The December Social Security Schedule will deliver two payments to millions of Americans as the Social Security Administration (SSA) shifts its disbursement calendar to accommodate the New Year’s Day federal holiday. The adjustment affects Supplemental Security Income (SSI) recipients nationwide and is designed to prevent delays that would otherwise push January’s benefit past its intended date.

December Social Security Schedule

| Key Fact | Detail / Statistic |

|---|---|

| Early SSI Payment | January 2026 SSI benefit paid Dec. 31, 2025 |

| Regular December SSI Payment | Paid Dec. 1, 2025 |

| Social Security Benefits | Paid on scheduled Wednesdays based on birthdate |

| No SSI Payment in January | Because funds are paid at end of December |

| COLA Increase Begins | Reflected in the early January payment |

| Official Website | Social Security Administration |

Why the December Social Security Schedule Includes Two Payments

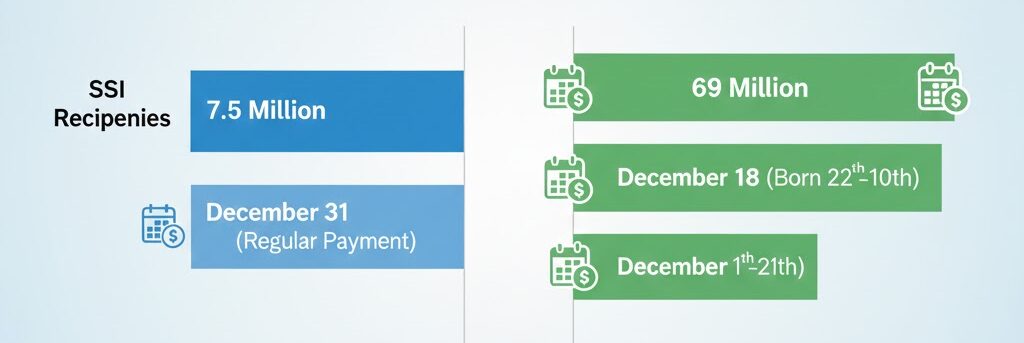

The SSA issues SSI benefits on the first day of each month. When the first falls on a weekend or federal holiday, federal administrative policy requires the agency to disburse funds on the closest prior business day. Because January 1, 2026, is a federal holiday, recipients will receive January’s SSI benefit on December 31, 2025.

An SSA spokesperson said the practice ensures “uninterrupted access to financial assistance for beneficiaries who depend on consistent and timely payments.” The administration has followed this policy since the late 1970s, when electronic payment systems replaced most paper checks.

While the shift may appear as a bonus payment, officials emphasize that “the December 31 deposit is not an additional benefit. It is simply the January payment delivered early to meet federal disbursement standards.”

How Social Security Benefits Are Scheduled in December

Unlike SSI, Social Security retirement, disability, and survivor benefits follow a multi-tiered system. Payment dates depend primarily on the beneficiary’s birthdate unless benefits were received before May 1997.

December 2025 Payment Breakdown

- December 3 — Recipients who began receiving benefits before May 1997

- December 10 — Birthdates between the 1st and 10th

- December 17 — Birthdates between the 11th and 20th

- December 24 — Birthdates between the 21st and 31st

Economist Dr. Alicia Munnell, director of Boston College’s Center for Retirement Research, notes that the structured staggered-payment system helps the agency manage cash flow for nearly 70 million beneficiaries. “The birthdate-based schedule reduces administrative strain and ensures that the Treasury can coordinate disbursements efficiently,” she said.

Who Receives Two Payments—and Why It Matters

The early payment applies to all SSI recipients, including more than 7 million adults and children who rely on the program for basic income assistance. Some individuals who receive both SSI and Social Security benefits may also see both payments appear in December.

Advocates stress that clarity is important because confusion about the double deposit can lead to budgeting errors.

According to Dr. Kathleen Romig, a senior researcher at the Center on Budget and Policy Priorities, “Families that depend heavily on SSI often face pressure during the holiday season. The early payment can help stabilize finances, but recipients must remember that January 1 will not bring a new deposit.”

Households that do not track the schedule closely may mistakenly assume their benefits were increased or duplicated. Financial counselors recommend that recipients review their SSA notices each year to understand upcoming shifts.

Cost-of-Living Adjustment (COLA) and How It Influences the Early Payment

One key detail that makes the December 31 payment especially significant is the annual Cost-of-Living Adjustment (COLA). Each January, the SSA raises monthly benefit amounts to reflect inflation, as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

The COLA increase will already be factored into the early January payment that arrives on December 31.

According to the SSA’s annual COLA announcement, the adjustment “protects beneficiaries from the impact of rising consumer prices.” Historically, COLA increases have ranged from 0% to more than 14%, depending on economic conditions.

