Alaska will issue a December 18 $1000 direct payment to residents who remain approved but unpaid under the 2025 Permanent Fund Dividend program, marking the final disbursement of the year, according to the Alaska Department of Revenue. The payment concludes a three-month rollout tied to the state’s long-standing resource-sharing initiative.

New $1000 Direct Payment

| Key Fact | Detail |

|---|---|

| Payment Amount | $1000 per eligible resident |

| Final Payment Date | December 18, 2025 |

| Eligibility | Approved applicants listed as “Eligible–Not Paid” |

| Program Origin | Established in 1976 to share oil revenue |

| Number of Applicants | Typically 625,000–700,000 annually |

Residents who do not receive their December disbursement due to unresolved eligibility questions may still receive payment once their status is updated in early 2026. Officials say processing times have improved over the past two years, and they anticipate faster verification during the next application cycle.

A Unique State Program That Stands Apart

The Alaska Permanent Fund Dividend (PFD) remains the only annual cash distribution program of its kind in the United States. Established nearly five decades ago, the fund was designed to convert a portion of Alaska’s oil wealth into long-term financial returns for residents. No other state has adopted a comparable model, according to policy analysts at the National Conference of State Legislatures.

Governor Mike Dunleavy has repeatedly emphasized the PFD’s role in supporting families. “The dividend is part of Alaska’s identity. It reflects our commitment to sharing resource wealth with the people,” he said during earlier budget discussions.

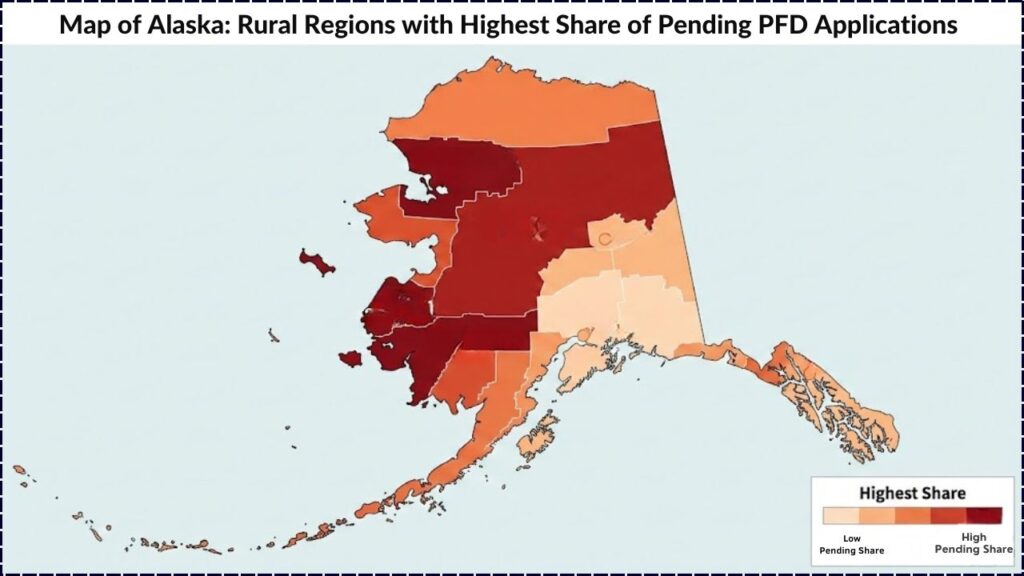

Economists note that the payout is especially important in remote communities where household incomes are lower and the cost of goods is far higher than in urban centers.

Who Qualifies for the December 18 New $1000 Direct Payment

The December batch includes applicants who were approved after verification delays or who submitted additional documentation late in the review period. Eligibility rules require:

- Full-year Alaska residency

- Limited absences outside the state

- A clean record free of certain disqualifying convictions

- Compliance with identification and income disclosures

Sara Race, Director of the Permanent Fund Dividend Division, said earlier this year, “December payments ensure that individuals whose applications took longer to verify still receive their dividend before the close of the calendar year.”

The Department of Revenue encourages applicants to check their status online, noting that most direct deposits are delivered on the scheduled date, while mailed checks can take additional time to arrive in rural regions.

