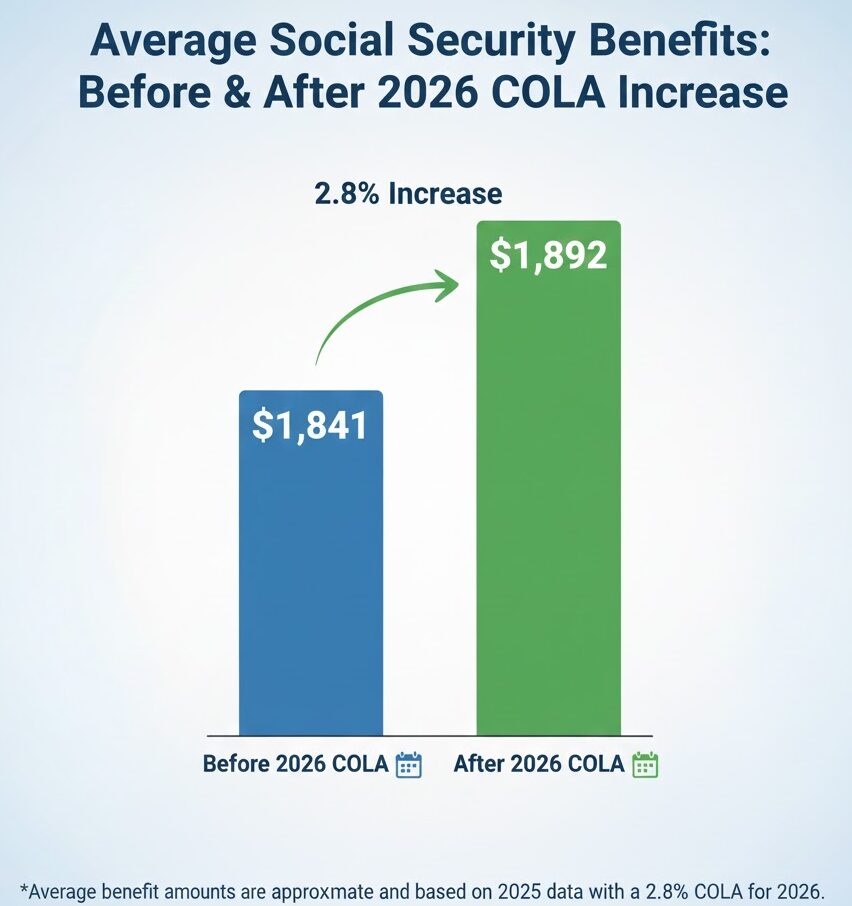

The Social Security 2.8% COLA for 2026 will raise monthly benefits for tens of millions of retirees, disabled workers, and survivors beginning in January. The adjustment reflects measured inflation over the past year and aims to preserve purchasing power, though rising medical, housing, and insurance costs may limit its real-world impact for many households.

Social Security Confirms 2.8% COLA for 2026

| Key Fact | Detail |

|---|---|

| COLA for 2026 | 2.8% increase |

| Effective date | January 2026 payments |

| Applies to | Retirement, SSDI, survivors, SSI |

| Typical impact | ~$50 monthly increase on $1,800 benefit |

| Official Website | Social Security Administration |

How the Social Security 2.8% COLA for 2026 Works

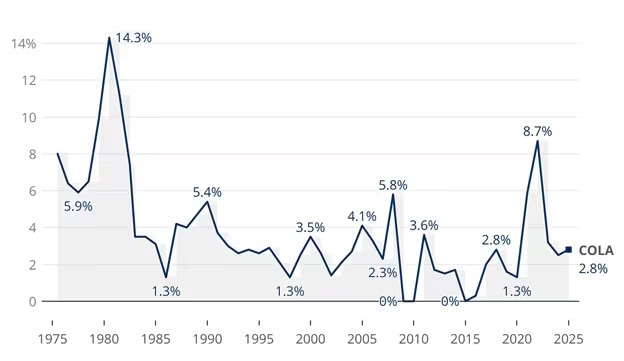

The Social Security cost-of-living adjustment, commonly known as COLA, is a statutory mechanism designed to protect beneficiaries from inflation. It is calculated using changes in consumer prices during the third quarter of the year compared with the same period one year earlier.

If prices rise, benefits increase automatically. If prices do not rise, benefits remain unchanged. The 2.8% COLA for 2026 reflects a year in which inflation slowed from recent peaks but remained elevated enough to trigger an adjustment.

Unlike discretionary benefit changes, COLAs are not subject to annual congressional approval. Once the inflation threshold is met, the increase is applied uniformly across eligible programs.

Why COLAs Exist

Social Security was originally designed to provide a stable income floor in retirement, disability, or survivorship. Without COLAs, inflation would steadily erode the real value of benefits over time. The adjustment mechanism was formally added in the 1970s following periods of high inflation that exposed vulnerabilities in fixed benefit payments.

