For millions of Americans, the transition into 2026 brings both a 2.8% increase in monthly benefits and a notably late start to the disbursement calendar. The Social Security Administration (SSA) has finalized the 2026 payment calendar, revealing that January’s payment dates will fall on their latest possible cycle due to the month beginning on a Thursday.

Understanding the 2026 Payment Calendar Breakdown

The Social Security for 2026 is anchored by the annual Cost-of-Living Adjustment (COLA), which was officially set at 2.8% following data from the Department of Labor. While the increase is designed to help 75 million beneficiaries keep pace with inflation, the physical arrival of these funds follows a strict departmental schedule based on birth dates and benefit types.

| Key 2026 Fact | Details |

| COLA Increase | 2.8% boost for all Social Security & SSI |

| Average Retired Worker Benefit | Approximately $2,071 (up from $2,015) |

| Standard Medicare Part B Premium | $202.90 per month |

| Maximum Taxable Earnings | $184,500 |

As 2026 begins, the Social Security Administration reminds beneficiaries to stay vigilant against “phishing” scams. Official COLA notices are only sent by mail or through the secure online Message Center; the agency will never call to request personal information in exchange for your cost-of-living increase.

Why January Payments Face Unusual Delays

Beneficiaries who receive payments on the second, third, and fourth Wednesdays of the month will experience a longer-than-average wait in January. Because January 1, 2026, is a Thursday, the first Wednesday does not occur until January 7. Consequently, the first wave of “COLA-boosted” retirement checks will not arrive until January 14.

This trend of “late starts” repeats in October 2026, where the first Wednesday also falls later in the month. For households living on a strict monthly budget, this seven-day shift compared to the usual early-month arrival can create significant cash-flow challenges.

Primary Payment Schedule by Birth Date

The SSA maintains a staggered system to avoid overwhelming the banking system. Your specific date is determined by the day of the month you were born:

- 1st – 10th: Paid on the Second Wednesday of each month.

- 11th – 20th: Paid on the Third Wednesday of each month.

- 21st – 31st: Paid on the Fourth Wednesday of each month.

Early Payments: Who Gets Paid First?

Not everyone will wait until mid-January. Two specific groups will receive their 2026 funds earlier due to federal holidays and weekend scheduling:

1. Supplemental Security Income (SSI)

SSI payments are traditionally issued on the first of the month. However, since January 1 is a federal holiday, the SSA advances these payments to the nearest business day. This means SSI recipients will receive their first 2026 payment—including the 2.8% increase—on December 31, 2025. This results in two payments in December and none in January, a vital detail for budgeting.

2. Pre-May 1997 & Combined Beneficiaries

Individuals who began receiving benefits before May 1997, or those who receive both Social Security and SSI, are paid on the third of each month. Since January 3, 2026, falls on a Saturday, these funds will arrive on Friday, January 2.

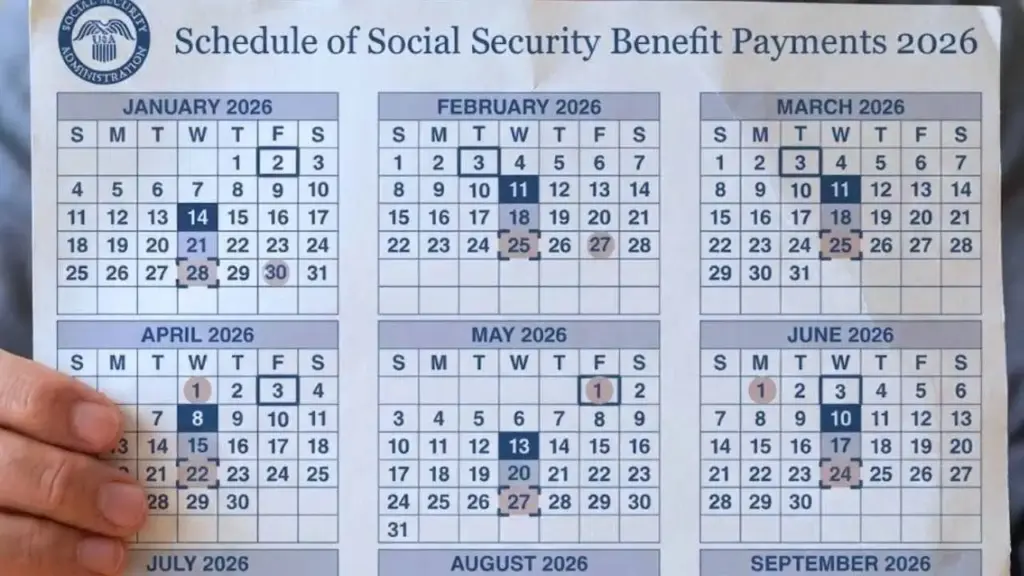

The 2026 Monthly Payment Calendar

Below is the comprehensive list of payment dates for the 2026 calendar year. Note that some dates shift for federal holidays, such as in November.

