Several small U.S. towns are emerging as viable places where retirees may cover essential expenses using Social Security alone, according to recent housing and economic assessments from the U.S. Census Bureau and private research groups. Rising national rents and inflation have strained fixed incomes, but analysts say certain communities offer stable prices, accessible services, and comparatively low housing costs, giving retirees limited earnings a chance to maintain financial stability.

Small U.S. Towns Where Social Security Alone Can Cover All Living Costs

| Key Fact | Detail/Statistic |

|---|---|

| Average Social Security retirement benefit (2025) | $1,907 per month |

| Number of identified towns where benefits may cover basic expenses | 10–15, depending on estimate |

| Primary cost driver for retirees | Housing affordability |

Policy analysts say more retirees may consider relocating as housing pressures increase. Future SSA cost-of-living adjustments and shifts in regional economic conditions will influence affordability trends. “Retirees should monitor their financial situation closely and evaluate communities with stable long-term costs,” said Han.

Why Certain Small Towns Remain Affordable for Retirees

Rising inflation has heightened concern among seniors who rely primarily on federal benefits. The Social Security Administration (SSA) reports that the average beneficiary receives just over $22,800 per year, a figure many experts say falls short in most major U.S. cities.

However, analysts from the AARP Public Policy Institute note that regional housing markets vary significantly. “A retiree’s financial security can depend almost entirely on ZIP code,” said Janet Ruiz, a senior housing policy researcher at AARP. She added that smaller communities often offer more stable housing prices and lower tax burdens.

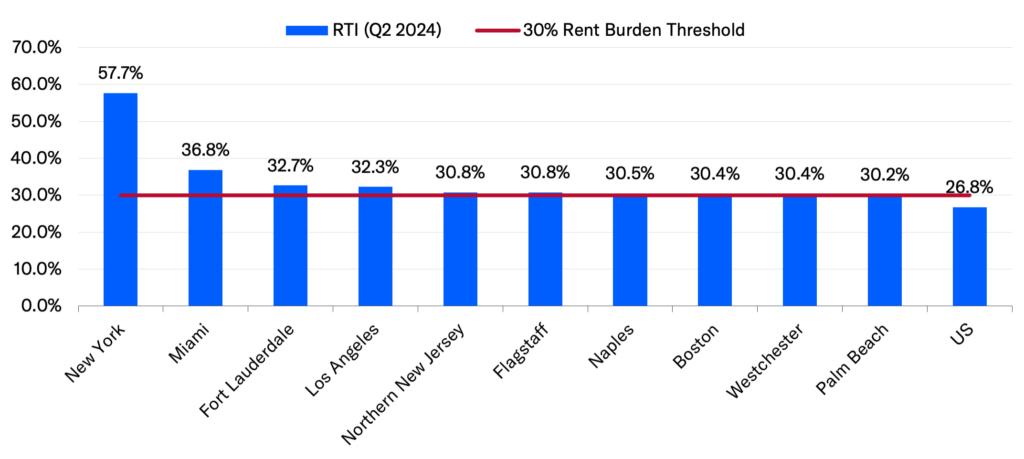

Housing Drives Retirement Affordability

Housing accounts for more than 30 percent of typical living expenses, according to the Bureau of Labor Statistics. In small towns across the Midwest and Appalachia, median rents remain well below the national average.

A 2024 Freddie Mac report found that towns with populations under 25,000 experienced slower rent growth compared with metro areas, giving retirees a financial advantage.

The Role of Inflation and Local Policy

Economists at the Federal Reserve Bank of Cleveland note that inflation affects regions unevenly. Rural areas often experience smaller price spikes for services and utilities, contributing to more predictable costs for long-term residents.

Local policy also matters. Some small towns offer property tax credits for seniors, subsidized utility programs, or discounted transit services. These policies can be decisive for retirees balancing fixed incomes with long-term financial planning.

Small Towns Highlighted for Viable Social Security-Only Living

1. Sandusky, Ohio

Sandusky has been noted for its low rents and stable utilities. Census figures show median monthly housing costs below $900 for renters. City officials say recent investments in healthcare access, including expanded clinic services, have improved retiree quality of life. The community benefits from proximity to Lake Erie, offering recreational spaces and low-cost outdoor activities.

