Alaskans eligible for the 2025 Alaska Permanent Fund Dividend (PFD) will receive a final check of US $1,000 on December 18, 2025. The payment goes to those still listed as “Eligible-Not Paid” as of December 10. This year’s low amount marks a notable reduction from recent years — illuminating how resource-based revenue, legislative decisions, and budget trade-offs combine to shape the payments that many residents count on.

Alaska PFD Update

| Key Fact | Detail / Statistic |

|---|---|

| 2025 PFD amount | US $1,000 per eligible person |

| Number of eligible recipients | Over 600,000 Alaska residents |

| First 2025 payment date | October 2, 2025 — for direct deposit applicants cleared by Sept. 18 |

| Final payment wave date | December 18, 2025 — for “Eligible-Not Paid” as of Dec. 10 |

| Historical high payout | US $3,284 in 2022 (including energy-relief bonus) |

| Fund size (as of 2025) | Estimated at ~US $83 billion |

Origins of the PFD — Why Alaska Pays a Dividend

The PFD springs from the Alaska Permanent Fund Corporation (APFC), a sovereign wealth fund created in 1976. Voters approved a constitutional amendment requiring that at least 25 % of all state mineral-lease revenues and royalties be deposited into a permanent fund, to safeguard oil wealth for future generations.

Initially managed by a state treasury division, the APFC was formed in 1980 to administer the fund professionally. The first PFD checks were mailed in 1982.

The idea behind the PFD was to share Alaska’s resource-driven prosperity with all residents, giving them a direct stake in the state’s natural wealth rather than leaving oil income solely under political control.

Over decades, the fund has grown substantially. Though the principal is constitutionally protected, the fund’s earnings — accrued from investments in equities, bonds, real estate and private equity — are eligible for distribution.

How Alaska PFD Is Supposed to Be Calculated — And What Changed

Originally, the PFD amount was tied to a statutory formula. Under that formula, the state would:

- Take the fund’s net income over the current and previous four fiscal years,

- Multiply that by 21 %,

- Divide by two (so half of “income available for distribution”),

- Subtract any prior obligations and operating costs,

- Then divide by the number of eligible residents.

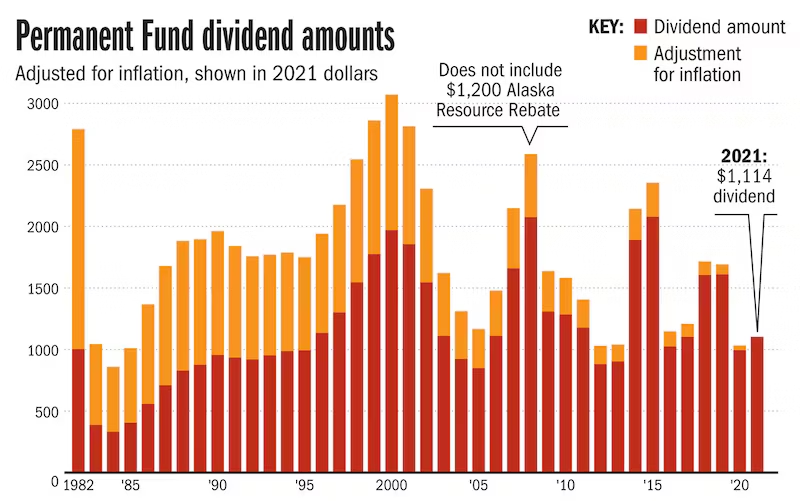

This formula yielded substantial variation depending on fund performance and number of applicants. For instance, the lowest PFD ever was about US $331 in 1984; the highest was US $3,284 in 2022.

However, in 2016 and subsequent years, the state faced major budget deficits. The Alaska Supreme Court ruled that automatic formula-based payments constituted an unconstitutional dedication of funds, prompting lawmakers to resume deciding the PFD amount directly within annual budgets.

Since then, the dividend has been determined more by political and fiscal trade-offs than strictly by fund performance. In 2025, the legislature set the amount at US $1,000 under the state’s operating budget law, House Bill 53.

According to the APFC and state disclosures, paying US $1,000 to all eligible recipients will cost roughly US $685.3 million — a major expenditure, but one that the state deemed manageable.

Why the 2025 Amount Fell to Alaska PFD Payment of $1,000

Several factors contributed to the lower payout this year:

- Budget constraints and legislative choices: In passing the 2025 budget, lawmakers prioritized funding for education, healthcare, and other essential services, leaving a smaller pool for PFD.

- Volatility in oil and mineral revenues: Alaska’s resource-based revenue streams remain unpredictable. Lower royalties and conservative outlooks for future revenue made legislators cautious about allocating a large dividend.

- Desire to preserve fund stability: By limiting the dividend, the state reduces its draw on the fund’s earnings, leaving more room for long-term savings — a priority amid economic uncertainty.

As state officials noted, though the fund itself remains large (estimated ~US $83 billion), payments must be balanced against other long-term obligations.

