The $2000 payment proposal championed by former President Donald Trump has revived a national debate over federal financial relief and the government’s economic priorities. The administration has framed the proposed checks as a “tariff dividend,” suggesting they would be funded entirely through expanded import duties rather than conventional taxpayer revenue. While officials have outlined preliminary ideas for eligibility, the proposal remains conceptual and will require congressional approval before moving forward.

$2000 Payment Proposal

| Key Fact | Detail |

|---|---|

| Payment amount | Proposed $2,000 per eligible adult |

| Funding mechanism | Revenue from expanded U.S. tariffs on imported goods |

| Eligibility concept | Middle- and lower-income households; high-income earners excluded |

| Legislative status | Not approved; awaiting congressional debate |

| Economic risks | Tariff revenue volatility; inflationary pressure |

Understanding the $2000 Payment Proposal

The administration’s vision for a tariff dividend represents a departure from traditional federal relief programs. Instead of drawing on general tax revenue or deficit spending, the White House argues the payments would redirect funds collected from higher import tariffs. During a December press briefing, a senior official said the plan aims to “return value to American families who bear the cost of foreign competition.”

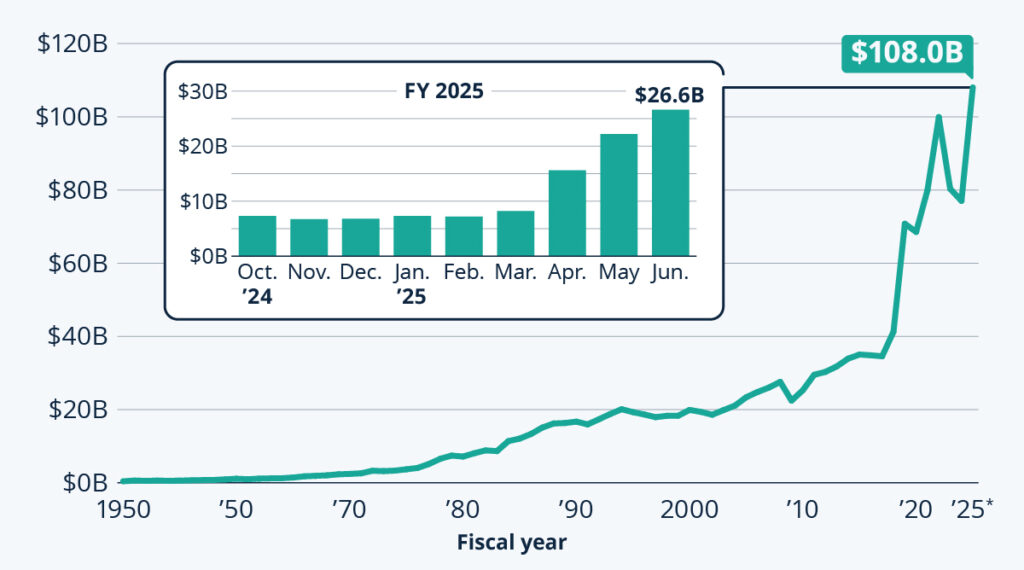

Independent trade economists are divided. A 2025 analysis by the Peterson Institute for International Economics found that tariff revenue varies widely depending on consumer demand and global supply chains. “This makes it difficult to guarantee stable, recurring payments based solely on tariff receipts,” the report concluded.

Who Could Qualify Under the Tariff Dividend Plan

Income Thresholds Under Consideration

The Treasury Department has discussed eligibility models that resemble prior stimulus checks, according to summaries provided to Reuters and ABC News. These models prioritize middle- and lower-income households, potentially using the following thresholds:

- Individuals earning under $75,000

- Heads of household earning under $112,500

- Married couples earning under $150,000

Dr. Elena Martinez, an economist with the Brookings Institution, said these thresholds are “administratively straightforward” and likely to appear in any final legislation because they mirror past federal relief rules.

