The U.S. Social Security Administration (SSA) is preparing for an increase in SSDI in 2026 applications as updated eligibility criteria and documentation standards take effect nationwide. Federal officials say the changes aim to streamline evaluations, though advocates warn the revised disability claim process may pose challenges for first-time applicants. The updates coincide with rising disability filings and backlogs across several states.

SSDI in 2026

| Key Fact | Detail / Statistic |

|---|---|

| Expected rise in SSDI applications | SSA projects growth due to aging workforce and chronic illness trends |

| Median SSDI review time | About 7–9 months depending on state workloads |

| Minimum work credits for most adult applicants | Typically 40 credits, with 20 earned in the past decade |

SSA officials say they will continue to evaluate administrative reforms throughout 2026 as caseloads fluctuate. The agency plans to release updated performance metrics later in the year, offering a clearer picture of how the revised system affects applicants nationwide.

Understanding SSDI in 2026: New Requirements and Persistent Challenges

The federal government’s administration of Social Security Disability Insurance (SSDI) continues to evolve, reflecting demographic shifts and updated program guidelines. Officials say the 2026 framework reinforces the SSA’s long-standing goal: ensuring benefits reach individuals with severe and long-term impairments who meet clearly defined eligibility criteria.

What Has Changed in SSDI in 2026

The SSA has revised several administrative rules to modernize the disability evaluation system. According to federal policy notices, these updates focus on improving medical evidence requirements, refining the definition of substantial gainful activity, and adjusting the earnings threshold needed to earn annual work credits.

Modernized Medical Evidence Standards

SSA guidance states that applicants must now provide more comprehensive medical documentation, including diagnostic results, clinician treatment notes, and functional assessments. The agency says these updates are intended to improve accuracy and reduce appeals.

Adjusted Work Credit Thresholds

The cost of a single work credit rises annually based on national wage data. In 2026, the threshold requires higher earnings than previous years, affecting how quickly workers accumulate credits needed to qualify. Policy analysts at the Urban Institute say this adjustment reflects inflation and wage growth trends but may place added pressure on low-income workers.

Broader Social and Economic Forces Behind the 2026 Changes

While the SSA has emphasized administrative modernization, economists note that broader structural forces have shaped the upcoming shift in SSDI in 2026.

Aging Workforce and Chronic Illness Trends

Researchers at the National Institutes of Health report a steady increase in long-term disability linked to cardiovascular disease, autoimmune disorders, and post-viral syndromes. These conditions disproportionately affect Americans over 50 — a demographic projected to make up nearly half of SSDI applicants by 2026.

Dr. Lena Martinez, a public health analyst at Johns Hopkins University, said in an interview, “The disability system is seeing the downstream effects of chronic illness patterns that began more than a decade ago.”

Regional Disparities in Approval Rates

Data compiled by disability advocacy groups show notable differences in approval rates across states. Southern and Midwestern states continue to report higher denial rates, driven in part by limited access to specialists and slower medical record retrieval systems.

How the Disability Claim Process Works in 2026

Applying for SSDI remains a multi-stage process designed to evaluate medical severity, work history, and functional limitations. The SSA continues to accept applications online, by phone, and in person.

