The Social Security Administration is sending out another round of monthly benefit payments on Wednesday, December 17, including checks of up to $5,108 for a small group of eligible retirees. The payments are part of the agency’s long-standing distribution schedule and reflect lifetime earnings, claiming age, and birth dates—not a special bonus or emergency relief.

Social Security Sends Payments Up to $5,108 on December 17

| Key Fact | Detail |

|---|---|

| Payment date | December 17 |

| Maximum monthly benefit | $5,108 |

| Eligibility group | Birth dates 11th–20th |

| Official Website | Social Security Administration |

Who Receives Social Security Payments on December 17

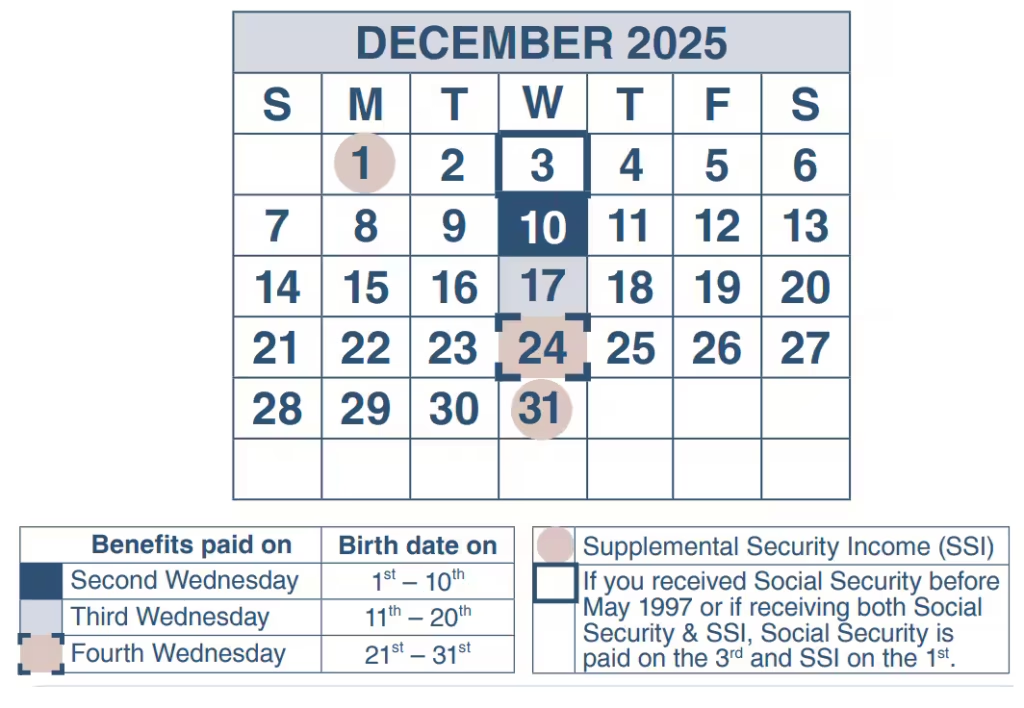

The December 17 payments apply to Social Security beneficiaries whose birthdays fall between the 11th and 20th of any month and who began receiving benefits after May 1997.

Under the Social Security Administration’s staggered system, payments are distributed over three Wednesdays each month to manage volume and ensure consistent processing. This system affects recipients of retirement benefits, Social Security Disability Insurance (SSDI), and survivor benefits.

Those who began receiving benefits before May 1997 generally receive payments on the 3rd of each month, regardless of birth date. Supplemental Security Income (SSI) recipients follow a separate payment schedule and are not part of this distribution.

The agency says the staggered approach reduces administrative strain and helps prevent delays for a program that serves more than 70 million Americans.

Why Some Social Security Payments Reach $5,108

The $5,108 figure represents the maximum monthly Social Security retirement benefit available in 2025. It is not a new payment, a stimulus check, or a temporary increase.

According to the Social Security Administration, reaching this level requires a rare combination of factors. Beneficiaries must have earned the maximum taxable income for Social Security purposes for at least 35 years and delayed claiming benefits until age 70.

Each year, Social Security adjusts the taxable earnings cap. Only income below that cap is subject to payroll taxes and counted toward future benefits. Workers who consistently earned at or above the cap accumulate the highest possible benefit credits.

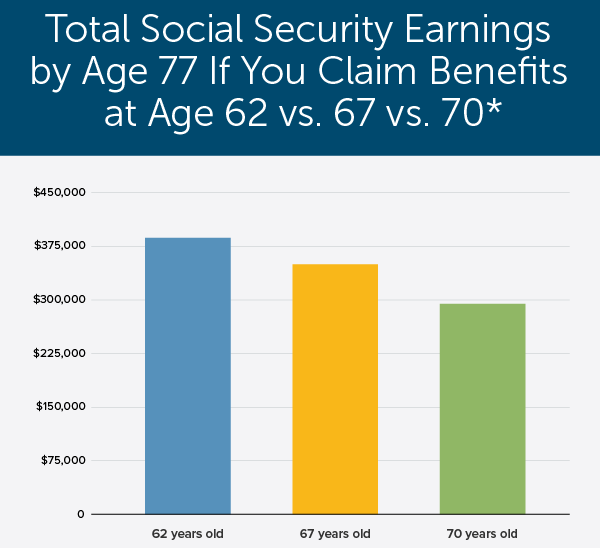

Delaying benefits beyond full retirement age results in delayed retirement credits, which permanently increase monthly payments. Claiming at age 70 yields the largest possible benefit under current law.

