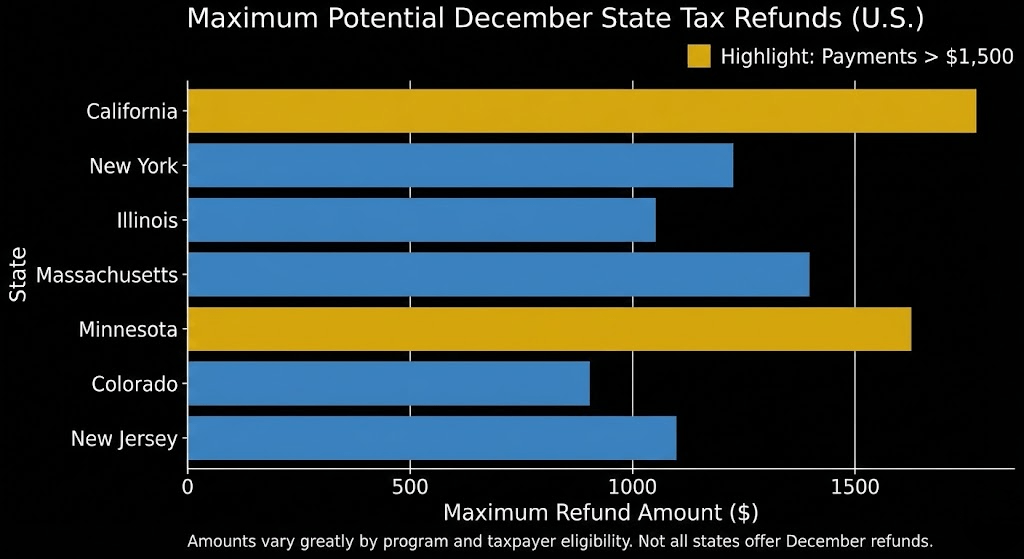

Several U.S. states are issuing December Tax Refunds as part of year-end relief initiatives designed to help residents manage rising living costs and lingering inflation pressures. Payments vary by state, but some households could receive as much as $1,500 before the month ends. According to state revenue agencies and official budget documents, millions of taxpayers are expected to qualify based on income, residency, and filing status.

December Tax Refunds

| Key Fact | Detail |

|---|---|

| Highest December refund | Up to $1,500 in several states |

| Programs active | Colorado, New Jersey, California, Maine, Georgia, Illinois |

| Drivers of payments | Surplus budgets, inflation relief, property-tax rebates |

Which States Are Issuing December Tax Refunds

Several states scheduled refund distributions for December after approving relief measures earlier in the year. While some programs are recurring, others were approved as one-time rebates based on strong state revenues or targeted cost-of-living adjustments.

Colorado

Colorado’s refund program offers payments up to $1,500 for eligible single and joint filers. State officials say the high payment ceiling reflects robust tax collections and increased federal support that boosted state reserves. Refunds are being issued through direct deposit and checks, with most expected to arrive before December 20.

New Jersey

New Jersey’s ANCHOR property-tax relief program remains one of the most substantial refund efforts in the country. Households can receive up to $1,500, depending on income and property-tax status. The state said December payments target residents whose earlier applications required additional verification.

California

California continues distributing tax refunds under legislation aimed at offsetting the effects of inflation and elevated housing costs. Payments reach $1,050 for some taxpayers, with lower amounts for higher-income households. The California Franchise Tax Board confirmed that most remaining payments should be delivered by late December.

Maine

Maine is issuing refunds up to $1,700, one of the highest in the nation, though not every resident qualifies for the maximum amount. Governor Janet Mills said the payments are part of a broader effort to assist families facing energy costs and rising food prices.

Other States With December Refund Activity

States including Georgia, South Carolina, and Illinois are providing smaller payments ranging from $100 to $500. These programs often stem from earlier tax legislation or year-end reconciliations of withholding amounts.

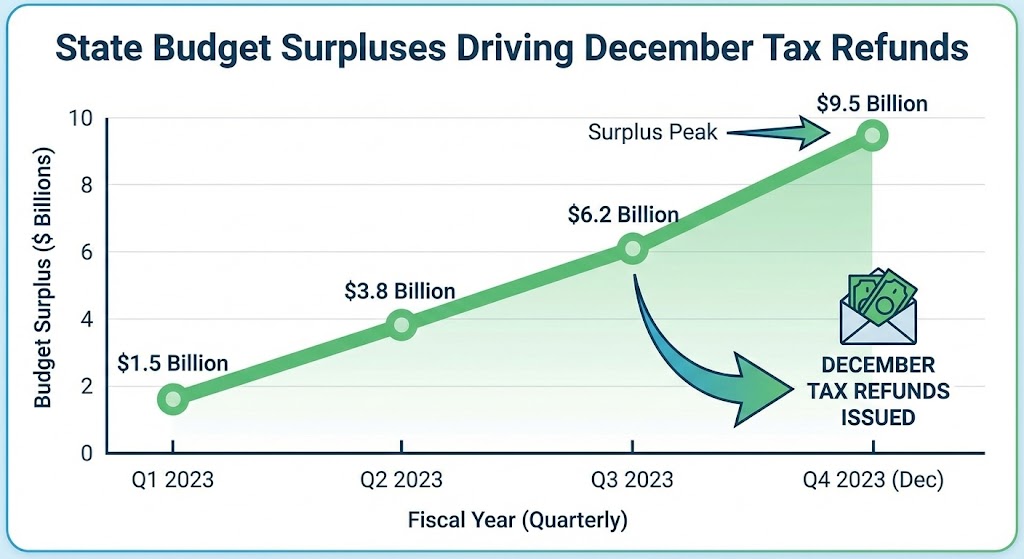

Why States Are Sending Payments in December

A combination of economic and political factors is driving states to distribute refunds before the end of the year. Many passed relief programs months ago, but processing delays, budget finalizations, and administrative verification schedules pushed payments into December.

