Social Security beneficiaries receiving a $1850 monthly check will see a modest increase in 2026 following the program’s annual cost-of-living adjustment. The change reflects inflation trends measured over the prior year and is intended to protect purchasing power. However, rising Medicare premiums, taxes, and other fixed costs mean the real-world impact of the increase may be smaller than the headline number suggests for many retirees.

Social Security $1850 Check

| Key Fact | Detail | Why It Matters |

|---|---|---|

| 2026 COLA | 2.8% | Determines the gross benefit increase |

| New Gross Payment | About $1,902 | Before deductions |

| Medicare Part B | Deducted automatically | Reduces take-home amount |

| First Payment | January 2026 | Timing varies by birthdate |

How the Social Security Increase Is Calculated

The Social Security cost-of-living adjustment, commonly known as COLA, is designed to help benefits keep pace with inflation. It is calculated using changes in consumer prices measured over a defined 12-month period. When prices rise, benefits increase automatically the following year.

This mechanism has been part of the Social Security system for decades and operates without the need for congressional approval. The intent is to shield beneficiaries—many of whom rely on fixed incomes—from erosion in purchasing power caused by rising prices for everyday necessities.

For 2026, the COLA is set at 2.8%, reflecting moderate inflation compared with the higher increases seen earlier in the decade. The adjustment applies uniformly across retirement, disability, and survivor benefits.

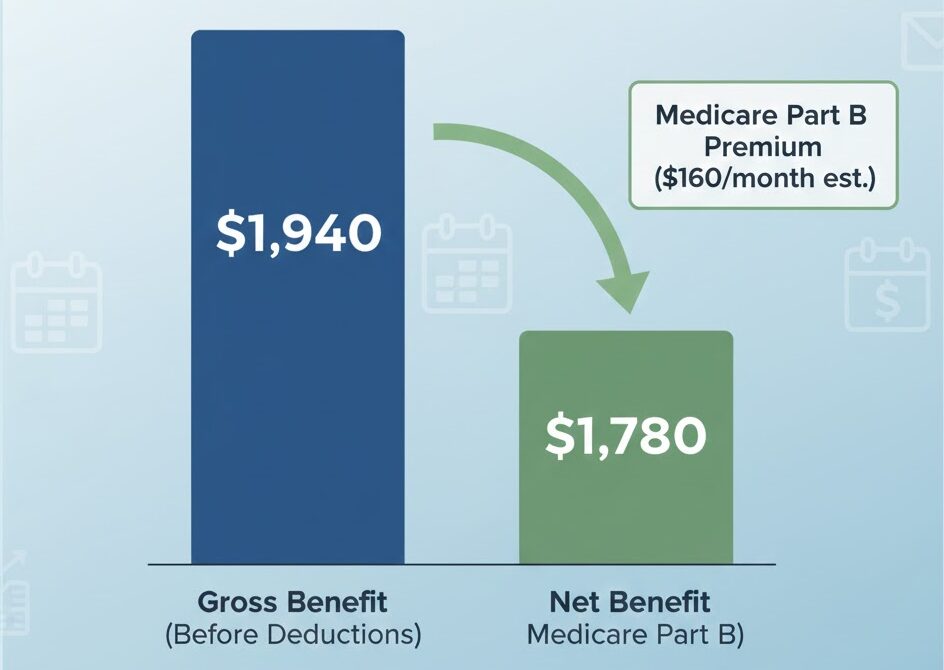

For someone receiving $1850 per month, the calculation is straightforward. A 2.8% increase equals roughly $51.80, bringing the gross monthly benefit to approximately $1,902. While this appears meaningful on paper, the actual benefit felt by households depends heavily on expenses deducted from the payment.

What Happens to a $1850 Check in 2026

Gross Increase vs. Take-Home Pay

Although the COLA applies evenly, beneficiaries do not all experience the increase in the same way. Most retirees have Medicare Part B premiums automatically deducted from their Social Security checks before the funds reach their bank accounts.

If Medicare premiums rise in the same year as the COLA—as they often do—the net increase can be significantly smaller than expected. For some beneficiaries, especially those with mid-range benefits like $1850, the increase may amount to only a few dollars per month once deductions are applied.

This dynamic frequently leads to confusion and frustration among retirees who expect their full COLA increase to appear in their deposit but instead see a smaller change.

Taxes Can Further Reduce Payments

Federal income tax rules can further affect how much of a Social Security increase beneficiaries actually keep. Depending on total income, a portion of Social Security benefits may be subject to federal taxation.

Income counted toward this calculation includes wages, pensions, withdrawals from retirement accounts, and investment earnings. Beneficiaries who have elected voluntary tax withholding will see the withheld amount rise proportionally as benefits increase.

As a result, the COLA can sometimes push beneficiaries slightly over income thresholds, increasing the portion of benefits subject to tax and reducing net gains.

