As 2025 concludes, President Donald Trump’s proposal to issue a “Tariff ” of $2,000 to American households remains a high-profile but unlegislated ambition. While the White House maintains that surging tariff revenues could fund direct relief, the plan faces significant hurdles in Congress and a pending Supreme Court ruling on executive trade authority.

Trump $2,000 Tariff Dividend

| Feature | Current Status | Details/Statistic |

| Proposed Amount | $2,000 per eligible person | One-time “dividend” or rebate |

| Eligibility | “Working Families” / Middle Income | Likely cap at $100,000 annual income |

| Revenue Status | $250 Billion+ collected in 2025 | Projected $2.5T over 10 years |

| Legal Status | Awaiting Supreme Court Ruling | Learning Resources v. Trump (Decision 2026) |

| Timeline | Mid-2026 (Earliest) | Requires new Congressional legislation |

The Origin of the Tariff: A 2025 Trade Strategy

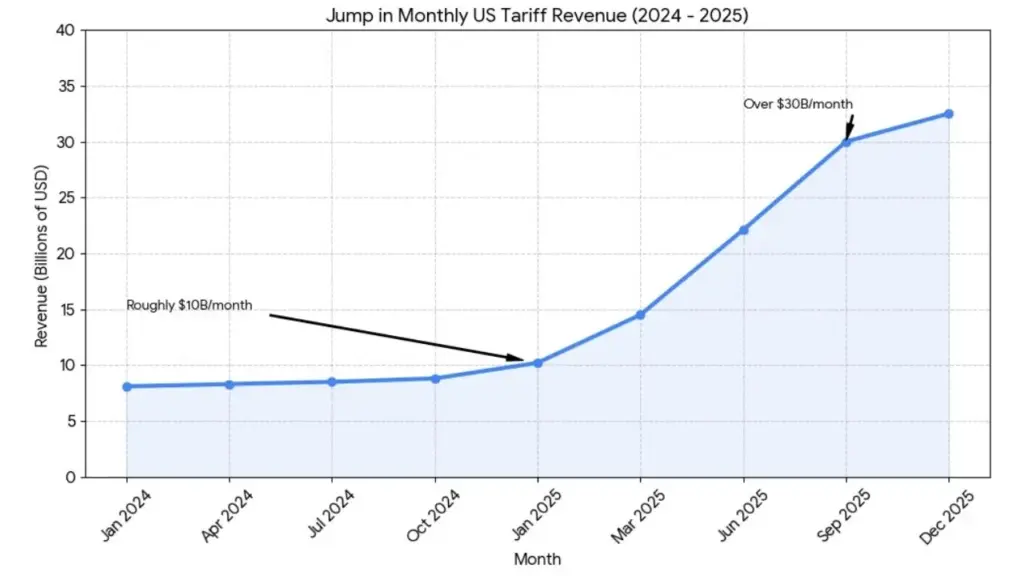

Throughout the second year of his term, President Donald Trump has fundamentally reshaped U.S. trade policy by implementing a “wall of tariffs” that peaked in April 2025. According to data from the Yale Budget Lab, the average effective U.S. tariff rate reached nearly 17% by November, the highest level since the 1930s. This aggressive trade stance has shifted the U.S. from a relatively open economy to one with some of the highest import barriers in the developed world.

In late 2025, the administration began pivoting from the collection phase to the distribution phase of this policy. President Trump suggested that the federal government, having collected more than $250 billion in new duties by December, should return a portion of this wealth to the public in the form of a Tariff.

“A dividend of at least $2,000 a person will be paid to everyone,” Trump stated in a November social media post, adding that “high income people” would be excluded. The administration argues that this payment acts as a “rebate” for the higher consumer prices caused by the tariffs, effectively recycling trade revenue back into the pockets of the American middle class.

Administration Pushes for 2026 Implementation

Kevin Hassett, Director of the National Economic Council (NEC), clarified in late December that while the White House is committed to the plan, it cannot move forward unilaterally. Speaking on Face the Nation on December 21, 2025, Hassett emphasized that the Tariff depends entirely on the cooperation of the 119th Congress.

