The Christmas Week Payments scheduled by the Social Security Administration (SSA) are drawing widespread attention as Americans look ahead to the holidays. Federal records show that only a narrow group of retirees will receive checks above $5,000, while millions of others will see standard amounts distributed on adjusted dates due to the federal holiday calendar. Analysts emphasize that the week’s timing can create confusion, especially when two payments appear in December.

Christmas Week Payments

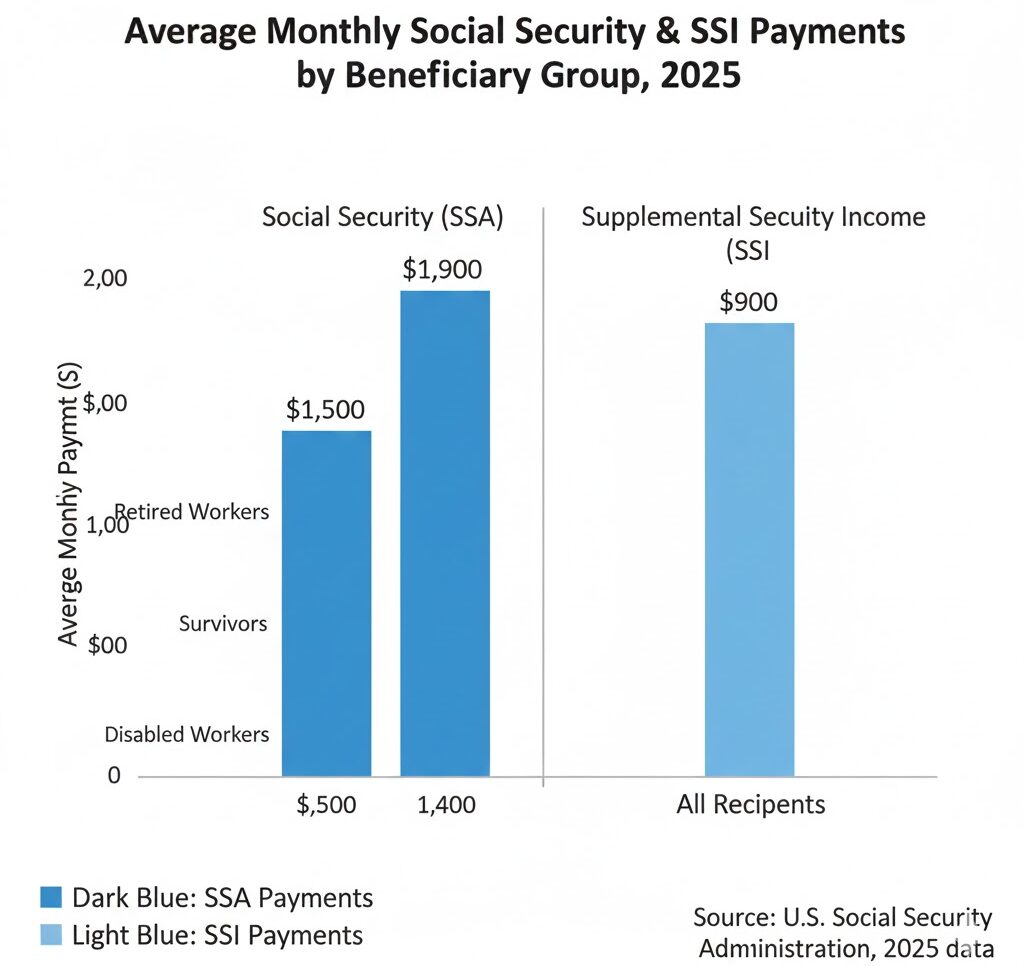

| Key Fact | Detail / Statistic |

|---|---|

| Maximum 2025 retirement benefit at age 70 | $5,108 per month |

| Who qualifies | Workers with 35+ years at maximum taxable earnings |

| Why holiday timing matters | Federal holiday closures shift January SSI payments into December |

| Portion of retirees receiving maximum | Fewer than 2% of new beneficiaries |

| Official Website | Social Security Administration |

As the holiday season approaches, analysts say the key to understanding the Christmas Week Payments is recognizing the difference between routine scheduling adjustments and the rare instances where a retiree qualifies for the system’s maximum benefit. While a small group will receive payments above $5,000, most Americans will see their standard benefits delivered on adjusted dates designed to ensure uninterrupted access to income.

How Christmas Week Payments Work and Why They Matter

The Christmas Week Payments reflect the Social Security Administration’s annual adjustments to its December and January benefit schedule. Social Security benefits are normally issued on designated Wednesdays based on beneficiaries’ birthdates. But when federal holidays fall on or near regular payment days, the SSA shifts certain deposits earlier.

This year, because January 1 is a federal holiday, Supplemental Security Income (SSI) recipients will receive their January 2026 payment on December 31, 2025. Retirees, disability beneficiaries, and survivors will continue to receive their standard December payments, some of which fall the week of Christmas depending on birthdate.

Officials caution that the schedule change does not increase anyone’s benefits. “We adjust delivery dates only to ensure uninterrupted access to funds,” the Social Security Administration said in a recent public guidance note.

Who Are the Beneficiaries Who Could See Checks Above $5,000?

Although many headlines emphasize that some beneficiaries could see checks above $5,000, this applies to a very small group. The SSA reports that the maximum monthly retirement benefit for individuals filing at age 70 will reach $5,108 in 2025. This amount represents the upper limit of what the system pays.

