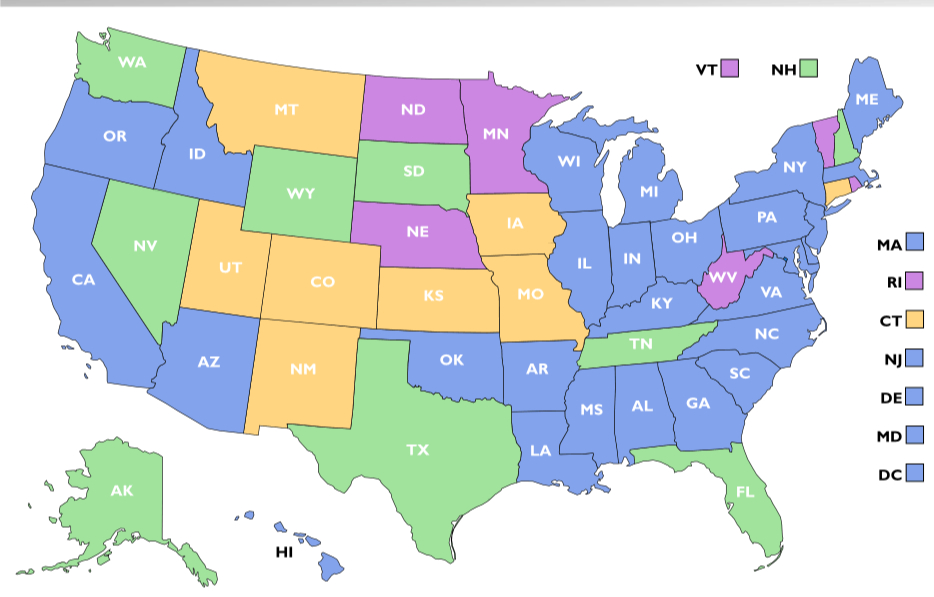

A newly approved tax law has ended Social Security taxes in one U.S. state, raising the number of states that exempt the benefit to 42. Officials say the change takes effect this tax year and aims to provide financial relief to retirees facing persistent inflation and rising housing costs. Budget analysts note that the repeal is part of a wider shift in how states handle retirement income and long-term demographic pressures.

Social Security Taxes

| Key Fact | Detail / Statistic |

|---|---|

| States that no longer tax Social Security benefits | 42 nationwide |

| Effective date | Current tax year |

| Anticipated revenue impact | Several hundred million dollars annually |

| Reason for change | Reduce financial pressure on retirees |

With 42 states now exempting Social Security benefits from taxation, the national landscape has shifted dramatically toward retiree-friendly policies. Lawmakers and analysts expect additional states to revisit their tax codes in coming years, though fiscal uncertainties may shape how quickly new reforms advance. For now, the newest repeal underscores how demographic change and economic pressure continue to influence tax policy across the United States.