What a 2.8% COLA Means for a $1,800 Monthly Benefit

For beneficiaries receiving $1,800 per month, the effect of the 2026 COLA can be calculated directly:

- Monthly increase: $50.40

- New gross monthly benefit: $1,850.40

- Annual increase: Approximately $605

This increase applies to the gross benefit before any deductions. The actual amount received may differ depending on individual circumstances, including Medicare premiums, tax withholding, and voluntary deductions.

Why Percentage-Based Increases Matter

Because COLAs are calculated as percentages rather than flat dollar amounts, higher-income beneficiaries receive larger dollar increases, while lower-income beneficiaries receive smaller ones. This structure preserves proportionality but can widen the gap in absolute benefit levels.

Medicare Premiums May Reduce Net Gains

For most retirees, Medicare Part B premiums are deducted automatically from Social Security checks. These premiums typically increase annually due to rising healthcare costs and utilization.

As a result, a beneficiary receiving a $50 gross COLA increase may see a smaller net change. Historically, it is common for 20% to 40% of a COLA to be absorbed by higher Medicare premiums, depending on the year.

Income-Related Adjustments

Higher-income retirees may also be subject to income-related monthly adjustment amounts, which increase Medicare premiums further. These additional deductions can significantly reduce or even eliminate the perceived benefit of a COLA increase.

This interaction between Social Security and Medicare remains one of the most common sources of confusion among beneficiaries.

Why Some Retirees Still Feel Financial Pressure

Although the Social Security 2.8% COLA for 2026 increases nominal income, it may not fully match the inflation retirees actually experience.

Older households typically spend more on healthcare, housing, utilities, and insurance—categories that often rise faster than overall inflation. Even modest increases in rent, property taxes, or prescription costs can outpace annual COLAs.

Inflation Measurement Challenges

The inflation index used for COLA calculations reflects spending patterns of working households rather than retirees. This difference has fueled longstanding debate over whether an alternative index would better capture seniors’ cost pressures.

As a result, beneficiaries may feel financially constrained even in years with positive adjustments.

Timing and Payment Details

- Most beneficiaries: Increased payments begin in January 2026.

- Supplemental Security Income recipients: Typically receive increased payments at the end of December due to calendar timing.

- Payment schedule: Remains tied to beneficiaries’ birth dates.

Annual benefit notices outline updated amounts, deductions, and net payments. Beneficiaries are encouraged to review these notices carefully.

Who Benefits Most—and Least—from the 2026 COLA

The impact of the COLA varies across demographic and economic groups.

- Long-term retirees: Often see smaller absolute gains due to lower base benefits.

- Recently retired workers: Tend to receive larger dollar increases.

- Disabled workers and survivors: Receive proportional increases but often face higher medical expenses.

- SSI recipients: Receive smaller increases due to lower baseline payments, though the increase is critical for basic living expenses.

Understanding these differences helps explain why reactions to COLA announcements are often mixed.

Broader Implications for the Social Security Program

The 2026 adjustment highlights the dual role of COLAs: protecting beneficiaries while increasing program costs. Each increase adds to long-term obligations, especially as the population ages and the number of beneficiaries grows.

Fiscal Sustainability

Demographic trends—including longer life expectancy and lower birth rates—continue to strain Social Security’s financing structure. While COLAs are not the cause of funding challenges, they contribute to the program’s overall cost growth.

Policy discussions frequently revisit whether changes to benefit formulas, revenue sources, or inflation measures are needed to ensure long-term stability.

Walmart Price Cut Draws Attention: Swarovski Necklace Marked Down to $19

How Beneficiaries Can Use the Increase Strategically

Financial planners often recommend using COLA increases to offset unavoidable expenses rather than discretionary spending. Common uses include:

- Covering higher Medicare or insurance premiums

- Offsetting rent or utility increases

- Rebuilding emergency savings eroded by inflation

While the increase may seem modest, applied strategically it can reduce financial stress.

FAQs About Social Security Confirms 2.8% COLA for 2026

Does everyone receive the same dollar increase?

No. The COLA percentage is uniform, but dollar increases vary based on benefit amounts.

Do I need to apply for the COLA?

No. The increase is automatic

Can the COLA ever be zero?

Yes. In years when inflation does not meet the threshold, benefits remain unchanged.

Does the COLA affect taxes on Social Security?

Indirectly. Higher benefits may increase taxable income for some beneficiaries.

Closing Context

The Social Security 2.8% COLA for 2026 offers modest relief amid easing inflation, but it is not a comprehensive solution to rising living costs. For millions of Americans, the adjustment helps stabilize household budgets, even as broader questions about affordability and long-term program sustainability remain unresolved.