Who Qualifies — Eligibility and Exceptions for 2025 Alaska PFD

The 2025 PFD remains subject to long-standing eligibility requirements maintained by the Department of Revenue’s PFD division. Key conditions include:

- The recipient must have been a resident of Alaska for the full calendar year 2024.

- They must intend to remain an Alaska resident indefinitely.

- They must meet minimum “tie-to-state” requirements — such as maintaining a driver’s license, vehicle registration, lease or property — rather than simply residing temporarily.

- They must not have been absent from Alaska for more than 180 days during the year, unless the absence was for approved reasons (military service, school, medical, etc.).

- The applicant must not have been convicted of a felony, or certain misdemeanors in combination with other crimes, during the qualifying year.

Children and minors are eligible if their guardians apply on their behalf — the dividend is distributed per eligible person, not per adult.

Once approved, recipients may choose direct deposit or a mailed paper check. The first wave goes out to those with direct deposit; later waves cover all remaining eligible claims.

2025 Payment Schedule — When and How Residents Receive the Funds

The Department of Revenue has laid out a staggered payment schedule to manage distribution:

- October 2, 2025 — First wave: direct deposit payments to those approved by September 18.

- October 23, 2025 — Second wave: all applicants approved by October 13 (paper or direct deposit).

- November 20, 2025 — Third wave: payments for “Eligible-Not Paid” as of November 12.

- December 18, 2025 — Final main wave: for those still “Eligible-Not Paid” as of December 10.

- January 15, 2026 — Last possible payment for any claims still pending as of January 7, 2026.

This schedule gives residents several opportunities to ensure their application is processed and, if eligible, paid.

The Real-World Impact: Economic and Social Significance

A Versatile Supplement for Many Households

For many Alaska families, especially those with modest incomes or living in rural areas, the PFD — even at US $1,000 — remains a meaningful supplement. According to reporting by a major U.S. news outlet, the payment often covers heating, groceries, housing expenses, snow-machinery maintenance, or emergency medical bills.

Consider one Fairbanks mother who noted the check “paid a surprise US$2,600 heating-fuel bill and still left a little for her children.”

Others use the dividend to build savings, invest in education, or contribute to charitable causes — leveraging what some scholars call a limited “universal basic income.”

Broader Economic Effects and State Budget Trade-offs

Beyond individual households, the PFD influences Alaska’s economy more broadly. Early studies showed that dividend disbursements helped spur consumer spending, especially after the program began in the early 1980s. A 1983 rollover reportedly created thousands of jobs in support industries and injected hundreds of millions of dollars into consumer purchasing across the state.

However, critics argue that large one-time payments can distort local economies, drive up prices (especially in goods and housing), and promote reliance on annual windfalls rather than stable income sources. These effects are especially acute in remote communities where delivery costs amplify price volatility.

From the state’s perspective, each PFD payment is a large line item. In 2025, the US $685.3 million cost for PFD is among the biggest expenditures in the budget — only behind major departments such as Education and Health.

That dynamic forces policymakers to balance between distributing dividends and maintaining robust funding for public services (schools, infrastructure, health care), especially in years of low oil/mineral revenue or economic uncertainty.

Political and Legal Contours — Why Dividend Size Is Often Contested

The shift from formula-based to legislature-set PFDs has political ramifications. Under the original formula, payments fluctuated but were predictable based on fund performance. Since lawmakers now decide each year, dividend amounts often reflect broader fiscal priorities and political debate.

In 2016, for example, the state grappled with severe budget deficits, prompting a veto of roughly half the PFD payout.

Some lawmakers have called for restoring a formula-based or hybrid system to ensure consistency and reduce political game-playing. Others argue structured payouts leave too little flexibility to meet urgent public-service needs when revenues drop.

The tension underscores a deeper question: what role should resource wealth play in Alaska’s long-term economic policy — generous dividends to residents, or sustained investment in public services, infrastructure, and social programs.

What the Future Holds — Key Variables to Watch

Oil & Mineral Market Fluctuations

Because the fund relies heavily on resource-based revenue and investment returns, global oil and mineral market dynamics will continue to shape future payouts. A rebound in commodity prices or robust investment returns could allow larger dividends; conversely, sustained downturns could constrain payments.

Political and Budget Decisions

Annual budgets — like the one that set 2025’s payout — will remain pivotal. Growing pressure to fund schools, healthcare, and infrastructure means lawmakers may again opt for modest dividends, even if the fund can afford more.

There is periodic debate about re-anchoring the dividend to a formula (or a hybrid formula + appropriation) to provide more predictability for households and avoid politicization.

