Reports of $1000 December Deposits scheduled for December 18 have drawn widespread attention across the United States, prompting renewed questions about whether the federal government is issuing new stimulus payments. In reality, the deposits stem primarily from a long-running state program in Alaska rather than a nationwide federal initiative, according to state payment schedules and officials familiar with the process.

The confusion reflects broader public uncertainty about government benefits, particularly as economic pressures, inflation concerns, and memories of pandemic-era stimulus checks continue to shape expectations.

$1000 December Deposits

| Key Fact | Detail |

|---|---|

| Payment Amount | $1000 per eligible person |

| Payment Date | December 18 |

| Federal Stimulus | None approved |

| Eligibility | Alaska residents only |

For now, $1000 December Deposits remain a state-specific payment rather than a nationwide policy shift. Unless Congress passes new legislation, federal agencies indicate that Americans should not expect additional universal cash deposits this year.

As economic conditions evolve, analysts say clarity from government institutions and careful reporting will remain essential to maintaining public trust around benefit programs.

What the $1000 December Deposits Refer To

Despite widespread claims circulating online and through word of mouth, $1000 December Deposits are not a new federal stimulus payment. Instead, they refer to scheduled distributions from the Alaska Permanent Fund Dividend, commonly known as the PFD, a state-run program that has operated for nearly five decades.

The Alaska Permanent Fund was established in the mid-1970s following the discovery and expansion of oil production on the North Slope. State leaders at the time sought to ensure that a portion of the state’s nonrenewable resource wealth would benefit both current and future generations. To achieve this, Alaska set aside oil revenues in an investment fund rather than relying solely on annual budget spending.

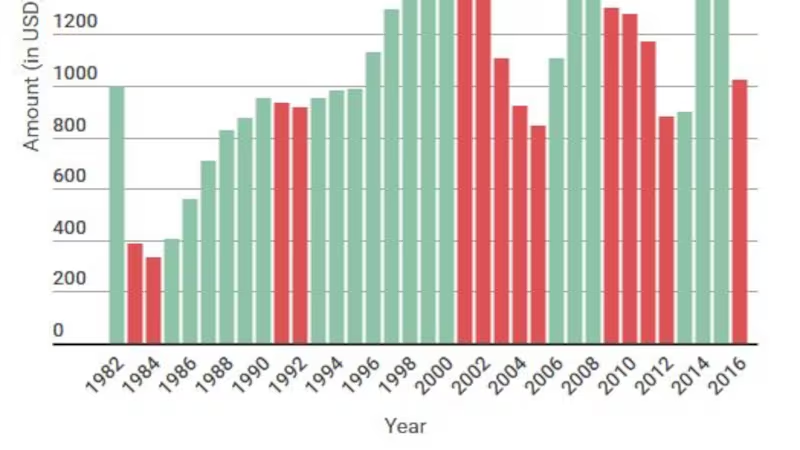

Each year, a portion of the fund’s earnings is distributed directly to residents in the form of a dividend. The payment amount varies annually based on market performance, fund earnings, and legislative decisions. Some years have seen dividends well above $1,000, while others have been lower, particularly during periods of market volatility or budgetary strain.

For 2025, state officials approved a $1000 payment per eligible resident, with December 18 designated as one of the final scheduled payment dates for approved applicants who were not paid earlier in the cycle.

Who Is Receiving the December 18 $1000 December Deposits

Eligibility Is Limited to Alaska Residents

Only individuals who meet Alaska’s residency requirements qualify for the payment. Applicants must have lived in the state for the entire qualifying year and must demonstrate intent to remain in Alaska indefinitely. These requirements are strictly enforced and include limitations on time spent outside the state, with specific exemptions for education, military service, or medical care.

Children are eligible under the same residency rules as adults, which means households with multiple qualifying members may receive several payments. For families, the dividend can represent a meaningful source of seasonal income, often used to offset winter heating costs, travel expenses, or household debt.

The dividend is issued on a per-person basis, not per household, distinguishing it from many other government assistance programs that calculate benefits based on income or family size.

State administrators say the December 18 payment date applies to applicants whose eligibility was confirmed but who were not included in earlier payment rounds, which typically occur in October and November. Applicants who missed deadlines or required additional verification may be scheduled for later distributions, sometimes extending into January.

