Millions of Americans participating in the Supplemental Nutrition Assistance Program (SNAP) are navigating a significantly altered landscape this winter as sweeping federal changes to work mandates take effect. Following the enactment of the One Big Beautiful Bill Act (H.R. 1) in July 2025, the federal government has expanded the age range for work-reporting requirements and eliminated several long-standing exemptions for vulnerable populations.

The primary keyword, SNAP work requirements, now applies to a much broader segment of the population, including older adults and parents of teenagers who were previously excluded from these mandates. Under the new policy, affected individuals must document at least 80 hours of work, training, or volunteering per month to maintain their benefits beyond a three-month window.

SNAP Work Requirements

| Feature | New Regulation |

| Expanded Age Limit | Mandatory for adults aged 18 to 64 |

| Monthly Threshold | 80 hours of work, training, or volunteering |

| Dependent Threshold | Exemption ends when youngest child turns 14 |

| Vulnerable Groups | Homeless and Veterans no longer automatically exempt |

The U.S. Department of Agriculture (USDA) has stated it will provide ongoing technical assistance to states to ensure a smooth transition, though critics maintain that the rapid implementation will inevitably lead to a “hunger gap” for the nation’s most vulnerable.

Expanding the Age Limit and Redrawing “Dependents”

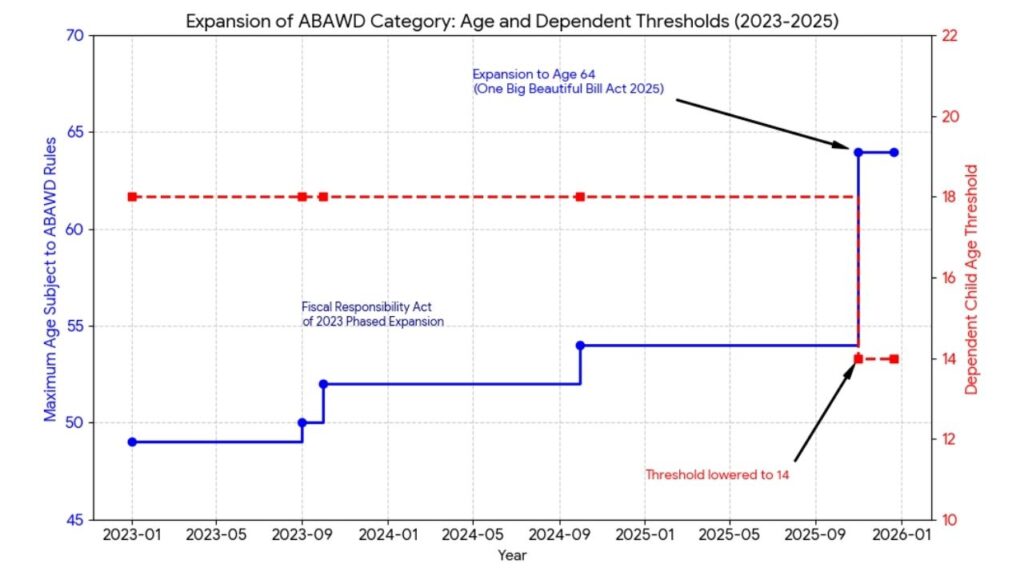

For decades, the age cap for the strictest SNAP work requirements was set at 50, later moving to 54 under the Fiscal Responsibility Act of 2023. The 2025 legislation has pushed this cap further to age 64, placing a new burden on older workers who may face age-related health issues but do not yet qualify for Social Security or Medicare.

According to the Congressional Budget Office (CBO), these expanded time limits are expected to reduce SNAP participation by approximately 2.4 million people over the next decade. The CBO notes that roughly 800,000 of those affected will be adults between the ages of 55 and 64 who do not have dependents.

Furthermore, the definition of a “dependent” has been tightened. Previously, parents or caregivers were exempt from work-reporting if they had a child under 18 in the household. Under the new law, that exemption now expires once the youngest child reaches 14 years of age. This change reflects a legislative shift toward the assumption that parents of high-school-aged children can return to the full-time workforce.

Removal of “Automatic” Exemptions for Veterans and the Unhoused

One of the most contentious aspects of the new policy is the removal of automatic exemptions for veterans and individuals experiencing homelessness. These protections, which were introduced as temporary measures in 2023, were rescinded as of November 1, 2025.

Advocates argue that requiring 80 hours of documented work from individuals in unstable living conditions creates an insurmountable administrative barrier. The Food Research & Action Center (FRAC) has noted that these changes dismantle critical protections for those who have served the country or lack stable housing.

States like North Carolina and New York have issued guidance suggesting that while the “automatic” exemption is gone, caseworkers may still exempt individuals if they are determined to be “unfit for employment” due to chronic homelessness or service-connected disabilities. However, this shift places the burden of proof on the recipient to provide medical documentation or undergo secondary screenings, a process that can take months.

State Waivers and Administrative Hurdles

The new law also severely restricts the ability of states to request waivers for areas with high unemployment. Previously, states could waive SNAP work requirements in regions with a “lack of sufficient jobs.” Under the 2025 rules, a waiver is generally only available if a specific area’s unemployment rate exceeds 10 percent.

This policy shift comes as states are also being asked to shoulder more of the program’s costs. By October 2026, states will be responsible for 75% of administrative expenses, up from the previous 50% share. Maryland’s Department of Human Services estimated this change would cost the state an additional $300 million annually, potentially leading to slower processing times for applicants.

Impact on Current Recipients

If you are currently receiving benefits, the new rules typically apply at your next recertification or renewal date. For most, this means the three-month “clock” for the time limit will begin in early 2026.

Recipients are encouraged to take the following steps:

- Update Contact Information: Ensure your state agency has your current address to receive mandatory “Work Activity Letters.”

- Gather Documentation: Keep pay stubs, volunteer logs, or medical records ready for your caseworker.

- Report “Good Cause”: If you fall short of 80 hours due to illness or transportation failure, report it immediately to avoid a “strike” against your three-month limit.

SNAP Rules for 2026: What Applicants and Current Recipients Must Meet Going Forward

FAQs About SNAP Work Requirements

1. Does volunteering count toward the 80-hour requirement?

Yes. Most states allow volunteering at non-profits, schools, or religious institutions to count. In some jurisdictions, the number of required volunteer hours is calculated by dividing your monthly benefit by the local minimum wage. For example, if you receive $300 in benefits and the minimum wage is $15, you may only need to volunteer 20 hours to comply.

2. What if I am 60 years old and have health issues?

While you are now subject to the time limit (age 18–64), you may still be exempt if you are “medically unfit for work.” This does not require a formal Social Security disability designation; a statement from a doctor, nurse, or even a social worker often suffices to verify that you cannot work 20 hours per week.

3. Are there any groups that remain permanently exempt?

Yes. Individuals who are pregnant, people who are physically or mentally unable to work, and those residing in a household with a child under age 14 remain exempt. Additionally, the 2025 law introduced a new, permanent exemption for members of federally recognized tribes.

4. What happens if I miss my 80-hour goal for one month?

If you are an “Able-Bodied Adult Without Dependents” (ABAWD), you can receive SNAP for only 3 months in a 36-month period without meeting the requirement. Each month you fail to hit 80 hours counts as one of those three months. Once you use all three “countable months,” you lose eligibility until the next 36-month cycle begins or you start working 80 hours again.

5. Can I combine part-time work and job training?

Yes. The 80-hour requirement is a total. You can meet it by combining 40 hours of a part-time job with 40 hours of a GED program, vocational training, or community service.