Social Security January 2 payments will mark the first benefit disbursements of 2026 for a defined group of Americans who fall under special federal scheduling rules. The early payment date is not the result of a policy change or new benefit increase, but rather a long-established administrative adjustment triggered by weekends and federal holidays. For millions of retirees, people with disabilities, and low-income beneficiaries, understanding this timing is essential for accurate financial planning at the start of the year.

Social Security January 2 Payments

| Key Fact | Detail |

|---|---|

| First 2026 Social Security payments | Issued on January 2, 2026 |

| Who is paid first | Beneficiaries who started benefits before May 1997 |

| Combined benefits recipients | Individuals receiving both Social Security and SSI |

| SSI January payment date | December 31, 2025 |

| Reason for early payments | January 3 falls on a Saturday; January 1 is a holiday |

Why Social Security Payments Shift in January 2026

The Social Security Administration operates one of the largest recurring payment systems in the world, distributing benefits to tens of millions of Americans every month. To ensure reliability, the agency follows a strict payment calendar governed by federal law and Treasury regulations.

When a scheduled payment date falls on a weekend or federal holiday, payments are automatically issued on the previous business day. This rule exists to prevent delays caused by bank closures and to ensure beneficiaries receive funds without interruption.

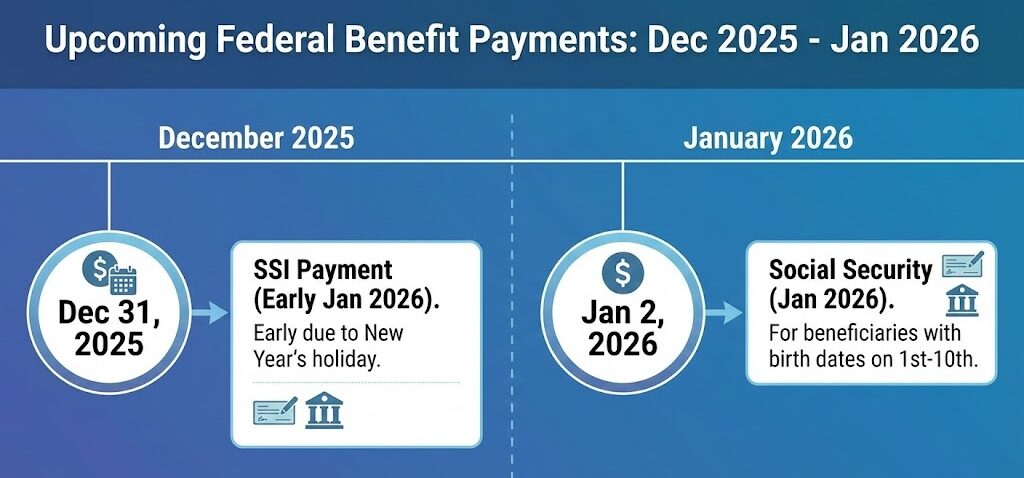

In January 2026, two calendar factors intersect. January 1 is a federal holiday, and January 3 falls on a Saturday. Together, these dates require the SSA to advance certain payments, creating an early disbursement at the very start of the year.

Who Will Receive Social Security January 2 Payments

Beneficiaries Who Claimed Benefits Before May 1997

Americans who began receiving Social Security benefits before May 1997 belong to a distinct administrative group. Prior to that date, all Social Security benefits were issued on the third day of each month, regardless of birth date.

Although the SSA introduced a staggered Wednesday payment system in 1997 to improve efficiency, existing beneficiaries at the time were allowed to remain on the original schedule. As a result, this group continues to receive payments around the third of each month.

Because January 3, 2026, falls on a Saturday, the SSA moves these payments to Friday, January 2, making these beneficiaries the first to receive Social Security income in the new year.

Recipients of Both Social Security and SSI

Individuals who receive both Social Security benefits and Supplemental Security Income (SSI) are also included in the January 2 payment group. This population often includes seniors with limited income and people with long-term disabilities.

The coordination of these two programs means that when holiday adjustments apply, recipients of both benefits are aligned with the earlier Social Security payment date rather than the standard Wednesday cycle.

SSI Payments Will Arrive Before the New Year

Supplemental Security Income follows a separate payment structure from Social Security retirement and disability benefits. SSI payments are normally issued on the first day of each month.

Because January 1, 2026, is a federal holiday, SSI payments scheduled for that date are moved to December 31, 2025. This ensures beneficiaries have uninterrupted access to funds during the holiday period.

It is important to note that this December 31 payment is not an extra benefit. It represents the January 2026 SSI payment issued early due to the holiday.

Regular January 2026 Social Security Payment Schedule

After early payments are issued, the SSA resumes its standard staggered payment system for most beneficiaries. Under this framework, payments are distributed based on the recipient’s birth date:

- January 14, 2026: Birthdays from the 1st through the 10th

- January 21, 2026: Birthdays from the 11th through the 20th

- January 28, 2026: Birthdays from the 21st through the 31st

This approach allows the federal government to manage payment volume efficiently while reducing strain on banking infrastructure.

Historical Context: Why the System Works This Way

The staggered payment schedule was introduced in the late 1990s to modernize Social Security operations. Prior to the change, issuing all payments on the same day placed heavy demands on banks and processing systems.

By spreading payments across several weeks, the SSA improved reliability and reduced the risk of system-wide delays. The grandfathering of pre-1997 beneficiaries ensured continuity for older recipients while allowing the system to evolve.

Holiday-related adjustments, such as those seen in January 2026, are a direct extension of this reliability-first approach.

Financial Planning Implications for Beneficiaries

Early payments can create confusion for recipients who rely on predictable monthly income. Financial counselors often caution beneficiaries to remember that early deposits do not increase total benefits.

For example, SSI recipients receiving a December 31 payment must budget carefully to ensure funds last through January. Similarly, Social Security recipients paid on January 2 should plan for a longer gap before their next deposit in February.

Clear understanding of payment timing helps prevent accidental overspending and reduces financial stress during the early months of the year.

Common Misunderstandings About Early Payments

Many beneficiaries mistakenly believe early payments signal a bonus or cost-of-living adjustment. In reality, benefit amounts remain unchanged.

Others assume early deposits mean future payments will also arrive sooner. In fact, once the holiday adjustment passes, the SSA returns to its standard calendar.

These misunderstandings highlight the importance of clear communication and annual review of benefit schedules.

Broader Impact of Social Security January 2 Payments on the Social Security System

From an administrative perspective, early January payments require coordination between the SSA, the U.S. Treasury, and private financial institutions. Automated systems ensure payments are released on time while preventing duplicate deposits.

Despite the complexity, such adjustments are routine and reflect the system’s capacity to adapt to calendar anomalies without disrupting beneficiaries.

Social Security Payments This Week – Who Gets Paid on Christmas Eve? Check the Full List Now

Forward Outlook

Similar calendar-related shifts will occur throughout 2026 whenever scheduled payment dates coincide with weekends or federal holidays. Beneficiaries can expect these adjustments to remain a regular feature of the Social Security system.

By understanding how and why these changes occur, recipients can better plan their finances and avoid unnecessary concern when payments arrive earlier than expected.

FAQs About Social Security January 2 Payments

Why are Social Security January 2 payments happening?

Because January 3, 2026, falls on a Saturday, requiring payments to be issued on the prior business day.

Does an early payment mean extra money?

No. Early payments change timing only, not total benefit amounts.

Will this affect all Social Security recipients?

No. Only specific groups, including long-term beneficiaries and people receiving both Social Security and SSI, are affected.