As the 2026 calendar year begins, the Supplemental Nutrition Assistance Program (SNAP) is undergoing one of its most complex transitions in decades. Beginning January 1, 2026, millions of participants will encounter a restructured program shaped by the “One Big Beautiful Bill Act” of 2025 and a series of federally approved state waivers. These changes include a modest increase in monthly allotments, a significant expansion of work requirements for older adults, and new restrictions on food eligibility in nearly a dozen states.

Federal authorities have finalized the 2026 cost-of-living adjustment (COLA) at 2.8%, a move designed to buffer low-income households against persistent food inflation. While the increased allotments technically took effect for the 2026 fiscal year on October 1, 2025, the January payment cycle marks the first month many families will navigate the program’s new restrictive purchasing rules and tightened eligibility enforcement.

SNAP Benefits January 2026 Payments

| Feature | 2026 Specification | Impact Area |

| Maximum Allotment (Family of 4) | $994 (Contiguous 48 States) | Financial Support |

| Expanded Work Age | Ages 18–64 (Up from 54) | Eligibility Compliance |

| New Purchase Restrictions | 18 States (e.g., Soda/Candy Bans) | Grocery Purchasing |

| COLA Increase | 2.8% | Inflation Adjustment |

The landscape of food assistance is shifting toward stricter compliance and nutritional oversight. As these rules take hold this month, the USDA and state agencies will be monitoring participation rates to determine the long-term impact on national food security.

January 2026 Payment Schedules: When to Expect Deposits

The distribution of SNAP benefits remains a state-level responsibility, resulting in a varied schedule across the country. In most regions, payments are staggered over the first 10 to 20 days of the month, determined by factors such as the last digit of a case number or the first letter of a recipient’s surname.

Because January 1 is a federal holiday, most states will ensure that Electronic Benefit Transfer (EBT) funds are available on the scheduled date, though some participants may see deposits arrive as early as December 31.

2026 State Distribution Windows:

- California & Colorado: January 1 – January 10

- Florida: January 1 – January 28 (staggered by case number)

- Texas: January 1 – January 28 (based on EDG number)

- New York: January 1 – January 14 (NYC follows a specific monthly schedule)

- Georgia & Indiana: January 5 – January 23

Recipients are encouraged to use their state’s mobile application, such as Providers or eBTEdge, to verify their specific deposit date.

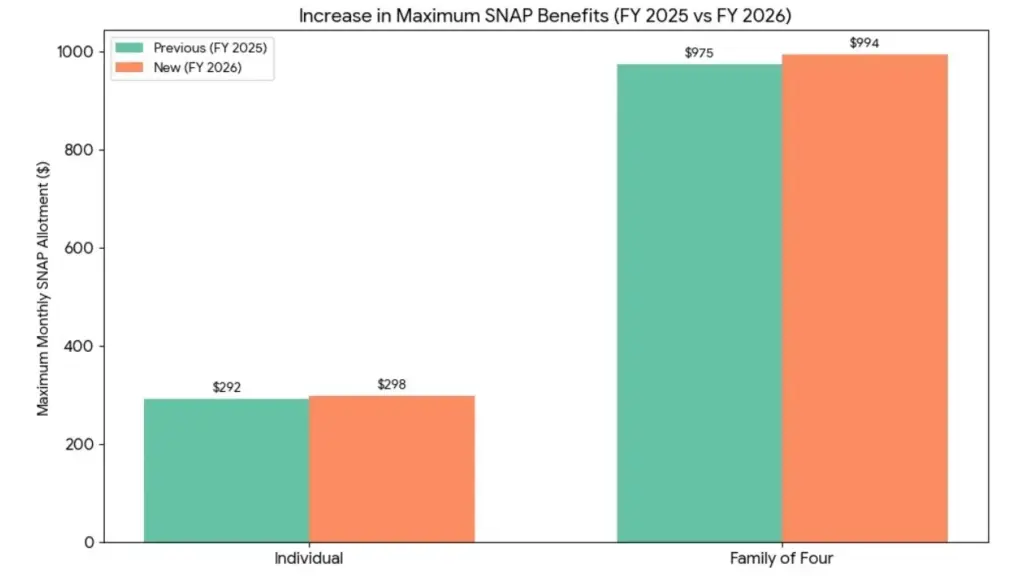

The 2026 COLA: Updated Maximum Allotments

The 2026 fiscal year adjustments reflect a 2.8% increase in maximum allotments for the 48 contiguous states and the District of Columbia. These amounts vary significantly for households in Alaska, Hawaii, Guam, and the U.S. Virgin Islands due to higher local food costs.

