Social Security recipients can expect a mix of regular and early payments in December 2025, with some beneficiaries receiving two checks due to early deposits for January. Understanding these key dates is crucial to ensure timely receipt of benefits.

December Social Security Payouts

| Key Fact | Detail/Statistic |

|---|---|

| December 2025 SSI Payments | December 1, 2025 (Regular), December 31, 2025 (Early January) |

| Retirement/Disability/Social Security Payments | December 3, 2025 (pre-May 1997), December 10–24, 2025 (post-May 1997) |

| Cost-of-Living Adjustment (COLA) | 2.8% increase to Social Security benefits from January 2026 |

December 2025 marks an important moment for Social Security beneficiaries, especially those on SSI, who will see two payments in December. As 2026 begins, recipients will experience the benefits of the 2.8% COLA increase, which will provide a financial boost to millions of Americans.

With the new year bringing additional changes to Social Security payments, beneficiaries are encouraged to stay informed and review their payment schedules to ensure they receive their benefits without delay.

Understanding December 2025 Social Security Payments

As the end of 2025 approaches, millions of Americans receiving Social Security benefits are preparing for their monthly payments. For many, December promises some significant changes in the timing of those payments. This is especially true for retirees, people with disabilities, and those who rely on Supplemental Security Income (SSI). Here’s a detailed look at the updated Social Security payout schedule for December, and the important context behind these changes.

Key Social Security Payment Dates for December 2025

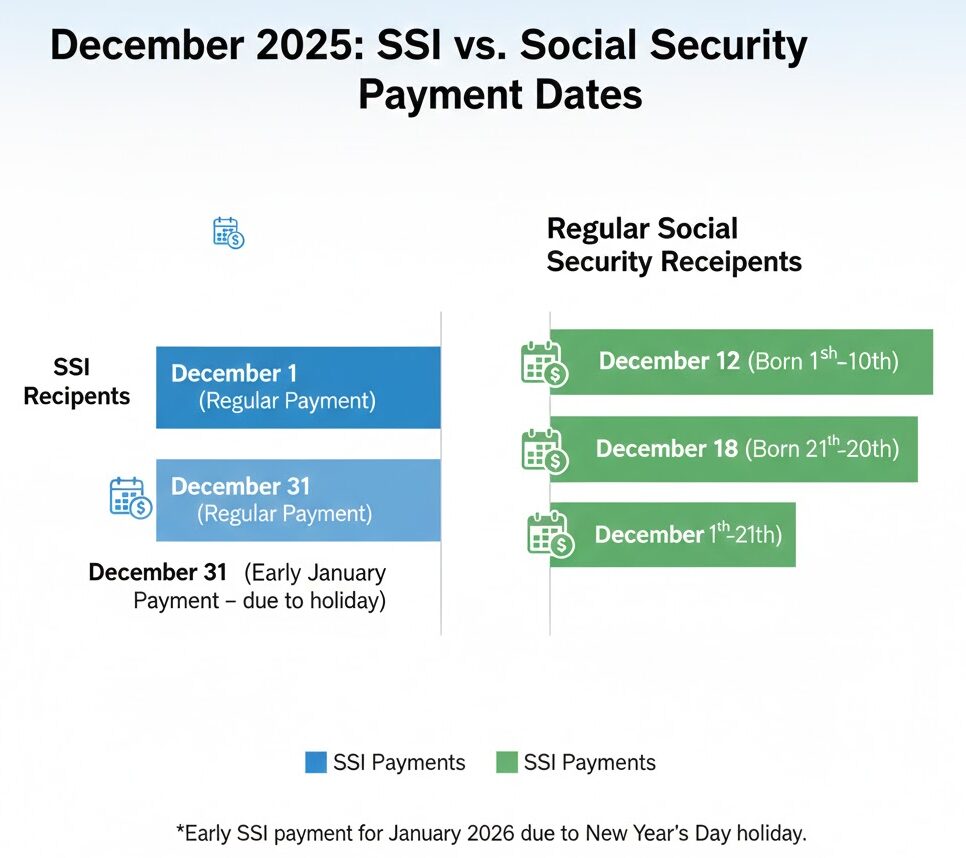

Social Security payments are issued on a regular schedule each month. However, in December 2025, some recipients will receive payments earlier than usual, particularly for those who qualify for SSI.

