A growing number of retired couples in the United States are searching for Affordable Living options as housing and consumer prices rise in many regions. New national studies show that several small towns continue to offer cost structures compatible with the average Social Security benefit. Analysts say these communities provide essential stability, making them increasingly attractive to aging households who depend primarily on fixed income.

Affordable Living

| Key Fact | Detail / Statistic |

|---|---|

| Average monthly Social Security benefit for couples | About $3,300 per month in 2024 |

| Number of small towns where a couple can meet essential living costs | 10–20 identified in national evaluations |

| Share of retirees relying on Social Security for at least half of their income | Approximately 40% |

| States with strongest retiree tax advantages | Mississippi, Florida, Tennessee, Wyoming |

| Official Website | Social Security Administration |

The landscape of Affordable Living remains uneven but still accessible in a number of small towns across the United States. As economic conditions evolve, retirees who rely heavily on Social Security will continue to evaluate these communities for their stability, services, and long-term livability. Many analysts believe the affordability question will grow more urgent as demographic trends reshape retirement patterns nationwide.

Why Affordable Living Persists in Select Small Towns

Many rural and semi-rural communities still offer conditions that appeal to retirees with limited budgets. Economists at the Bureau of Labor Statistics (BLS) attribute this to slower population growth, relatively stable housing markets, and local economies that have not experienced the rapid expansion seen in major metropolitan regions.

“Affordability is often a function of supply, demand, and long-term development patterns,” said Dr. Elena Price, a housing economist at the Urban Institute. “Towns that did not undergo aggressive real estate speculation have retained accessible property values for seniors.”

Utilities and transportation also tend to be cheaper in smaller cities, where congestion, fuel demand, and infrastructure pressures are lower. This combination creates predictable monthly expenses—critical for households living almost entirely on Social Security.

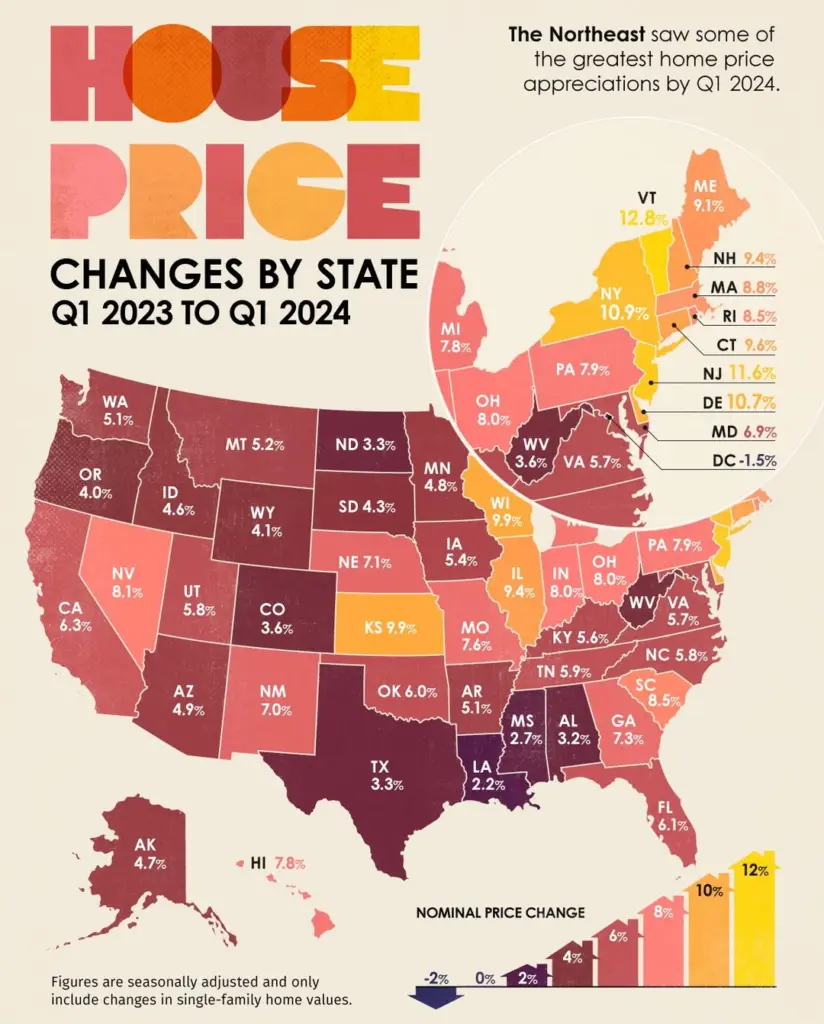

Regional Dynamics and Where Affordability Concentrates

Affordability is not evenly spread across the United States. Analysts identify three broad regions where retirees can make Social Security income stretch further:

The South

Southern states, including Mississippi, Arkansas, and Alabama, continue to offer the lowest overall living costs. Property taxes are often minimal, and states like Mississippi do not tax Social Security benefits.

The Midwest

Midwestern towns feature stable home prices and relatively low food, transportation, and utility costs. The region also has strong community institutions and comparatively low crime rates.

