A new national assessment of 182 U.S. cities has identified 15 as the least suitable for retirement, citing high costs, limited healthcare access, weak amenities, and broader quality-of-life concerns. The findings highlight the growing difficulties facing older Americans as living expenses rise and local services struggle to keep pace with the needs of an aging population.

U.S. Cities Ranked as Least Ideal for Retirement

| Key Fact | Detail |

|---|---|

| Cities evaluated | 182 |

| Cities ranked “least ideal” for retirees | 15 |

| Major scoring categories | Affordability, Healthcare, Quality of Life, Activities |

| Leading concerns | Housing cost burden, access to medical care, limited senior-friendly infrastructure |

How the U.S. Cities Rankings Were Developed

The study combined economic, health, environmental, and social indicators to evaluate how well each city meets the needs of retirees. Analysts weighted four categories:

Affordability

This included cost of living, housing expenses, local tax structure, insurance costs, and the overall financial burden placed on households with fixed or limited income.

Healthcare

Indicators measured the availability of medical providers, emergency services, specialist care, long-term care infrastructure, insurance accessibility, and the overall capacity of local systems to support an aging population.

Quality of Life

This section accounted for safety, environmental conditions, access to public services, transportation, senior protections, green space availability, and neighborhood livability.

Activities and Community Engagement

Cities were also scored on recreation, social amenities, cultural access, walkability, and opportunities for seniors to remain active and connected.

The bottom 15 cities generally scored lower across multiple categories, with affordability and healthcare access emerging as consistent weaknesses.

The 15 U.S. Cities Rated Least Ideal for Retirement

- San Bernardino, California

- Stockton, California

- Rancho Cucamonga, California

- Bakersfield, California

- Newark, New Jersey

- Fresno, California

- Fontana, California

- Pearl City, Hawaii

- Salem, Oregon

- Bridgeport, Connecticut

- Riverside, California

- Ontario, California

- Tacoma, Washington

- Modesto, California

- Moreno Valley, California

More than half of the cities are in California, which reflects persistent cost-of-living pressures and strained health-service capacity across the state.

Why These U.S. Cities Performed Poorly

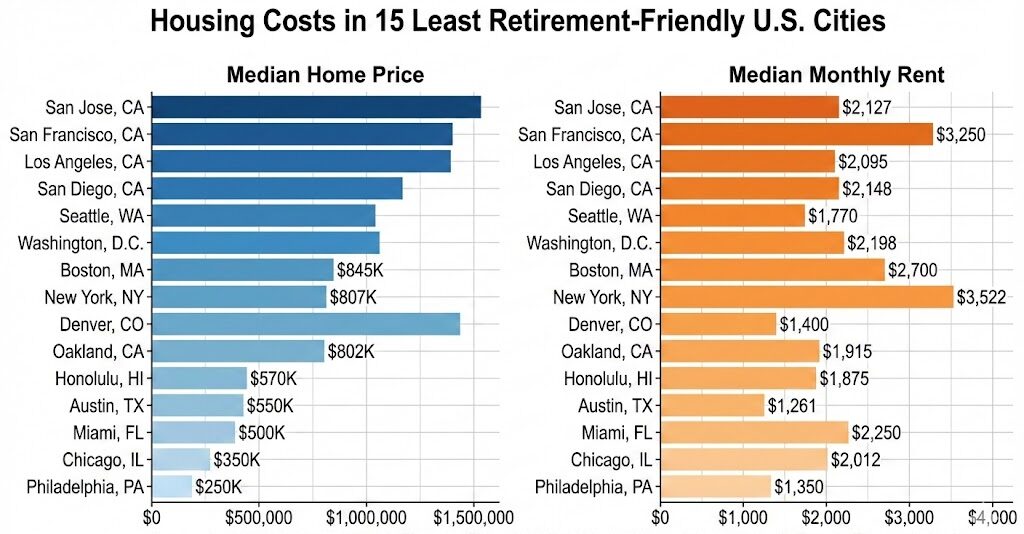

Housing and Cost Burdens

Housing represents the largest single expense for most retired households. In many of the lowest-ranked cities, home prices and rents far exceed what fixed-income seniors can safely sustain. Even retirees who own their homes may face large property taxes, insurance premiums, and maintenance costs.

These expenses can erode savings, limit access to other necessities, and increase dependence on public assistance or family support.

Healthcare Limitations

Several bottom-ranked cities report:

- Shortages of primary-care physicians

- Limited availability of geriatric specialists

- Long travel distances to hospitals

- Underfunded long-term care services

- Strained emergency and elder-care systems

Healthcare access becomes increasingly critical with age. Limited local capacity forces retirees to travel or delay care, both of which can worsen health outcomes.

Quality-of-Life Constraints

Quality of life encompasses multiple dimensions: access to parks, safety, noise levels, environmental health, transportation options, and the reliability of public services.

Lower-ranked cities often face challenges such as:

- High pollution exposure

- Limited public transportation

- Unsafe or poorly maintained neighborhoods

- Lack of walkable areas

- Few dedicated senior centers or community programs

These factors reduce daily comfort and complicate independent living.

Social Isolation and Limited Amenities

Retirees depend on social infrastructure — recreation programs, community events, senior organizations, libraries, cultural spaces. When a city lacks these elements, older adults face higher risks of loneliness and disengagement.

Isolation is strongly linked to depression, physical decline, and shorter lifespan among seniors.