Initial Review and Documentation

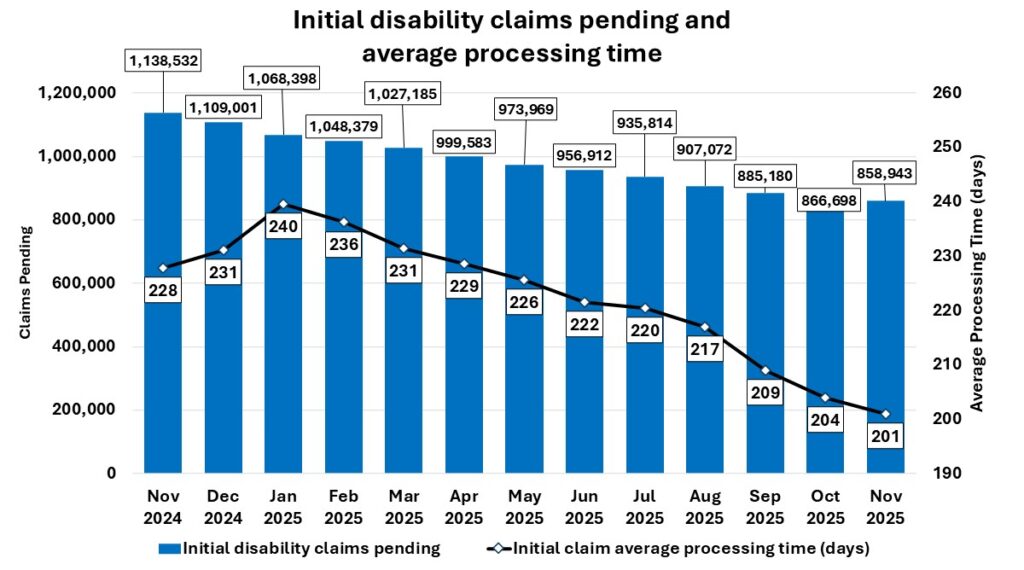

During the initial review, Disability Determination Services (DDS) examiners assess medical records, employment history, and administrative forms. According to SSA performance reports, this stage accounts for the longest delays, especially in states experiencing staffing shortages.

Appeals and Hearing Backlogs

If a claim is denied, applicants may request reconsideration and, if necessary, a hearing before an administrative law judge. Legal assistance groups report that hearing wait times can exceed one year in areas with heavy caseloads. Advocates say early documentation accuracy remains the strongest factor in avoiding appeals.

The Human Impact — Applicant Experiences

Applicants and advocacy organizations say the disability claim process remains emotionally and financially taxing, despite SSA efforts to improve transparency.

Voices From the Field

“I waited nearly 14 months for my hearing,” said Michael Avery, a former construction worker from Ohio who applied after developing a severe spinal injury. “The process is overwhelming, especially when you’re too sick to work.”

Advocacy attorneys say experiences like Avery’s are common, particularly for applicants without legal representation.

The Role of Representatives

Legal experts note that representation can significantly improve the likelihood of approval during appeals. According to the Government Accountability Office, applicants with attorneys are nearly three times more likely to receive benefits after a hearing.

Who Qualifies Under the 2026 Eligibility Criteria

The SSA’s definition of disability remains unchanged: the condition must be severe, medically determinable, and expected to last at least 12 months or result in death. Eligibility also requires sufficient work credits earned through wages subject to Social Security taxes.

Medical Severity and Functional Limits

Federal guidelines state that the SSA evaluates how an impairment affects daily functioning and work capacity. Conditions ranging from neurological disorders to advanced musculoskeletal injuries remain among the most frequently approved categories.

Work History Requirements

Most adult applicants need long-term employment histories reflecting at least 40 credits. Younger workers may qualify with fewer credits depending on the age at which disability begins. SSA officials emphasize that these standards exist to preserve the insurance-based nature of the SSDI program.

Financial Implications for Applicants and Households

Payments under SSDI vary based on lifetime earnings, yet many beneficiaries remain near or below the federal poverty level. Economists note that inflationary pressures in 2026 are widening the gap between benefit levels and living costs.

Cost-of-Living Adjustments (COLA)

The SSA applies an annual COLA based on consumer price index data. While COLA increases help offset rising expenses, advocates argue they lag behind real-world costs for housing, food, and healthcare.

Impact on Families

Families relying on SSDI benefits often face financial strain. Benefits for dependents remain available, though these allocations are capped by the SSA’s family maximum formula. Policy researchers say these limits create challenges for single-parent households in particular.

Expert Perspectives on the 2026 Outlook

Public policy researchers note that SSDI reforms arrive at a time of increased applications linked to long-term illness trends, including post-viral conditions and aging workforces. Analysts at the Brookings Institution say that while the updates aim to reduce inconsistencies, further investments in staffing and technology will be required to meaningfully speed up the disability claim process.

Advocacy organizations, including the National Organization of Social Security Claimants’ Representatives (NOSSCR), warn that the stricter documentation rules may burden applicants lacking access to comprehensive healthcare.

December Social Security Schedule: Who Will Receive Two Checks Before the Month Ends

Technology and Automation in SSDI Evaluations

SSA has begun experimenting with automated systems to help process medical files and verify earnings histories more quickly.

Benefits and Concerns

Officials say these tools could reduce clerical errors, though civil liberties groups warn of risks related to algorithmic bias and transparency. A 2025 report from the National Academy of Social Insurance recommended strict oversight as automation expands.

Modernizing Communication

The SSA is also piloting improved digital dashboards to help applicants track case updates. Early feedback suggests these tools may reduce uncertainty for claimants waiting months for decisions.

FAQs About SSDI in 2026

What is the biggest change to SSDI in 2026?

The most significant updates involve expanded medical evidence requirements and revised work credit thresholds that reflect national wage changes.

How long does an SSDI application take in 2026?

Processing typically ranges from 7 to 9 months, though appeals can extend the timeline significantly, depending on state workloads.

Can younger workers still qualify?

Yes. SSA rules allow younger applicants to qualify with fewer work credits if their disability began early in their careers.