The Internal Revenue Service (IRS) has stated that it has not approved any federal program authorizing a December $2000 payout, pushing back against a wave of online claims suggesting payments were imminent. The agency emphasized that no legislation exists to support such a distribution, and no direct deposits are scheduled for release.

December $2000 Payout Guide

| Key Fact | Detail |

|---|---|

| No federal approval | IRS notes no current law authorizing a December $2000 payout |

| Public confusion rising | Rumors tied to social media claims and misinterpreted proposals |

| Proposed alternative | “Tariff dividend” floated but not legislated |

| Eligibility unknown | No payment framework exists without congressional action |

IRS Says No Federal Program Authorizing a December $2000 Payout

IRS spokespersons reiterated in December that the agency “has not issued any new stimulus payments and has no program scheduled for release.” The clarification follows widespread speculation on social media, where thousands of posts claimed that a December payout had already been approved.

“We urge the public to rely only on statements published through IRS.gov or Treasury.gov,” the agency said. The statement stressed that the IRS cannot create or release payments without explicit authorization from Congress.

How the December $2000 Payout Rumors Began

Many of the circulating claims link back to discussions of a potential “tariff dividend,” a proposal supported by former President Donald Trump. Under the concept, households could receive periodic payments funded by tariff revenue collected on imported goods.

Trump described the idea as a “way to return money to American families” during an October policy speech. However, he provided no legislative language or implementation timeline. The proposal has not been introduced in Congress, and no federal agency has been directed to prepare a distribution plan.

Dr. Lena Ortiz, a senior economist at the Tax Policy Center, said discussions appear to be “informal rather than grounded in legislative activity.” She added that “tariff revenue is neither stable nor large enough to guarantee fixed household payments without major structural modifications to trade policy.”

Economists also note that tariff revenue depends on global supply chains and foreign policy decisions, making it an unpredictable funding stream for social programs.

Economic Context: Why New Payments Are Unlikely

The broader economic climate also reduces the likelihood of a federal stimulus payment in the near term. While the U.S. economy grew moderately through 2025, inflation pressures and budget constraints have influenced federal lawmakers’ decisions.

According to the Bureau of Labor Statistics, inflation has cooled from its 2022 peak but remains above the Federal Reserve’s long-term target. Employment remains strong, and consumer spending has stabilized. “These are not the macroeconomic conditions that typically trigger emergency federal stimulus,” said Dr. Samuel Reed, a public finance scholar at Georgetown University.

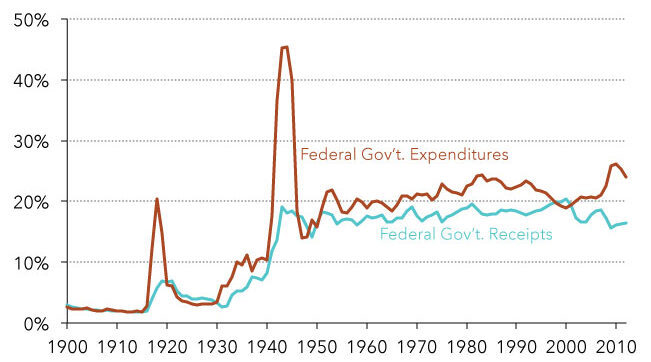

Federal Budget Considerations

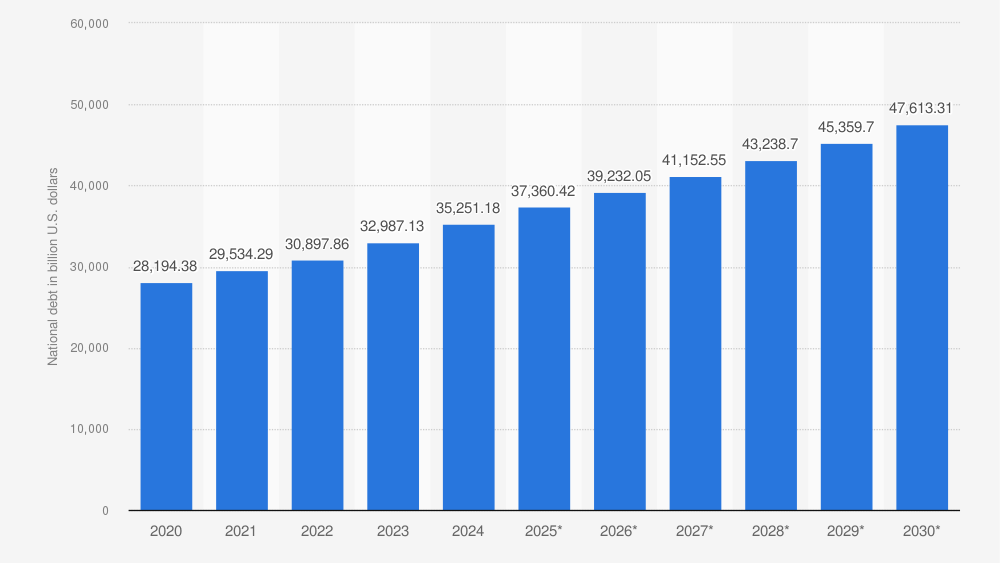

The 2025 federal budget faces significant constraints, with rising interest payments and defense spending outpacing revenue growth. Any new stimulus program—especially one projecting billions in direct payments—would require a bipartisan fiscal agreement that currently appears unlikely.

