Millions of Americans who receive Supplemental Security Income (SSI) will get two Social Security payments in December 2025, the Social Security Administration (SSA) has confirmed. The early disbursement—caused by the New Year’s Day holiday—means beneficiaries will receive their January 2026 payment on December 31, just weeks after the regular December check. The timing coincides with a 2.8% cost-of-living adjustment (COLA) that raises monthly benefits to keep pace with inflation.

Double Social Security Checks

| Key Fact | Detail/Statistic |

|---|---|

| Double payments month | December 2025 |

| 2026 COLA increase | 2.8% |

| Affected group | SSI recipients |

| Reason for double payment | January 1 holiday |

| New SSI maximum (2026) | $994/month |

| Official Website | SSA.gov |

Why Double Social Security Checks Are Arriving in December

The Double Social Security Checks December 2025 are not a surprise bonus but an administrative necessity. Supplemental Security Income (SSI) payments are issued on the first day of each month. When that date coincides with a federal holiday or weekend, the payment is sent one business day earlier to ensure uninterrupted benefits.

Because January 1, 2026, is New Year’s Day, the January SSI payment will be made on December 31, 2025, resulting in two deposits in December—one on December 1 and another at the end of the month.

According to the Social Security Administration (SSA), this adjustment prevents delays and ensures continuous income flow for millions of vulnerable Americans.

“This is a normal adjustment to our payment calendar,” said Larry Gage, an SSA spokesperson. “It helps ensure that SSI recipients receive funds on time, regardless of holidays or government closures.”

Who Qualifies for the Double Social Security Checks

The double payment applies only to those receiving Supplemental Security Income (SSI). This program supports roughly 7.4 million Americans—older adults, people with disabilities, or those who are blind and have limited income and resources.

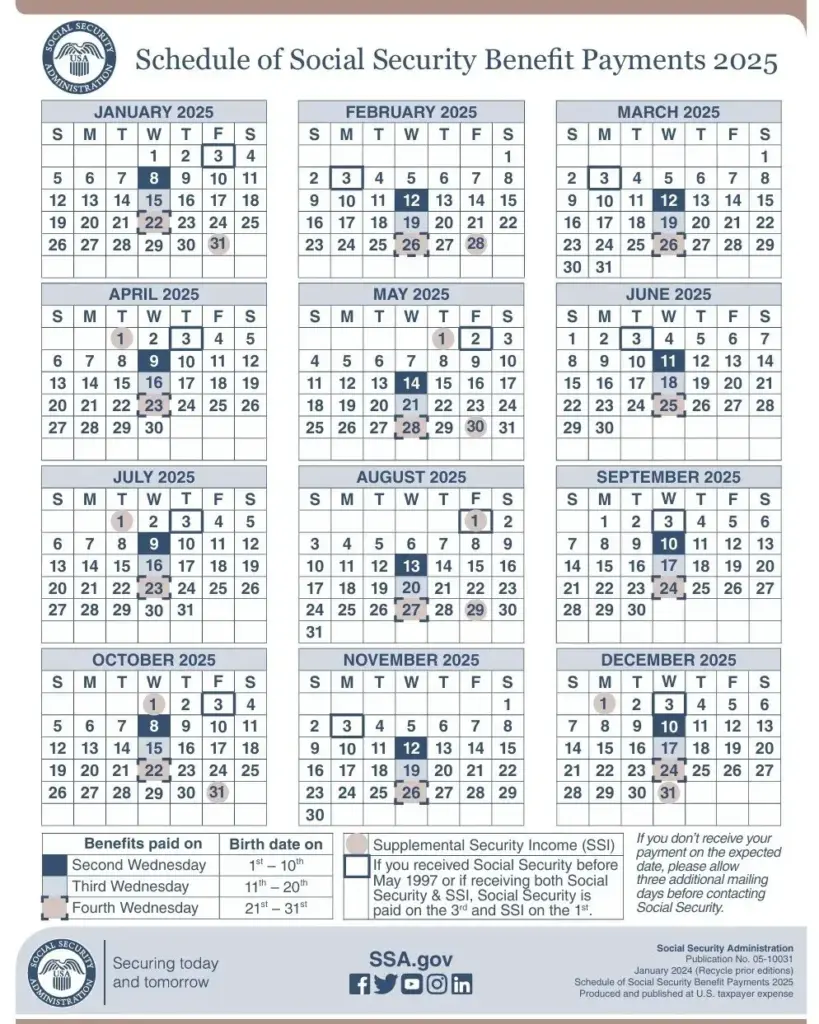

Recipients of Social Security retirement, survivor, or disability benefits (SSDI) will not receive an extra payment. Their benefits follow a different schedule, typically disbursed on the second, third, or fourth Wednesday of each month based on the recipient’s birth date.