Understanding What Makes a City Good—Or Bad—for Retirement

Experts identify several recurring themes that influence senior livability.

1. Affordability Remains the Top Priority

A city must allow retirees to stretch savings over decades. Rising inflation, property values, and insurance costs make retirement planning more difficult each year.

2. Healthcare Access Is Non-Negotiable

As physical and cognitive needs increase with age, a reliable medical system becomes essential.

3. Community Matters More Than People Expect

Loneliness is one of the most serious public-health risks affecting older adults.

4. Mobility and Infrastructure Determine Independence

Walkable neighborhoods, safe sidewalks, accessible public transit, and age-friendly housing allow seniors to remain active and self-sufficient.

5. Climate, Environment, and Safety Shape Daily Comfort

Extreme heat, wildfire smoke, flooding, or unsafe neighborhoods can severely disrupt retirement stability.

What Better-Rated Cities Do Differently

Cities that consistently rank well for retirement tend to share characteristics such as:

- Moderate or low cost of living

- Strong hospital networks

- Age-friendly city planning

- Good transportation options

- Extensive community programming

- A balance between safety, comfort, and affordability

- Opportunities for outdoor recreation or cultural engagement

Some communities also invest in “aging-in-place” strategies — programs to help residents remain in their homes as long as possible through accessibility improvements and home-care support.

America’s Aging Population: Why Retirement Livability Matters

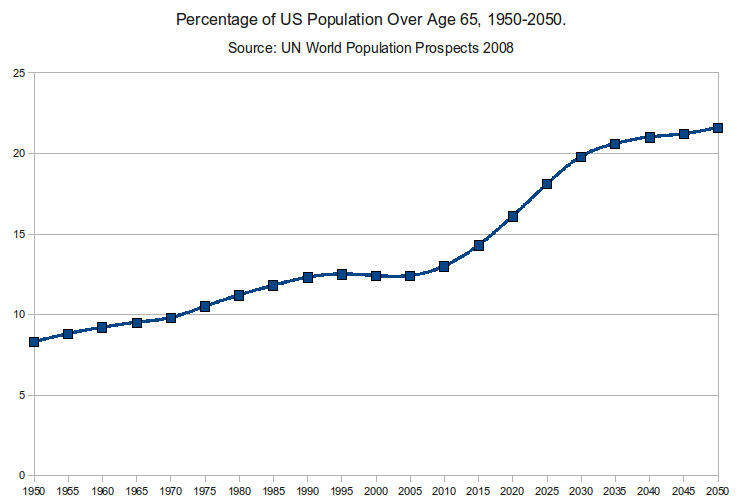

The United States is experiencing rapid demographic change. Adults aged 65 and older account for a growing share of the national population, and lifespans are increasing. This shift places pressure on local governments, healthcare systems, and housing markets.

Cities that fail to adapt may see:

- Increased senior poverty

- Higher healthcare demand than local hospitals can handle

- Rising homelessness among older adults

- Growing pressure on family caregivers

- Lower overall well-being for retirees

The bottom-ranked cities illustrate how economic stress and aging demographics collide.

Retiree Profiles Show Why No Single City Fits Everyone

The Budget-Conscious Retiree

Seeks low housing costs and affordable healthcare.

Best match: Smaller cities with strong insurance networks and stable housing markets.

The Medically Vulnerable Retiree

Needs regular treatment, specialists, or long-term care.

Best match: Metropolitan areas with large hospital systems and home-care networks.

The Active and Social Retiree

Values recreation, walkability, cultural amenities, and community engagement.

Best match: Cities with strong public transit, parks, and senior centers.

The Family-Centered Retiree

Places high value on living close to children or grandchildren.

Best match: Any city near family support, even if other factors are imperfect.

This diversity underscores why rankings should inform — not dictate — personal decisions.

How Local Governments Can Improve Retirement Livability

Experts recommend several policy tools that cities can implement:

- Expand affordable senior housing

- Offer grants or incentives for home modifications

- Improve pedestrian safety and accessibility

- Increase funding for senior centers and community programs

- Strengthen healthcare partnerships and emergency services

- Enhance public transportation networks

- Provide tax relief for low-income seniors

- Invest in environmental health measures

Such improvements support not only retirees but also families, workers, and people with disabilities.

Affordable Living: Small Towns Where Couples Can Rely Solely on Social Security

A Practical Checklist for Retirees Evaluating a City

Before choosing a retirement destination, experts suggest evaluating:

- Actual monthly cost-of-living

- Local hospital quality and availability

- Walkability and transportation

- Senior-center programs and community activities

- Neighborhood safety

- Climate and environmental health

- Proximity to family

- Availability of age-friendly housing

A short visit or temporary stay can reveal strengths and weaknesses that rankings cannot capture.

Conclusion

The ranking of the 15 least retirement-friendly American cities highlights a deeper national challenge: rising costs, uneven healthcare access, and aging infrastructure are making retirement more difficult for millions. While these cities face significant obstacles, the broader issue extends far beyond any single location.

As the U.S. population ages, cities will need to adapt with clearer planning, stronger services, and more accessible housing. For retirees, careful evaluation — not just of costs but of comfort, safety, healthcare, and community — remains essential.

Retirement, once defined by stability, now depends as much on geography as on savings. And for many Americans, choosing the right city may be one of the most important decisions of later life.