In Social Security in 2026, the highest possible monthly retirement benefit exceeds $5,200, marking the upper edge of a system designed to provide income security rather than full wage replacement. The figure reflects a combination of inflation adjustments, lifetime earnings, and delayed claiming, while also underscoring the widening gap between maximum benefits and what most retirees actually receive.

Although the headline number draws attention, it applies to a narrow slice of Americans with decades of consistently high earnings. For the majority of beneficiaries, monthly payments remain far closer to the national average, reinforcing Social Security’s role as a financial foundation rather than a complete retirement solution.

Social Security in 2026

| Key Fact | Detail |

|---|---|

| Maximum monthly benefit at age 70 | ≈ $5,251 |

| Maximum benefit at full retirement age | ≈ $4,152 |

| Average retired worker benefit | Slightly above $2,000 |

| Taxable earnings cap (2026) | $184,500 |

| Years used in benefit calculation | 35 highest earning years |

| Official Website | Social Security Administration |

How the Maximum Social Security Benefit Is Reached

Social Security calculates retirement benefits using a worker’s 35 highest-earning years, adjusted for wage growth across a lifetime. These earnings are converted into an average indexed monthly amount, which forms the basis for the final benefit calculation.

Only income subject to Social Security payroll taxes counts toward this total. In Social Security in 2026, earnings above the annual taxable cap of $184,500 do not increase future benefits, regardless of how high a worker’s salary climbs beyond that point.

This structure means that reaching the maximum benefit requires three rare conditions simultaneously: consistently high earnings, a long uninterrupted work history, and a strategic delay in claiming benefits.

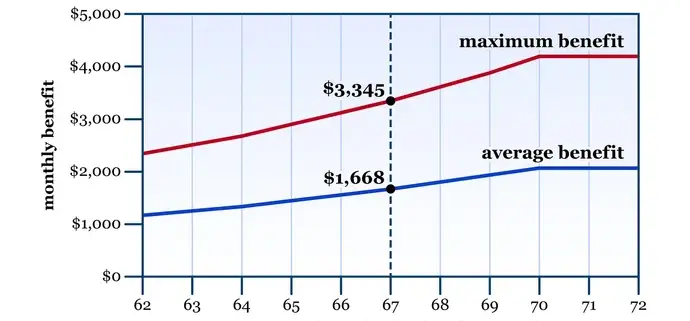

Why Claiming Age Matters For Social Security in 2026

Claiming age remains one of the most powerful — and often misunderstood — levers in determining benefit size. Workers may begin collecting benefits as early as age 62, but doing so permanently reduces monthly payments.

In contrast, delaying benefits beyond full retirement age earns delayed retirement credits, which increase benefits by roughly 8% per year until age 70. For high earners, this delay can add more than $1,000 per month to their eventual check.

In Social Security in 2026, the difference between claiming early and waiting until age 70 can exceed $2,000 per month, creating a lifetime gap that reaches hundreds of thousands of dollars for long-lived retirees.

Average Benefits Remain Far Lower

Despite the attention paid to maximum payouts, most retirees receive benefits that are substantially smaller. The average monthly retirement benefit in Social Security in 2026 is projected to hover just above $2,000.

That gap reflects both income inequality in the labor market and the program’s progressive benefit formula, which replaces a higher percentage of income for lower earners while limiting payouts for those with higher wages.

For many retirees, Social Security replaces roughly 30% to 40% of pre-retirement income, leaving households dependent on personal savings, pensions, or continued employment to maintain their standard of living.

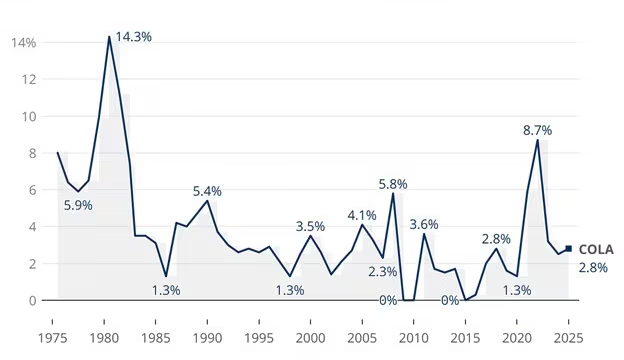

The Role of Cost-of-Living Adjustments

Annual cost-of-living adjustments (COLAs) are intended to preserve purchasing power by linking benefits to inflation. In Social Security in 2026, the adjustment reflects easing inflation compared with recent years, resulting in a more modest increase than those seen during periods of elevated price growth.

While COLAs apply equally to all beneficiaries, their real-world impact varies. Higher-income retirees may absorb rising costs more easily, while lower-income seniors often feel disproportionate pressure from increases in housing, utilities, and healthcare expenses.

Critics argue that the inflation index used to calculate COLAs does not fully reflect seniors’ spending patterns, a debate that continues to shape policy discussions.

Economic Pressures and Policy Context

Social Security in 2026 exists against a backdrop of demographic and fiscal challenges. Americans are living longer, birth rates remain lower than historical norms, and the ratio of workers to beneficiaries continues to shrink.

Without legislative action, these trends are expected to strain the program’s trust funds in the coming decade. Potential policy responses include raising payroll taxes, increasing the taxable earnings cap, adjusting benefits, or modifying eligibility ages.

While no immediate changes are scheduled, the long-term outlook remains a recurring issue in national economic debates.

Who Actually Reaches the Maximum Benefit

Only a small percentage of retirees qualify for the highest possible monthly check. These individuals typically share several characteristics:

- Decades of earnings at or near the taxable maximum

- Stable, uninterrupted employment histories

- Access to employer-sponsored retirement plans

- The financial flexibility to delay claiming benefits

In Social Security in 2026, these retirees are often professionals, executives, or business owners whose careers align with the program’s highest thresholds.

What Financial Experts Emphasize

Financial planners consistently caution against focusing solely on the maximum benefit. While delaying benefits increases monthly payments, it is not always the optimal choice.

Health status, family longevity, spousal benefits, employment plans, and other income sources all factor into the decision. For some households, claiming earlier and investing or using benefits strategically may produce better outcomes.

Experts emphasize that Social Security works best as part of a broader retirement strategy rather than as a standalone solution.

The Psychological Impact of ‘The Maximum’

The concept of a maximum benefit carries psychological weight. Headlines highlighting five-figure annual increases can create unrealistic expectations among workers who may never approach those levels.

In Social Security in 2026, policymakers and advocates alike stress the importance of realistic planning, emphasizing that the program’s primary mission is income stability, not wealth accumulation.

$2000 Payment Proposal: Who Might Qualify Under Trump’s Plan? Check Details

Looking Ahead

As 2026 approaches, beneficiaries will receive updated statements outlining their personalized benefit amounts. For most, the changes will be incremental rather than transformative.

While the maximum monthly check draws attention, the broader conversation surrounding Social Security in 2026 centers on sustainability, adequacy, and fairness — questions that will shape retirement security for decades to come.

FAQs About Social Security in 2026

What is Social Security in 2026?

It refers to the structure, benefit levels, and payment rules governing Social Security retirement benefits during the 2026 calendar year.

Can most workers reach the maximum benefit?

No. It requires decades of earnings at the taxable maximum and delaying benefits until age 70.

Does working longer always increase benefits?

Only if additional earnings replace lower-earning years among the top 35 used in the calculation.

Are benefits guaranteed to keep up with inflation?

Benefits include cost-of-living adjustments, but these may not fully offset all retiree expenses.