Millions of Americans will receive their December Social Security payments in the coming days as the Social Security Administration (SSA) begins its final monthly disbursements of the year. The schedule includes regular retirement and disability benefits, as well as early SSI benefits adjusted for the upcoming New Year’s holiday. The payments arrive during a period of heightened household costs, making this month’s distribution especially significant for many beneficiaries.

First Social Security Payments

| Key Fact | Detail |

|---|---|

| First major December payments | Begin December 1 for SSI recipients |

| Regular benefit schedule | Payments issued Dec. 3, 10, 17, and 24 |

| Extra end-of-month payment | Early SSI check issued Dec. 31 due to Jan. 1 holiday |

| Official Website | SSA.gov |

Understanding the December Social Security Payment Schedule

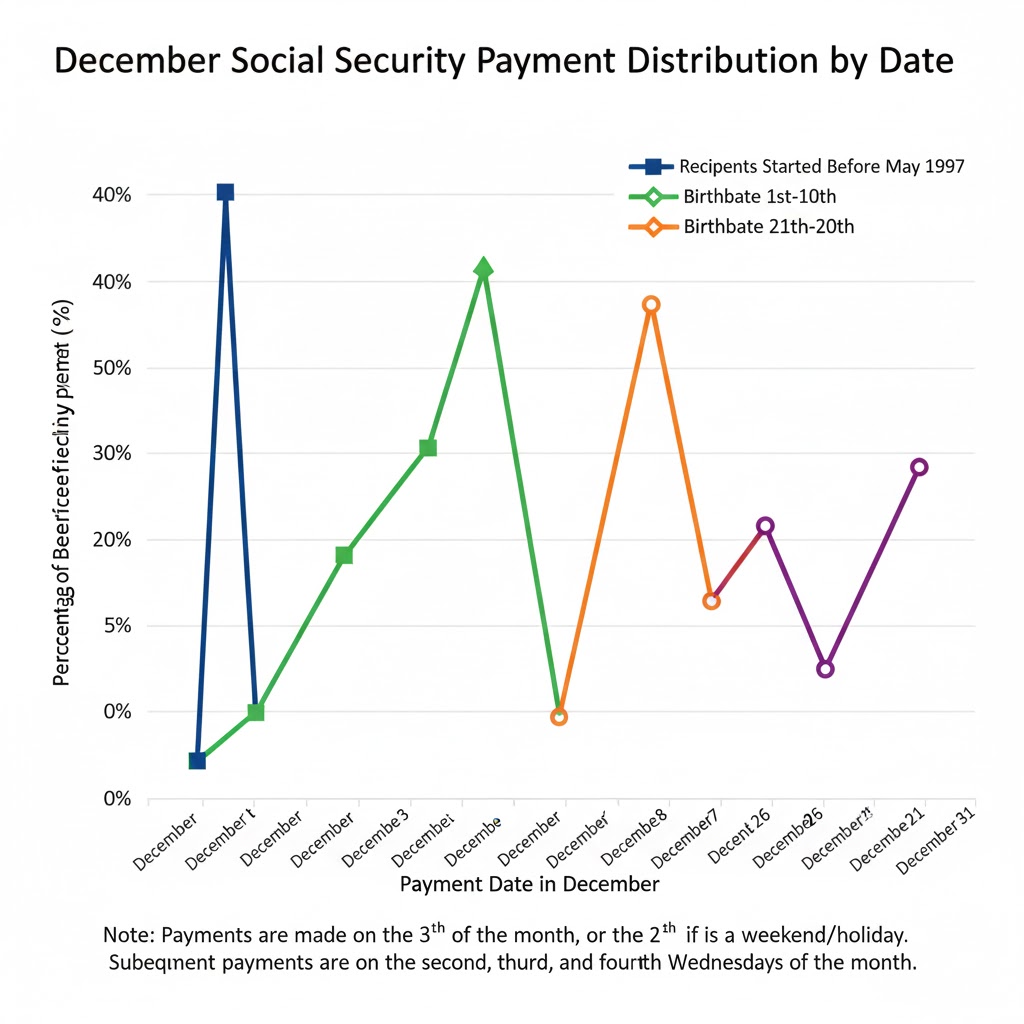

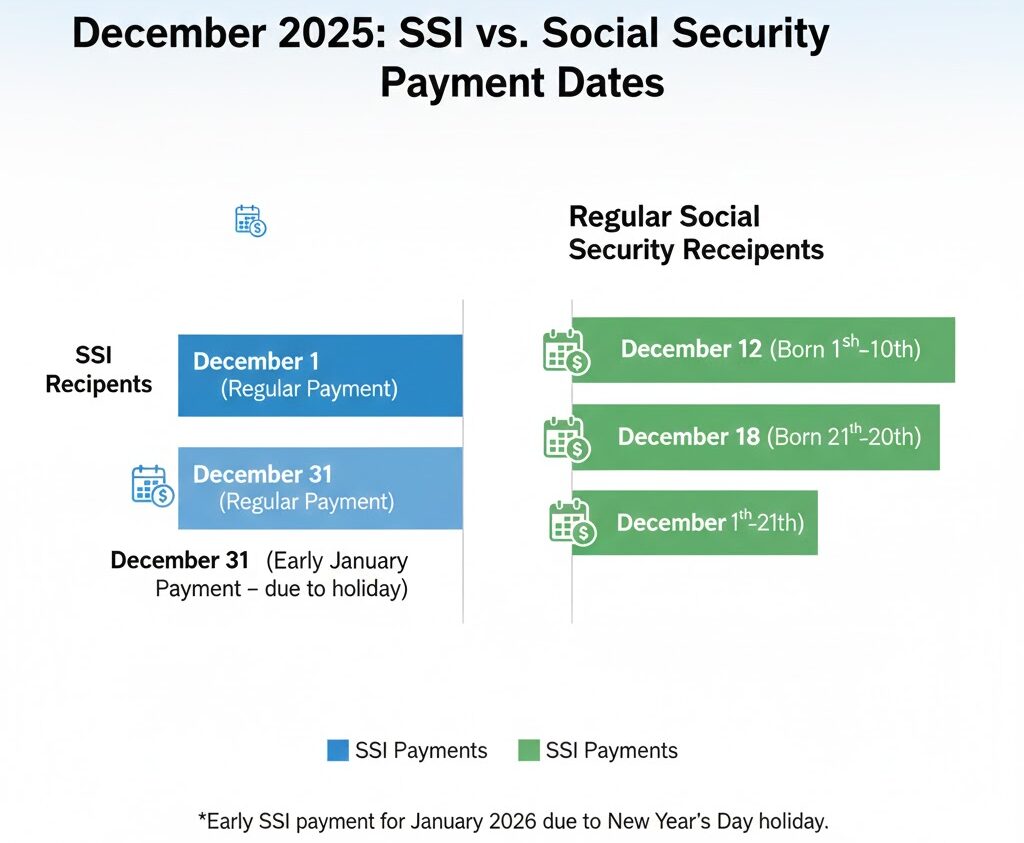

The SSA distributes retirement, survivor, and SSDI payments on a staggered Wednesday schedule each month. According to the agency’s official calendar, beneficiaries who began receiving payments before May 1997 are paid on December 3, while all others are scheduled based on their birthdates.

- “The Wednesday-based payment system ensures consistency and reduces administrative delays,” said Mark Hinkle, spokesperson for the Social Security Administration, in a recent agency briefing.

Payment Breakdown by Birthdate

- December 10: Birthdays between the 1st and 10th

- December 17: Birthdays between the 11th and 20th

- December 24: Birthdays between the 21st and 31st