“These income bands are familiar to policymakers and the Internal Revenue Service (IRS),” Martinez said. “That alone makes them appealing during negotiations.”

Additional Criteria Likely to Be Included

Although the administration has not issued a formal eligibility document, several rules typically accompany federal relief programs:

- U.S. citizens and legal permanent residents only

- Valid Social Security number

- Recent tax return on file with the IRS

- Potential exclusion for individuals with significant unpaid federal tax debt

A Treasury adviser, speaking anonymously to The Wall Street Journal, said future drafts may also consider phaseout reductions for earners slightly above the primary income thresholds.

How the Trump Plan Compares to Past Federal Payments

The U.S. government has issued direct payments during previous economic disruptions, most notably:

- 2001 tax rebate checks (President George W. Bush)

- 2008 Economic Stimulus Act payments

- 2020–2021 pandemic-era relief checks under both the Trump and Biden administrations

Unlike those programs—funded through deficit spending—the current Trump plan is tied to tariff revenue. Dr. Liam Cho, a trade specialist at the University of Michigan, argues that this connection makes the proposal “more politically symbolic than financially stable.”

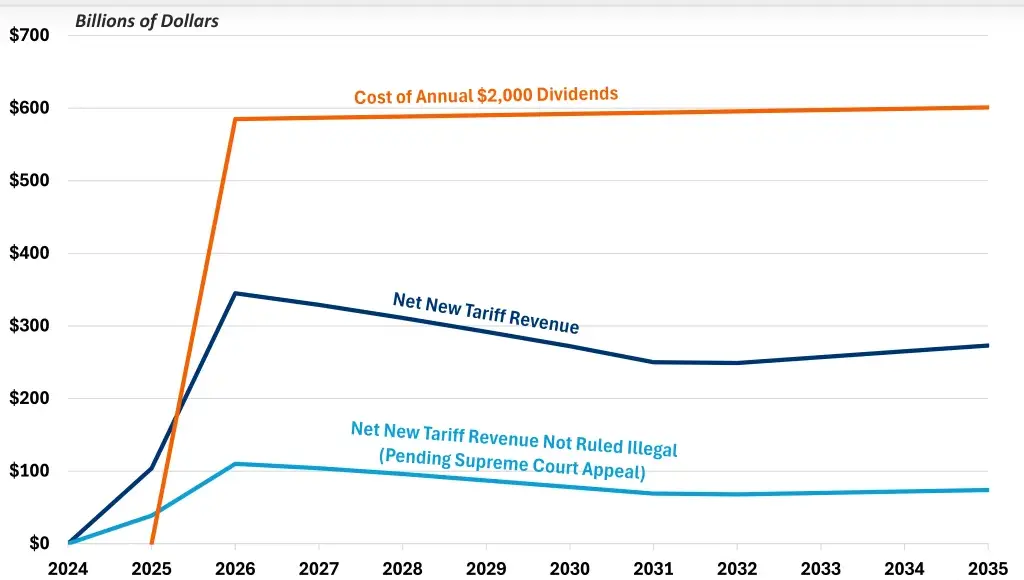

“Tariffs rise and fall with the volume of imported goods,” Cho said. “If imports decline, so does the funding for these checks.”

Historic data supports this concern. During trade slowdowns between 2019 and 2020, tariff revenue fell by nearly 20%, raising questions about how payments would fare during economic contractions.

Economic Implications and Expert Opinions

Economists have expressed strong, often conflicting views.

Supporters’ Perspective

Supporters argue that a tariff-financed rebate could:

- Offset higher consumer costs caused by tariffs

- Provide targeted support to working households

- Encourage domestic manufacturing by reducing reliance on imports

A White House spokesperson said the plan aims to “create a self-reinforcing cycle of economic strength,” although details of that mechanism remain unclear.