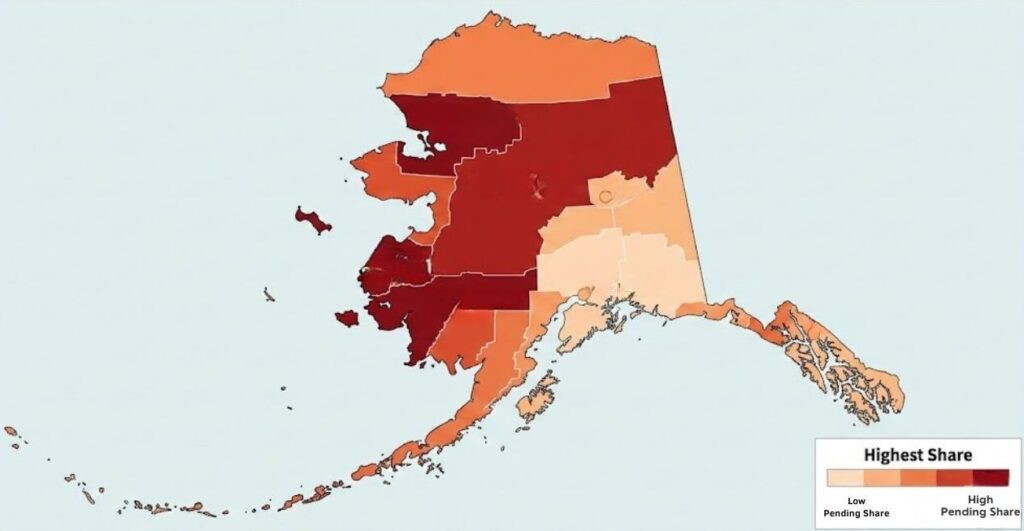

Demographic & Social Trends

As populations shift — for example, younger Alaskans moving out, new residents moving in, or fluctuations in rural vs. urban residency — the number of eligible recipients could change. That affects per-person payouts under any formula or fixed-amount scheme.

Additionally, increasing costs of living — housing, fuel, transport — especially in remote regions, may make even modest PFDs more important for economic stability for many households.

Personal Stories: How Alaskans Are Using the 2025 Dividend

To illustrate the human side of the PFD:

- A single mother in Fairbanks reportedly used her dividend to pay for a surprise heating-fuel bill and still had enough left for her children’s needs — illustrating how the payout supports essential household expenses during harsh winters.

- Some rural residents, especially in remote villages, rely on the dividend to fund fuel, heating, snow-machine repairs, or bulk food purchases — all necessities given high living costs and logistical challenges.

- Others are choosing to save or invest — using their dividend to fund education, retirement accounts, or long-term household savings — giving potential multi-year benefit beyond a single seasonal expense.

These varied uses highlight how the PFD, though a single payment, can play many different roles depending on a household’s income level, location, and needs.

Debate and Criticism: Is the Dividend Model Sustainable?

While many residents welcome the annual PFD, some economists, policy experts, and critics raise concerns about the dividend model’s long-term sustainability and broader consequences. Key criticisms include:

- Dependence on volatile resource markets: Because payout depends on oil and mineral revenues (directly or indirectly), downturns can sharply reduce available funds. That reality undermines stability for residents who may come to rely on the PFD as a semi-stable income supplement.

- Political instability: When dividend size depends on annual legislative budgets, changes in political priorities or fiscal pressures can dramatically shift payouts from year to year — creating unpredictability for households.

- Inflationary or distorting effects: Large, lump-sum payments can drive up demand for housing or goods, especially in smaller or remote communities, potentially increasing prices for locals.

- Opportunity cost for public services: Funds used for dividends might otherwise support long-term investments — schools, infrastructure, health, climate resilience — especially important in a state with challenging geography and high costs.

As analysts point out, balancing resource-dividend payments and public-sector investment remains a difficult trade-off for Alaska’s policymakers.

Why 2025’s Alaska PFD Still Matters — Despite Reduced Amount

Even at US $1,000 — the lowest per-person payout in several years — the 2025 PFD remains significant for many Alaskans. The payment:

- Provides immediate relief or support for heating, groceries, utility bills during winter months.

- Acts as a buffer for households facing economic pressure, especially in rural or remote areas where cost of living is high.

- Offers discretionary income — which some use to save, invest, or support children’s education or other long-term needs.

- Keeps alive a decades-old principle: sharing resource wealth with state residents.

Moreover, even though 2025’s payout is modest, the underlying fund remains large and structurally intact. That leaves the possibility of higher dividends if market conditions and policy decisions align.

U.S. Cities Ranked as Least Ideal for Retirement — The Full 15-City List

What to Watch Next: Questions for 2026 and Beyond

As Alaska moves into 2026, several key developments will shape whether PFDs return to higher levels — or remain modest. Among them:

- Whether lawmakers restore or modify a formula-based dividend system to stabilize payments and reduce political volatility.

- How global oil and mineral markets evolve — including prices, demand, and Alaska’s royalty revenues.

- Budgetary pressures on state services (education, health, infrastructure) that could compete with dividend funds.

- Demographic shifts — including migration, retirements, and changing rural/urban population distribution — affecting the number of eligible recipients.

These factors will determine whether the PFD remains a modest supplemental payment or returns to being a major financial boost for Alaskans.

Final Thoughts

Alaska’s 2025 Permanent Fund Dividend — a fixed US $1,000 per resident — stands as a reminder of both the promise and challenge of sharing resource wealth. The payout offers practical help to many, yet it reflects tough budget realities and shifting policy priorities. As the state enters 2026, Alaskans and lawmakers will continue wrestling with how to balance equitable resource distribution against long-term fiscal sustainability and social investment.