Maximum Monthly Allotments for 2026:

- Household Size 1: $298

- Household Size 2: $546

- Household Size 3: $785

- Household Size 4: $994

- Household Size 5: $1,183

- Household Size 6: $1,421

- Household Size 7: $1,571

- Household Size 8: $1,789

- Each additional person: +$218

Mandatory Work Requirements Expand to Age 64

One of the most impactful changes taking effect this January is the expansion of the Able-Bodied Adult Without Dependents (ABAWD) work requirements. Under the new federal mandates, adults aged 18 to 64 who do not have children in the household must document at least 80 hours of qualifying work activity per month to maintain benefits.

Previously, this requirement capped at age 54. The new age threshold means that older workers, many of whom may face health challenges or age-related employment barriers, must now participate in 20 hours of work or vocational training per week. Failure to comply can result in the loss of benefits after three months within a three-year period.

Qualifying Activities Include:

- Paid Employment: Including part-time and gig work.

- Job Training: Programs approved by the state SNAP Employment & Training (E&T) office.

- Community Service: Volunteer work at recognized non-profit organizations.

- In-Kind Work: Work performed in exchange for goods or reduced rent.

Exemptions remain for those with documented physical or mental disabilities, pregnant individuals, and those caring for a child under the age of 14.

“Make America Healthy Again”: The Junk Food Restrictions

Starting January 1, 2026, a “patchwork” of purchasing rules will appear across the United States. Eighteen states have received USDA waivers to restrict the purchase of “non-nutritious” items, part of a broader federal initiative to align SNAP with public health goals.

Indiana and Iowa are the first to implement these bans on New Year’s Day. In these states, EBT cards will no longer be authorized for the purchase of candy, energy drinks, and sugar-sweetened soft drinks. Other states, including Florida and Texas, have scheduled their rollouts for later in the spring and summer of 2026.

Critics of the policy, including the grocery retail industry, warn that the lack of national uniformity will cause confusion at checkout lines. Retailers must now update their point-of-sale software to recognize state-specific “banned” product codes, creating an administrative challenge for small independent grocers.

State Moves Ahead With SNAP Limits on Sugary Drinks and Candy Starting January 1 – Check Details

FAQs About SNAP Benefits January 2026 Payments

1. Will I lose my benefits if I cannot find 20 hours of work per week?

If you are between the ages of 18 and 64 and do not meet an exemption (such as disability or having a dependent), you are limited to three months of benefits in a three-year period unless you meet the 80-hour monthly work requirement. You should contact your caseworker to see if you qualify for a “Good Cause” exception or state-sponsored training.

2. Can I still buy soda or candy with SNAP in 2026?

This depends entirely on your state. If you live in a state like Indiana or Iowa, these items are restricted as of January 1. However, in states like New York or California, there are currently no restrictions on these food items.

3. Is the $994 for a family of four an increase from last year?

Yes. The maximum allotment for a family of four increased from $975 in 2025 to $994 in 2026, a 2.8% rise based on the Thrifty Food Plan calculations.

4. How do I report my work hours to keep my benefits?

Most states require you to submit pay stubs or signed volunteer hour logs through their online portals or at a local Department of Human Services (DHS) office. Documentation is usually required once a month or during your mid-year recertification.

5. What should I do if my EBT card is declined for a healthy item?

Ensure the item is not taxable or prepared (hot) food, which are generally excluded. If a standard grocery item is declined, it may be due to a system error with the store’s new software updates for the 2026 restrictions. You can report these errors to your state’s SNAP hotline.