Requirements to Reach the Maximum Benefit

To qualify for a benefit above $5,000, an individual must meet strict requirements:

- Earn the SSA’s maximum taxable amount for at least 35 years

- Pay Social Security taxes on those earnings

- Delay filing for retirement benefits until age 70

- Have a consistent work record with no gaps

- Avoid early filing, which permanently reduces monthly benefits

“These high payments are rare because reaching them requires both high and sustained income over a long period,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College.

The SSA confirms that fewer than 2 percent of new retirees meet these conditions.

What About Survivors or Disability Beneficiaries?

While the $5,000 threshold applies primarily to retirees filing at age 70, some surviving spouses may receive large payments if the deceased partner earned maximum benefits. Survivor benefits top out near the same maximum as retirement benefits, though exact amounts depend on the deceased worker’s earnings record and the survivor’s filing age.

Disability Insurance beneficiaries rarely approach that level. Disability payments are based on the worker’s average indexed monthly earnings and do not include delayed retirement credits, making amounts above $5,000 highly unlikely.

Why Holiday Timing Creates Confusion

Every year, the combination of December payments and early January SSI deposits leads many recipients to believe they are receiving additional funds. Experts say this misunderstanding is common.

“When two deposits hit in December, people sometimes assume they’re receiving a bonus,” said Kathleen Romig, a senior policy analyst at the Center on Budget and Policy Priorities. “But SSA simply shifts the January deposit backward to ensure timely access.”

Common Misconceptions

- Misconception: Higher holiday payments

Reality: Normal amounts issued on adjusted dates - Misconception: “Christmas bonus” payments

Reality: SSA has no bonus or holiday benefit program - Misconception: Extra COLA is applied at year-end

Reality: Cost-of-living adjustments start January, not December

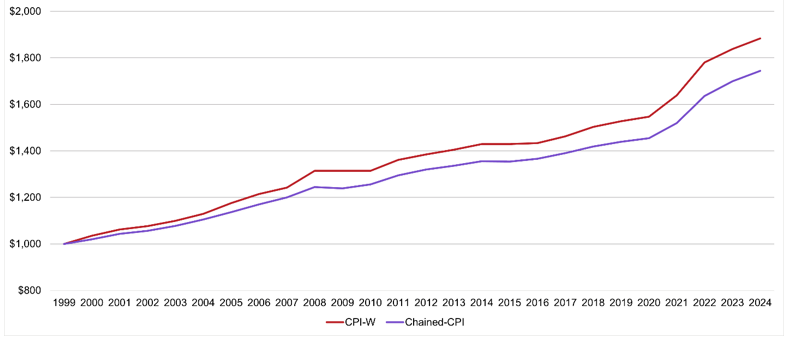

How Maximum Benefits Reached $5,108

Social Security benefits gradually increase through annual cost-of-living adjustments (COLAs). The COLA formula is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), and high inflation in recent years contributed to significant benefit increases.

Key Historical Milestones

- 2019: Maximum at age 70 was $3,770

- 2021: Increased to $3,895

- 2023: Jumped significantly due to high inflation

- 2025: Set to reach $5,108

According to SSA records, the rapid rise since 2022 reflects inflationary pressures across the U.S. economy.

Inflation, Medicare, and Net Payments

Even if beneficiaries could see checks above $5,000, many Americans will receive less in net payments due to rising Medicare Part B premiums. The Centers for Medicare & Medicaid Services (CMS) expects premiums to rise again in 2026, reducing the net benefit amount for most retirees.

“High gross benefits don’t always translate to higher take-home payments,” said Andrew Biggs, a senior fellow at the American Enterprise Institute. “Health care costs continue to erode the purchasing power of retirees.”

Additionally, prices for housing, energy, and groceries remain elevated compared to pre-pandemic levels, further shaping retirees’ financial security.

How to Know Your December and January Payment Dates

The SSA issues benefits using the following structure:

For Social Security retirement, survivor, and disability benefits:

- Born on the 1st–10th → paid the second Wednesday

- Born on the 11th–20th → paid the third Wednesday

- Born on the 21st–31st → paid the fourth Wednesday

For SSI:

- Always paid on the 1st of each month

- Unless the 1st is a holiday or weekend—in which case payment shifts to the previous business day

This year, that means the January 2026 SSI payment arrives on December 31.

Fraud and Scam Warnings During Holiday Payment Season

Federal agencies warn that scammers often target older adults during the holidays, exploiting interest in Christmas Week Payments and COLA announcements. The Federal Trade Commission (FTC) reports increased impersonation scams during December.

Common Signs of Fraud

- Calls claiming your benefits are suspended unless you “verify” information

- Messages asking for bank account numbers

- Emails requesting SSA login details

- Threats of arrest or legal action

The SSA reminds beneficiaries that it never calls to demand personal information or payment.

December 2025 Benefits — Exact Dates Social Security Will Send Monthly Payments

What Experts Expect for 2026 and Beyond

According to the Social Security Board of Trustees, the combined trust funds will face shortfalls by 2033 unless Congress adopts reforms. Analysts expect lawmakers to consider adjustments to payroll taxes, benefit formulas, or retirement ages.

Economists also expect a smaller COLA in 2026 if inflation continues to cool. That could mean lower benefit increases than the unusually high adjustments seen in 2022 and 2023.

“Long-term solvency remains a major challenge,” said Dr. Jason Fichtner, chief economist at the Bipartisan Policy Center. “But current retirees can count on receiving benefits, including those scheduled for the upcoming holiday season.”