The SSA confirmed that all disbursements will be made via direct deposit or Direct Express unless a beneficiary receives paper checks through the U.S. Postal Service.

Early SSI Benefits Add Complexity to This Month’s Timeline

Recipients of Supplemental Security Income (SSI) will receive their regular monthly payment on December 1. Because January 1, 2026, is a federal holiday, the SSA will issue January’s SSI payment one day early, on December 31.

According to an SSA procedural note, “Payments scheduled on federal holidays must be advanced to the nearest prior business day.” This adjustment does not provide an extra monthly payment; instead, it shifts the January disbursement into the previous year.

Impact on Low-Income Households

Policy analysts say this rescheduling can improve budgeting for beneficiaries who rely on SSI to meet monthly essentials.

- “For many households, shifting SSI benefits before the holiday helps them manage rent, utilities, and rising food costs,” said Dr. Carla Green, an economist at the Center on Budget and Policy Priorities.

COLA Increase Looms as Beneficiaries Await Higher 2026 Payments

The final month of the year arrives as seniors and people with disabilities prepare for the 2026 cost-of-living adjustment (COLA increase), which the SSA will implement in January. The agency announced the new rate in October, following inflation data from the U.S. Bureau of Labor Statistics.

Economists note that rising prices for housing, medical care, and food have made Social Security adjustments especially important for fixed-income households.

- “This year’s COLA reflects persistent inflation pressures, though many seniors may still feel squeezed,” said Dr. Laura Mitchell, a professor of public policy at Georgetown University.

