The decision of when to claim Social Security benefits is crucial for millions of Americans. Claiming at the earliest age, 62, versus waiting until 70 can create a substantial monthly benefit gap. Depending on an individual’s earnings record, the difference could exceed $800 a month. This article explores how timing impacts the size of your Social Security payments, backed by expert analysis and data.

For many, Social Security benefits are the foundation of retirement income. Understanding the financial implications of when to start drawing from this resource is essential to making the most of it. A decision made at age 62 could differ greatly from one made at age 70—both in terms of monthly payments and long-term financial well-being.

Social Security at 62 vs. 70

| Key Fact | Detail/Statistic |

|---|---|

| Early Claiming Impact | Claiming at 62 results in a permanent benefit reduction of up to 30%. |

| Delayed Claiming Benefit | Delaying benefits until 70 can increase monthly payments by up to 75%. |

| Typical Monthly Gap | The difference in monthly benefits between claiming at 62 vs. 70 can be $800 or more for higher earners. |

| Official Website | Social Security Administration |

Claiming Social Security benefits at age 62 instead of waiting until 70 can significantly reduce your monthly payments, potentially creating an $800 gap or more. While delaying can provide higher payments and long-term security, individuals should carefully evaluate their personal financial situation and health. Ultimately, understanding the financial trade-offs and making an informed decision can have a lasting impact on retirement income.

Claiming Social Security at 62 vs. 70: What’s the Difference?

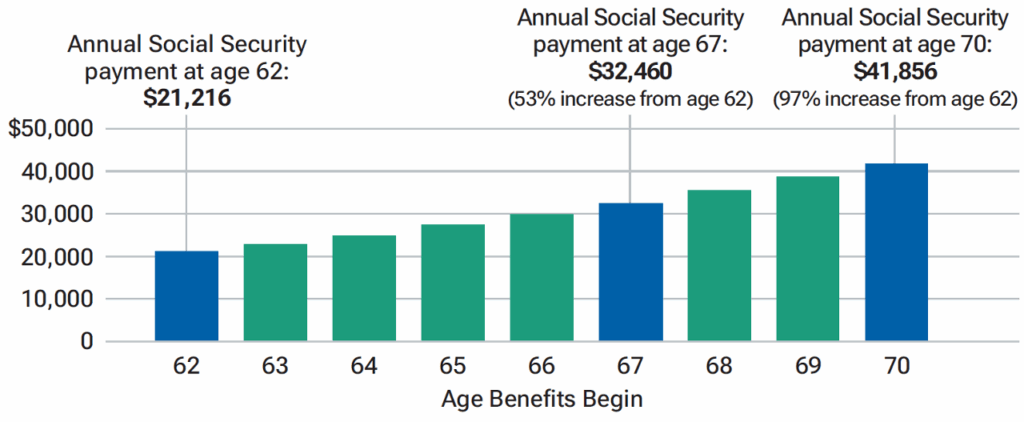

The decision to claim Social Security benefits early or later is one of the most impactful financial choices individuals will make in retirement. The Social Security Administration (SSA) allows individuals to claim benefits as early as 62, but waiting until age 70 offers a significantly higher monthly payout. Understanding the differences in these choices requires analyzing how Social Security payments are structured.

Early Claiming: A Permanent Reduction

When someone claims Social Security benefits at age 62, they are accepting a permanent reduction in the amount they will receive each month. The reduction can be as much as 30% compared to waiting until full retirement age (FRA), which is typically 66 or 67 for most people. For example, if someone’s monthly benefit at FRA is $2,000, claiming at 62 could result in a monthly benefit of just $1,400—a 30% decrease.

“Claiming early might seem like a good option if you need income immediately, but it’s important to understand that you are locking in a reduced amount for life,” said Dr. Emily Weaver, an economist at the Brookings Institution. “This choice can be particularly impactful for individuals who live longer, as it results in a lower overall benefit over time.”

Waiting Until 70: Boosting Monthly Benefits

On the other hand, delaying Social Security benefits until age 70 can lead to a substantial increase in monthly payments. Delayed Retirement Credits (DRCs) increase benefits by about 8% per year beyond FRA, up until age 70. This can result in a 75% increase in benefits compared to claiming at 62. For the same individual whose monthly benefit at FRA is $2,000, waiting until 70 could result in a monthly payment of $3,500.

This strategy is often recommended for individuals who can afford to wait, as it maximizes their long-term benefits. “For many high earners, the difference between claiming early and waiting until 70 can be as much as $800 to $1,000 per month,” said John Fisher, a retirement planning expert at Fisher Financial Advisors.

The $800 Monthly Gap: Who Does It Impact Most?

The financial gap between claiming at 62 versus 70 can be particularly striking for those with a high income or significant work history. For individuals with a strong earnings record, the $800 gap is not uncommon, and in some cases, it could be even larger.

