The 2026 COLA Boost is projected to raise monthly Social Security payments starting in January 2026, with early estimates showing that five Northeastern states may see the largest dollar increases due to their higher average baseline benefits. Analysts say the projected adjustment reflects slowing but persistent inflation trends and regional differences in lifetime earnings.

2026 COLA Boost

| Key Fact | Detail |

|---|---|

| 2026 COLA percentage | Estimated 2.8% increase |

| Average national benefit increase | Around $56 per month |

| States with highest increase | Connecticut, New Jersey, New Hampshire, Delaware, Maryland |

| Reason these states lead | Higher lifetime earnings and higher baseline benefits |

| Official Website | Social Security Administration |

Why the 2026 COLA Boost Matters

Each year, the Social Security Administration adjusts benefits through the cost-of-living adjustment (COLA) to help protect retirees, disabled workers, and survivors from the effects of inflation. The 2026 COLA Boost reflects a period of moderate inflation following significant price volatility from 2021 to 2024.

A projected 2.8% increase would raise the average retired worker’s monthly benefit from about $2,015 to roughly $2,071. While the percentage is uniform nationwide, the dollar amount varies significantly based on each recipient’s earnings record.

“COLA is not a bonus. It’s an essential adjustment designed to maintain purchasing power for older Americans,” said Dr. Laura Benton, a retirement policy researcher at the Urban Institute. “Even a modest change can make a notable difference for people living on fixed incomes.”

Five States Expected to See the Largest Dollar Gains

Connecticut, New Jersey, New Hampshire, Delaware, and Maryland are projected to receive the largest increases in monthly benefits under the 2026 COLA Boost. Experts attribute these differences to higher average lifetime earnings in these states, which result in higher base benefits.

Estimated Monthly Increases

Although final figures will be confirmed later this year, analysts estimate the following increases:

- Connecticut: about $60

- New Jersey: slightly above $60

- New Hampshire: around $60

- Delaware: just under $60

- Maryland: around $59

These figures apply to Social Security retirement benefits, not Supplemental Security Income (SSI), which follows a separate timeline.

Why Northeastern States Lead the List

Several factors cause benefits in these states to rise more sharply in dollar terms:

Higher Lifetime Earnings

States like Connecticut and New Jersey have some of the highest median incomes in the country. Workers in these regions often earn more throughout their careers, leading to larger Social Security benefit calculations.

“COLA is the same everywhere, but the effect is unequal,” explained Michael Rodriguez, a policy analyst at the Center for Retirement Research at Boston College. “If you start with a higher benefit, your COLA increase will naturally be larger.”

Differences in Workforce Composition

Regions with skilled workforces—such as New England’s healthcare, biotechnology, and finance sectors—tend to reflect higher long-term wages.

Higher Cost of Living

Although COLA is calculated nationally, states with expensive housing and healthcare sectors tend to report higher baseline benefits because workers in those states earn more while employed.

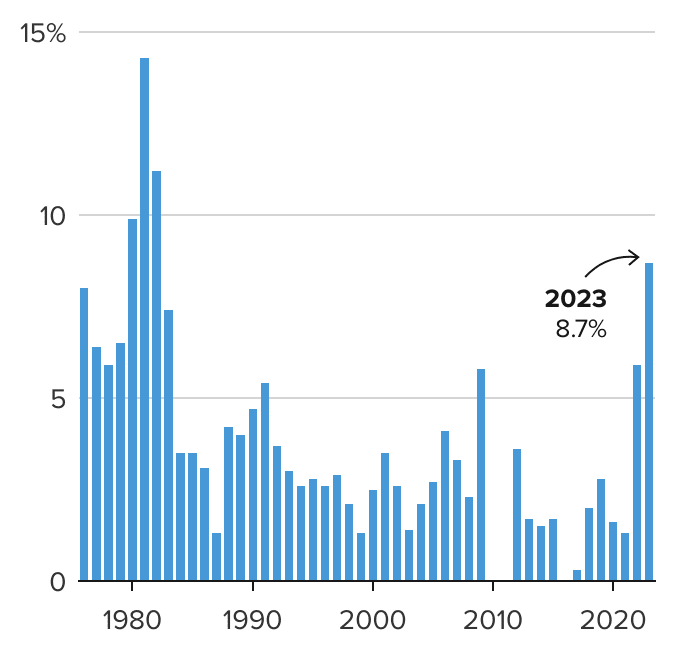

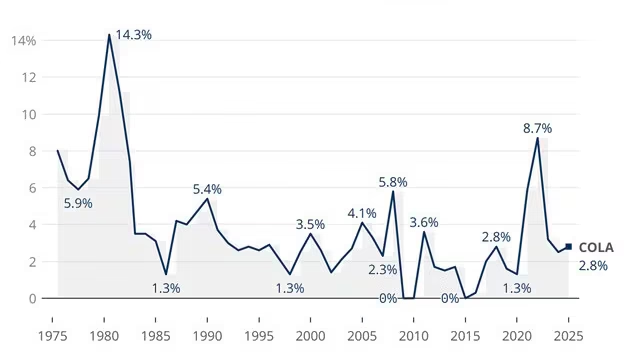

How 2026 Compares With Previous COLA Adjustments

To understand the significance of the 2.8% projection, it helps to compare it with recent increases:

