New York’s inflation refund payments, a one-time rebate approved in the state’s 2025–2026 budget, are still arriving in mailboxes as December approaches, leaving some taxpayers uncertain about when—or if—their checks will arrive. State officials say the staggered delivery reflects administrative sequencing, tax return processing timelines, and reliance on traditional mail rather than electronic payments.

New York Inflation Refunds

| Fact | What It Means |

|---|---|

| Refund size | One-time payments of $150–$400, based on 2023 income |

| Who qualifies | Eligible New York residents who filed a 2023 IT-201 tax return |

| How payments are sent | Paper checks only, no direct deposit |

| Why some checks are late | Batch mailings, tax filing order, and postal delays |

| Mailing timeline | Rolling deliveries from late September through December 2025 |

| Tracking available | No check-tracking system for recipients |

What Is the New York Inflation Refund?

New York inflation refund

The New York inflation refund is a one-time tax rebate aimed at returning surplus state revenue to residents amid persistent cost-of-living pressures. Approved by lawmakers earlier this year, the program distributes $150 to $400 per eligible household, depending on income level and filing status for tax year 2023.

The payments were framed by state leaders as a partial offset for inflation-driven increases in everyday expenses, including food, housing, utilities, and transportation. Unlike recurring tax credits, the refund is not permanent and does not require an application.

How Eligibility Is Determined For New York Inflation Refunds

Eligibility for the inflation refund is based entirely on 2023 New York State personal income tax filings. Residents must have filed Form IT-201, the full-year resident return, and must not have been claimed as a dependent.

Refund amounts are structured as follows:

The state uses previously filed tax data, meaning no updated banking or mailing information is collected for the program. Checks are sent to the last address on record, a factor that has contributed to some delivery complications.

Why Some Checks Are Still Pending in December

A Rolling, Batch-Based Mailing System

New York began mailing inflation refund checks in late September 2025, but officials emphasized from the outset that payments would be sent in waves over several months. There is no publicly available mailing schedule by region, income bracket, or filing date.

This approach means that even households with similar profiles may receive checks weeks apart. According to the state, the process is designed to manage volume and reduce fraud risk rather than prioritize speed.

Tax Filing Order Plays a Role

While the state has not published a precise formula, officials acknowledge that tax return processing order affects mailing timing. Returns filed later in the tax season—or processed after corrections—tend to be placed later in the payment queue.

This has led to confusion among taxpayers who filed electronically yet still have not received refunds, underscoring that electronic filing does not equate to electronic payment in this program.

Reliance on Paper Checks

Unlike federal stimulus payments issued during the pandemic, New York opted to distribute inflation refunds exclusively by paper check. State officials say this decision reflects administrative constraints and fraud-prevention considerations.

However, reliance on mail introduces variables beyond the state’s control, including regional postal delays and seasonal slowdowns during the holiday period.

Why Not Direct Deposit?

The absence of direct deposit has been one of the most common criticisms of the program. Policy analysts note that while the state does collect bank information for refunds and tax payments, using that data for a separate rebate would have required additional legal authorization and system upgrades.

State budget officials have also cited fraud concerns, noting that bank information on file may be outdated or compromised, especially for taxpayers who no longer receive refunds via direct deposit.

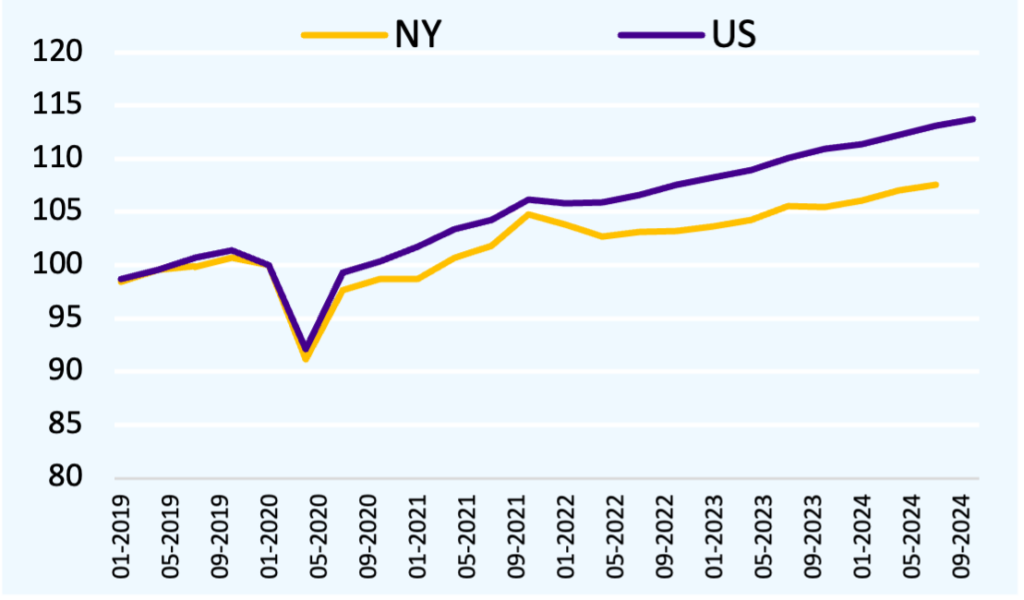

How Much Relief Does the Refund Actually Provide?

