The December SSI & Social Security Guide provides essential details on early payment schedules, annual inflation adjustments, and new financial thresholds that will shape benefits in 2026. The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment (COLA) for the upcoming year, while December 2025 will include two SSI deposits because of the federal holiday calendar, according to official SSA payment schedules and public briefings.

December SSI & Social Security Guide

| Key Fact | Details |

|---|---|

| 2026 COLA | 2.8% increase for Social Security and SSI benefits |

| Early SSI Check | January 2026 benefit issued Dec. 31, 2025 |

| SSDI December Schedule | Payments continue on standard Wednesday dates based on birthdays |

| 2026 SSI Maximum | $994 (individuals), $1,491 (couples) |

| Earnings Limits | Higher income thresholds for working beneficiaries |

| Official Website | Social Security Administration |

Why December Brings Complex Payment Timing for SSI Recipients

Two Payments but Not Extra Income

Supplemental Security Income (SSI) beneficiaries will see deposits on December 1 and December 31, with the second payment representing January 2026’s benefit. The SSA issues early payments when regular paydays fall on weekends or federal holidays.

“Early payments are strictly administrative,” said Nancy Berryhill, former acting commissioner of the SSA. “They do not indicate an additional benefit or a bonus check.”

How Budgeting Is Affected

Economic researchers at the Center on Budget and Policy Priorities warn that shifting payments may cause financial strain for households living month to month. When beneficiaries spend the December 31 payment early, they may face cash shortages early in January.

Advocates recommend treating the New Year’s Eve deposit as future income. Several state agencies overseeing food assistance, rent subsidies, or Medicaid eligibility require households to document these timing shifts to avoid discrepancies in reporting cycles.

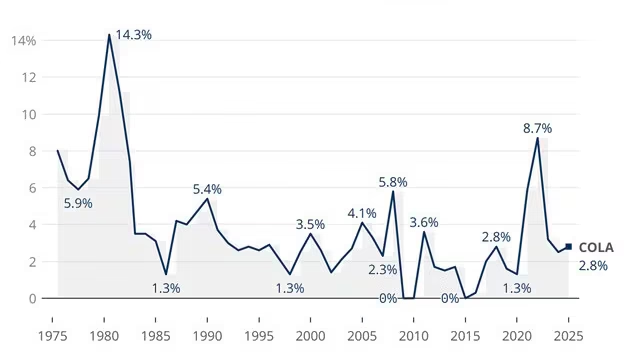

The Social Security 2026 COLA: What the 2.8% Increase Means

A Return Toward Historical Averages

The Social Security 2026 COLA marks a moderate adjustment after years of irregular inflation. The SSA announced the 2.8% increase based on Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) data supplied by the U.S. Bureau of Labor Statistics.

According to SSA analyses, the increase will:

- Raise the average retirement benefit by about $56 monthly

- Lift SSI federal payment standards to $994 per month for individuals

- Increase couple rates to $1,491 per month

Expert Analysis on Inflation Stability

“The 2026 COLA reflects relative price stability compared to the periods of elevated inflation earlier in the decade,” said Dr. Elena Ramirez, economist at the Urban Institute. Ramirez noted that the COLA serves as a safeguard for seniors and disabled workers who often face rising medical and housing expenses at higher-than-average rates.

Federal Budgetary Impact

The Congressional Budget Office estimates that each 1% COLA increase adds roughly $12 billion annually to Social Security outlays. A 2.8% adjustment represents a substantial fiscal shift, but analysts say it remains consistent with long-term projections.

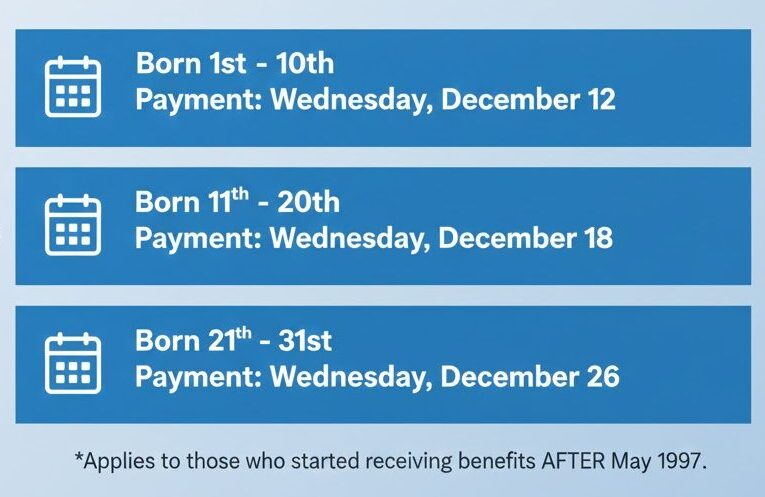

Inside the SSDI December Schedule and Standard Social Security Payments

Who Gets Paid and When

The SSDI December schedule mirrors the standard monthly distribution system:

- 2nd Wednesday — birthdays on the 1st–10th

- 3rd Wednesday — birthdays on the 11th–20th

- 4th Wednesday — birthdays on the 21st–31st

SSDI, retirement, and survivor benefits follow identical timing rules. The SSA confirms that no special or bonus Social Security payments are scheduled for December.