2. Nutter Fort, West Virginia

Nutter Fort offers some of the lowest property tax rates in the region. According to the West Virginia Housing Development Fund, median home prices remain under $150,000, easing pressure on retirees who own or plan to downsize. Local leaders emphasize community safety and senior engagement programs funded through county partnerships.

3. Jerome, Illinois

Jerome provides a combination of low property taxes and accessible services near Springfield. Local officials emphasize community policing, public libraries, and stable year-round utility rates as key factors supporting retirement affordability. According to the Illinois Department on Aging, Sangamon County hosts multiple service agencies that help seniors with transportation and medical support.

4. Meadville, Pennsylvania

Meadville hosts a regional medical center that helps draw older residents seeking reliable healthcare. Researchers at the University of Pittsburgh note that northwestern Pennsylvania maintains some of the most consistent cost-of-living indices in the state. The town also offers modest grocery prices and subsidized public transportation.

Additional Factors Retirees Consider When Choosing a Small Town

Services and Accessibility

Access to health services is a cornerstone of retirement planning. Many small towns partner with regional hospitals to ensure consistent coverage. The Centers for Medicare & Medicaid Services (CMS) notes that most affordable towns reviewed offer at least one federally qualified health center or telehealth support.

Transportation Limitations

Public transportation is less common in rural areas. Some retirees may need private vehicles, increasing fuel and maintenance expenses. To address this, certain counties offer subsidized ride programs for medical visits, meals, or shopping.

Climate and Seasonal Costs

Cold-weather towns may require higher heating expenses. Analysts recommend reviewing average utility costs before relocating.

Expert Views on Sustainability and Risks

Economists warn that affordability may not remain stable. “Inflation continues to outpace cost-of-living adjustments for many seniors,” said Dr. Marcus Han, an economist at the Brookings Institution. He added that rural healthcare shortages, limited transit, and aging infrastructure may challenge long-term sustainability.

The National Council on Aging (NCOA) urges retirees to review their personal budgets and local tax structures before relocating. The group notes that even affordable towns can have hidden costs such as rising insurance premiums or limited rental availability.

How Retirees Can Evaluate Whether a Town Fits Their Budget

Assess Living Costs Accurately

Experts recommend evaluating local housing, transportation, healthcare, and food costs. Several state universities publish public cost-of-living calculators designed for retirees.

Check Healthcare Networks

The Centers for Medicare & Medicaid Services (CMS) maintains a searchable database for hospitals and clinics. Healthcare access remains one of the most important factors for older Americans living in rural regions.

Review Taxes and Long-Term Costs

States differ in how they tax retirement income. According to the Tax Foundation, 12 states tax Social Security benefits in some circumstances, which can reduce retirees’ effective income.

The Science Behind Aging in Place

What Research Shows About Staying in One Community

Studies from the Harvard Joint Center for Housing Studies show that retirees who remain embedded in stable, low-cost communities report better physical and mental health outcomes.

Community Support Networks

Smaller towns often provide stronger community ties, which can reduce loneliness and improve emergency support options.

Comparing Costs Across Regions

Midwest vs. Northeast vs. South

Analysts at Moody’s Analytics found the Midwest offers the most consistent affordability for retirees relying on Social Security, followed by the South.

Utilities and Insurance Differences

Insurance and utility costs vary widely by region. For example, coastal towns may face higher home insurance rates due to storm risk.

SSA Year-End Report: Major Social Security Changes You Need to Know for 2025

Potential Future Challenges

Demographic Shifts

Many small towns face population decline. This can reduce tax revenue and limit investment in public services.

Housing Shortages

Even affordable towns can experience limited housing supply as more retirees consider relocation.

Digital Access

Reliable broadband is essential for telehealth. Rural gaps persist but are shrinking due to recent federal funding.

FAQ About Small U.S. Towns Where Social Security Alone Can Cover All Living Costs

Can retirees truly live on Social Security alone?

Experts say it is possible in select small towns with low housing costs, but most retirees require additional savings.

What is the main factor that determines affordability?

Housing is the dominant factor, followed by healthcare access and local taxes.

Are these towns safe for retirees?

Most listed towns report crime levels below national averages, according to FBI Uniform Crime Reporting data.