Economists are divided on the effectiveness of one-time rebates as an inflation-fighting tool. While direct payments can offer short-term relief, they do little to address underlying cost pressures.

“Refunds like this help households cover immediate expenses, but they don’t meaningfully reduce inflation or stabilize long-term budgets,” said one public finance economist familiar with state fiscal policy. “They are best understood as political and social relief measures.”

For lower-income households, even a $150 payment can help offset rising utility bills or grocery costs. For middle-income families, the impact is more symbolic than structural.

Equity and Who Is Left Out

The inflation refund excludes several groups, including:

- Non-filers

- Dependents

- Part-year residents

- Individuals whose income exceeded eligibility thresholds

Advocacy groups have noted that some of the residents most affected by inflation—such as undocumented workers or seniors with limited filing requirements—receive no benefit.

Administrative Transparency and Public Frustration

One of the most significant challenges has been the lack of a tracking system. Taxpayers cannot check the status of their refund online or by phone, a limitation that has fueled uncertainty and mistrust.

State officials say call-center representatives have no access to individual check status beyond confirming eligibility, leaving many residents with unanswered questions.

Avoiding Scams and Misinformation

Authorities warn that inflation refunds have become targets for scams. The state does not:

- Call or text taxpayers

- Request personal information

- Charge fees to release payments

Residents are urged to treat unsolicited messages claiming to expedite refunds as fraudulent.

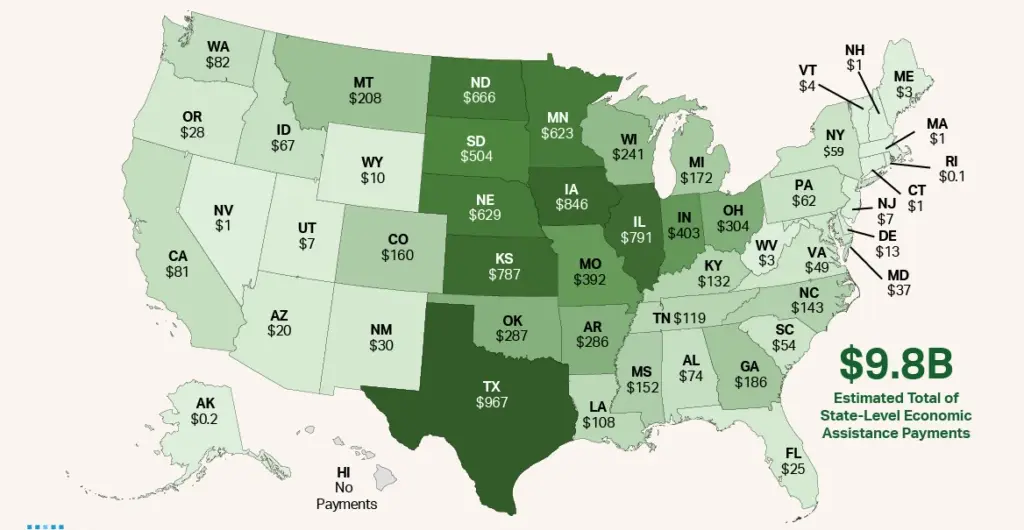

How New York’s Program Fits a National Pattern

New York’s inflation refund mirrors similar efforts in other states that have experienced budget surpluses. Across the U.S., lawmakers have increasingly used one-time rebates rather than permanent tax cuts to return excess revenue.

Experts say this approach offers political flexibility but lacks long-term economic impact.

What To Do If Your Check Does Not Arrive

State guidance advises residents to wait through December before reporting missing checks. Replacement procedures exist but may take additional time.

Taxpayers are also encouraged to ensure their mailing address is current for future filings.

Looking Ahead

As New York completes the final phase of its inflation refund rollout, the program highlights both the benefits and limits of one-time financial relief. While millions of households have received modest assistance, the delays and uncertainty underscore broader challenges in delivering rapid, equitable aid through existing state systems.

State officials say they will review the program’s effectiveness as part of future budget discussions, though no changes are currently planned.

2026 COLA Update: Why Higher Social Security and SSI Rates May Not Raise Your Take-Home Pay

FAQs About New York Inflation Refunds

Will checks continue after December?

Officials say most payments should be delivered by year’s end, though limited replacements may extend into early 2026.

Is the inflation refund taxable?

No. The refund is not considered taxable income under state or federal law.

Can I request direct deposit instead?

No. All payments are issued by check.

Will there be another inflation refund next year?

There is no indication the program will be repeated. Future relief depends on budget conditions and legislative approval.