Americans preparing to retire in 2026 are facing important decisions about how their Social Security check will be calculated and what factors could influence their final benefit. The Social Security Administration (SSA) uses a detailed formula based on lifetime earnings, age at filing, and inflation adjustments. Experts say understanding these elements can help retirees make informed financial plans as the retirement landscape shifts.

Planning to Retire in 2026

| Key Fact | Detail / Statistic |

|---|---|

| 2026 Cost-of-Living Adjustment (COLA) | Forecasts point to modest increases based on inflation trends |

| Average Monthly Benefit (2025 baseline) | $2,008.31 for retired workers |

| Benefit Reduction for Early Filing | Up to 30% if claiming at 62 |

| Years Used in Calculation | 35 highest-earning years, inflation-adjusted |

As retirement approaches for many Americans in 2026, experts say the best strategy involves early planning, realistic expectations, and careful use of available tools. “The more informed you are,” Dr. Munnell said, “the better positioned you’ll be to make confident decisions about your retirement future.”

How the SSA Will Calculate a Social Security Check if You Are Planning to Retire in 2026

The Social Security Administration determines Social Security benefits by reviewing a worker’s 35 highest-earning years and adjusting each year for wage inflation. These earnings are used to create the Average Indexed Monthly Earnings (AIME), which forms the basis of every benefit calculation.

The SSA then applies a progressive formula using “bend points,” which assign different percentage values to segments of income. These bend points change annually to reflect national wage growth.

Why 2026 Retirees Face a Unique Calculation Environment

Economists say workers retiring in 2026 may see the effects of wage fluctuations from both the pandemic period and the post-pandemic rebound. Dr. Alicia Munnell of Boston College’s Center for Retirement Research noted that “retirement planning now requires a close look at earnings volatility, inflation risk, and the timing of benefit claims.”

The Impact of Filing Age on the 2026 Social Security Check

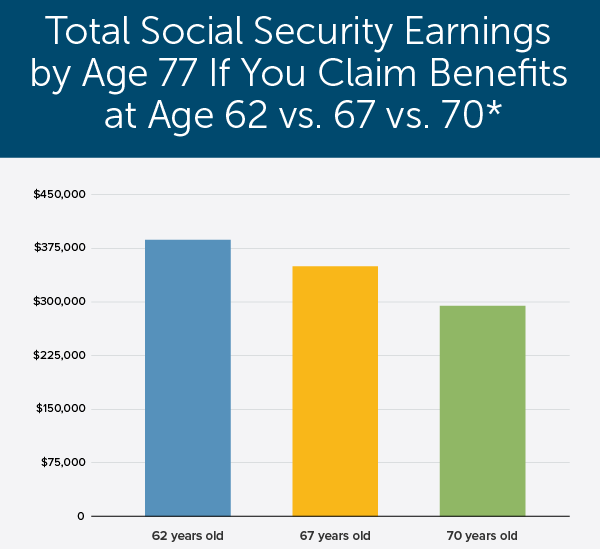

Age at filing is one of the most important factors in retirement planning. According to the SSA, retirees who file at age 62 may see their monthly benefit reduced by up to 30%. Filing at Full Retirement Age (67 for most Americans born after 1960) avoids a reduction.

Delaying Benefits Past FRA

Delaying benefits beyond Full Retirement Age earns delayed retirement credits, increasing payments by about 8% per year until age 70. SSA data shows that those who wait until 70 often receive the highest monthly benefit, though total lifetime payments depend on health and longevity.

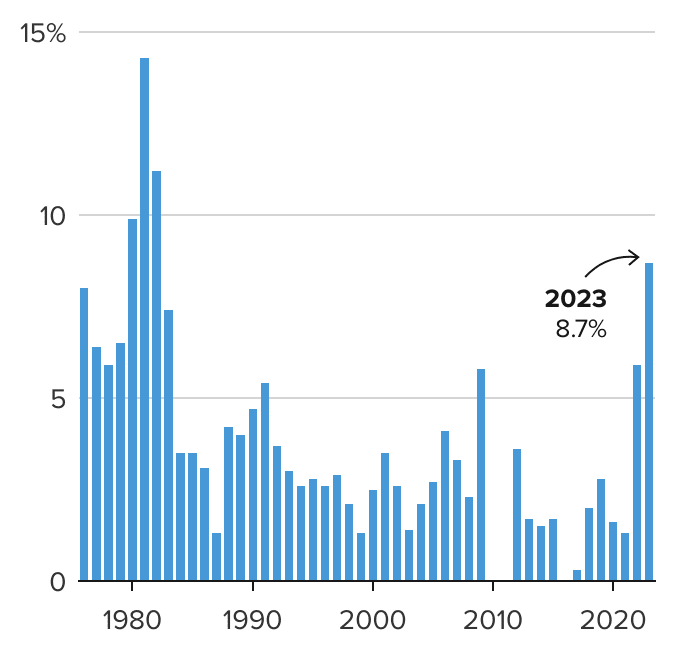

How Inflation and COLA Influence 2026 Benefits

The annual cost-of-living adjustment (COLA) reflects inflation measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Analysts from the Congressional Budget Office expect moderate inflation into 2026, suggesting a typical COLA increase.

