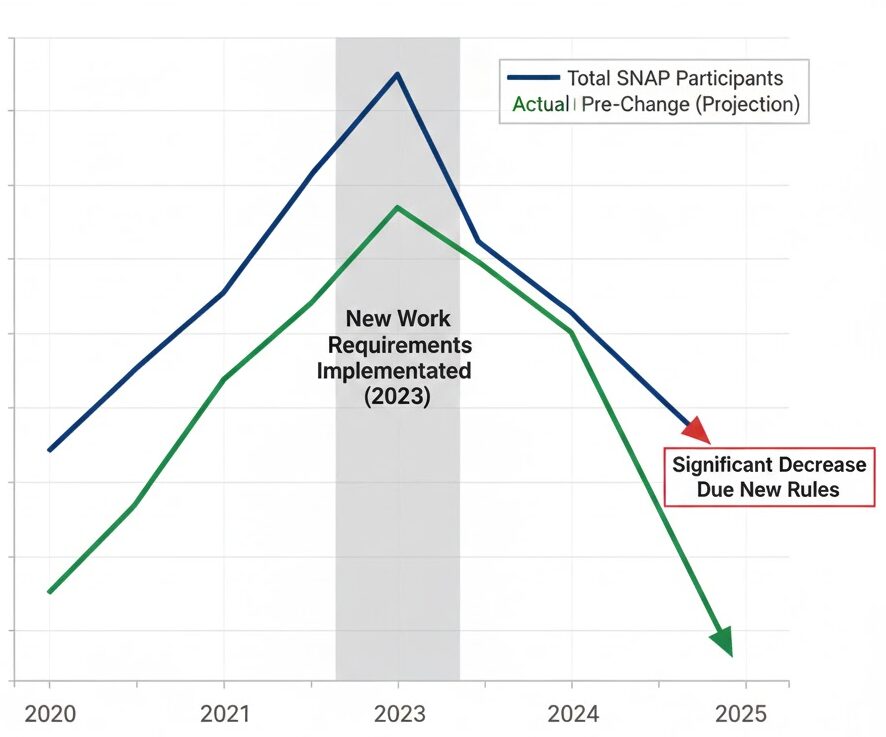

A SNAP policy update approved by Congress is expanding work requirements for food assistance recipients, potentially changing eligibility for millions of low-income Americans beginning this year, according to federal and state officials. The changes broaden age limits, narrow exemptions, and place new reporting obligations on beneficiaries of the Supplemental Nutrition Assistance Program, marking one of the most significant adjustments to the program in years.

SNAP Policy Update

| Key Fact | Detail |

|---|---|

| Program affected | Supplemental Nutrition Assistance Program (SNAP) |

| Main change | Expanded work requirements |

| Age range | Up to 64 for some adults |

| Risk | Loss of benefits after 3 months |

What the SNAP Policy Update Changes

The Supplemental Nutrition Assistance Program, administered by the U.S. Department of Agriculture (USDA), provides monthly food benefits to more than 40 million Americans and serves as the nation’s largest anti-hunger initiative. The SNAP policy update modifies long-standing work rules tied to eligibility for certain adults, reshaping how the program balances nutritional support with employment expectations.

Under the revised framework, more recipients classified as able-bodied adults without dependents, commonly known as ABAWDs, must meet work or activity requirements to continue receiving benefits beyond a limited period. Federal lawmakers embedded the changes within broader fiscal legislation, arguing that the updates modernize SNAP to reflect current labor market conditions.

Previously, the work mandate largely applied to adults ages 18 to 49. The updated rules extend that age range, in phases, to include adults up to age 64 unless they qualify for a statutory exemption. The gradual rollout is intended to give states time to adjust administrative systems and conduct outreach to affected households.

How the New Work Requirements Function

Monthly Activity Thresholds

Affected recipients must complete at least 80 hours per month of approved work or qualifying activities. These include paid employment, job training programs, education courses, workfare placements, or volunteer service recognized by state agencies.

Federal guidance allows states to define which activities qualify, but participation must be documented and verified. Failure to meet the requirement limits SNAP access to three months within a 36-month period, often referred to as the “time-limit clock.”

Once benefits are suspended, recipients can regain eligibility only by meeting work requirements or qualifying for an exemption. Advocates note that this structure places heavy emphasis on consistent monthly compliance, even for individuals with fluctuating schedules.

According to the USDA, states are responsible for tracking hours and verifying participation, a process that often relies on recipient-submitted documentation. States may use digital portals, employer verification, or third-party training program records to confirm compliance.

Who Is Most Likely to Be Affected By SNAP Policy Update

Narrower Exemptions

The SNAP policy update reduces exemptions that previously shielded certain groups from work rules. Veterans, people experiencing homelessness, and former foster youth, once broadly exempt under federal law, may now need to meet work thresholds unless states grant waivers or determine that individual circumstances qualify for hardship exemptions.

Caregivers are also affected. Only adults responsible for children under age 14 automatically qualify for an exemption, down from under 18 in prior policy. Caregivers of older teenagers must now demonstrate work activity or risk losing benefits.

