Millions of Americans weighing Claiming Social Security at 62 will face steeper lifetime reductions in 2025, as the federal government’s scheduled rise in the full retirement age (FRA) changes how early benefits are calculated. The Social Security Administration (SSA) confirmed that people born in 1960 and later will have an FRA of 67, widening the gap between early and full benefits and intensifying the financial cost of early retirement.

Claiming Social Security at 62 Could Cut Your Pay

| Key Fact | Detail / Statistic |

|---|---|

| FRA rises to 67 in 2025 | Applies to those born in 1960 and later |

| Reduction at age 62 | Up to 30% lower benefits for life |

| Trust Fund projection | Depletion expected in 2033 without reform |

| Earnings test | $1 withheld for every $2 earned over annual limit before FRA |

| Official Website | SSA.gov |

How the 2025 FRA Increase Changes Early Claiming

Beginning in 2025, Americans born in 1960 will be the first cohort required to wait until age 67 to receive full retirement benefits. Those who choose Claiming Social Security at 62 will see a steeper reduction—about 30%—compared with approximately 25% when the FRA was 66.

“Increasing the FRA reduces monthly benefits for early claimants while increasing incentives to work longer,” said Andrew Biggs, a senior fellow at the American Enterprise Institute. “The adjustment reflects demographic pressures, including longer life expectancy and structural funding challenges.”

This rise is part of a phased-in change first enacted in 1983. For workers born in 1954 or earlier, the FRA was 66. That full age expanded incrementally until reaching 67 for those born in 1960 or later.

The Math Behind the New Reduction

Under the SSA’s formula, each month benefits are claimed before FRA results in a proportional reduction. With an FRA of 67, claiming at 62 equals 60 full months early, significantly increasing the cumulative discount.

The reduction breaks down as follows:

- For the first 36 months early: 5/9 of 1% per month

- Beyond 36 months: 5/12 of 1% per month

That results in a 30% lifetime reduction for those claiming at 62.

By comparison, when FRA was 66, the reduction was 25%.

“These numbers matter because most retirees rely heavily on Social Security,” said Dr. Laura Quinlan, professor of retirement economics at the University of Michigan. “Even a five-point change in reduction rates can translate into tens of thousands of dollars over a retiree’s lifetime.”

Growing Economic Pressures: Why Congress Raised the FRA

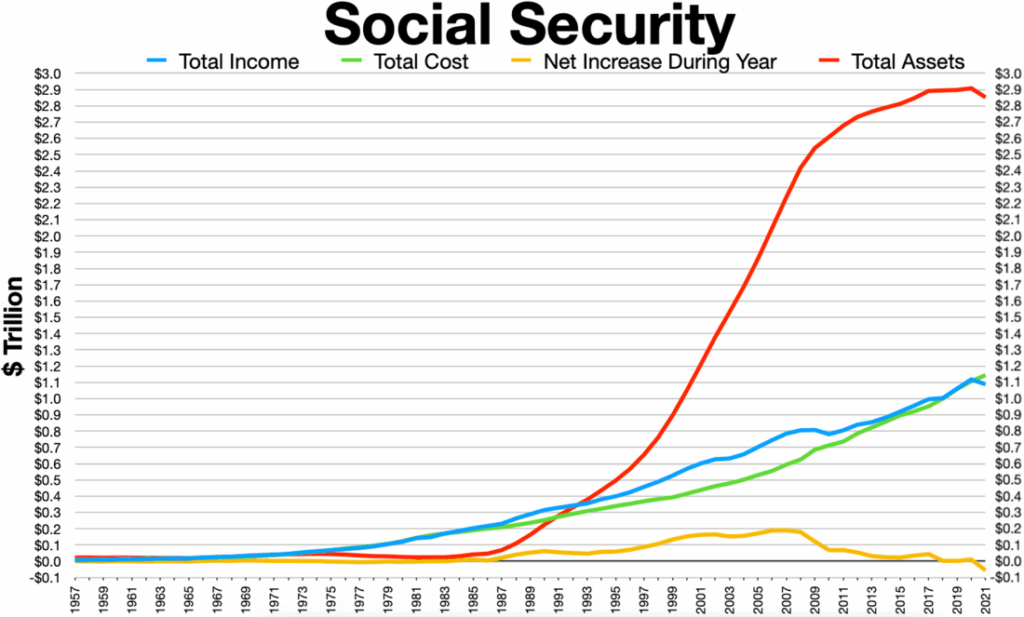

The Social Security Amendments of 1983 set today’s FRA changes in motion. Lawmakers were responding to the program’s long-term solvency concerns—concerns that have only grown more urgent.

According to the 2024 Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund is projected to become depleted in 2033, at which point benefits would face an automatic 21% cut without Congressional action.

Demographers point to several underlying pressures:

- Longer life expectancy

- Lower birth rates

- A shrinking worker-to-beneficiary ratio (from 3.3 in 2000 to 2.7 today)

- Rising costs of retiree health care, indirectly affecting retirement ages

“The FRA increase is one of the few policy levers Congress has already enacted,” said Kathleen Romig, director of Social Security policy at the Center on Budget and Policy Priorities (CBPP). “But more adjustments will be necessary to ensure long-term sustainability.”

Who Is Most Affected by Claiming at 62?

Experts say the impact of early claiming varies significantly across demographic groups.

Low-income earners

Workers with lower wages are more likely to claim at 62 due to financial need. According to the Urban Institute, 55% of low-income workers file as early as possible, compared with 31% of high-income workers.

