Social Security beneficiaries across the United States will see January 2026 payments arrive on a staggered schedule, with benefit amounts reflecting the latest cost-of-living adjustment. The January 2026 Social Security Deposit Dates have drawn heightened attention as retirees, disabled workers, and low-income recipients assess when checks will arrive and how inflation-linked changes affect monthly income, according to the Social Security Administration.

January 2026 Social Security Deposit Dates

| Key Fact | Detail |

|---|---|

| January 2026 payment timing | Deposits issued on Wednesdays based on birth date |

| SSI January benefit | Paid early due to New Year’s Day holiday |

| COLA impact | Monthly benefits adjusted for inflation |

| Official Website | Social Security Administration |

How January 2026 Social Security Payments Are Scheduled

The Social Security Administration (SSA) distributes benefits using a birth-date-based payment system that staggers deposits throughout the month. The approach, implemented nationwide in the late 1990s, was designed to improve efficiency, reduce administrative strain, and provide greater predictability for beneficiaries.

Under this system, the January 2026 Social Security Deposit Dates for retirement, disability, and survivor benefits fall on the second, third, and fourth Wednesdays of the month.

For January 2026, the schedule is as follows:

- January 14: Beneficiaries born between the 1st and 10th

- January 21: Beneficiaries born between the 11th and 20th

- January 28: Beneficiaries born between the 21st and 31st

According to the SSA, most recipients receive payments via direct deposit, which typically posts to bank accounts early in the morning on the scheduled date. Beneficiaries who still receive paper checks should expect delivery several business days later, depending on mail service.

The agency advises recipients not to report a missing payment until three full business days after the scheduled deposit date, as minor banking delays can occur.

SSI and Early Payments Around the New Year

Supplemental Security Income (SSI), which supports low-income seniors and people with disabilities, follows a distinct payment schedule. SSI is normally paid on the first day of each month, but when that date falls on a weekend or federal holiday, payments are issued early.

Because January 1, 2026, is a federal holiday, SSI payments for January are scheduled to arrive on December 31, 2025.

In addition:

- Beneficiaries who receive both SSI and Social Security benefits, or who began collecting Social Security before May 1997, typically receive their Social Security payment on January 2, 2026.

The SSA emphasizes that early payments do not represent extra benefits. Instead, they reflect a calendar adjustment to ensure beneficiaries are not disadvantaged by holidays.

January 2026 Social Security Deposit Dates and the Role of the COLA Adjustment

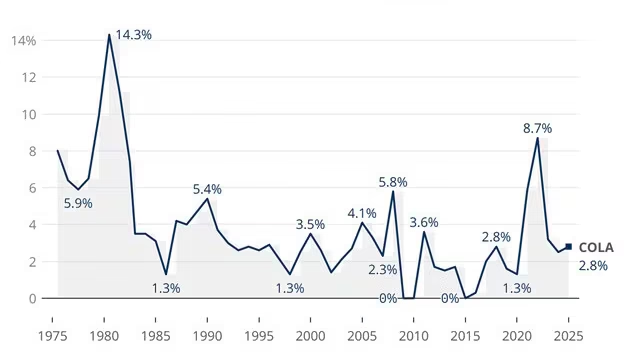

A central feature of the January 2026 Social Security Deposit Dates is the application of the annual Cost-of-Living Adjustment (COLA). The COLA is designed to protect beneficiaries from inflation by adjusting benefits to reflect rising consumer prices.

The SSA calculates COLA using changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the U.S. Bureau of Labor Statistics. The index tracks price movements for essential goods and services, including food, housing, transportation, and medical care.

If the CPI-W increases year over year, Social Security benefits rise by the same percentage. If prices remain flat or decline, benefits do not increase.

“The COLA ensures that Social Security benefits maintain their purchasing power,” the SSA said in its annual explanation of the adjustment mechanism.

For most beneficiaries, the COLA is automatically applied, requiring no action from recipients.

What the Adjustment Means for Monthly Benefit Amounts

Unlike stimulus payments or one-time bonuses, COLA increases are percentage-based, meaning the dollar impact varies depending on a beneficiary’s existing payment.

For example:

- A retiree receiving $1,500 per month would see a larger nominal increase than someone receiving $900.

- Disabled workers and survivors receive proportional increases tied to their benefit amounts.

- SSI recipients see changes to federal maximum payment levels, though state supplements may vary.

According to SSA projections, the average retired worker sees monthly benefits rise modestly under most COLA adjustments. However, advocacy groups caution that healthcare costs, particularly Medicare Part B premiums, can offset some or all of the increase for certain households.

“COLA helps, but it does not always fully cover rising out-of-pocket medical expenses,” said Kathleen Romig, a senior policy analyst at the Center on Budget and Policy Priorities, in previous policy analysis.

The Broader Economic Context Behind the 2026 Adjustment

Economists note that COLA adjustments reflect broader economic trends rather than individual household experiences. While inflation may ease in some sectors, costs for essentials such as housing, insurance, and prescription drugs can continue to rise.

The CPI-W, which underpins COLA calculations, has long been debated by policymakers and economists. Critics argue it underweights healthcare costs, which disproportionately affect older Americans, while supporters say it provides a consistent and objective benchmark.

Despite these debates, Congress has not enacted changes to the COLA formula, leaving the CPI-W as the governing metric for the foreseeable future.

Why Payment Timing Matters for Millions of Americans

For roughly 70 million Americans, Social Security represents a crucial source of income. For about one-third of retirees, it provides nearly all monthly income, according to SSA data.

Because of this reliance, even small changes in deposit timing can have significant consequences. Late payments may affect rent, utility bills, or prescription refills.

“Knowing the exact deposit date allows people to plan essential expenses,” Romig said. “Predictability is just as important as the amount.”

The January 2026 Social Security Deposit Dates are particularly significant because they coincide with the start of the calendar year, when households often face higher heating bills, insurance premiums, and property taxes.

How Beneficiaries Can Prepare and Avoid Disruptions

The SSA encourages beneficiaries to take several steps to ensure smooth payment delivery:

- Enroll in direct deposit, which remains the fastest and most secure option.

- Maintain updated banking information, especially after changing financial institutions.

- Create or review a “my Social Security” account, which provides personalized payment details, benefit verification letters, and notices.

The agency also warns beneficiaries to remain alert to scams. Fraudsters frequently exploit payment schedule changes and COLA announcements to impersonate SSA officials.

The SSA states it does not demand payment, threaten arrest, or request personal information via unsolicited phone calls or emails.

2026 Tax Refund Expectations – The Quiet Reasons Refunds May Be Larger Next Year

Looking Ahead: Sustainability and Policy Debate

Beyond January 2026, Social Security’s long-term financial health remains a subject of national debate. Trustees of the Social Security Trust Funds have warned that without legislative action, the program may face funding shortfalls in the next decade.

Potential solutions under discussion include adjusting payroll taxes, modifying benefit formulas, or raising the retirement age. None of these proposals has been enacted, and benefits continue to be paid in full under current law.

For now, the SSA emphasizes that scheduled benefits, including those tied to the January 2026 Social Security Deposit Dates, remain secure.

FAQs About January 2026 Social Security Deposit Dates

When will my January 2026 Social Security payment arrive?

Payments arrive on January 14, 21, or 28, depending on your birth date.

Why did my SSI payment arrive in December?

SSI payments are issued early when the first of the month falls on a federal holiday.

Do January 2026 Social Security Deposit Dates change my benefit amount?

No. The deposit dates affect timing, while COLA determines the benefit amount.

Do I need to apply to receive the COLA increase?

No. COLA adjustments are applied automatically by the SSA.