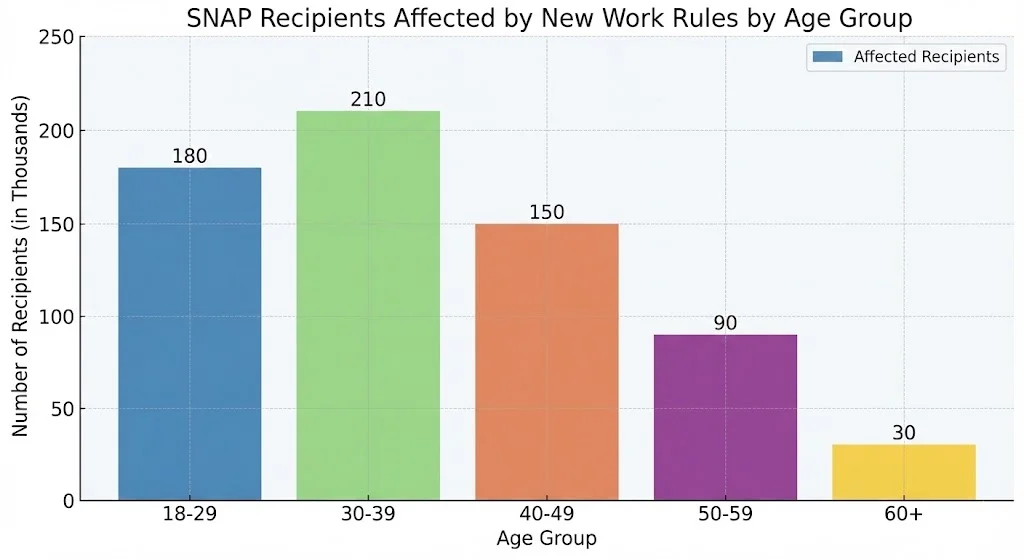

State agencies say these adjustments could affect tens of thousands of current beneficiaries, particularly older adults with unstable employment, limited transportation, or health conditions that do not meet federal disability standards. Rural residents may face additional challenges due to fewer job opportunities and longer travel distances.

Supporters Cite Workforce Engagement

Supporters of the SNAP policy update argue that the expanded work requirements encourage labor force participation while preserving benefits for those most in need. Lawmakers backing the changes say SNAP should complement, not replace, employment.

“Work requirements reinforce the idea that SNAP is temporary support, not a permanent solution,” said a senior congressional aide involved in drafting the legislation. Supporters argue that the changes reflect historically low national unemployment and increased availability of entry-level jobs.

The Congressional Budget Office estimates the policy will reduce federal SNAP spending over the next decade, largely due to fewer long-term recipients. Proponents say savings could help stabilize the program amid rising food costs and growing demand.

Some state officials also argue that work requirements can connect recipients with training and employment pathways that improve long-term economic stability. They emphasize that states retain flexibility to approve a wide range of qualifying activities.

Critics Warn of Increased Food Insecurity

Critics, including anti-hunger advocates and policy researchers, caution that stricter rules may disproportionately affect people facing unstable work conditions rather than unwillingness to work. Many SNAP recipients already hold jobs but struggle with irregular hours, seasonal employment, or caregiving responsibilities.

“Many SNAP recipients already work in low-wage or part-time jobs,” said a senior analyst at the Urban Institute. “The risk is that people lose food assistance because of paperwork barriers or short-term job disruptions, not because they failed to seek employment.”

Research from prior work-requirement expansions suggests that benefit losses often occur because recipients fail to navigate reporting systems rather than refusing to work. Food banks and community organizations in several states report preparing for higher demand as recipients adjust to the new rules.

State-by-State Implementation Varies

While the federal rules establish a baseline, states retain flexibility in enforcement, exemptions, and approved activities. Some states have sought temporary waivers for regions with high unemployment, limited broadband access, or seasonal labor markets.

Implementation timelines also vary. States must update eligibility systems, train caseworkers, and notify affected households, a process that can take months. Advocates warn that inconsistent rollout may lead to confusion among recipients who move between states or receive conflicting information.

State SNAP administrators say outreach and education will be critical in the coming months to prevent unintentional benefit losses. Many agencies plan to partner with workforce development offices, nonprofit organizations, and employers to expand qualifying opportunities.

Social Security 2026 Payment Calendar FULL Breakdown — Year-Long Dates, Delays & What to Expect

What Comes Next

The SNAP policy update is being rolled out gradually, with additional age expansions scheduled over the next two years. Federal officials say they will monitor enrollment data, employment outcomes, and food security indicators to assess the policy’s impact.

Several states are expected to publish early reports on participation rates and benefit suspensions later this year. Lawmakers from both parties have signaled interest in reviewing the data before considering further changes.

“We are committed to ensuring eligible households continue to receive support while promoting pathways to employment,” a USDA spokesperson said. “States and communities will play a key role in making this transition work.”

FAQs About SNAP Policy Update

Does the SNAP policy update affect everyone on food benefits?

No. The changes primarily affect certain adults without dependents who do not qualify for exemptions, while children, seniors, and people with qualifying disabilities remain protected.

Can states soften the impact of the new rules?

Yes. States may apply for waivers, broaden approved activities, or provide additional support services based on local economic conditions.

What happens if someone temporarily loses work hours?

Recipients must report changes promptly. Short gaps can still trigger benefit limits if monthly thresholds are not met, though hardship exemptions may apply in some cases.