“Many people confuse SSI and SSDI,” said Dr. Elaine Foster, a senior analyst at the Center for Retirement Policy. “They serve different groups, and their calendars don’t always align—especially when holidays fall at month-end.”

The 2026 Cost-of-Living Adjustment: A Modest but Meaningful Increase

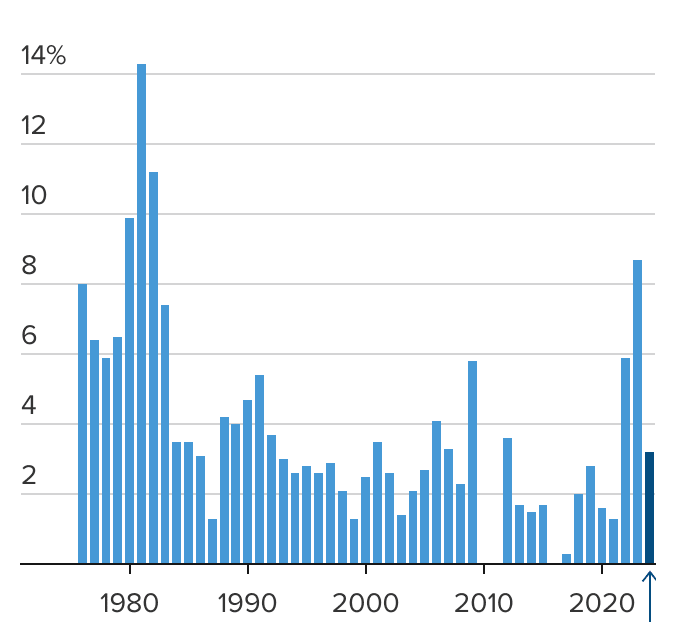

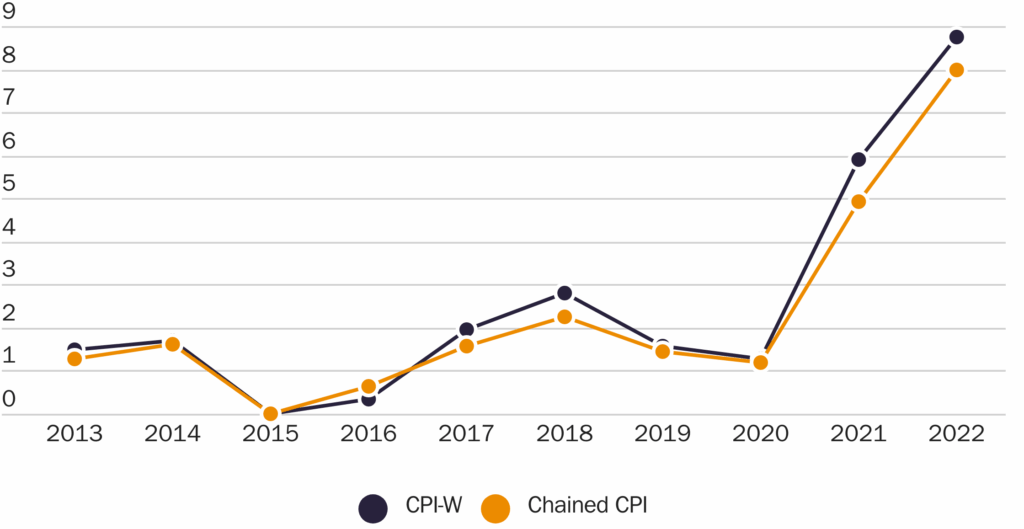

The SSA announced a 2.8% COLA for 2026, intended to offset inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

The increase raises the maximum SSI benefit to $994 for individuals and $1,490 for couples, up from $967 and $1,451 respectively in 2025. The adjustment affects nearly 71 million Americans, including retirees, disabled workers, and survivors.

According to the Bureau of Labor Statistics (BLS), consumer prices rose moderately in 2025 after several volatile years. The new adjustment reflects a slower inflation trend while maintaining purchasing power for those on fixed incomes.

