The 90% VA Disability COLA Increase 2026 will raise monthly compensation for millions of veterans beginning in January, following a 2.8 percent Cost-of-Living Adjustment set by the Social Security Administration. The increase reflects year-over-year inflation trends and aims to help veterans maintain purchasing power as essential expenses climb. The Department of Veterans Affairs confirmed that the adjustment will apply automatically to all eligible beneficiaries.

90% VA Disability COLA Increase in 2026

| Key Fact | Detail |

|---|---|

| 2026 COLA Rate | 2.8% increase for federal benefits |

| New Monthly Payment (90% rating, no dependents) | ~$2,362.30 |

| First Payment at New Rate | Early January 2026 |

Understanding the 90% VA Disability COLA Increase 2026

The federal Cost-of-Living Adjustment ensures that long-term government benefits keep pace with rising consumer prices. For 2026, the Social Security Administration (SSA) announced a 2.8 percent COLA, calculated according to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This measure tracks price changes in goods such as food, fuel, utilities, and healthcare.

The Department of Veterans Affairs (VA) is required by law to apply the same adjustment to its disability compensation program. VA officials said the alignment protects beneficiaries from the erosion of purchasing power during periods of sustained inflation.

“COLA is a safeguard against economic volatility,” said Dr. Michael Caldwell, an economist at the University of Michigan who studies federal benefit programs. “Without annual adjustments, fixed-income recipients would face significant hardship as costs rise.”

How the COLA Adjusts VA Disability Payments

New Rate for a 90 Percent Disability Rating

A veteran rated at 90 percent disability will receive approximately $2,362.30 per month starting with the January 2026 payment cycle. This reflects an increase of slightly more than $64 compared with the previous year. Veterans who qualify for additional allowances—such as Aid and Attendance, Special Monthly Compensation, or dependents’ benefits—will receive proportionally higher compensation.

The VA noted that updated payment charts will remain publicly available on VA.gov to allow beneficiaries, family members, and financial advisors to calculate expected income.

Eligibility Criteria for the 2026 COLA Increase

Automatic Benefit Adjustment

No action is required from veterans to receive the increase. Any veteran with a service-connected disability rating of 10 percent or higher will automatically see the new rate applied. This includes individuals who also receive additional benefits for dependents or secondary conditions.

According to a VA spokesperson, “COLA adjustments are fully automated. Veterans do not need to submit forms, call support lines, or request a recalculation. The system updates on a national schedule.”

Why Automatic Eligibility Matters

Automatic eligibility reduces administrative burden and ensures timely delivery of benefits. Dr. Rebecca Mann, a policy analyst with the Rand Corporation, said automation helps prevent delays common in other benefit systems.

“Many veterans live on fixed incomes,” she said. “Ensuring that adjustments occur seamlessly is key to protecting financial stability.”

When Veterans Will Receive the Updated Payments

While the updated rate technically takes effect on December 1, 2025, the first payment that reflects the 2026 increase will arrive in early January 2026, coinciding with VA’s regular monthly disbursement schedule.

Banks may process direct deposits on different timelines, though the VA stated that it expects no delays. Historically, COLA-adjusted payments have been delivered on time, except during rare systemwide disruptions or national emergencies.

Why the 2026 COLA Increase Matters for Veterans

Impact of Inflation on Essential Goods

Inflation has raised costs in nearly every consumer category, including housing, healthcare, insurance, and energy. According to SSA data, rising medical expenses were a significant factor in the 2026 COLA calculation.

Veterans with chronic medical conditions—especially those requiring ongoing care, medication, or assistive devices—are more affected by rising healthcare costs than the general population. COLA increases help offset some of these pressures, though experts warn they may not fully compensate for regional price variations.

Veterans’ Advocacy Groups Respond

Organizations such as the Disabled American Veterans (DAV) and the Veterans of Foreign Wars (VFW) welcomed the increase but emphasized the need for deeper structural reforms.

In a written statement, DAV National Commander Nancy Espinoza said, “COLA increases are essential, but many veterans still face rising healthcare and housing costs that outpace inflation. We continue to urge Congress to strengthen long-term support systems.”

Broader Economic Context Influencing the COLA Rate

How CPI-W Determines COLA

The Consumer Price Index–Wage Earners (CPI-W) is the benchmark used to determine annual COLA adjustments. It measures the average price changes in goods and services over time in urban areas. The SSA calculates COLA by comparing the CPI-W figures from the third quarter of the previous year with the third quarter of the current year.

