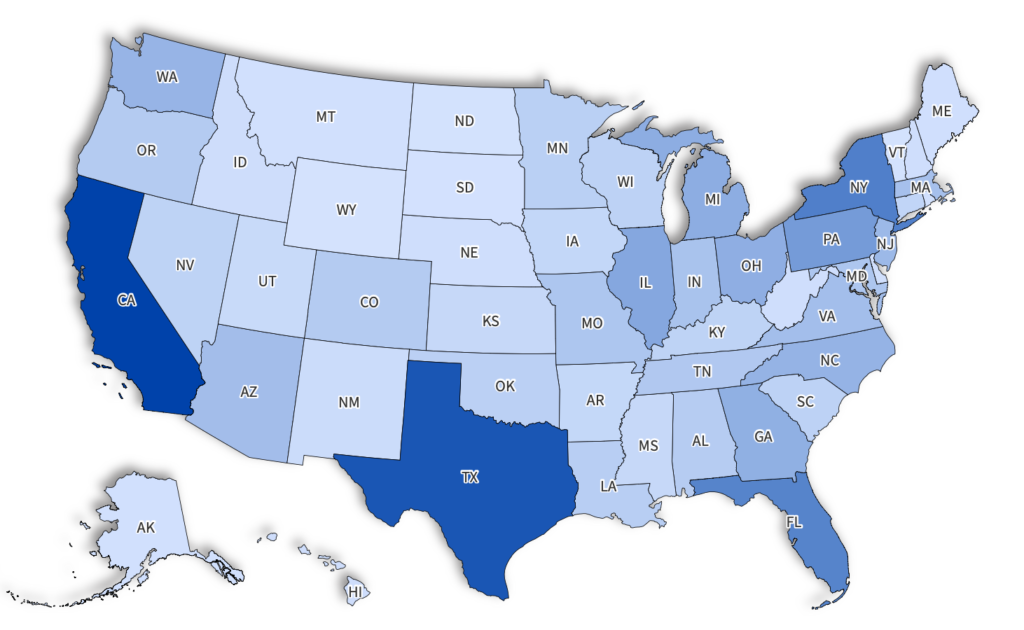

Several U.S. states are still issuing tax refunds and targeted rebate payments as the end of 2025 approaches, according to state revenue agencies and recent fiscal reports. The payments, which include refunds, statutory rebates, and inflation-related relief measures, aim to return surplus funds or support households facing higher living costs. Officials in all 15 states say most distributions will conclude by late December, though some programs may extend into early 2026.

Tax Refunds Still Going Out in 15 States

| Key Fact | Detail / Statistic |

|---|---|

| States issuing payments | 15 |

| Most widely distributed program | Alaska Permanent Fund Dividend |

| Main reasons for payments | Surpluses, inflation relief, delayed processing |

State officials say refund activity will continue through December and, in some cases, into early 2026. Legislative reviews in several states may determine whether similar payments will recur in future budget cycles, especially if economic conditions shift.

Why Fifteen States Are Still Sending Out Tax Refunds

Fifteen states continue distributing tax refunds and rebate payments due to statutory obligations, budget surpluses, and expanded relief initiatives. The timing varies widely, and while some states issue refunds throughout the year, others are processing final batches caused by earlier delays in verification or system updates.

A spokesperson for the Colorado Department of Revenue said the most recent Taxpayer’s Bill of Rights payments “reflect higher-than-expected revenue collections that must be returned under the state constitution.” The department added that additional identity checks caused slower-than-normal processing periods.

Several states are also completing relief programs introduced during periods of elevated inflation. These measures were crafted to offset higher consumer costs in energy, groceries, and housing, according to the National Association of State Budget Officers (NASBO).

Economic Conditions Behind the Continuing Payments

Many states recorded stronger-than-expected revenue collections following the pandemic-era economic rebound. Sales tax revenues rose as consumer spending increased, and income tax collections remained resilient in several states with strong job markets.

According to a report from the Pew Charitable Trusts, more than 30 states experienced surpluses over the last three years, though the scale varied. In 2025, 15 of those states chose to distribute a portion of their excess revenue to residents through rebates.

Dr. Julia Harlan, a senior economist at the Brookings Institution, said the combination of workforce recovery and federal stimulus during the pandemic allowed states to “build cushions that now support rebate programs despite slowing revenue growth in 2025.”