Economic Factors

According to fiscal policy analysts at the National Association of State Budget Officers, revenue surpluses in several states were bolstered by strong consumer spending and delayed federal stimulus flows. These conditions provided room for governments to fund rebates without affecting essential services.

Economist Dr. Alicia Romero of the Brookings Institution noted that states are “attempting to provide rapid, targeted support to households that may be under pressure from still-elevated housing, food, and transportation costs.”

Political and Budgetary Factors

End-of-year refunds also allow lawmakers to demonstrate fiscal responsibility by returning surplus funds to taxpayers. Some states have laws requiring surplus revenue to be refunded if reserves exceed certain limits.

How Tax Refund Amounts Are Calculated

Refund amounts vary widely based on program design. Some rely on income thresholds, while others calculate payments based on property-tax liability, dependents, or previous tax-year filings.

Income-Based Refunds

Income-driven programs, such as those in California and Colorado, assign higher payments to residents in lower or middle-income brackets. This structure aims to channel the greatest relief toward households more likely to experience financial strain.

Property-Tax Refunds

States like New Jersey direct payments toward homeowners and renters facing some of the nation’s highest property-tax rates. Renters must provide lease or landlord documentation, while homeowners often qualify automatically through state records.

Surplus Refund Calculations

Certain states calculate refunds as a percentage of previous tax liability. This method can produce uneven totals but ties relief to a resident’s economic contribution.

How Residents Can Check Eligibility for December Tax Refunds

Required Tax Returns

Most states require residents to have filed their most recent tax return. Missing or late filings can delay or reduce payments. Several states extended filing deadlines due to natural disasters, creating unique eligibility timelines.

Residency Verification

Refunds usually require full-year state residency unless otherwise specified. Military personnel, students, and new residents may face special rules.

Online Payment Trackers

States including California, New Jersey, and Colorado offer online portals where taxpayers can check refund status. Officials advise residents to review these tools before contacting call centers, which are experiencing high call volumes.

Avoiding Scams and Fraud During Refund Season

December is peak fraud season, according to officials at the Federal Trade Commission (FTC). Scammers often use tax refunds as bait in phishing emails or text messages.

Key Warning Signs of a Scam

- Messages requesting personal or banking information

- Claims that a resident must “verify tax status” to receive a refund

- Pressure to click links or download attachments

FTC spokesperson Thomas Walker warns that “no legitimate government agency sends unsolicited messages requesting sensitive data. Residents should always initiate contact through official websites.”

Broader Economic Impact of December Tax Refunds

Refunds provide temporary financial relief, but economists caution against overstating their long-term effects on inflation or economic growth.

Short-Term Boost for Households

Many households use refund payments to cover essential expenses, reduce debt, or manage year-end bills. A study by the Federal Reserve found that lower-income recipients are more likely to spend refunds quickly, creating a modest short-term economic boost.

Limited Impact on National Inflation Trends

Dr. Reyna Patel, a policy specialist at the University of Michigan, explained that these payments “are too small and too targeted to influence national inflation in a meaningful way.”

Long-Term Considerations

Some state lawmakers say future refund programs may depend on revenue performance in 2026. Budget committees are expected to revisit refund scenarios in upcoming legislative sessions.

How Residents Can Prepare for December Tax Refunds

Update Personal Information

Many refund delays stem from outdated addresses or banking information. Residents are encouraged to update contact details directly with state tax authorities or through online portals.

Retain Tax Records

Keeping copies of previous returns can help resolve disputes if payment amounts appear incorrect. Some states require additional documentation if records show discrepancies.

Monitor Legislative Developments

Refund programs often depend on annual budget negotiations. Residents who follow state legislative updates may receive earlier notice of upcoming payments.

This Social Security Timing Mistake Could Eliminate Your Full $2,000 Payment

What Comes Next

State agencies expect high inquiry volumes into January as residents track missing or delayed payments. Many programs will continue distributing refunds into early 2026 due to backlogs and verification processes. Some lawmakers are advocating for permanent cost-of-living rebates, though economists warn that long-term sustainability depends on stable revenue.

FAQs About December Tax Refunds

1. Who qualifies for the highest December Tax Refund amounts?

Typically, residents with low to moderate incomes or significant property-tax burdens qualify for the largest payments, depending on the state program.

2. Do I need to apply for these state refunds?

Most states issue refunds automatically based on tax filings, but property-tax relief programs sometimes require an application.

3. Will these refunds affect my federal tax return?

In most cases, state tax refunds must be reported when filing federal taxes if the taxpayer itemized deductions the previous year. Residents should consult a tax professional.

4. What if my refund does not arrive in December?

Many payments continue into January due to mail delays or verification issues. Online state portals provide the most accurate updates.

5. Are December Tax Refunds taxed as income?

Generally, state tax refunds are not considered taxable income at the state level. Federal tax treatment varies based on prior-year filing methods.