Proposed Eligibility and Delivery

- Income Thresholds: Treasury Secretary Scott Bessent has indicated that the “dividend” would likely target individuals and families earning under $100,000 annually. This threshold is intended to ensure the relief reaches those most impacted by the rising costs of imported goods, such as electronics, automobiles, and apparel.

- Distribution Method: The administration prefers using the existing Internal Revenue Service (IRS) tax infrastructure. This would mirror the “Economic Impact Payments” used during the COVID-19 pandemic, allowing for rapid electronic deposits or mailed checks.

- Timeline: President Trump stated in an Oval Office interview in mid-November that Americans could expect the checks around mid-2026, provided legislative approval is secured early in the new year.

Economic Debate and Mathematical Skepticism

While the administration touts the success of its trade agenda, many economists question the fiscal viability of the Tariff. The Committee for a Responsible Federal Budget (CRFB) released an analysis in late 2025 estimating that a $2,000 check for every eligible American—including children—could cost approximately $600 billion.

“The math doesn’t quite add up yet,” said analysts at the Tax Foundation. They noted that while 2025 revenues were record-breaking, they only cover about half of the projected cost of a near-universal dividend. To bridge this gap, the administration may need to either narrow eligibility further or rely on deficit spending, which has drawn criticism from fiscal hawks within the Republican party.

The Looming Supreme Court Decision on Trump $2,000 Tariff Dividend

A critical variable is the case Learning Resources v. Trump, which the Supreme Court heard in November 2025. The court is weighing whether the President overstepped constitutional bounds by using the International Emergency Economic Powers Act (IEEPA) to impose broad “reciprocal tariffs” without specific Congressional authorization.

If the court rules against the administration in early 2026, the government may be forced to refund billions of dollars to importers.Such a ruling would effectively bankrupt the proposed dividend fund, as the “surplus” intended for the checks would be legally owed back to the corporations that paid the duties initially.

The Impact on Consumers and Manufacturing

The 2025 trade war has had a polarized impact on the American economy. Manufacturing output has expanded by an estimated 2.5%, according to the Urban-Brookings Tax Policy Center, as domestic firms benefit from reduced foreign competition. However, these gains have been offset by significant price increases in specific sectors.

By December 2025, consumers faced roughly 30% higher prices for leather goods and apparel, while the price of an average new car rose by nearly $4,500. The Tariff is designed to mitigate these inflationary pressures, essentially acting as a progressive wealth transfer from importers and high-consumption households to lower-income families.

Trump’s $2000 Tariff Rebate: Will 2025 Bring a Surprise Cash Windfall for American Families?

FAQs About Trump $2,000 Tariff Dividend

1. When will I receive my $2,000 tariff check?

As of late December 2025, no checks have been sent. President Trump has projected a “mid-2026” timeline, but this is entirely dependent on Congress passing a new law to authorize the spending.

2. Do I need to sign up or apply for the dividend?

No. There is no official application. If the proposal becomes law, the IRS would likely use your 2025 tax return data to determine eligibility and send payments automatically. Be wary of scams asking for personal information to “register” for a check.

3. Who is eligible for the $2,000 payment?

The White House has suggested an income limit of $100,000 per household. High-income earners would be excluded. Whether the $2,000 applies per adult or includes children is still a subject of debate in the current proposal.

4. Is the dividend a one-time payment or annual?

The administration has characterized it as a “dividend” from annual tariff revenue, but most legislative discussions currently focus on a one-time “rebate” for the 2025 fiscal year. Future payments would depend on continued tariff collections and new budget approvals.

5. What happens if the Supreme Court strikes down the tariffs?

If the Supreme Court rules the tariffs unconstitutional in the Learning Resources v. Trump case, the revenue source for the checks would vanish. In that scenario, it is highly unlikely the Tariff would be issued, as the funds would likely be returned to the companies that paid them.