For example, individuals earning the maximum taxable income over their careers may see monthly benefits increase by more than $1,000 by delaying their claims. For those relying heavily on Social Security for retirement income, this difference can be a game-changer. Additionally, married couples may want to consider how their decision will affect survivor benefits, which are often higher if one spouse delays their claim.

Moreover, the decision can vary greatly depending on how long an individual expects to live. For example, if an individual anticipates a shorter lifespan, claiming earlier may make more sense to ensure they don’t miss out on Social Security payments during their lifetime. “The timing of your claim should reflect both your health and financial needs,” advises Dr. Jason Green, a retirement strategist with Global Wealth Advisors.

Real-World Examples: The Difference in Dollars

To illustrate the $800 difference, consider two individuals:

- Individual A: Earns $100,000 annually for 35 years, with an FRA benefit of $2,500.

- Claiming at 62: $1,750 per month (a 30% reduction)

- Claiming at 70: $4,375 per month (a 75% increase)

- Individual B: Earns $50,000 annually for 35 years, with an FRA benefit of $1,500.

- Claiming at 62: $1,050 per month

- Claiming at 70: $2,625 per month

These examples show that the gap in benefits grows significantly for higher earners, where the monthly difference can be as much as $2,625, further reinforcing the financial advantage of delaying claims.

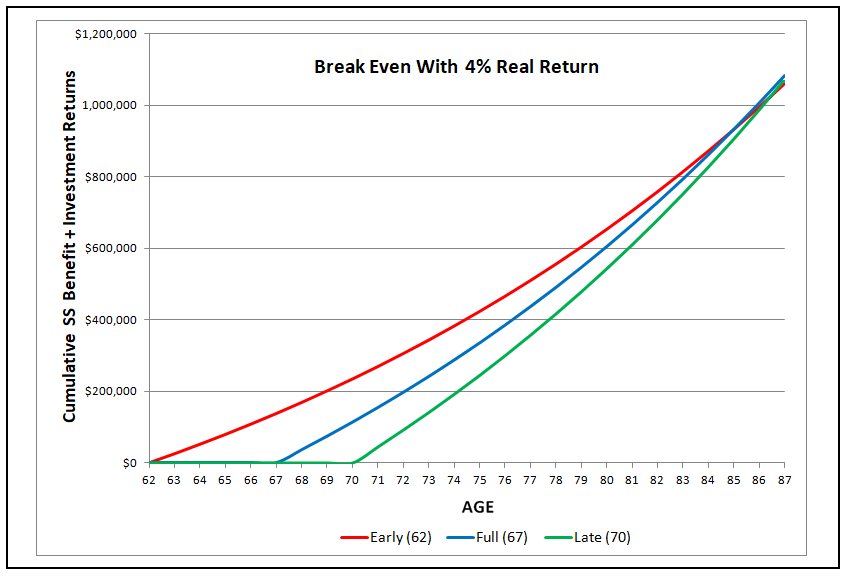

The Financial Risks and Rewards of Delayed Claims

While waiting until age 70 can provide higher monthly payments, there are several factors to consider. The most significant is health: individuals who expect to have a shorter life expectancy may prefer to claim early to maximize their benefits in the near term. Additionally, the ability to delay claims until age 70 often depends on having sufficient retirement savings or other income sources.

“Delaying Social Security benefits until age 70 is a powerful strategy for many, but it’s not right for everyone,” said Dr. Claire Thompson, a retirement expert at Pew Research Center. “It’s crucial to weigh the financial trade-offs based on your health, expected longevity, and other retirement income streams.”

Some financial experts argue that, if the decision to delay is based solely on maximizing benefits, it could lead to “missing out on years of benefits in the interim”, particularly for those who may need income earlier. Waiting until age 70 may not be the best approach for someone with a family history of health problems or someone who needs to access retirement funds sooner.

Planning for the Future: How to Make the Right Call

The timing of Social Security claims should be made with careful thought and planning. A comprehensive retirement strategy should account for income needs, healthcare costs, and anticipated lifespan. Financial planners suggest building a diversified portfolio of investments alongside Social Security, so individuals aren’t solely dependent on government benefits.

Government Raises the Bar for Qualifying for Social Security Benefits: What This Means for You

Some strategies include:

- Maximizing retirement savings through employer-sponsored 401(k) plans or IRAs, allowing individuals to afford to delay Social Security benefits.

- Taking advantage of spousal benefits, as one spouse’s delay can increase survivor benefits for the other.

- Planning for healthcare costs by factoring in Medicare, long-term care insurance, or private savings.

“The timing of Social Security should not be made in a vacuum,” said Andrew McKinney, a financial advisor at WealthTrust Financial. “It’s part of a broader retirement income plan, and it requires a holistic approach.”