Security or SSI benefits, making COLA adjustments economically significant.

According to an analysis from the Federal Reserve Bank of Boston, early-year increases in benefit payments contribute to:

- Higher consumer spending in the first quarter

- Increased demand for essential goods

- Stability in regional economies with large retiree populations

Retail and grocery sectors often see a measurable uptick in sales following COLA-related benefit increases, especially in states with high concentrations of older adults such as Florida, Arizona, and Pennsylvania.

Population Trends and Long-Term Sustainability

The Social Security Trustees project that the combined retirement and disability trust funds will face long-term financing challenges by the mid-2030s. Although COLA payments do not directly determine system solvency, they influence annual outlays.

“The COLA is necessary to maintain purchasing power, but rising life expectancy and demographic shifts place pressure on the system,”

— Dr. Michael Henderson, Professor of Public Policy, Georgetown University

Congress continues to debate proposals ranging from payroll tax adjustments to benefit formula changes, but no major legislation has passed.

Fraud Prevention: SSA Warns Beneficiaries to Stay Alert

The SSA reports an increase in fraudulent schemes during periods of major benefit announcements. Scammers may pretend to be agency employees and request personal information.

Beneficiaries should note:

- The SSA does not call, text, or email individuals asking for bank details.

- Official communications are typically sent via mail or through the my Social Security online portal.

- Suspicious contact should be reported to the Office of the Inspector General.

“Fraudsters exploit moments when people expect official updates,”

— Kimberly George, National Council on Aging

$2000 IRS Deposit Set for December: Check If Your Bank Account Is Eligible

Regional and Demographic Effects of the 2026 COLA

While the COLA adjustment applies uniformly nationwide, its impact varies by region:

- High-cost states (California, Massachusetts, New York) may see minimal relief due to elevated housing and healthcare expenses.

- Low-cost states (Mississippi, Arkansas, New Mexico) may see more significant real purchasing power gains.

- Rural seniors continue to face transportation and healthcare access challenges that COLA alone cannot offset.

Demographically, the increases most affect:

Individuals over age 75, who rely almost entirely on fixed income

- People with disabilities

- Women, who are statistically more likely to depend on Social Security as a primary income source due to lifetime earnings gaps

Looking Ahead: When the Next COLA Will Be Announced

The SSA will announce the 2027 COLA in October 2026, once the final third-quarter CPI-W data is released. Economists say that inflation trends in the first half of 2026 will provide early signals about next year’s adjustment.

Lawmakers also expect renewed debate over long-term program solvency, particularly as beneficiaries continue to grow in number and life expectancy trends evolve.