Why the Increase Feels Smaller Than Expected

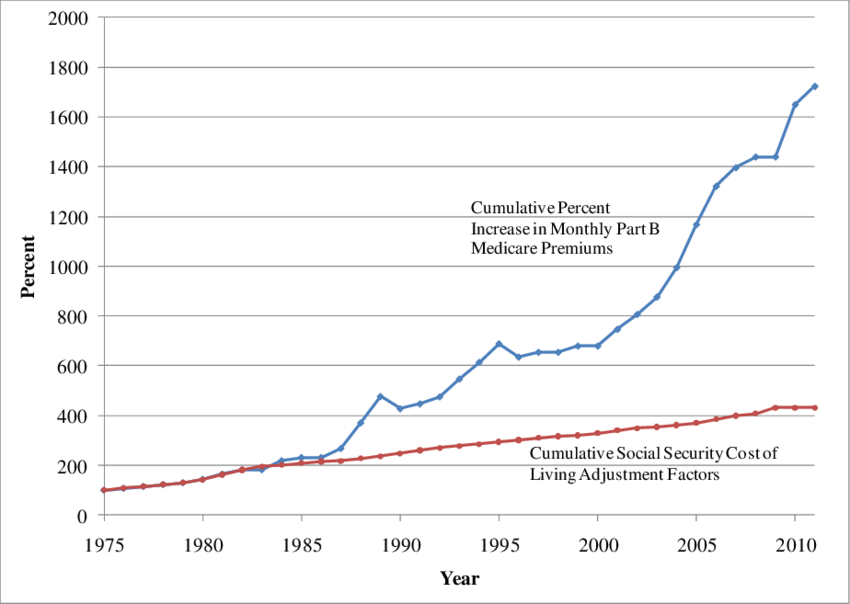

Many beneficiaries report that annual Social Security increases do not seem to keep up with their real-world expenses. One key reason is that healthcare costs, which represent a large share of retiree spending, often rise faster than overall inflation.

Medicare premiums, prescription drug costs, and supplemental insurance plans can consume a growing portion of monthly income. Housing, utilities, and property taxes have also risen in many regions, putting additional pressure on fixed incomes.

Because the COLA is based on general inflation rather than retiree-specific expenses, it does not always reflect the cost increases most relevant to older Americans. This gap helps explain why even a positive adjustment can feel insufficient.

Who Benefits the Most from Social Security $1850 Check — and Least

Beneficiaries Who Gain More

Some groups are positioned to benefit more fully from the 2026 increase. These include:

- Individuals not enrolled in Medicare, such as some disability beneficiaries

- Retirees with higher monthly benefits, where percentage increases translate into larger dollar amounts

- Beneficiaries whose Social Security income is not subject to federal taxation

Beneficiaries Who Gain Less

Others may see minimal impact:

- Retirees paying standard or higher Medicare premiums

- Individuals with taxable Social Security benefits

- Beneficiaries facing rapidly rising healthcare or housing costs

Historical Perspective on COLA Changes

To understand the significance of the 2026 adjustment, it helps to view it in historical context. COLAs have varied widely over time, ranging from zero in years of low inflation to increases exceeding 8% during periods of rapid price growth.

The 2.8% adjustment for 2026 reflects a period of cooling inflation after more volatile years earlier in the decade. While smaller than recent peaks, it remains higher than the long-term average seen in much of the 2010s.

For beneficiaries, this moderation signals a more stable inflation environment but also reinforces the reality that Social Security increases alone may not be sufficient to address rising costs in certain areas of spending.

Payment Timing and Distribution

The increased benefit will appear in January 2026 payments for most Social Security recipients. Payment dates follow the standard schedule, which is determined by the beneficiary’s date of birth.

Supplemental Security Income recipients receive the adjusted amount slightly earlier, typically at the end of December. Beneficiaries do not need to take any action to receive the increase, as it is applied automatically.

Budgeting and Financial Planning Implications

For many retirees, even a modest increase can play an important role in monthly budgeting. Financial planners often advise beneficiaries to treat COLA increases conservatively, especially when healthcare costs are rising.

Rather than committing the full increase to new spending, experts frequently suggest using it to offset anticipated cost increases or to rebuild emergency savings. For those with limited financial flexibility, careful planning becomes essential to prevent gradual erosion of purchasing power.

The 2026 increase may also prompt beneficiaries to reassess withholding elections, Medicare plan options, and other recurring expenses to ensure their income stretches as far as possible.

Long-Term Sustainability Concerns

The annual COLA adjustment operates within the broader context of Social Security’s long-term finances. Demographic shifts, including an aging population and slower workforce growth, continue to place pressure on the system.

While the 2026 increase reflects current inflation conditions, it does not address underlying funding challenges. Policymakers continue to debate options ranging from revenue increases to benefit adjustments, though no major changes are imminent.

For beneficiaries, this means that while near-term adjustments remain predictable, long-term planning should account for potential future reforms.

Social Security 2026 Payment Calendar FULL Breakdown — Year-Long Dates, Delays & What to Expect

Looking Ahead

The 2026 Social Security increase offers modest relief against inflation but underscores the limits of COLAs in addressing the full range of financial challenges facing retirees. For beneficiaries receiving $1,850 per month, the increase provides additional income, but rising healthcare costs and taxes may reduce its practical impact.

As inflation trends evolve and policy discussions continue, beneficiaries will need to remain attentive to how annual adjustments interact with their personal expenses and financial plans.

FAQs About Social Security $1850 Check

Will everyone receiving $1850 get the same increase?

Yes. The percentage increase is uniform, but net payments vary due to deductions.

Does the increase require action from beneficiaries?

No. The adjustment is applied automatically.

Can Medicare premiums eliminate the increase entirely?

In some cases, yes—especially for beneficiaries with higher healthcare costs.

Will future COLAs be similar?

Future adjustments depend entirely on inflation trends measured each year.