Economic Significance of the 2025 PFD

The PFD amount fluctuates based on the investment performance of the Alaska Permanent Fund, which draws income from oil royalties, global market investments, and real estate holdings. The fund exceeded $75 billion in value this year, making it one of the largest sovereign wealth funds in the world.

Economist Dr. Mouhcine Guettabi, a former University of Alaska Anchorage faculty member, explains that the PFD provides a meaningful boost to household finances. “In many rural communities, the dividend represents a critical portion of annual disposable income,” he said during a recent public lecture. “It increases purchasing power and reduces economic instability.”

Some policymakers argue for a larger dividend, while others point to revenue shortages in state services. Alaska continues to debate the long-term sustainability of the current PFD formula, especially as oil revenue becomes more volatile.

How the 2025 Distribution Compares to Previous Years

The 2025 dividend amount of $1000 is lower than several recent payouts, including the $3,284 distributed in 2022. Analysts attribute recent decreases to:

- Lower oil production

- Market volatility affecting fund earnings

- Legislators reallocating revenue to cover budget shortfalls

However, the 2025 amount aligns with the state’s push for predictable, stable annual payments rather than larger one-time disbursements.

A report from the Institute of Social and Economic Research notes that households typically use dividend money for basic expenses such as fuel, groceries, and winter supplies—particularly in remote communities where living costs can be two to three times higher than national averages.

Why No Other State Qualifies for Similar Payments

Unlike pandemic-era stimulus programs or temporary state relief initiatives, the PFD operates independently of federal legislation. Other states have issued one-time rebates or tax credits in recent years, but none maintain a permanent, resource-based annual payout.

Policy experts at the Center on Budget and Policy Priorities note that Alaska’s model is difficult to replicate because few states have comparable natural-resource revenue or sovereign wealth funds. “Alaska’s economy and fiscal structure are unique,” said one analyst. “Most states rely heavily on income or sales taxes rather than royalties.”

Distribution Timeline for 2025

The payment rollout occurred in three waves:

- October 23, 2025 – First round of direct deposits

- November 20, 2025 – Second wave for newly approved applicants

- December 18, 2025 – Final distribution for remaining eligible residents

The 2025 schedule closely mirrors distribution patterns used in previous years, though officials say they continue to improve verification systems to reduce delays.

Impact on Alaska’s Rural Communities

Rural regions, particularly in western and northern Alaska, rely more heavily on the dividend due to higher transportation costs and limited access to full-service grocery stores. A 2024 analysis from the University of Alaska Fairbanks Cooperative Extension Service found that dividend income often goes toward:

- Heating fuel

- Vehicle and snowmobile maintenance

- Bulk food purchases

- Winter travel and supplies

For many residents, the timing of the December payment provides critical financial flexibility ahead of peak winter conditions.

Political Debate Surrounding the PFD

The PFD remains one of the most debated issues in Alaska politics. Legislators continue to disagree over whether to:

- Increase the payout to historical standards

- Tie the dividend to a structured formula

- Use a larger share of fund earnings to stabilize the state budget

Supporters of larger payments argue that the dividend belongs to residents and has a measurable economic stimulus effect. Opponents say the state must balance PFD spending with investments in public safety, education, and infrastructure.

Despite differing political views, lawmakers have generally supported maintaining the dividend at or near the current level to provide predictability for households.

2026 Senior Driving Rules: What Americans Turning 87 Need to Know

Looking Ahead to the 2026 Application Cycle

The application period for the 2026 PFD begins on January 1. State officials recommend applying early and verifying personal information to prevent processing delays.

The Department of Revenue is also expected to expand digital tools that allow applicants to track their status and update their mailing or banking information in real time.

FAQs About New $1000 Direct Payment

1. Will everyone in Alaska receive the $1000 payment on December 18?

No. Only applicants who are approved and listed as “Eligible–Not Paid” before early December will be included.

2. Can this payment be garnished for debts?

Yes. Certain debts—such as child support or federal obligations—may be deducted before the payment is issued.

3. Is the PFD considered taxable income?

Yes. The Internal Revenue Service treats the dividend as taxable income, and residents must report it when filing federal taxes.

4. When will the 2026 application open?

The application period begins on January 1, 2026, and continues through March 31.

5. How can residents track their payment status?

Applicants may log in to the official PFD portal using their myAlaska account to verify approval, payment dates, or missing documentation.