1. Supplemental Security Income (SSI)

The majority of SSI beneficiaries will receive their regular December payment on Monday, December 1, 2025. However, due to the New Year’s Day holiday falling on January 1, 2026, recipients will also receive an early payment for January 2026 on Wednesday, December 31, 2025. This gives some SSI recipients two payments in December, helping ensure they have access to funds before the New Year.

2. Regular Social Security Retirement/Disability Payments

For those receiving regular Social Security benefits, the payment dates depend on when they were born. The following dates are set for those receiving retirement, disability, or survivor benefits:

- Born before May 1997: Payments will be issued on Wednesday, December 3, 2025.

- Born between the 1st and 10th of the month: Payments will be issued on Wednesday, December 10, 2025.

- Born between the 11th and 20th of the month: Payments will be issued on Wednesday, December 17, 2025.

- Born between the 21st and 31st of the month: Payments will be issued on Wednesday, December 24, 2025.

Why Is December 2025 Special for Social Security Payments?

December’s schedule is unique for a couple of reasons. First, the early SSI payment on December 31, 2025, is due to January 1, 2026, being a federal holiday. The Social Security Administration (SSA) has adjusted payment dates for SSI recipients to ensure that they are not impacted by the holiday.

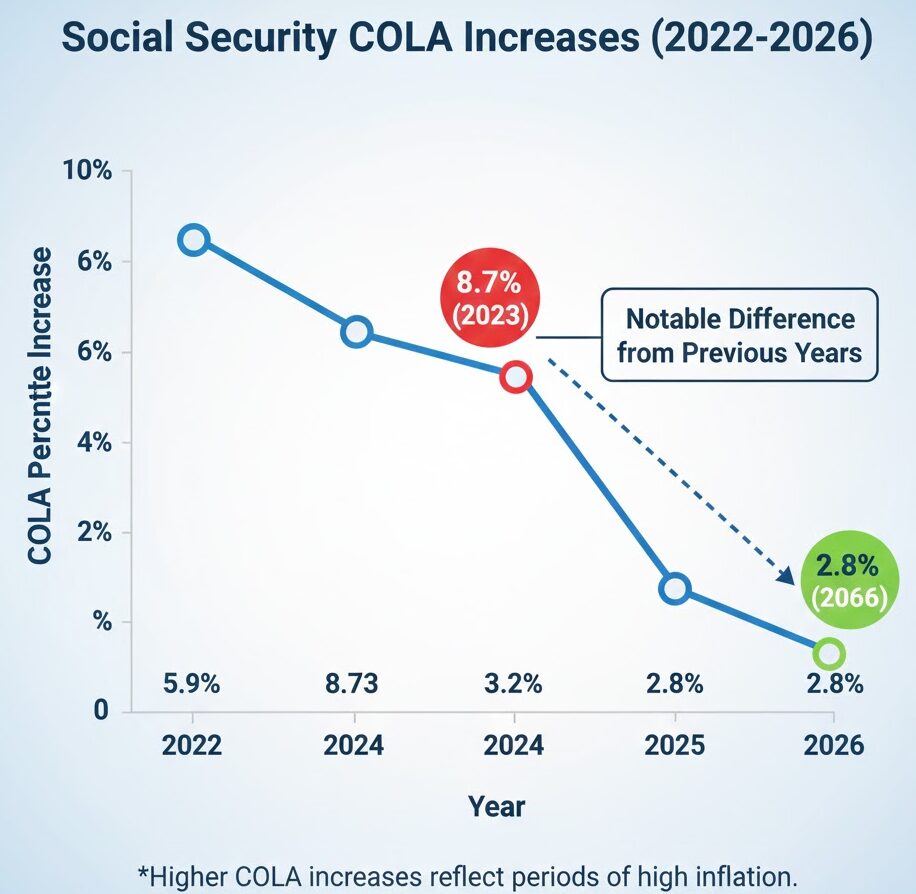

Additionally, Social Security’s Cost-of-Living Adjustment (COLA) for 2026 has been announced at a 2.8% increase. While the COLA adjustment will be officially applied to January 2026 payments, some recipients will benefit from the increase earlier if they receive their January check on December 31. This marks a significant boost in benefits, averaging an extra $56 per month for retirees and disabled individuals.