Why Federal Stimulus Claims Keep Circulating

Confusion surrounding $1000 December Deposits reflects a broader national pattern that has persisted since the COVID-19 pandemic. During 2020 and 2021, the federal government issued multiple rounds of direct payments to households, commonly referred to as stimulus checks. Those payments, which ranged from $600 to $1,400 per person, created a lasting public association between economic uncertainty and direct government deposits.

Since then, periods of inflation, rising interest rates, and high consumer prices have fueled expectations that similar federal relief programs might return. Social media posts, short-form videos, and unverified websites often amplify speculation by recycling familiar dollar amounts and payment dates, even when no legislation exists.

Economic uncertainty and election-cycle politics also play a role. Analysts note that election years tend to see an increase in claims about government payments, as economic messaging becomes more prominent in public discourse.

However, budget experts emphasize that federal stimulus payments are complex undertakings. They require congressional authorization, funding approval, administrative planning, and coordination between the Treasury Department and the Internal Revenue Service. Without those steps, no nationwide payment can occur.

What Federal Agencies Have — and Have Not — Announced

The Internal Revenue Service and the U.S. Department of the Treasury have not announced any universal $1000 direct deposit scheduled for December. Officials consistently emphasize that legitimate federal payments are accompanied by formal announcements, public guidance, and detailed eligibility rules.

Federal agencies also caution that automatic payments are rare outside established programs such as Social Security, veterans’ benefits, or tax refunds. Even during the pandemic, stimulus payments were accompanied by extensive public communication and official documentation.

Consumer protection specialists note that vague claims referencing unnamed “government sources” or promising deposits without applications or paperwork are common indicators of misinformation. In some cases, such claims are used to drive website traffic; in others, they may be linked to scams seeking personal or banking information.

How Americans Should Verify Payment Claims

Public finance experts advise Americans to take a careful and methodical approach when encountering claims about government payments, particularly those circulating on social media or through unofficial channels.

Key steps include:

- Confirming whether a payment is state-based or federal

- Identifying the administering agency by name

- Checking for official letters, emails, or public notices

- Avoiding unsolicited messages requesting Social Security numbers or bank details

Alaska residents expecting a dividend are advised to rely on official state correspondence and previously established application accounts. Residents of other states should look to direct communications from federal agencies rather than third-party summaries or viral posts.

Financial counselors also recommend monitoring bank statements carefully and reporting suspicious activity promptly, especially during high-volume payment periods at the end of the year.

The Broader Context

While $1000 December Deposits are real for a specific group of Americans, they highlight the fragmented nature of the U.S. benefits landscape. State-level dividends, federal tax credits, retirement benefits, and targeted assistance programs often operate independently and follow different calendars.

In Alaska, the dividend has become a cultural and economic fixture, influencing household budgeting and even local business activity. Economists have observed that dividend payments can temporarily boost consumer spending in the state, particularly in rural areas where cash income opportunities are limited.

By contrast, most other states do not have comparable programs tied to natural resource revenue. This difference can make Alaska’s payments appear unusual or misunderstood when discussed in national contexts.

Public policy researchers note that clearer communication and more precise headlines could reduce misunderstandings, particularly when state-specific programs are framed as national developments.

New Mexico Looks to Reduce SNAP Errors — Funding Request Sparks Debate

Historical Perspective: How the Alaska Dividend Became Unique

Alaska’s dividend program is often cited in academic and policy discussions as a rare example of a resource-based universal payment system. Unlike means-tested welfare programs, the dividend does not depend on income level. Every eligible resident receives the same amount.

Supporters argue that this universality simplifies administration and fosters broad public support. Critics, however, debate whether dividend payouts reduce funds available for public services such as education or infrastructure.

Over the years, lawmakers have adjusted formulas, delayed payments, or debated using dividend funds to address budget gaps. These debates reflect ongoing tension between individual payments and collective spending priorities.

Despite those debates, the dividend remains one of the most visible and widely recognized features of Alaska’s fiscal system.

FAQs About $1000 December Deposits

Are all Americans receiving $1000 December Deposits?

No. The payments apply only to eligible Alaska residents through a state dividend program.

Is this a federal stimulus check?

No. There is no approved federal stimulus payment scheduled for December.

Why December 18 specifically?

That date corresponds to a scheduled payment wave for previously approved Alaska dividend applicants.

Will there be additional payments in January?

Some applicants who complete verification later in the process may receive payments in early January, depending on administrative timing.

Does the payment affect federal taxes?

Dividend payments are generally considered taxable income at the federal level, though individual circumstances vary.