Critics’ Perspective

Concerns focus on three primary risks:

- Tariff-driven inflation

Import taxes raise prices for consumer goods, affecting low-income households most. The Consumer Federation of America warned in a recent brief that such inflation “would likely erode much of the dividend’s value.” - Revenue instability

If tariffs discourage imports, revenue decreases—even as the cost of maintaining dividend payments remains constant. - Trade retaliation

Other nations may impose counter-tariffs, harming U.S. exporters and potentially reducing revenue sources.

Dr. Aisha Grant, a policy director at the Council on Foreign Relations, said these factors create a “fragile policy foundation.”

Administrative Capacity and IRS Preparedness

Past stimulus distributions exposed challenges within the IRS, including outdated technology and delays in processing returns. A 2024 report from the Government Accountability Office (GAO) found that the agency still struggles with backlogs and staffing shortages.

If Congress approves the tariff dividend, the IRS would need to:

- Process millions of payments within weeks

- Update systems to track tariff-funded accounts

- Coordinate with the Treasury Department on funding releases

IRS Commissioner Daniel Werfel has not commented publicly on the proposal but has acknowledged that “any large-scale payment program requires months of advance planning.”

Political Landscape and Legislative Pathway

Congress holds the decisive role in determining whether the $2000 payment proposal advances. Current political signals point to a challenging but possible path.

Republican Caucus Tension

Fiscal conservatives question the sustainability of tariff-funded payments.

Representative Mark Hollins (R-UT) said the idea “demands rigorous budget scoring” before being considered.

Democratic Position

Democrats appear open to new economic relief but oppose tariffs as the funding mechanism.

Senator Maria Lewis (D-CA) said the plan “risks raising prices for working families while offering them a check that may not cover the difference.”

Likely Legislative Scenarios

| Scenario | Likelihood | Outcome |

|---|---|---|

| Full $2,000 annual payment passes | Low | Requires bipartisan support unlikely under current revenue levels |

| One-time $2,000 payment | Moderate | Could pass as part of a broader economic bill |

| Scaled-down dividend (e.g., $500–$1,000) | High | More consistent with current tariff revenue |

| Proposal stalls | Moderate | If budget estimates show significant shortfalls |

Public Opinion and National Response

A December 2025 survey by the Pew Research Center found:

- 52% of Americans support the idea of a $2,000 payment

- 44% worry tariffs may increase consumer prices

- 60% are unsure whether tariff revenue alone can finance such a program

The survey also found a sharp partisan divide, with strong support among Republican voters and mixed reactions among independents.

Global Context: Have Other Countries Tried Dividend Models?

Several nations have experimented with dividend or rebate-style programs funded by natural resources or trade revenue:

- Alaska issues annual Permanent Fund dividends, financed by oil revenue.

- Hong Kong distributed consumer vouchers during economic contractions, funded by general reserves.

However, no major country has relied solely on tariff revenue for household payments. Trade analysts argue this makes the U.S. plan a “policy outlier” with unpredictable outcomes.

January 2026 SNAP Schedule: State-by-State Deposit Dates Released – Check Details

What Comes Next After $2000 Payment Proposal?

Congress is expected to hold preliminary hearings early next year.

The administration continues to urge swift action, but lawmakers have signaled that cost estimates and economic modeling must come first.

As the debate unfolds, the $2000 payment proposal remains a high-profile yet uncertain component of the national economic agenda. Whether it evolves into a one-time payment, an annual dividend, or stalls entirely will depend on legislative negotiations and future tariff collections.

FAQs About $2000 Payment Proposal

Is the $2000 payment approved?

No. Congress has not passed any legislation authorizing the payments.

Who is most likely to qualify?

Middle- and lower-income households based on IRS income data. Final criteria are still pending.

Will the payments recur annually?

Unclear. The White House has suggested recurring dividends, but revenue levels may not support them.

Could tariffs raise prices?

Yes. Most economists agree tariffs increase consumer prices, though supporters argue the dividend offsets this effect.