First Half of 2026

- January: 14th (1–10), 21st (11–20), 28th (21–31)

- February: 11th (1–10), 18th (11–20), 25th (21–31)

- March: 11th (1–10), 18th (11–20), 25th (21–31)

- April: 8th (1–10), 15th (11–20), 22nd (21–31)

- May: 13th (1–10), 20th (11–20), 27th (21–31)

- June: 10th (1–10), 17th (11–20), 24th (21–31)

Second Half of 2026

- July: 8th (1–10), 15th (11–20), 22nd (21–31)

- August: 12th (1–10), 19th (11–20), 26th (21–31)

- September: 9th (1–10), 16th (11–20), 23rd (21–31)

- October: 14th (1–10), 21st (11–20), 28th (21–31)

- November: 10th* (1–10), 18th (11–20), 25th (21–31)

- December: 9th (1–10), 16th (11–20), 23rd (21–31)

*Note: November 11 is Veterans Day. Payments for the first birth group will be issued one day early on Tuesday, Nov 10.

Essential Changes Beyond the Calendar

The SSA has confirmed several threshold adjustments that go into effect alongside the new calendar. These changes affect both current workers and those already in retirement.

Higher Earnings Limits for Workers

If you work while receiving benefits and are under Full Retirement Age (FRA), the amount you can earn before benefits are reduced will increase to $24,480. For those reaching their FRA in 2026, the limit jumps to $65,160. Earnings above these marks result in a temporary withholding of benefits ($1 for every $2 or $3 earned, respectively).

Medicare Premium Impact

While the 2.8% COLA adds an average of $56 per month to retirement checks, the net increase will be lower for most. The standard Medicare Part B premium is rising from $185 to $202.90 in 2026. Because this premium is deducted directly from Social Security checks, roughly one-third of the average COLA raise will be redirected to healthcare costs.

December 24 Social Security Checks: Check Payment Amounts and Who Gets Paid

FAQs About Social Security 2026 Payment Calendar

1. Why did I receive two payments in December 2025?

SSI recipients receive their January payment early when January 1 is a holiday. You will receive your standard December check on Dec 1, and the “January” check (with the 2026 increase) on Dec 31. You will not receive a check in the month of January.

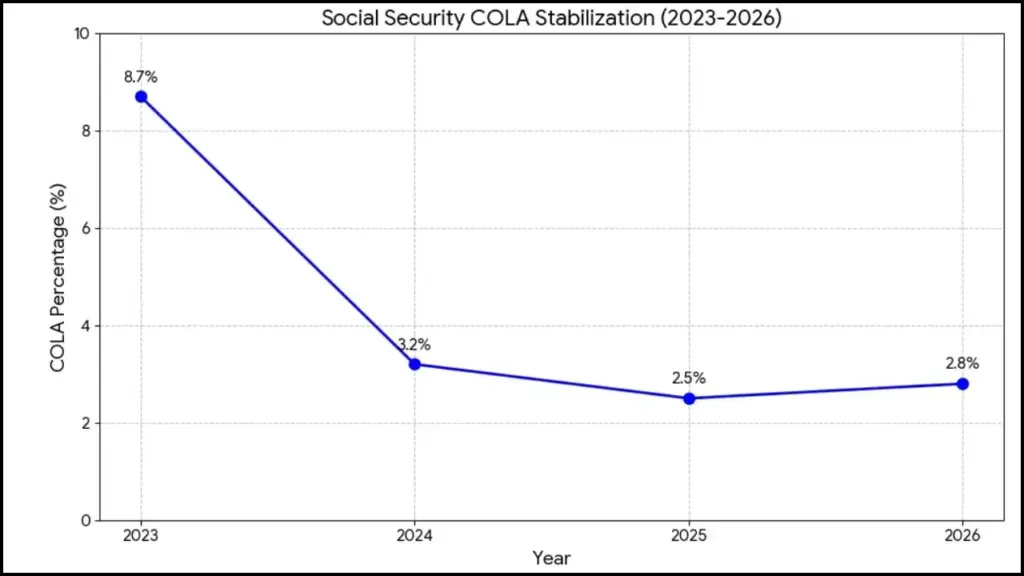

2. Is the 2026 COLA smaller than last year?

Actually, it is slightly higher. The 2025 COLA was 2.5%, while the 2026 COLA is 2.8%. While it is significantly lower than the record-breaking 8.7% seen in 2023, it reflects a cooling of inflation across the broader economy.

3. What should I do if my check is late in January?

The SSA advises waiting three additional mailing days before contacting them. In January 2026, many recipients may feel their check is late simply because the first Wednesday is Jan 7, pushing the entire schedule back by a week.

4. Does the increase apply to Disability (SSDI)?

Yes. The 2.8% COLA applies to all Social Security programs, including Retirement, Survivors, and Social Security Disability Insurance (SSDI).

5. How can I see my exact new benefit amount?

The SSA began mailing COLA notices in December 2025. You can also log into your “my Social Security” account online to view a personalized one-page notice that details your new gross amount and any Medicare deductions.