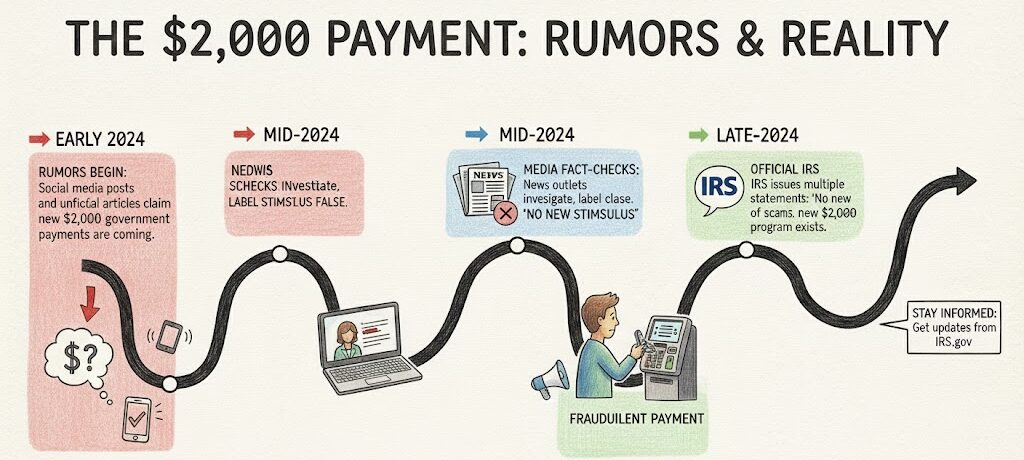

The IRS December 2025 Deposit Update drew widespread attention this month as online posts and videos claimed that Americans could receive a $2,000 payment before the end of the year. However, federal officials and fiscal policy analysts say no such deposit has been approved, and no legislation authorizing new direct payments is moving through Congress. Experts warn that the claims are tied to a political proposal rather than a functioning program and that misinformation continues to circulate due to economic anxiety and online amplification.

IRS December 2025 Deposit

| Key Fact | Detail |

|---|---|

| No approved $2,000 payments | IRS confirms no new stimulus or relief deposits scheduled for December 2025 |

| Origin of rumor | Linked to a “tariff dividend” proposal discussed during the 2024 election cycle |

| Payment authorization | Federal payments require congressional legislation and a signed law |

| Scam risk | FTC warns that viral rumors trigger fraudulent websites |

The IRS December 2025 Deposit Update continues to generate public interest, but federal officials stress that no $2,000 payment has been approved. While policymakers may revisit relief proposals in the future, experts say Americans should rely only on official government announcements and remain cautious about online claims. For now, the situation remains unchanged, with no authorized federal direct payments scheduled for December or beyond.

Understanding the IRS December 2025 Deposit Update

Federal agencies say the current wave of posts about a $2,000 IRS deposit has no basis in official government action. The Internal Revenue Service (IRS) clarified through spokesperson statements that it only administers payments approved by Congress and signed by the president, and no such law exists in 2025.

Official IRS Position

An IRS spokesperson reiterated earlier this year, “There are no new federal stimulus or relief payments scheduled at this time. Taxpayers should rely only on official IRS.gov announcements.”

This aligns with reporting from major outlets such as Reuters and the Associated Press, both of which have published multiple fact-checks addressing similar claims.

Where the $2,000 Payment Claim Originated

The current claim can be traced to a concept proposed during the 2024 presidential campaign known as the tariff dividend proposal. The idea suggested that revenue generated from higher import tariffs could be redistributed to U.S. households, potentially in the form of periodic direct payments.

Expert Analysis on the Proposal

Economists from the nonpartisan Tax Policy Center evaluated the proposal and concluded that tariff revenue alone would not be sufficient to support a $2,000 payment for all eligible households.

In a 2024 briefing, senior researcher Dr. Paul Kendrick stated, “Tariff revenue fluctuates dramatically year to year and does not reliably support large-scale distributions.”

Congress has not drafted or passed any legislation to create such a program in 2025.

Historical Comparison: How the 2020–2021 Stimulus Checks Happened

To understand why the current rumor is unlikely to be true, it helps to examine how previous stimulus checks were passed.

Between 2020 and 2021, Congress approved three rounds of Economic Impact Payments during the COVID-19 emergency.

They were enacted because:

- Public health conditions triggered a national emergency declaration.

- Economic shutdowns led to record unemployment.

- Bipartisan pressure mounted to stabilize households.

In contrast:

- There is no national emergency declaration in 2025.

- The unemployment rate remains near historical norms.

- Congressional appetite for new large-scale spending is low due to deficit concerns.

Dr. Lena Porter, a public finance professor at Georgetown University, said,

“The legislative environment in 2025 is fundamentally different. There’s no political or economic consensus for direct payments.”

How IRS December 2025 Deposit Payments Are Legally Authorized

The Constitution grants spending authority to Congress. For any nationwide payment program to exist, several steps must occur:

- A bill must be introduced in the House or Senate.

- Congress must pass it through both chambers.

- The president must sign it into law.

- Funding must be appropriated through the federal budget.

- The IRS and Treasury Department implement the program.

Why this matters

Because none of these steps have occurred, the IRS has no legal authority to issue a $2,000 payment.

Why $2,000 Payment Claims Keep Circulating

Researchers at the Pew Research Center note that misinformation about government payments often re-emerges during periods of inflation or financial stress. Viral posts are frequently reposted from earlier years and adapted with new dates.

Dr. Aaron Feldman from the MIT Media Lab explained,

“People are more likely to believe claims that match what they hope will happen, especially during financially stressful times.”

Social media algorithms accelerate the spread by promoting emotionally charged content, regardless of accuracy.

Consumer Protection: How to Avoid Scams Tied to the Rumor

The Federal Trade Commission (FTC) warns that fraudsters often exploit government-payment rumors to steal personal information.

Common red flags include:

- Websites asking for Social Security or bank account numbers

- “Registration portals” claiming you must sign up

- Messages promising faster payment for a “processing fee”

- Emails pretending to be from IRS or Treasury

Could a Payment Become Possible in 2026?

Experts say it is theoretically possible for Congress to authorize new federal payments in the future, but unlikely under current conditions.

Barriers to approval include:

- Federal deficit exceeding $1.5 trillion

- Divided government with competing fiscal priorities

- Lack of bipartisan consensus

Mark Richardson, an economist at the Brookings Institution, explained,

“Direct payments are politically attractive but fiscally challenging. Without a major economic event, they remain improbable.”

Why Waiting Until 70 for Social Security May Not Pay Off, According to Retirement Experts

What Americans Should Expect Next

Federal officials emphasize that there is no active or pending program that would send a $2,000 IRS deposit in December 2025. Any future changes would require:

- Formal legislation

- Public announcements

- IRS implementation guidance

As of now, no such actions have been initiated.

FAQs About IRS December 2025 Deposit

Is the IRS sending a $2,000 payment in December 2025?

No. No legislation authorizing such a payment exists.

Does the tariff dividend proposal guarantee a payment?

No. It was a campaign idea, not a federal program.

Did Congress discuss a new stimulus check in 2025?

No major stimulus legislation has been introduced.

Can the IRS issue payments without Congress?

No. The IRS only administers legally approved payments.

Why are so many posts claiming the payment is real?

Misinformation spreads rapidly during economic uncertainty.

Are phishing scams linked to this rumor?

Yes. The FTC warns that scammers often mimic government programs.

If Congress wanted to create a payment, how long would it take?

Several months, including legislative drafting, voting, and administrative setup.