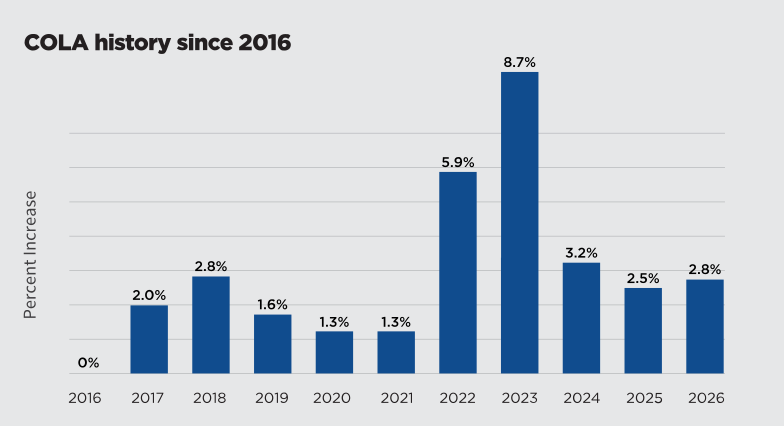

Historical Perspective on COLA Trends

Over the past decade, COLA rates have fluctuated significantly:

- 2021: 1.3%

- 2022: 5.9%

- 2023: 8.7% (highest in four decades)

- 2024: 3.2%

- 2025: 3.0%

- 2026: 2.8%

Economists attribute recent declines to stabilizing inflation rates after the pandemic-era spikes.

How Veterans Can Confirm Their New Payment Amount

VA Account Notifications

Veterans can verify their new monthly amount by logging into their account on VA.gov or the My HealtheVet portal. The VA typically posts updated payment information prior to the first January disbursement.

Bank Statements and Direct Deposit

Most veterans receive benefits through direct deposit. Banks will display the updated amount in the January 2026 transaction history. Veterans who rely on mailed paper checks should expect delivery on the standard schedule unless delays occur.

When to Contact VA Support

Veterans should contact the VA only if:

- Their January payment amount does not reflect the COLA adjustment.

- Payments are delayed beyond one business day of the expected date.

- Personal information such as address or bank account details are outdated.

Additional Financial Considerations for Veterans in 2026

Tax Implications

VA disability compensation remains non-taxable under federal law. The COLA increase does not alter this status. Financial advisors recommend that veterans verify tax obligations for any additional income sources, but VA disability benefits do not affect federal tax brackets.

Interaction With Other Federal Programs

Veterans receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) will also receive the 2.8 percent COLA increase. However, because VA disability compensation is not considered earned income, it does not reduce eligibility for most federal assistance programs.

Impact on State Benefits

Several states offer tax exemptions, property tax reductions, or reduced vehicle registration fees for disabled veterans. These programs may use the veteran’s disability rating or adjusted income thresholds. Veterans should verify eligibility updates through their state’s Department of Veterans Affairs.

Alaska’s December PFD: Final $1,000 Deposit Arrives on the 18th — Check Eligibility Criteria

Forward-Looking Considerations

Analysts expect moderate COLA increases in the coming years, depending on inflation trends and economic conditions. The Congressional Budget Office has projected steady, though not dramatic, increases in consumer prices through 2027.

Federal agencies will release updated benefits data later this year, providing veterans with more precise payment projections for 2026. Until then, veterans’ advocacy organizations encourage beneficiaries to review their budgets and plan for potential cost changes.

FAQs About 90% VA Disability COLA Increase in 2026

Q: Do I need to apply for the COLA increase?

No. The VA applies COLA increases automatically to all eligible disability payments.

Q: Does the 2.8% rate apply to every disability rating?

Yes. The COLA percentage applies uniformly, though total monthly benefit amounts differ by rating and dependents.

Q: When does the increase take effect?

The adjustment takes effect on December 1, 2025, but the first payment at the new rate arrives in January 2026.

Q: What if my payment is incorrect?

Veterans should contact the VA directly or consult a Veterans Service Organization for assistance.

Q: Will my payments for dependents increase as well?

Yes. Dependents’ allowances rise by the same COLA percentage.