The COLA helps preserve purchasing power, but experts caution that it may not fully cover rising costs for medical care and housing.

What the 2026 Adjustment Could Mean for Retirees

Although the official COLA will not be released until late 2025, early projections point toward a modest increase. Mary Johnson, a policy analyst at The Senior Citizens League, said the 2026 adjustment “will likely offer moderate protection from inflation but may not offset rising medical expenses.”

How Americans Can Estimate Their Social Security Check if Planning to Retire in 2026

The SSA encourages future retirees to use its online tools, including the mySocialSecurity portal and the Retirement Estimator. These tools apply actual SSA formulas and use each worker’s verified earnings record.

Financial advisors recommend running multiple scenarios—filing at 62, at 67, and at 70—to compare long-term outcomes and determine the most sustainable plan.

Incorporating Secondary Income and Tax Considerations

The Internal Revenue Service (IRS) may tax Social Security benefits depending on total income levels. Retirees are encouraged to include savings withdrawals, pensions, and part-time earnings when estimating their tax liability and long-term financial stability.

Broader Trends Shaping Retirement Planning in the United States

The U.S. Census Bureau reports that the country is approaching a historic wave of adults turning 65, increasing demand for retirement planning. Rising life expectancy, higher medical costs, and changes in the labor market continue to influence how far a Social Security check will stretch for future retirees.

Understanding Spousal, Survivor, and Divorced Benefits for 2026 Retirees

Many Americans underestimate how much spousal and survivor benefits can influence their total income in retirement. The SSA allows eligible spouses to receive up to 50% of their partner’s benefit at Full Retirement Age.

Spousal Benefits

A spouse with little or no work history may qualify for a benefit based on their partner’s earnings record. This can significantly improve household income for retirees with uneven earnings histories.

Survivor Benefits

Widows and widowers may receive up to 100% of their deceased spouse’s benefit. Financial planners often recommend delaying the higher-earning spouse’s claim to maximize the survivor benefit.

Divorced Spouses

Individuals divorced after at least 10 years of marriage may still be eligible for spousal benefits without affecting their former spouse’s payments. Many Americans nearing retirement are unaware of this provision and overlook potential income.

How Work After 62 Affects Your Social Security Check

Some retirees choose to continue working part-time. While this can help increase savings, it may temporarily reduce Social Security payments for those who file before FRA.

Earnings Test Rules

The SSA deducts benefits if earnings exceed annual limits before Full Retirement Age. In 2025, the earnings limit was $22,320, though this number changes yearly. After FRA, no benefit reductions apply, regardless of income.

Long-Term Gains

Continued earnings may replace a zero or low-income year in the 35-year calculation, potentially increasing benefits permanently.

Health Costs, Medicare Enrollment, and Their Impact on Net Benefits

Medicare premiums automatically deducted from Social Security checks can reduce the net amount retirees receive.

Medicare Part B Premium Trends

Part B premiums typically rise each year. Retirees should monitor annual announcements, as these deductions meaningfully reduce take-home benefits.

Late Enrollment Penalties

Missing Medicare enrollment deadlines can result in lifelong penalties. Financial planners stress coordinating SSA filing and Medicare registration to avoid unnecessary costs.

Alaska’s $1000 Direct Payment: Who Qualifies and When Funds Will Be Released

Strategies Financial Advisors Recommend for 2026 Retirees

Retirement specialists often guide clients to maximize their Social Security benefits through several evidence-based strategies.

1. Delay the Higher Earner’s Benefit

This ensures the highest possible survivor benefit, which economists say greatly improves financial security later in life.

2. Coordinate Withdrawals With SSA Filing

By drawing from savings earlier, retirees may delay claiming Social Security and secure a higher lifetime benefit.

3. Use Break-Even Analysis

Break-even tools show retirees when delayed benefits surpass early-claim totals. This can help determine the best filing strategy based on health and life expectancy.

4. Build a Social Security “Bridge Strategy”

Some retirees use temporary income sources—such as savings, annuities, or part-time work—to delay filing until FRA or age 70.

FAQs About Planning to Retire in 2026

How much will the average Social Security check be in 2026?

This will depend on the 2026 COLA. Estimates start from the 2025 average benefit of $2,008.31, according to the SSA.

Are benefits guaranteed to rise with inflation?

Benefits increase through COLA each year, but the adjustment may not match inflation in all spending categories.

Is delaying benefits to age 70 better financially?

Monthly payments are higher when filing at 70, but the best choice depends on personal health, longevity, and income needs.

Can I work and collect benefits at the same time?

Yes, but early filers may have benefits temporarily reduced if income exceeds SSA yearly limits.

Do divorced spouses qualify for benefits?

Yes, if the marriage lasted at least 10 years and other SSA conditions are met.