However, she cautioned that states may not see the same level of surpluses in 2026 if economic conditions cool further.

Breakdown of Active Payments in Each State

Below is a concise summary of ongoing payments in key states.

California

Processing continues for residents whose Middle Class Tax Refund filings required manual review or corrected information. Payments range from $200–$1,050 depending on income and dependents.

Alaska

The Permanent Fund Dividend, funded by oil revenue, continues disbursements. This year’s PFD is approximately $1,525 per eligible resident.

Colorado

TABOR refunds remain underway. Payments vary but typically fall between $400 and $1,000.

Florida

Homeowner-focused property tax rebates still being issued, targeting households facing rising insurance and housing costs.

Georgia

“Excess tax refund” distributions continue for eligible filers due to surplus revenues.

Minnesota

Payments tied to 2023 tax law changes continue as the state updates verification systems for expanded credits.

Other Participating States

Rebate or refund activity is also confirmed in:

- South Carolina

- Idaho

- New Mexico

- New Jersey

- Illinois

- Massachusetts

- Virginia

- Montana

- Arizona

Each state offers different eligibility rules, often tied to residency, income, or filing status.

How Residents Can Track Their Refunds

Each state maintains a “Where’s My Refund?” portal — though requirements differ.

Most require:

- Social Security Number

- Filing year

- Exact refund amount

The Internal Revenue Service (IRS) advises residents to verify state contacts before responding to emails or texts claiming to provide refund updates.

An IRS spokesperson noted, “State refund timelines vary significantly, especially where new fraud-prevention systems are in place.”

Refunds vs. Rebates: Understanding the Difference

Tax refunds represent money owed to taxpayers after overpayment. Rebates, however, are tools used by states to return revenue surpluses, encourage spending, or counter economic pressures.

Dr. Anya Sharma, a public finance scholar at the University of Michigan, said, “Refunds reflect taxpayer overpayment. Rebates are policy instruments tied to larger budget decisions. Understanding this helps residents see why payments differ from year to year.”

Who Benefits Most From the Tax Refunds Payments

Analysts say most benefits go to:

- Low- to middle-income households

- Families with dependents

- Homeowners in high-cost regions

- Rural residents who faced elevated fuel or energy prices

A study from the Urban-Brookings Tax Policy Center found that rebates issued between 2022 and 2024 reduced financial strain for households with incomes under $75,000 more than any other demographic.

Criticisms and Concerns From Economists and Lawmakers

Some lawmakers argue that rebates may worsen inflation by boosting consumer spending. Others say states should invest surpluses in infrastructure, education, or long-term reserves.

In Massachusetts, several legislators said returning funds too quickly could undermine future budget planning. In contrast, governors in Alaska, Georgia, and Colorado argue that state laws or voter mandates leave little discretion over how surpluses must be distributed.

Economist Dr. Harlan added that while rebates provide tangible relief, “their long-term impact on economic stability depends on broader fiscal policy choices.”

Fraud Prevention and Public Guidance

States are warning residents to be cautious about unsolicited texts or emails regarding tax refunds.

Common fraud tactics include:

- Fake refund tracking links

- Requests for banking information

- Impersonation of state tax officials

Officials urge residents to access refund portals only through government websites and to avoid responding to messages requesting personal data.

Texas SNAP Benefits: Payment Window for December 15–21 – Check Eligibility Criteria

What States Expect in 2026

Most analysts expect fewer or smaller rebates in 2026 as state revenues normalize. However, several legislatures may revisit rebate laws or consider new automatic refund mechanisms tied to future surplus thresholds.

The National Conference of State Legislatures (NCSL) predicts that only a handful of states will maintain robust refund programs without policy changes.

FAQs About Tax Refunds Still Going Out in 15 States

Are these payments taxable?

Most refunds are not taxable, but certain rebates may be. Residents should refer to IRS annual guidance.

Can late filers still receive payments?

Yes, if they meet state eligibility rules. Processing times may be longer.

Do these refunds affect federal taxes?

Generally no, unless the refund represents a deduction previously claimed.

What causes delays in receiving payments?

Verification checks, identity confirmation, outdated bank information, or high processing volume.

How can residents avoid scams?

Use only official state websites and never share personal information through unsolicited messages.