Why More States Are Eliminating Social Security Taxes

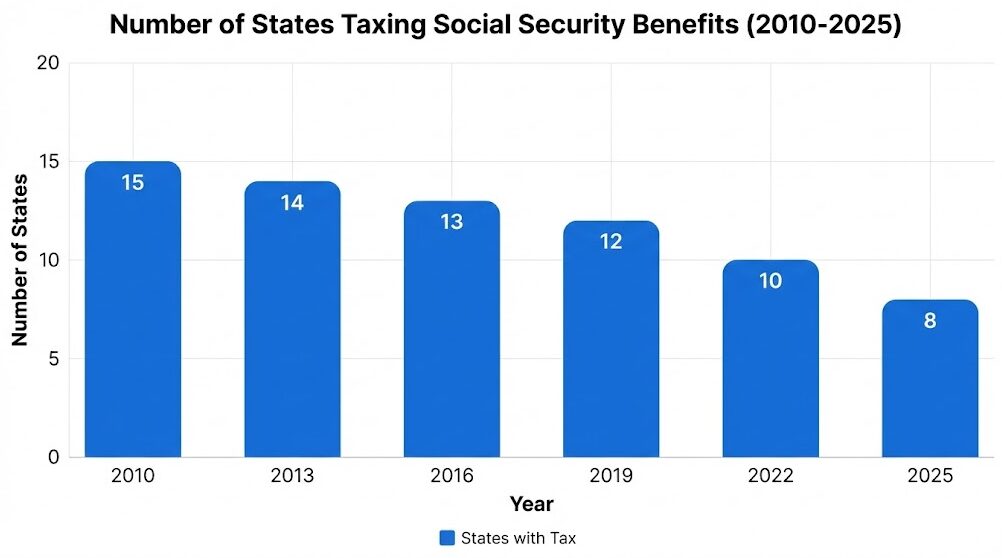

The repeal reflects a growing national trend in state tax policy as states compete to attract and retain older residents. Over the past decade, a combination of demographic change, shifting political priorities, and stronger state budgets has pushed lawmakers to revise tax codes affecting retirees.

The U.S. population aged 65 and older has expanded rapidly. According to U.S. Census Bureau projections, older adults will outnumber children for the first time in U.S. history by 2034. States facing shrinking workforces and declining birth rates have increasingly targeted policies designed to keep retirees from relocating to more tax-friendly regions.

“States are paying attention to out-migration patterns,” said Dr. Michael Carter, a senior researcher at the Urban Institute. “When older residents leave, states lose not only tax revenue but also volunteer labor, community involvement, and consumer spending that supports local businesses.”

This newest repeal places additional pressure on the remaining states that still levy taxes on Social Security income, several of which already have bills under consideration for partial or full repeal.

Understanding How the New Policy Works

Under the new law, the state will no longer count Social Security benefits as taxable income for residents beginning this tax year. The state’s Department of Revenue said the change will simplify how retirees file their returns and may reduce administrative burdens on tax preparers who often navigate conflicting federal and state rules.

The repeal covers benefits for individuals of all income levels, though lawmakers noted that most of the relief will go to middle-income retirees who previously owed several hundred to several thousand dollars in state taxes each year.

“Many seniors live on fixed incomes,” said Linda Morales, state director of AARP. “This change ensures those dollars stay in their pockets, not in government coffers.”

Budget officials expect the state to absorb the revenue loss through stable growth in other tax categories, including sales taxes and property taxes. In a briefing, the Office of the Budget Director said the state’s revenue forecast is “strong enough to allow targeted tax relief without jeopardizing essential services.”

Why Lawmakers Pursued the Social Security Taxes Change

State legislators cited several reasons for eliminating Social Security taxes, including:

1. Rising Cost of Living

Retirees have faced heightened financial pressure as rents, utilities, and healthcare costs continue to rise. Although inflation has slowed compared to its peak in 2022, many essential goods remain more expensive than prepandemic levels.

2. Regional Competition

Neighboring states have long promoted their tax-free treatment of Social Security benefits. Real estate agents in low-tax states often market their tax codes directly to retirees deciding where to settle.

3. Political Promises

Lawmakers from both parties supported the measure. Some argued that taxing Social Security benefits amounts to “double taxation,” since residents already pay federal tax on up to 85% of their benefits depending on income.

4. Strong State Finances

Many states have reported robust tax revenues in recent years, driven in part by wage growth, pandemic-era federal funding, and increased consumer spending.

“States have seized this moment to take bold steps,” said Dr. Sara Ng, an economist at a public policy institute. “But the long-term sustainability of these decisions will depend on fiscal discipline and the broader direction of the economy.”

National Context: How the U.S. Reached 42 Tax-Free States

Forty years ago, several states taxed Social Security benefits as part of their general income tax structure. Over time, rising senior populations, shifting political incentives, and efforts to match federal tax rules have all contributed to a steady decline in state taxation.