Workers in physically demanding jobs

Americans in construction, manufacturing, caregiving, and service-sector roles often cannot continue working into their late 60s. The FRA increase effectively reduces benefits for groups with shorter life expectancies.

Women

Women live longer on average and often have lower lifetime earnings. According to the U.S. Census Bureau, women are nearly 20% more likely to rely on Social Security as their primary income source.

Rural Americans

Due to limited employment opportunities, rural retirees claim earlier and face proportionally larger lifetime reductions.

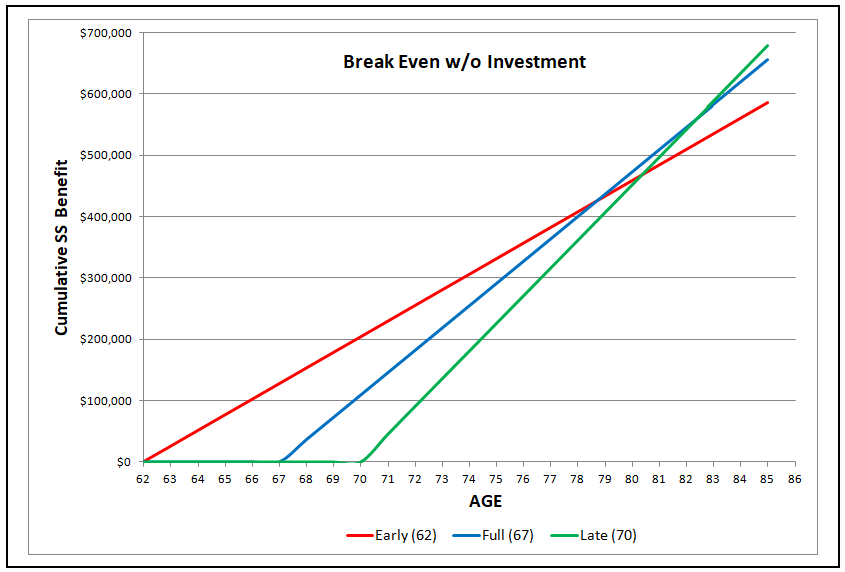

Case Study: Two Workers, One Decision

Case 1: Maria, age 62, retail employee

- Would receive $1,050/month at 62

- Full benefit at 67 would be $1,500/month

- Lifetime reduction: nearly $6,000 per year

Case 2: David, age 62, engineer

- Has savings and continues working

- Delays until 70 and receives $1,860/month from delayed credits

- Gains roughly $80,000 more over a 20-year retirement

These contrasting experiences illustrate how the FRA system widens disparities among workers with different financial and health profiles.

Impact on Workers Who Keep Working Before FRA

Americans who claim before FRA and continue working face the earnings test, which withholds $1 for every $2 earned above the annual limit. In 2024, that threshold was $22,320. A higher limit applies in the year someone reaches FRA.

“Withheld benefits aren’t lost,” the SSA notes. “They are recalculated at full retirement age.”

However, that recalc does not eliminate the early-claiming penalty—claimants start permanently lower.

Why Many Americans Still Claim at 62

Behavioral researchers highlight several reasons:

- Loss aversion makes people prefer a smaller benefit now over a larger benefit later.

- Misunderstanding of the rules leads many to believe early benefits “increase later,” which they do not.

- Health uncertainty drives earlier claims, especially among workers in physically demanding roles.

- Distrust of political stability causes some workers to claim early “before benefits run out.”

A 2023 Pew Research Center survey found that 52% of Americans believe Social Security will not provide full benefits in the future.

Planning Tools and Practical Strategies

Experts recommend that workers approaching retirement consider:

1. Estimate your benefit

Use the SSA’s “My Social Security” account for personalized forecasts.

2. Consider spousal strategies

Couples can coordinate claiming ages to maximize survivor and household benefits.

3. Review health and longevity

Chronic conditions can make early claiming more financially reasonable.

4. Evaluate employment prospects

Staying employed even part-time can delay claiming and raise future benefits.

5. Seek financial counseling

Nonprofit agencies and community organizations offer free retirement planning services.

How the U.S. Compares Internationally

Many advanced economies have raised retirement ages in response to aging populations:

- United Kingdom: FRA rising to 67 by 2028

- Germany: Increasing to 67 by 2031

- Japan: Maintaining 65 but encouraging delayed retirement

- France: Recently raised from 62 to 64 amid widespread protests

The U.S. remains in the global middle—later than France but earlier than Japan.

Policy Debate: What Might Happen Next?

Congress continues to debate several proposals:

1. Raising the payroll tax cap

Currently capped at $168,600, proposals recommend lifting or eliminating it.

2. Further FRA increases

Some lawmakers propose raising FRA to 68 or higher, a move economists say would disproportionately affect lower-income workers.

3. Means-testing benefits

Several bills propose reducing benefits for high-income retirees.

4. Expanding benefits for vulnerable groups

Reform advocates support enhanced minimum benefits and caregiver credits.

None of these proposals has bipartisan support, making immediate changes unlikely.

New Social Security Plan Targets High Earners — Drastic COLA Limits Proposed

Looking Ahead

While the 2025 FRA increase marks the last scheduled adjustment under current law, policymakers continue to debate long-term reforms to stabilize the Social Security Trust Fund. For now, experts say Americans need to make more informed decisions as early claiming becomes increasingly costly.