Historical Context of COLA: Why It Matters

The Cost-of-Living Adjustment (COLA) is a crucial part of Social Security. Introduced in 1975, COLA is designed to ensure that Social Security benefits keep pace with inflation. Without it, the purchasing power of beneficiaries would erode over time as prices for goods and services increase.

COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the price of a basket of goods and services such as food, rent, and medical care. In recent years, the COLA has varied significantly. For example, in 2023, the adjustment was a substantial 8.7% due to rising inflation rates, but this year’s increase is more moderate at 2.8%.

The Impact of Inflation on Social Security Payments

Inflation is a constant concern for retirees and others on fixed incomes. While inflation affects everyone, those who rely on fixed benefits, like Social Security, can struggle to keep up. This is why the COLA adjustment is so critical. For example, in the past year, prices for consumer goods—especially groceries and healthcare—have risen sharply, impacting seniors and those with disabilities the most.

The 2.8% COLA in 2026 is smaller than the previous year, but it is still significant. For a retiree receiving $2,000 per month in Social Security, this adjustment will translate to an additional $56 per month—a much-needed increase to cover rising costs. While it may not offset all the financial challenges seniors face, it helps to maintain purchasing power in a period of persistent inflation.

Social Security Eligibility: Who Qualifies?

Social Security benefits are available to a wide range of individuals, not just retirees. Social Security is based on an individual’s work history. To qualify, a person must have paid into the system for a certain number of years through payroll taxes (FICA) or other contributions. Here’s a breakdown of common eligibility:

- Retirement Benefits: Most people qualify for Social Security retirement benefits after working for at least 10 years and earning 40 credits. Full retirement age is between 66 and 67 years old, depending on your birth year. Early retirement can begin at age 62, but the benefit amount will be reduced.

- Disability Benefits: Social Security also provides benefits for individuals who are unable to work due to a disability. To qualify, you must have a medical condition that is expected to last at least one year or result in death, and you must have worked enough years to be considered “insured” under the program.

- Survivor Benefits: Spouses, children, and even ex-spouses may qualify for benefits after the death of a Social Security recipient.

Advice from Financial Experts: Maximizing Social Security Benefits

Experts recommend that individuals think strategically about their Social Security benefits, particularly in retirement. Here are a few tips:

- Delay Claiming Benefits: If possible, delaying benefits until full retirement age or beyond (up to age 70) can result in a higher monthly payment. The longer you wait, the higher your payout.

- Consider Spousal Benefits: Married couples may be eligible for spousal or survivor benefits, which allow one spouse to claim benefits based on the other’s work record if it provides a higher benefit.

- Plan for Taxes: Some Social Security benefits are taxable depending on your income level. It’s essential to plan for this and take it into account when managing your retirement income.

Comparing Social Security with Other Government Assistance Programs

Social Security is just one part of the U.S. social safety net. For those struggling with food insecurity, Supplemental Nutrition Assistance Program (SNAP) and Medicaid are also vital programs. While Social Security provides income support, SNAP offers food assistance, and Medicaid provides healthcare benefits to those with low income. These programs, alongside Temporary Assistance for Needy Families (TANF), ensure that basic needs are met for many Americans, particularly during times of economic uncertainty.

Social Security Paper Checks Were Supposed to End — Now the Government Is Backpedaling

Looking Ahead: The Future of Social Security

As we look to the future, Social Security’s financial sustainability is a topic of ongoing debate. The program faces significant challenges due to an aging population, particularly the Baby Boomer generation, who are retiring in large numbers.

According to the Social Security Trustees, the trust fund that supports Social Security will be depleted by 2034 unless changes are made. This could result in a reduction of benefits for future retirees unless policymakers take action to either raise taxes, reduce benefits, or change the program in some other way.

FAQs About December Social Security Payouts

Why is there an early SSI payment in December?

The early payment for January is due to the New Year’s Day holiday on January 1, 2026. The SSA issues payments early to avoid delays.

How does the 2.8% COLA adjustment affect my Social Security check?

Starting in January 2026, the COLA will increase Social Security payments by 2.8%, with some beneficiaries receiving the increase earlier if they get their January check on December 31, 2025.

What should I do if my Social Security check is delayed?

If your payment is delayed beyond the expected date, wait a few business days, then contact the SSA to ensure there are no issues with your direct deposit or payment method.