- 2023: 8.7% (highest increase in four decades)

- 2024: 3.2%

- 2025: 2.6%

- 2026: projected 2.8%

Historical averages show that COLA typically ranges between 2% and 3%. The spike in 2023 was an anomaly driven by inflation surges following global supply chain disruptions and energy price increases.

How COLA Is Calculated: The CPI-W Debate

The COLA formula relies on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Some economists argue that this metric underestimates the inflation experienced by seniors.

“Older Americans spend disproportionately on healthcare and housing, which rise faster than the general inflation rate,” said Dr. Anya Sharma, an economist at Georgetown University. “A measurement designed around workers may not capture retirees’ actual living costs.”

Proposed Alternatives

Several proposals in Congress use different inflation measures:

- CPI-E: an index focused on elderly expenses

- Chained CPI: a more conservative formula that typically results in lower COLAs

- Medicare-adjusted inflation models

None of these proposals have passed, but they highlight ongoing debates about the COLA system.

Impact on Different Beneficiary Groups

The COLA increase affects several categories of Social Security recipients:

Retired Workers

The largest group of beneficiaries—about 50 million people—will receive the standard 2.8% increase.

Disabled Workers (SSDI)

Disability benefits rise at the same percentage. SSDI recipients tend to have smaller benefit amounts than retired workers, so their dollar increases are slightly lower.

Survivors

Widows, widowers, and dependents will also receive COLA adjustments. For many surviving spouses, even a small increase can ease financial pressures.

Supplemental Security Income (SSI)

SSI recipients see adjustments slightly earlier, with new payment levels taking effect on December 31, 2025.

Inflation and Cost Pressures Facing Retirees

While inflation has cooled from earlier peaks, several cost categories continue to rise:

Housing

Rental prices and property taxes remain a financial strain for many retirees, particularly in high-cost Northeastern states.

Healthcare

Medicare Part B premiums often rise each year, reducing the net impact of COLA increases. Prescription drugs and long-term care costs continue to outpace general inflation.

Everyday Expenses

Food, transportation, and energy have stabilized but remain higher than pre-2021 levels.

“Even with COLA, retirees may feel like they are still catching up to inflation,” said Paul Emerson, a senior fellow at the Brookings Institution. “Costs have increased faster than incomes in many categories.”

State-by-State Economic Conditions Driving Higher COLA Gains

Connecticut

High wages in finance, insurance, and healthcare contribute to strong lifetime earnings.

New Jersey

Median household incomes regularly rank among the highest in the nation.

New Hampshire

A strong labor market and relatively low unemployment buoy earnings.

Delaware

Pharmaceutical, chemical, and financial sectors drive higher-than-average salaries.

Maryland

Federal employment and biotech jobs elevate median earnings across the state.

Policy and Political Implications

Discussions about Social Security’s long-term stability continue in Congress. The program’s trustees project that the trust fund could face shortfalls by the mid-2030s without policy changes.

Reform Proposals

- Raising the payroll tax cap

- Adjusting full retirement age

- Restructuring COLA calculations

- Means-testing benefits

No major reforms are expected before 2026, but the debate intensifies during election years.

Financial Planning Considerations for Retirees

Experts advise retirees to reassess their budgets each time COLA increases take effect.

Key Tips

- Review Medicare premiums to determine net increases.

- Revisit long-term care plans and out-of-pocket medical budgets.

- Evaluate tax implications of higher benefits.

- Consider adjusting withdrawal rates from retirement accounts.

“COLA increases are helpful, but they should be viewed as part of a broader financial strategy,” said certified financial planner Joyce Lambert.

Real-World Examples: How COLA Affects Households

A retired worker receiving $2,300 per month in Connecticut would see an increase of about $64.40. A similar worker receiving $1,700 per month in a lower-income state might see only about $47.60.

These differences illustrate how uniform percentages produce unequal real-world outcomes.

Last Chance to Claim the $5000 Energy Rebate — Program Closing Soon

Final Paragraph

The Social Security Administration will issue the final 2026 COLA announcement later this year once federal inflation data is complete. Until then, policymakers, analysts, and retirees will continue to assess both the financial relief and the ongoing challenges associated with rising living costs.