Legislative analysts at the Congressional Budget Office (CBO) note that the federal deficit is projected to rise further in 2026, driven by mandatory spending obligations. “Congress is not in a position to authorize new cash payments without offsetting revenue or cuts,” said one CBO official who spoke on background.

Lessons from Previous Stimulus Programs

The United States issued three rounds of large-scale stimulus payments between 2020 and 2021. Each was authorized by Congress through major legislation, including the CARES Act and the American Rescue Plan Act (ARPA).

Those programs required:

- Detailed eligibility formulas

- IRS distribution plans

- Treasury oversight mechanisms

- Bipartisan negotiation

Dr. Ortiz explains that “none of those payments happened through administrative discretion alone.” All required statutory authority and substantial political agreement.

These historical facts highlight the gap between previous stimulus programs and the current situation, in which neither legislative text nor bipartisan consensus exists.

Public Reaction and Growing Economic Anxiety

Rumors of the December $2000 payout gained traction partly because many households remain financially strained. Advocacy groups representing low-income Americans report that food insecurity and housing instability remain above pre-pandemic levels.

“We see families making impossible choices every day,” said Maria Hernandez, director of the National Community Support Coalition, a nonprofit focused on household stability. Hernandez said misinformation spreads quickly “because people are desperate for relief.”

Taxpayer associations have also expressed concern about the confusion. The National Taxpayers Union urged federal agencies to issue clearer communication when rumors arise. “Misunderstanding federal programs erodes public trust,” the organization wrote in a December policy note.

Expert Analysis: Could a Tariff Dividend Ever Work?

Trade analysts argue that a tariff-funded dividend program faces substantial challenges. The U.S. imports more than $3 trillion worth of goods annually, but tariff revenue accounts for a small portion of federal income.

According to the U.S. International Trade Commission (USITC):

- Tariff revenue totaled roughly $75 billion in 2024

- A nationwide $2,000 annual dividend would require more than $500 billion

“That math alone makes the proposal unrealistic without dramatic tariff increases,” said Dr. Howard Kim, a trade economist at Stanford University. Kim noted that aggressive tariff hikes could raise consumer prices, offsetting any dividend benefits.

Some analysts also warn that tariffs risk retaliatory measures from trading partners, which could disrupt supply chains and raise import costs.

Fraud Risks Rise as Misinformation Spreads

The Federal Trade Commission (FTC) has issued multiple warnings about scams exploiting stimulus rumors. Past federal payment programs triggered waves of fraudulent schemes, including:

- Fake IRS emails requesting Social Security numbers

- Text messages linking to malicious websites

- Impersonation calls claiming to “verify eligibility”

In 2021 alone, FTC data shows more than $300 million in fraud losses linked to stimulus check scams.

“Scammers move faster than official agencies,” said Monique Harris, an FTC investigator. She urged consumers to remember that “the IRS does not initiate contact through text messages, social media, or unsolicited email.”

Global Perspectives: How Other Countries Handle Relief Payments

Some countries have maintained recurring household relief programs, though typically through taxation rather than tariff revenue. For example:

- Canada issues quarterly carbon rebates to households

- Japan has deployed targeted cost-of-living payments funded through national budgets

- Germany distributes energy credits during inflation spikes

These programs underscore the unusual nature of the U.S. tariff dividend proposal and highlight why international economists say such a model would be difficult to implement in the United States.

Year-end CalFresh Benefits 2025 – What You Can Buy and When Your EBT Deposit Arrives Each Month

What Comes Next

Congress has not introduced legislation related to a new federal payout, and lawmakers from both parties have expressed skepticism about major new spending measures before the next budget cycle. The IRS said it will continue to update the public if any authorized programs emerge.

For now, officials stress that no December $2000 payout exists, and any credible updates will appear only on federal websites or in official press releases.

FAQs About December $2000 Payout

Is the IRS sending out a December $2000 payout?

No. The IRS has confirmed there is no such program.

Where did the rumor come from?

The idea is linked to a proposed tariff-funded dividend, but it has not become law.

Could a payout still happen later?

Only if Congress passes a bill authorizing payments.

Do Social Security or veterans automatically qualify?

No eligibility rules exist because no legislation exists.

Is the IRS asking for personal information by phone or text?

No. Any such communication is likely fraudulent.