Avoiding Misinformation

Rumors circulating on social platforms suggest additional year-end Social Security checks, but the SSA has repeatedly denied such claims. The agency clarifies that only SSI beneficiaries receive two December deposits—and solely due to calendar rules.

New 2026 Policy Changes: Earnings Limits, Tax Thresholds, and Benefit Calculations

Higher Earnings Limits for Working Beneficiaries

The 2026 adjustment increases the amount beneficiaries may earn before facing benefit reductions. Working Social Security recipients under full retirement age can expect a higher threshold, reflecting national wage growth.

According to the SSA Annual Statistical Supplement, adjustments ensure that work incentives remain aligned with inflation.

Changes to Social Security Taxable Maximum

Workers contributing to Social Security will see the taxable maximum increase in 2026. This change affects higher-income workers but supports the long-term financial stability of the Social Security trust funds.

Medicare Part B Premium Expectations

Although Medicare premiums are not finalized until late fall, policy analysts at Kaiser Family Foundation predict moderate increases due to medical cost inflation and program demands. Because Medicare premiums are deducted from Social Security payments for most recipients, COLA gains may be partially offset.

How Early SSI Check Timing Affects Other Benefits and Reporting Requirements

Impacts on Rent Subsidies, SNAP, and Medicaid

State agencies typically require beneficiaries to report income based on the month in which it is intended, not when it arrives. A December 31 SSI payment must be recorded as January income for:

- SNAP (food stamps)

- HUD rent assistance programs

- Medicaid eligibility reviews

Errors in reporting can cause benefit interruptions that take weeks to correct.

Financial Experts Advise Strategic Planning

Certified financial planner Jason Lee recommends that households build reserves when possible. “A COLA increase helps with rising living costs, but early payments can cause unintended gaps,” Lee said. “Consistent record-keeping and understanding payment calendars are essential.”

Historical Context: How COLA and SSI Timing Rules Developed

The Origin of COLA Adjustments

Congress introduced automatic COLA adjustments in 1975 to ensure benefits kept pace with inflation without requiring annual legislative approval. The CPI-W remains the metric used, although some advocacy groups argue that the CPI-E, which tracks costs for elderly consumers, may better reflect actual expenses.

Why SSI Payments Shift Around Holidays

SSI is set for the 1st of each month, but federal holidays have long affected the schedule. When January 1 falls on a holiday—as in 2026—the law requires payments to shift earlier. This rule aims to ensure timely access to funds but inadvertently creates budgeting challenges.

Looking Ahead: What Beneficiaries Should Expect in 2026

Future SSA Updates

The SSA plans to release updated income thresholds, disability evaluation criteria, and administrative adjustments in early 2026. Analysts expect modest changes but warn that the system faces long-term funding challenges.

Advocacy Groups Call for Broader SSI Reform

Organizations such as the National Disability Rights Network and AARP continue pressing Congress to modernize SSI asset limits and outdated income rules. No major legislative changes are currently approved, but bipartisan proposals remain under review.

Social Security & Medicare Changes for 2026 Just Announced – And They’re Bigger Than Expected

Final Outlook on December SSI & Social Security

The December payment cycle and the 2026 COLA illustrate how federal policy, inflation data, and holiday scheduling shape benefits for millions of Americans. While the early SSI check and updated COLA provide clarity for 2026 budgeting, experts warn that beneficiaries must remain attentive to income reporting rules and monitor official SSA updates as the new year approaches.

FAQs About December SSI & Social Security

1. Why are there two SSI payments in December?

The SSA issues January’s SSI payment early when the regular payday falls on a federal holiday. The December 31 deposit is not an additional benefit; it is simply advanced due to scheduling rules.

2. Does the Social Security 2026 COLA apply to SSDI and survivors benefits?

Yes. The 2.8% COLA applies to all Social Security programs, including retirement, survivor, and Social Security Disability Insurance (SSDI) benefits.

3. Will Medicare premiums reduce my COLA increase?

Possibly. Many beneficiaries have Medicare Part B premiums deducted from their Social Security payments. Final premium amounts for 2026 will be released later in the year.

4. Are there any additional Social Security checks in December?

No. Only SSI beneficiaries receive two December deposits due to calendar circumstances. SSDI and retirement benefits follow standard schedules without bonus or extra checks.

5. How much will SSI recipients get in 2026 after the COLA increase?

The federal standard benefit will rise to $994 per month for individuals and $1,491 for couples, though actual payments may vary depending on income and living arrangements.