By the early 2000s, many states began phasing out the tax, often replacing it with targeted exemptions or age-based credits. States with higher costs of living, such as those in the Northeast and West, tended to move more slowly because of the larger revenue implications.

The acceleration in reforms over the past decade reflects:

- Demographic pressure: States with aging populations seek to remain attractive to retirees.

- Economic mobility: Older adults increasingly relocate after age 60.

- Political pressure: Advocacy groups like AARP have intensified campaigns to eliminate taxes on retirement income.

- Budget surpluses: Many states reevaluated their tax codes during years of strong revenue growth.

Today, only a handful of states continue to tax Social Security benefits in full or in part, though many impose income thresholds or offer exemptions that shield low-income retirees.

Economic Consequences of Social Security Taxes: Potential Benefits and Risks

Experts say eliminating Social Security taxes can produce widespread advantages for retirees but note several potential trade-offs.

Benefits

1. Increased Disposable Income for Retirees

For households living primarily on Social Security and modest retirement savings, even small tax reductions can significantly influence financial stability. Healthcare premiums, prescription drugs, and housing represent major expenses for older adults.

2. Local Economic Boost

Seniors who keep more of their income often spend it locally on groceries, dining, transportation, and personal services. Studies from state economic development offices suggest that retiree spending supports thousands of jobs in sectors like retail and healthcare.

3. Competitive Advantage in Retiree Migration

States with no Social Security taxes often spotlight the benefit in marketing materials aimed at older adults considering relocation. Migration data from the Census Bureau show retirees increasingly move toward states with favorable tax codes and lower costs of living.

Risks and Uncertainties

1. Reduced State Revenue

While most states say they can absorb the revenue loss for now, economists caution that future downturns could complicate funding for schools, transportation, and healthcare services.

2. Uneven Impact Across Income Groups

High-income retirees could gain larger tax benefits than low-income residents, depending on how the tax repeal interacts with other state tax credits or exemptions.

3. Long-Term Demographic Pressure

An aging population may strain state budgets in areas unrelated to taxation, including healthcare, long-term care facilities, and social services.

“Tax relief feels good today,” Dr. Ng noted. “But policymakers must ensure it doesn’t create structural gaps that future lawmakers will struggle to close.”

How Retirees Are Responding to Social Security Taxes

Retiree advocacy groups welcomed the repeal, describing it as a meaningful step toward financial security. Senior centers and community organizations say they are already receiving questions from residents about how the change will affect their tax filings.

“I’ve talked to many seniors who feel they’ve earned every dollar of their Social Security benefits,” said David Thompson, director of a local senior services nonprofit. “Knowing the state won’t tax those benefits brings real peace of mind.”

Financial advisers are urging retirees to review their tax plans to understand whether the repeal affects their estimated quarterly tax payments or eligibility for state-level credits.

Three December 2025 Social Security Payments Confirmed — Full Monthly Schedule Inside

How the Change Affects Low-, Middle-, and High-Income Retirees

Low-Income Retirees

Most low-income seniors already paid little or no state tax on Social Security benefits, but the repeal removes filing complexity and eliminates the risk of unexpected tax bills.

Middle-Income Retirees

The largest financial benefits will go to this group. Many rely on Social Security plus modest savings, pensions, or part-time work. Previously, this combination often triggered state taxes.

High-Income Retirees

Wealthier retirees stand to gain the most in dollar terms. Some critics argue this raises equity concerns, but supporters say uniform rules are simpler and fairer.

What Comes Next for States That Still Tax Social Security

Only a small number of states continue to tax Social Security benefits. Several legislatures have active repeal or reform proposals, and analysts say the total number of tax-free states could rise again within the next two to three years.

State lawmakers in these remaining states say they are monitoring economic conditions closely. Several are expected to bring forward repeal bills in upcoming sessions, especially in states where older adults represent a growing share of voters.