How Common Is the Maximum Benefit?

Despite widespread attention, only a small fraction of retirees receive the maximum Social Security payment.

SSA data show that most beneficiaries receive far less. The average monthly retirement benefit is slightly above $2,000, while many recipients—particularly women and lower-income workers—receive substantially less.

Experts note that long careers with uninterrupted high earnings are increasingly rare due to workforce changes, caregiving responsibilities, and economic disruptions.

“Social Security replaces only a portion of pre-retirement income for most workers,” said a retirement policy analyst at a U.S. research institute. “The maximum benefit is designed for a very specific earnings profile.”

How Social Security Calculates Monthly Benefits

Social Security benefits are based on a worker’s highest 35 years of inflation-adjusted earnings. If a worker has fewer than 35 years of earnings, years with zero income are included, lowering the benefit amount.

The formula is progressive, meaning lower earners receive a higher replacement rate relative to their wages than higher earners. This structure is intended to provide a stronger safety net for lower-income retirees.

Benefits are also adjusted annually through cost-of-living adjustments (COLAs), which are based on inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Understanding the December Payment Schedule

The Social Security Administration follows a predictable monthly calendar:

- Birth dates 1st–10th: second Wednesday

- Birth dates 11th–20th: third Wednesday

- Birth dates 21st–31st: fourth Wednesday

This system has been in place for decades and allows beneficiaries to anticipate payments well in advance.

The agency publishes its annual payment calendar publicly and advises recipients to rely on official SSA sources rather than social media posts or viral claims.

Clearing Up Common Misconceptions

The December 17 payments have generated confusion online, with some posts suggesting a special payout or holiday bonus. The Social Security Administration has repeatedly stated that no such program exists.

“These are standard monthly benefits paid according to the regular schedule,” the agency has said in public guidance. Any claims of surprise checks or limited-time bonuses should be treated with skepticism.

Consumer advocates warn that misinformation can create unrealistic expectations and make beneficiaries vulnerable to scams.

What to Do If a Social Security Payment Is Late

The Social Security Administration advises beneficiaries to wait at least three business days after the scheduled payment date before reporting a missing payment.

Most delays are related to banking or mail processing issues rather than SSA errors. Direct deposit remains the fastest and most reliable way to receive benefits.

Recipients can check payment status through their secure “my Social Security” online account or contact the agency directly if problems persist.

The Role of Social Security in Retirement Security

Social Security remains a cornerstone of retirement income in the United States. According to SSA data, about 40 percent of retirees rely on Social Security for at least half of their income, and roughly one in five depend on it for nearly all of their income.

As life expectancy increases and private pensions decline, the program’s role has become even more significant.

Economists note that while Social Security was never intended to replace all retirement income, it provides a stable, inflation-adjusted foundation that private savings alone often cannot guarantee.

Financial Planning Implications for Workers

The attention surrounding high Social Security payments highlights the importance of long-term planning.

Financial advisors generally recommend that workers view Social Security as one component of a broader retirement strategy, alongside employer-sponsored plans, personal savings, and other assets.

Decisions about when to claim benefits can have lasting consequences. Claiming early reduces monthly payments permanently, while delaying increases them but requires sufficient income in the interim.

Fraud Risks and How to Protect Benefits

The Social Security Administration warns that scammers often exploit payment cycles and headlines to target beneficiaries.

Common scams include phone calls or messages claiming payments are delayed, suspended, or require immediate verification. The agency emphasizes that it does not threaten beneficiaries or demand personal information through unsolicited communications.

Officials urge recipients to report suspected fraud to the SSA Office of the Inspector General.

The Long-Term Outlook for Social Security

Beyond monthly payments, the program faces long-term financial challenges. Trustees have warned that without legislative changes, the Social Security trust funds could face shortfalls in the coming decade.

Lawmakers from both parties have proposed various solutions, including adjusting payroll taxes, modifying benefits, or raising the taxable earnings cap. No consensus has yet emerged.

Policy analysts stress that changes are likely to affect future beneficiaries more than current retirees, but the debate underscores the program’s importance to the U.S. economy.

Tax Refunds Still Going Out in 15 States — Check If Your State Is on the List

Looking Ahead

The Social Security Administration will issue the next round of December payments later in the month to beneficiaries born between the 21st and 31st. January payments will follow the standard schedule unless adjusted for federal holidays.

For now, officials encourage beneficiaries to rely on official SSA communications and plan carefully around their expected payment dates.

FAQs About Social Security Sends Payments Up to $5,108 on December 17

Is the $5,108 Social Security payment a one-time check?

No. It is the maximum monthly retirement benefit under current rules.

Do SSDI recipients receive the same maximum?

No. SSDI benefits are calculated differently and typically fall below the retirement maximum.

Does delaying benefits always make sense?

Not necessarily. The best claiming age depends on health, income needs, and life expectancy.