If you’re like most working Americans, you’ve probably been eyeing your paycheck and wondering where that next bump comes from. Well, get ready because 2026 tax refunds explained point to something big: many of you could snag an extra $1000 or more when filing your 2025 returns come early next year. President Trump’s One Big Beautiful Bill, signed back in July 2025, rolled out retroactive cuts that weren’t reflected in your withholding all year long. That means overpaid taxes now turn into fatter refunds, potentially the largest season ever.

In 2026 tax refunds explained, the spotlight falls on how everyday workers stand to gain from fresh deductions on overtime pay, tips, and bumped up state tax write-offs. Treasury Secretary Scott Bessent predicts $100 billion to $150 billion flowing back, averaging $1,000 to $2,000 per household. Middle income brackets, say $60k to $400k, capture most of it since they mix wage jobs with itemizing potential. Retroactive rules mean no mid-year paycheck hikes for many, so refunds explode instead. White House calls it the biggest payout wave in history, and analysts back it up with hard numbers on over withholding. If you’re in a high-tax state or pulling extra shifts, this could mean thousands back in your pocket without lifting a finger beyond filing.

2026 Tax Refunds

| Key Change | Details | Potential Impact |

|---|---|---|

| No Tax on Overtime & Tips | Full deduction for qualified overtime and tipped income | Saves $1,000+ for workers like nurses ($10k OT) or servers ($18k tips) earning $45k-$65k |

| SALT Deduction Cap | Raised from $10,000 to $40,000 for incomes under $500k | Big win for high-tax state residents itemizing over standard deduction |

| Average Refund Boost | From $3,151 (2025 season) to $4,151 | Extra $1,000 per filer; uneven—best for $60k-$400k earners |

| Total Payout Projection | $270B base + $90B extra | Largest season ever, per analysts and White House |

| Filing Timeline | Early 2026 submissions; refunds in 21 days | Over-withholding due to mid-year law passage |

Why Refunds Are Ballooning In 2026

- The bill dropped mid-July 2025, after the IRS had already locked in withholding tables for the year. You and millions of others kept sending extra cash to Uncle Sam at the old rates throughout the second half of the year. But when you sit down to file your 2025 taxes in early 2026, those new deductions kick in retroactively, slashing your actual tax bill. Boom suddenly, you’ve overpaid by a cool grand on average, and it all comes rushing back as a refund.

- Economists project this extra layer at around $90 billion on top of the usual $270 billion in annual refunds. Why didn’t everyone see bigger paychecks right away? Most folks don’t tweak their W-4 forms mid-year, especially if overtime or tips fluctuate. It’s easier to let the IRS hold the money interest-free and grab it all at once. Middle-class workers like teachers taking summer gigs, factory hands on double shifts, or restaurant staff relying on gratuities stand to benefit the most. Low earners often stick with the standard deduction and refundable credits, while ultra-high earners face phase-outs that limit their slice.

- The White House Press Secretary has been vocal about this, labeling it the “largest tax refund season of all time.” With no major hiccups in projections as we head into late 2025, expect the buzz to build. Families planning big purchases, debt payoffs, or just a breather from inflation could find this timely boost transformative. It’s a reminder that tax policy isn’t just abstract numbers, it hits your bank account in very real ways.

Major Tax Breaks Fueling The $1000 Boost

- Diving deeper, the star attractions here are the full deductions on overtime and tips for qualified workers. Imagine a nurse pulling $10,000 in extra shifts or a server banking $18,000 in tips on a $45,000-$65,000 base salary. That income now slips right off your taxable total, potentially saving over $1,000 in taxes without changing a thing about your daily grind. Phase-outs start at $150,000 for singles or $300,000 joint, so most blue-collar and service pros qualify fully.

- Then there’s the SALT deduction overhaul state and local taxes cap jumps from $10,000 to $40,000 for households under $500,000. This is a lifeline for residents in New York, California, New Jersey, or Illinois, where property and income taxes devour paychecks. But heads up: you only get it if itemizing beats the standard deduction, now $15,750 for singles or $31,500 for joint filers after inflation tweaks. Homeowners with mortgages and high state bills? You’re looking at a serious refund padding.

Don’t sleep on the ripple effects either. The Child Tax Credit and Earned Income Tax Credit received inflation adjustments, lifting low-to-moderate income families toward $2,000 refunds. Seniors over 71 snag up to $6,200 in extra breaks, while self-employed folks deduct more business costs. These layers stack up, turning modest over-withholding into windfalls. For gig workers on platforms like Uber or DoorDash, tip reporting ties right in, making compliance pay off big.