Parts of the Great Plains

Communities in North Dakota, South Dakota, and Kansas benefit from slow population growth and accessible housing markets. These states offer predictable expenses, even as broader national costs increase.

Profiles of Small Towns Known for Retirement Affordability

Research from AARP, Kiplinger, and regional economic institutes highlights several small towns frequently recognized for cost-effectiveness.

Tupelo, Mississippi

Tupelo’s overall living costs sit more than 20 percent below the national average. According to Kiplinger, housing remains especially affordable. Local health care facilities—such as the North Mississippi Medical Center—give retirees essential support often missing in towns of similar size.

“Retirees want a balance between affordability and access,” said Sarah Collins, a regional demographer at Mississippi State University. “Tupelo offers both.”

Jamestown, North Dakota

Jamestown is notable for its stable home prices, easy transportation network, and low-density living. A report from North Dakota State University’s Center for Social Research shows that seniors make up nearly 20 percent of the city’s population, creating a range of community programs designed for older adults.

Hutchinson, Kansas

Hutchinson stands out for its variety of affordable rental options and modest utility costs. Local officials report that retirees relocating from higher-cost states often choose the city for its reliable services and predictable expenses.

“You know what your monthly bills will be,” said Mayor Karen Delaney, noting that affordability is a major driver of population stability.

How Social Security Shapes Retirement Budgets

Social Security is the foundation of retirement income for millions of Americans. According to the Social Security Administration, nearly 90 percent of people aged 65 and older receive benefits, and about 40 percent of retired couples rely on those checks for at least half of their income.

“Social Security was designed to provide a basic income floor,” said Michael Dalton, senior analyst at the Center for Retirement Research at Boston College. “In high-cost regions, that floor is insufficient. But in the right small town, it can sustain a safe, modest lifestyle.”

The challenge is that inflation has eroded purchasing power. Cost-of-living adjustments (COLAs) have helped, but expenses—especially for food and housing—rose faster in several years following the pandemic.

Federal Policy and the Economics of Retirement Affordability

Retirement security researchers emphasize the importance of examining Social Security benefits in the context of federal policy.

A recent report by the Congressional Budget Office (CBO) notes that while Social Security remains solvent for now, projected funding gaps after 2033 could affect future COLAs unless Congress enacts adjustments.

Economists say this uncertainty makes low-cost towns even more appealing.

“Retirees who plan ahead are looking at both current affordability and long-term sustainability,” said Dr. Karen Morales, a public finance specialist at the Brookings Institution. “Communities with stable housing markets provide insulation against future volatility.”

Amenities, Health Care Access, and Community Well-Being

Affordability alone does not determine retirement suitability. Seniors also evaluate:

- Availability of health care

- Access to pharmacies and essential services

- Transportation networks

- Safety and community engagement opportunities

A report from the National Rural Health Association (NRHA) warns that medical access can be inconsistent in smaller towns. Retirees may need to travel significant distances for specialized care, making transportation a core planning consideration.

However, many affordable towns are expanding partnerships with nearby regional hospitals. Community centers, senior programs, and volunteer networks often support older residents in meaningful ways.

Risks, Climate Considerations, and Infrastructure Strain

While affordability is attractive, experts warn retirees to consider environmental and infrastructure concerns.

Climate risk varies significantly across small towns:

- Gulf Coast states face hurricane exposure.

- Great Plains regions experience harsh winters.

- Western states may face wildfire or drought risk.

According to the National Oceanic and Atmospheric Administration (NOAA), climate events have become more frequent and more destructive, adding potential long-term costs for homeowners.

Infrastructure is also a point of concern. Smaller towns may have:

- Limited broadband

- Aging water systems

- Narrow economic bases that affect local tax revenue

These challenges can influence both short-term comfort and long-term value for retirees.

End-of-Year Tax Refunds Still Going Out — States Continuing Payments Into December

Looking Ahead—Will Affordable Living Shrink or Expand?

Demographers agree that affordability in small towns could shift over the next decade as more retirees explore relocation options.

A 2024 Pew Research Center study shows a modest rise in migration to low-cost regions among people aged 55 to 74.

“Population changes can drive prices up quickly,” said Dr. Henry McAllister, a senior researcher at Pew. “The question is whether these towns can maintain low costs while expanding services.”

Some analysts believe that broader economic pressures could push retirees toward even smaller communities. Others say remote work trends may draw younger households into traditional retirement towns, complicating affordability.

For now, small towns identified by researchers remain viable for couples who need Social Security to cover basic living costs.

FAQs About Affordable Living

How far can Social Security stretch in low-cost towns?

In many rural regions, the average monthly Social Security benefit can cover essential expenses including housing, utilities, and food. However, medical costs may vary depending on available local services.

Are taxes a major factor in retirement affordability?

Yes. States that exempt Social Security benefits or offer low property taxes significantly improve retirement budgets.

What risks should retirees consider when moving to small towns?

Experts point to gaps in health care access, limited public transportation, and potential climate-related risks such as storms or extreme temperatures.

Are these affordability rankings stable over time?

Rankings can change due to population shifts, new housing development, or regional economic changes. Experts recommend monitoring annual cost-of-living reports.