“Even small COLA changes are crucial,” explained Anita Patel, senior economist at the Urban Institute. “For low-income seniors, an extra $25 a month can mean a week’s worth of groceries or medication.”

A Historical Pattern: Double Payments Are Not New

This is not the first time SSI recipients have received two checks in a single month. In fact, “double months” occur nearly every year, depending on the calendar.

For example:

- In 2023, recipients received two payments in September.

- In 2024, a double payment occurred in May.

- In 2025, December becomes the “double month.”

This consistency stems from the same holiday rule: when the first of the month falls on a weekend or federal holiday, payments shift to the previous business day.

“It’s not a glitch; it’s just how the system works,” said Michael Reynolds, policy director at the National Committee to Preserve Social Security and Medicare. “But every year, we see confusion when beneficiaries suddenly receive what looks like an extra payment.”

How the COLA Affects the Broader Economy

Economists say the annual COLA adjustment, though moderate, injects billions into the U.S. economy. According to the SSA, Social Security benefits make up about 30% of total income for Americans aged 65 and older.

“When benefits rise, spending rises,” said Dr. Lisa Cheng, an economist at the Brookings Institution. “The COLA helps stabilize consumer demand, particularly in rural and low-income areas where seniors spend locally.”

However, Cheng cautions that inflation’s uneven impact means the COLA may still lag behind actual cost increases in housing and healthcare. “For seniors in high-cost states, even a 2.8% increase won’t cover rising rent or prescription prices,” she said.

The Budgeting Challenge: Managing a “Double Month”

While two deposits in December might seem advantageous, financial experts urge recipients to plan ahead. The next SSI payment won’t arrive until February 1, 2026, creating a longer-than-usual gap between checks.

“Treat the second December payment as January’s income,” advised Marcia Hall, a certified financial planner and Social Security specialist. “Set it aside for essential expenses—especially rent, food, and utilities.”

The SSA recommends beneficiaries use direct deposit or Direct Express debit cards to prevent check delays, particularly around the holidays when postal services slow down.

Real-Life Impact: Americans Adjusting to Modest Gains

For recipients like Gloria Thompson, a 72-year-old retiree in Ohio, the COLA offers limited relief.

“Everything costs more—the electric bill, the groceries,” Thompson said. “The extra $25 helps, but it disappears fast. I just stretch every dollar.”

Still, many appreciate the stability that the Social Security system provides. “Even small increases matter,” Thompson added. “It’s good to know the government is watching inflation.”

Global Perspective: How Other Nations Handle Adjustments

The U.S. approach to annual inflation-linked benefit increases mirrors that of many developed nations. The United Kingdom adjusts pensions each April using the Consumer Prices Index (CPI), while Canada reviews its Old Age Security payments quarterly.

However, few countries issue payments early due to holidays as the SSA does. “The U.S. system is unique in its punctuality,” said Patel. “By ensuring payments arrive before holidays, it minimizes disruptions for low-income beneficiaries.”

Policy Outlook: Can the System Keep Up?

The Social Security Trust Fund faces long-term solvency challenges. The Congressional Budget Office (CBO) projects that the combined trust funds could be depleted by 2035, potentially reducing future payments by up to 20% unless Congress acts.

“The COLA is a lifeline, but sustainability is the bigger issue,” said Reynolds. “The upcoming decade will test whether reforms—like raising payroll tax caps or adjusting eligibility ages—can preserve benefits for future generations.”

Lawmakers continue to debate measures to reinforce the system’s finances without cutting benefits. For now, the 2026 COLA reflects a balancing act between economic realism and social protection.

What Recipients Should Do Now

- Check your “My Social Security” account for official payment notifications.

- Confirm your bank or Direct Express details before December to ensure smooth deposits.

- Budget for a longer gap between December’s and February’s checks.

- Stay alert for scams—the SSA never calls or emails demanding money or personal data.

Two Social Security Checks in December? What to Expect and Who Actually Gets Them

Looking Ahead

The next cost-of-living adjustment will be announced in October 2026, based on inflation trends through mid-year. Analysts expect a similar, moderate rise if consumer prices remain stable.

“The annual COLA remains one of the most important protections for low-income Americans,” said Cheng. “It may not make anyone rich, but it ensures dignity and predictability.”