Who Qualifies For The Extra $1000 2026 Tax Refunds

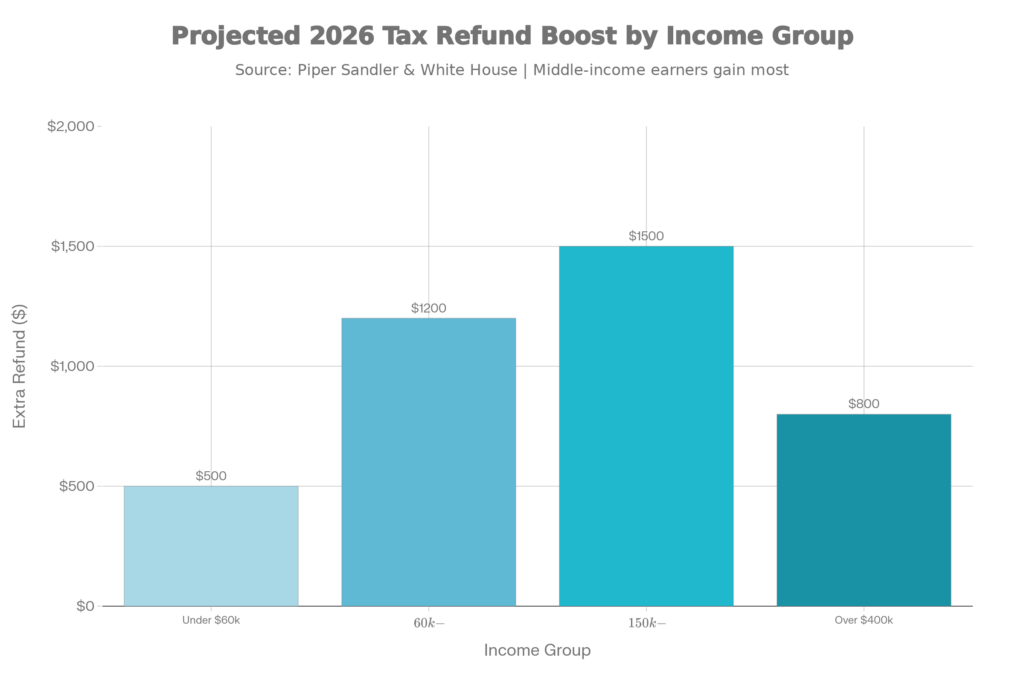

- Not every taxpayer wakes up to this bonus, but a huge chunk does. Households pulling $60,000 to $400,000 snag about 60% of the total benefits, according to breakdowns from tax experts. That’s your sweet spot: enough income for overtime, tips, or SALT to matter, but not so high that phase-outs bite.

- High-tax state homeowners lead the qualifiers, especially if they itemize aggressively. Followed closely by shift workers in manufacturing, healthcare, or hospitality where overtime pads W-2s. Tip-heavy jobs like bartending or delivery shine too. Over $217,000? You might grab a disproportionate share of cuts, but SALT fades at $500,000. Low-wage earners lean on EITC and CTC, which got boosts but don’t scale like deductions.

- Roughly 100 million filers could feel the lift, though unevenly. Check your stubs now: reported overtime or tips? State taxes topping $10,000? Multiple kids or senior status? You’re in prime position. Gig economy participants, parents, and suburban homeowners form the core group eyeing that extra $1,000 in 2026 tax refunds explained.

When And How to Claim Your 2026 Tax Refunds

- Mark your calendars: IRS e-filing typically opens late January 2026. File a clean return with direct deposit, and most see funds in 21 days often by early February. Peak season hits March-April, so beat the rush for speedier processing.

- Free tools on IRS.gov handle the new breaks automatically or grab software like TurboTax for guided walkthroughs. Update your W-4 right now through your employer’s portal or the IRS withholding estimator it factors in the One Big Beautiful Bill precisely, dialing back 2026 over-withholding. Paper returns? Expect weeks longer, so go digital every time.

- Track everything at IRS.gov’s “Where’s My Refund?” tool. VITA sites offer free prep for under $64,000 earners, while military and low-income programs extend help. With volumes projected as the highest ever, glitches could pop double-check forms and attachments like 1099s for tips or overtime.

SNAP Rules for 2026: What Applicants and Current Recipients Must Meet Going Forward

Potential Downsides And Next Steps

- No policy’s perfect. Low-wage folks without itemizable expenses or ultra-wealthy in top brackets see slimmer gains. Critics whisper about inflation risks from this stimulus-like cash flood, though proponents point to growth sparks outweighing it. Refunds mean you loaned the government interest-free money all year adjusting W-4s prevents that going forward.

- Prep smart: Tally paystubs, mortgage interest, state tax forms, and 1099s today. CPAs excel for tangled situations like rentals or investments; free File covers straightforward ones. Once the check clears, think strategically pay down high-interest debt, bulk up emergency funds, or invest in Roth IRAs. Avoid splurges that vanish quick.

This 2026 tax refunds explained moment flips tax dread into opportunity for millions. Stay proactive, file sharp, and turn policy into pocket money.

FAQs on 2026 Tax Refunds

Will everyone get an extra $1000 in 2026 tax refunds?

No, benefits skew to middle income $60k-$400k with overtime, tips, or high SALT. Low earners lean on credits, tops hit caps.

Do I need to itemize for the SALT boost?

Yes, only if over standard deduction ($15,750 single, $31,500 joint). High-tax states qualify easiest.

How does overtime deduction work exactly?

Qualified overtime fully deductible up to phaseout at $150k single/$300k joint. W-2 reports it clean.

What if I have kids does that change my refund?

Yes, inflation-adjusted Child Tax Credit pushes family refunds higher, often toward $2,000 combined with other breaks.