Experts note that the December 31 deposit is the first opportunity for SSI recipients to see the new rate.

How the December Social Security Schedule Affects Household Budgeting

Financial planners say the adjusted schedule can create both opportunities and challenges.

Benefits of the Early Payment

- Helps cover increased winter heating and utility costs.

- Supports households during the expensive holiday season.

- Allows earlier access to funds for rent and essential bills due January 1.

Risks and Potential Confusion

- January includes no SSI payment, which may cause budgeting gaps.

- Households relying on automatic transfers timed to monthly deposits may need adjustments.

- Misinterpretation of the early payment as a “bonus” may lead to overspending.

Certified financial advisor James Liu, founder of JFL Financial Advisors, warns that “beneficiaries should treat the early deposit as their January payment to avoid shortfalls in the first weeks of the new year.”

Many local social service agencies distribute annual calendars to help clients understand payment shifts, especially when two checks fall in December.

Historical Context: Why SSA Schedules Payments This Way

Prior to the expansion of direct deposit systems in the 1970s and 1980s, Social Security checks were mailed and often delayed by holidays, postal volume, or weather events. To address disruptions, Congress authorized payment adjustments to prevent late disbursements.

The SSA now processes nearly all payments electronically through the U.S. Department of the Treasury’s systems.

Holiday scheduling rules are embedded in Title 42 of the U.S. Code, ensuring consistency across decades.

Retired SSA administrator Linda Kerrigan, who oversaw schedule reforms in the 1990s, said the policy “was created to protect low-income Americans and ensure deposits reach accounts without administrative delays.”

Understanding the Programs: SSI vs. Social Security Benefits

The two main programs affected in December serve different populations.

SSI (Supplemental Security Income)

Serves:

- Adults with disabilities and limited income

- Children with disabilities

- Seniors age 65+ with low income and limited resources

Funded by general U.S. Treasury revenues, not Social Security taxes.

Social Security Benefits

Serve:

- Retired workers

- Disabled individuals through Social Security Disability Insurance (SSDI)

- Surviving spouses and dependents

Funded by payroll taxes under the Federal Insurance Contributions Act (FICA).

Understanding these distinctions helps explain why SSI follows the first-of-month rule while Social Security uses a staggered Wednesday schedule.

What Recipients Should Expect Going Into January 2026

January begins without an SSI payment because benefits were advanced to December 31.

Social Security retirement and disability payments will continue on their regular Wednesday cycle.

The SSA is expected to release updated guidance early in the new year, including details on COLA increases, resource limits, and reporting requirements related to income changes.

Economists suggest continued inflation and shifting federal policies may shape benefit adequacy in 2026 and beyond. “The payment schedule is a stable feature,” said Dr. Munnell, “but long-term demographic trends will drive the future of Social Security financing.”

Looking Ahead: Could Payment Schedules Change in the Future?

Lawmakers and policy researchers have occasionally discussed simplifying the payment system, but no major reforms are imminent. Proposals cited by the Congressional Research Service include:

- Consolidating SSI and Social Security payment days

- Providing optional biweekly payments

- Allowing beneficiaries to select their own deposit date

However, the SSA has argued that the current structure supports long-term administrative efficiency.

A senior SSA official, speaking on background, said any major overhaul “would require extensive testing, new Treasury protocols, and congressional approval.”

For now, the December Social Security Schedule—including early payments during holiday periods—remains a predictable part of the system.

Florida SNAP Benefits Fully Restored — Check Your December Distribution Date Now!

Conclusion

The two-payment structure in December reflects long-standing SSA policy designed to prevent disruptions caused by federal holidays. For millions of SSI recipients, the early payment ensures timely access to essential income, while Social Security beneficiaries continue on their standard Wednesday cycle.

As the new year approaches, analysts expect continued discussion about benefit adequacy, inflation pressures, and the stability of Social Security funding. For now, the agency advises recipients to review their annual statements carefully and plan ahead for the shifted January schedule.

FAQs About December Social Security Schedule

Why do SSI recipients get two payments in December?

Because January’s benefit is paid early when the first of the month falls on a federal holiday.

Is the second December payment a bonus?

No. The December 31 deposit is the January SSI payment issued in advance.

Will Social Security retirement beneficiaries receive two payments?

Not unless they also receive SSI.

Does the early payment include the COLA increase?

Yes. The December 31 payment reflects the new year’s cost-of-living adjustment.

Will there be an SSI payment in January?

No. January’s payment is delivered on December 31.

What should beneficiaries do to avoid confusion?

Review the SSA annual notice and treat the December 31 deposit as their January payment.