What Beneficiaries Should Expect in the Coming Weeks

The SSA urges beneficiaries to confirm their direct deposit details and report any mailing address changes promptly to avoid delays. The agency also advises individuals receiving SSDI payments to monitor their My Social Security online accounts, where updated notices and future COLA adjustments will be posted.

Postal delays are possible for paper checks as the holiday season leads to heavier mail volume nationwide, according to the U.S. Postal Service.

The SSA has said it has no plans to modify the distribution schedule beyond the standard holiday adjustment already in place.

How Many People Receive December Social Security Payments?

According to SSA data, more than 71 million Americans collect a monthly Social Security or SSI benefit. Of these beneficiaries:

- About 52 million receive retirement benefits.

- Roughly 9 million receive SSDI payments.

- An estimated 7.4 million receive SSI benefits.

These groups rely heavily on predictable payment schedules. December is one of the busiest months for the SSA, with staff preparing for both the regular distribution cycle and the early payment for SSI recipients.

A recent report from the Congressional Research Service noted that over 80 percent of SSI households have no other form of income, underscoring the importance of timely payments.

Economic Pressure Heightens Importance of December Payments

Inflation has remained elevated for much of the past year, affecting essential goods such as groceries, utilities, and prescription medications.

A study from the Pew Research Center found that nearly half of adults aged 65 and older are concerned about covering basic expenses due to persistent price pressures. This makes December’s payments—and the upcoming COLA increase—particularly important for seniors and disabled adults.

Dr. Alan Roberson, a senior economist at the Federal Reserve Bank of Chicago, said the timing of December benefits matters.

“Households with limited financial reserves depend on these payments for stability, especially during peak holiday spending and colder weather,” he said.

How the Direct Deposit System Reduces Holiday Delays

More than 99% of Social Security beneficiaries now receive their payments electronically.

The Treasury Department’s Electronic Transfer Account (ETA) and Direct Express card networks are designed to process payments even during high-demand periods.

Why This Matters

- Direct deposit reduces the risk of lost or stolen checks.

- Funds typically clear by 9 a.m. local time on the payment date.

- Electronic payments bypass delays caused by winter storms or postal backlogs.

Still, experts encourage beneficiaries to confirm account details ahead of time. A mismatched routing number or a closed bank account can cause payments to be returned to the SSA, triggering delays of several days.

Potential Fraud Risks During the Holiday Season

The SSA and the Federal Trade Commission (FTC) warn that scams tend to increase in December. Fraud attempts often target seniors and people with disabilities.

Common schemes include:

- Fake calls claiming Social Security numbers have been “suspended.”

- Threats of benefit termination unless a fee is paid.

- Emails or texts directing recipients to fraudulent SSA look-alike websites.

The SSA stresses that it never asks for money, gift cards, wire transfers, or personal banking information by phone or email.

“We see a sharp rise in impersonation scams during the holidays,” said Kimberly Schmidt, director of the FTC’s Division of Consumer Response.

“Beneficiaries should be cautious of unsolicited requests.”

Looking Ahead: What Will Change in Early 2026?

Beyond the COLA increase, the SSA plans to introduce several updates early next year:

1. Adjusted Earnings Limits

Workers receiving early retirement benefits will see an updated limit on how much they can earn before benefits are reduced.

2. Updated Disability Thresholds

The Substantial Gainful Activity (SGA) thresholds for both non-blind and blind workers will increase in 2026, according to current SSA projections.

3. Expanded Online Services

The agency is continuing to modernize its portal, My Social Security, with improved accessibility, clearer benefit statements, and faster processing of appeals.

SSA Acting Commissioner Kilolo Kijakazi said in a recent statement that modernization is a priority for the agency.

“We are committed to improving service delivery and reducing administrative burdens on beneficiaries,” she said.

Millions Set to Receive a Rare Double Social Security Payment — Who Gets the Extra $1,450?

Historical Perspective: How Social Security Payments Have Evolved

Social Security payments have followed calendar-based rules since the program’s inception in 1935. But several major changes have shaped modern payment schedules:

- 1997: Introduction of the Wednesday-based staggered payment system.

- 2008: Wider adoption of direct deposit following Treasury Department rules.

- 2021–2025: Growth in online claims and digital communications with beneficiaries.

Policy analysts say the staggered schedule helps spread out administrative demand and reduces strain on financial institutions.

Final Paragraph

While December brings the usual holiday adjustments to the Social Security calendar, officials emphasize that the timing should remain predictable for most households. The agency is expected to release updated materials on next year’s payment procedures in early January, offering beneficiaries a clearer view of their 2026 income outlook.